[ad_1]

Current Retail Environment

Retail performance is generally thought to be quite cyclical. There is the typical Christmas season surge in retail sales and periods of highs and lows in between. In an economy where almost anything can be purchased online through platforms like Amazon (AMZN), the retail environment has changed dramatically over the last decade. E-Commerce is flourishing and disrupting the retail space and traditional brick and mortar players need to adapt.

Per this CNBC article “U.S. retail sales unexpectedly rose in January, lifted by an increase in purchases of building materials and discretionary spending, but receipts in December were much weaker than initially thought.” This was good news but article continued to discuss how the December retail sales figures were adjusted downward from a decrease of 1.2% to 1.6%. This was the worst retail sales showing since September 2009, around the time when the economy was recovering from recession. (Source: US retail sales edge up in January, but December is revised sharply lower). Currently, the S&P 500 is nearing all-time highs, and many retail names have been along for the ride.

This SA article also highlighted some of the recent retail trends in the market. The article reiterated that online non-store retailers continue to do well and are growing, which does not come as a surprise. The SPDR S&P Retail ETF (XRT) provides exposure to the retail sector for investor who wishes to be long this basket of consumer discretionary companies. In this article, we will break down the characteristics of the fund, who the fund is suitable for, and some reasonable investment alternatives.

XRT Fund Profile

The fund profile of XRT describes the product summary as follows, “The SPDR S&P Retail ETF seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the S&P Retail Select Industry Index (the ‘Index’. “From an exposure standpoint the fund invests in the following sub industries: “Apparel Retail, Automotive Retail, Computer & Electronic Retail, Department Stores, Drug Retail, Food Retailers, General Merchandise Stores, Hypermarkets & Super Centers, Internet & Direct Marketing Retail, and Specialty Stores”. Source: XRT Fund Profile

The ETF has 94 holdings and has a weighted average market capitalization of approximately $25.2 billion. It is the largest ETF offered in the retail/consumer discretionary space. As XRT is an ETF, the minimum investment would be the cost of one share, approximately $45. Source: XRT Fund Profile

Holdings

The SPDR S&P Retail ETF XRT holds several big names as a part of their top ten holdings and some other more unknown companies as well.

Source: XRT Fund Profile

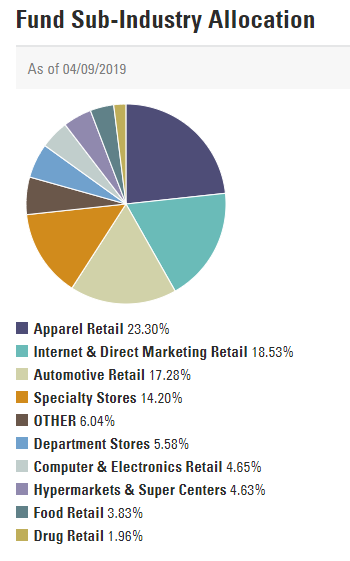

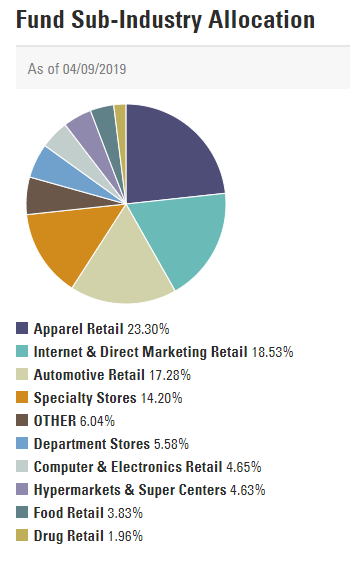

As shown, the 10 largest holdings of the fund represent approximately 13.2% of the total net assets of the fund. This provides a nice balance of names with little individual stock concentration risk. Note that Amazon is only 1.3% of the fund’s holdings. The sub industry allocation of XRT is provided below:

Source: XRT Fund Profile

This portfolio composition reveals that the fund does have some concentration risk in the apparel, Internet, automotive and specialty sectors, which make up approximately 73% of the fund.

Performance

XRT’s three year performance chart is provided below. The performance of the S&P 500 has been added for comparative purposes.

Data by YCharts

Data by YChartsAs shown above, XRT has trailed the S&P 500 almost by almost 8% total return over the preceding three year period.

Who Should Invest in XRT

Per the State Street fund profile some of the key features of the fund are as follows:

- “Seeks to track a modified equal weighted index which provides the potential for unconcentrated industry exposure across large, mid and small cap stocks

- Allows investors to take strategic or tactical positions at a more targeted level than traditional sector based investing.”

Source: SPDR S&P Retail ETF Profile

XRT is a good way to get exposure to the consumer discretionary sector if that fits your portfolio goals. XRT is not really appropriate as a sole investment on its own but rather complementing a balanced portfolio. It does provide some diversification from the core U.S. market as evidenced by its return against the S&P 500. Given that there are only approximately 90 companies in the fund, there will be inherently more sector specific volatility than a broad based index fund that tracks the S&P 500. If you are bullish on the future of online platforms like Amazon or eBay (EBAY), these names are only represented as approximately 1% of the total holdings of the fund.

XRT also has penny wide option spreads available in both the weekly and monthly duration time periods.

Fees

Per State Street, the fund has an expense ratio of 0.35% and the current net assets of the fund are $25.2 billion as of April 10, 2019. At the current net asset level of the fund, Vanguard would be earning approximately $75M annually for managing the fund.

Distributions

The ETF does payout distributions and the current yield of the fund is 1.38%. Dividends are declared and paid quarterly with the most recent dividends being shown below:

Source: (State Street Website )

ETF Alternatives to XRT

Some alternatives to XRT are provided below. There are considerable differences between the three ETFs based on number of companies, type of holdings and fees.

VanEck Vectors Retail ETF (RTH)

The most noticeable difference in the fund as compared to XRT is within the actual holdings of the two funds. RTH has a 20.66% exposure to Amazon while XRT’s holding of Amazon is only about 1.3%. The fund only has 25 holdings so the risk will be more concentrated. Over 40% of the fund is allocated to Amazon, Home Depot (HD) and Walmart (WMT). If you are an investor who is bullish on these companies then this ETF could be a good fit. As of April 9, 2019, the gross expense ratio of the fund was 0.52%. Source: RTH Fund Profile

Amplify Online Retail ETF (IBUY)

IBUY differs from XRT most notably in its 27% exposure to non U.S. companies and its focus on online and virtual sales companies rather than traditional in store type business. There are 41 holdings in the fund and the expense ratio is 0.65% as of December 31, 2018. No one company comprises more than 5% of the fund.

Source: Amplify Online Retail ETF Profile

Overall Takeaway

The SPDR S&P Retail ETF XRT could be suitable for complementing a balanced portfolio if the investor was bullish on the sector. If you are more bullish on the continued disruption of in-store retailer through the rise of E-Commerce, than this ETF would not be recommended as an investment. The other two ETF alternatives would be appropriate if more exposure to online sales was desired. Ultimately, XRT is an effective way to purchase a basket of U.S. consumer retail or consumer discretionary type companies in a simple and cost effective manner.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News