[ad_1]

emson/iStock via Getty Images

Despite its small size and relative obscurity, the iShares MSCI Qatar ETF (NASDAQ:QAT) can offer investors a reliable dividend and an exemplary hedge against inflation. I believe investors who are wary of inflation should allocate a certain percentage of their portfolio to QAT to get some protection in case commodity prices continue to rise.

The ETF

The iShares MSCI Qatar ETF is relatively small, with almost $110 million in assets. It has 32 total holdings and aims to provide investors with exposure to stocks of companies based in Qatar. The ETF is highly correlated to the country’s main QE index in terms of directional movement and the constituents, but the ETF does not seek primarily to mirror the performance of the index. More than 50% of the ETF’s holdings are from the financial sectors. Industrials, Materials, and Energy are the three next biggest sectors with a weighting of 14.7%, 8.5%, and 8.2% respectively. QAT is trading at 16x TTM earnings and has a dividend yield of 2%.

Stocks That Offer A Safe Hedge To Higher Commodity Prices

The jump in commodity prices buoyed QAT 12% so far this year. Approximately 47% of Qatar’s GDP comes from Hydrocarbons, according to official data for 2019. That figure is likely to rise sharply in 2022 as commodity prices (particularly oil and gas) jumped following Russia’s war on Ukraine. For QAT in particular, close to 85% of the holdings benefit from a rise in commodity prices. Only businesses in the Healthcare, Consumer Staples, Utilities, Communications, and the Real Estate sectors (a combined 15% of the ETF) do not benefit directly from increases in commodity price increases. And even real estate has historically benefited from rising commodity prices, as increasing household disposable income pushed house prices, but let’s discount that out of conservatism, if nothing else.

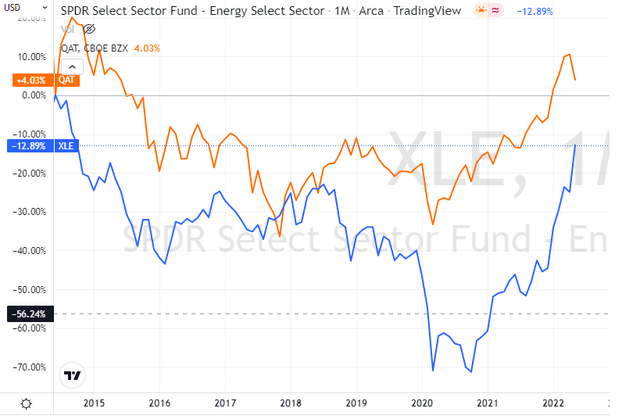

One could argue that an investment in QAT is no better hedge than the Energy Select SPDR Fund ETF (XLE), especially since the latter is up more than QAT so far this year. The crucial point to understand here is that QAT is a superior hedge to XLE due to its ability to weather periods of declining commodity prices. A comparison between the two since the top in oil prices back in June 2014 demonstrates that ability:

QAT Vs. XLE (TradingView)

The outperformance is a result of the strong balance sheet and cashflow position of QAT’s holdings compared to US oil companies. QAT also has a non-hydrocarbon component to it that cushions the blow of falling commodity prices. Many of the non-Hydrocarbon companies are also designated monopolies in their industry.

Baladna (1.07% of the ETF), for example, has a monopoly on dairy products. Companies like QNB (22.9% of the ETF) and Ooredoo (2.49% of ETF) have a dominant position in Qatar and significant operations overseas.

The Hydrocarbon holdings of the ETF (mainly the industrials, materials, and energy sectors) are also safer investments on average than those in the XLE. Clearly, the oil majors are in a league of their own, but QAT holdings are safer than the smaller US oil players.

The biggest Hydrocarbon business in the ETF is Industries Qatar with an 8.96% weight. The Petrochemicals company has never had a negative net profit over the past 10 years. Free cash flow was negative only once during the same period, in 2019.

Mesaieed Petrochemicals is the second-biggest holding, with 4.37%. Its record in terms of positive net income and free cash flow is identical to that of Industries Qatar.

The third company on the list is Qatar Gas Transport Company at 3.65% of the ETF. It has the world’s largest Liquified Natural Gas shipping fleet. It has never experienced a year of negative net profits or free cash flow over the past decade.

While Qatar Fuel (3.61% of the ETF) has 80% share in gas stations, a monopoly on vehicle inspections to renew car registration, as well as a monopoly on the sale of jet fuel. Every airplane arriving into the country will have to buy jet fuel from Qatar Fuel on its way out, including Qatar Airways planes. The pandemic was the only time this company experienced negative free cash flows over the last decade. It has never experienced a negative net profit during the same period.

The seven companies combined make up 47% of QAT, painting a clear picture of what the ETF has to offer.

The World Cup Could Boost Returns

2022 first quarter earnings for QE index constituents (a good proxy for QAT) increased by more than a quarter year-over-year as commodity prices skyrocketed. Earnings are likely to rise further this year as Qatar welcomes 1.5 million fans at the FIFA World Cup 2022. Qatar’s total population is about 4 million, so its population is expected to balloon 37.5% during the competition. That increase in population will be translated into increased economic activity, and eventually higher dividends paid by the ETF’s holdings, especially that those holdings have a propensity to pay out the majority of their earnings in dividends.

Investor-Friendly Reforms Could Push Prices Even Higher

The government approved, in April this year, legislation that allowed foreigners to own 100% of the listed companies, compared to the previous cap of 50%. Banks are the only sector to have implemented this change so far, and their stocks were rewarded with big moves following the announcement. Executives in other companies will likely look to speed up their implementation of the legislation, in a bid to boost the price of their companies’ shares, as was the case with bank stocks.

Price Target

Dividend yields are an appropriate method to determine QAT’s potential price target, given local investors’ style that resembles that of dividend investors in the US. Over the past five years, dividend yields were at an average of 3%. Dividends per share are likely to at least reach the seven-year high of $0.8562 for QAT, bringing the price target to 0.8562/0.03 = $28.5. I would also make a wager on the over for the dividend per share value paid in 2023, given the strength of economic conditions in the country this year. Also note that the country’s currency, the Riyal, is pegged to the US Dollar, so investors need not worry about FX risk. My view is the peg will hold for the foreseeable future, given the country’s strong balance of payments and reserves.

Risks

Although QAT presents a superior alternative to XLE and a better hedge to inflation than most of the financial instruments touted by financial media, it still has risks in absolute terms. Obviously, a sudden decline in commodity prices could affect the ETF price negatively. A decision to move the World Cup from Qatar would also represent a devastating blow to market sentiment and fundamentals. Shares in Qatar are also extremely volatile; the index has lost 40% of its value on 3 occasions since late 2005. Those sharp declines occurred after periods of very strong returns, similar to this year’s setup. There is no guarantee that a similar decline would not happen in the near future or that anyone would see it coming.

QE Index occasionally experiences sharp sell-offs (TradingView)

Conclusion

QAT is an overlooked ETF that offers a good hedge for the rise in commodity prices. Its quality companies make money whether commodity prices are rising or falling, unlike other energy ETFs like XLE that rely on rising commodity prices. Hosting the World Cup and introducing investor-friendly legislation could boost dividends and the share price to $28.5 by May of 2023. Significant risks remain, however, as shares are rather volatile, and a decline in oil and gas prices could hit sentiment.

[ad_2]

Source links Google News