[ad_1]

Bet_Noire/iStock via Getty Images

The JPMorgan Equity Premium Income ETF (JEPI) is a reasonable supplement to a core or total market equity allocation within a tax advantaged retirement account. JEPI holds a diversified portfolio of U.S. large cap stocks, and it seeks to generate monthly income through both dividends and the selling of covered calls. The ETF has a total cost of 0.35 percent, but it also currently yields about eight percent, with monthly distributions.

This ETF’s distributions are taxed as income, but in most circumstances that should not be meaningful within a tax advantaged account. Those monthly payouts vary depending upon how well the call writing strategy works, which may depend upon a variety of factors, including whether dividend payments were received, as well as whether the written calls were sold, called, or expired worthless.

Payouts are likely to be higher than usual when volatility is higher. This is because the level of implied volatility is a factor in options pricing. So far, 2022 is pretty volatile. If that continues to be the case, it should be a good year for options writing in general.

The distributions are more a function of the call writing than the portfolio’s natural income production. Not all of JEPI’s holdings have dividends, but some do. JEPI is an actively managed ETF, but it is a reasonably conservative portfolio in many ways. For example, JEPI’s holdings are not market weighted, but rather far closer to equal weighted.

No single publicly traded company makes up more than two percent of the holdings. Most are between one and two percent of the portfolio, but JEPI does also have S&P 500 (SPY) futures exposure, and it generally seeks to deliver a significant portion of the returns associated with the S&P 500 Index, but with reduced volatility and an automated monthly income component.

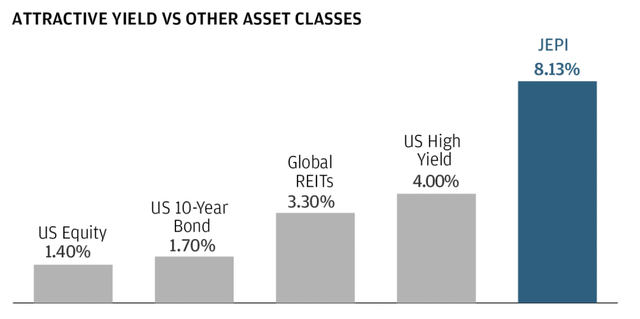

In seeking to provide a significant portion of the returns, that also means it is unlikely to match the total return of the S&P 500. That reduced volatility also corresponds to reduced returns, plus the constant distribution of cash reduces returns. That cash could be used to invest in a more aggressive manner, but it more likely the case that the majority of investors in JEPI are using the allocation as a high yield bond alternative. Most publicly traded high yield and junk offerings yield less than JEPI does.

JEPI yield comparison

JPMorgan

JEPI appears to be a reasonable supplement to a core equity portfolio that is transitioning into income production. Many investors appear to believe they need to increase their income allocation, yet believe that income producing assets are overvalued. The basis for wanting or needing an income allocation could be retirement, peace of mind, or near term expenses, among others.

It is also not entirely clear that traditional income producing assets offer greater safety. Interest rate and duration risk profiles are likely to be comparable to worse for junk bonds, unless they are extremely short term. Simultaneously, JEPI yields around four times a 10-year US Treasury bond. The income JEPI produces would also permit higher levels of cash and short term bills that may be more easily deployed if new opportunities are identified.

Risk

JEPI holds a bunch of equities, so it carries market risk. This means JEPI is likely to fall when the market declines. JEPI generally acts in a low beta manner, and will generally move less than the S&P 500, but market corrections and their corresponding effect should be foreseeable.

JEPI’s call writing strategy could provide strange bouts of volatility during options expirations, resulting in underperformance. These may be buying opportunities, but they may also be stressful occurrences that trigger poorly timed sales.

JEPI is an actively managed fund that is making decisions based upon perceived value. While attempting to be low volatility, active management always adds a potential element of human error.

JEPI’s fee of 0.35% is not unreasonable for an actively managed fund with a call writing strategy, but it is high for a core equity fund, or if compared to a proper total market fund. Moreover, JEPI’s strategy of being actively managed and using options is likely to be considered very aggressive by many traditional standards, as well as certain brokerages.

Conclusion

2022 appears to be a volatile year, which means options are likely to be expensive, and market returns may be capricious. JEPI provides monthly income based upon selling such options, which is likely to be a successful strategy this year.

Well-priced income producing assets are getting hard to find. JEPI’s attempt to provide monthly income through a portfolio of low volatility equities appears to be a reasonable alternative to junk bonds. It is also a sensible supplement to a core equity index fund or S&P 500 holding where the investor may require increased income production, but has a general disinterest in the current bond market.

[ad_2]

Source link Google News