[ad_1]

ETF Overview

The iShares Global REIT ETF (REET) has a portfolio of global REITs. The fund tracks the investment results of the FTSE EPRA Nareit Global REITs Index. REITs from the U.S. represent nearly two thirds of its portfolio. This is beneficial as the U.S. has a much higher population growth rate than Europe and Japan where a few other global REITs have much higher exposure. The fund’s exposure to retail REITs is concerning due to the rise of e-commerce.

However, this exposure is offset by residential and industrial REITs in its portfolio. These two subsectors should benefit from the trends of declining homeownership rate and the rise of e-commerce. REET’s fund performance is inversely correlated to the treasury yield. Given the fact that the market has likely already priced in some rate cuts, we think the risk/reward profile is not particularly compelling. Therefore, investors may want to wait on the sideline.

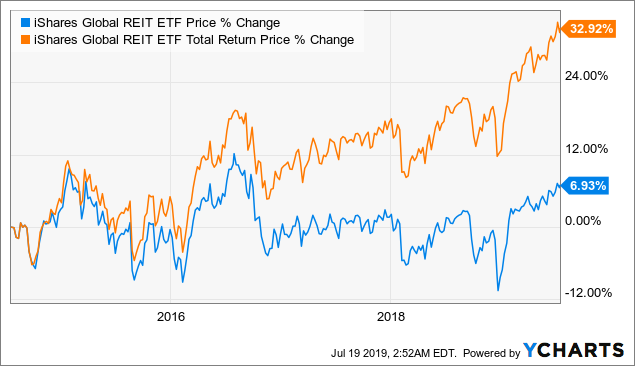

Data by YCharts

Data by YCharts

Fund Analysis

REET’s exposure to the U.S. should be beneficial

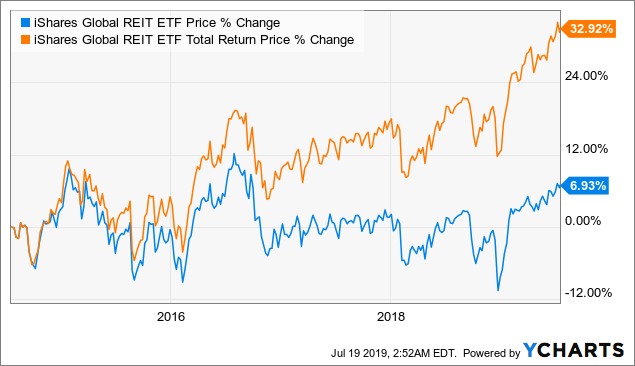

Although REET invests in global REITs, it is still largely invested in REITs in the U.S. As can be seen from the chart below, U.S. REITs represent nearly two thirds of its portfolio.

Source: iShares Website

While there is concentration risk, we actually think its exposure to the U.S. is beneficial because the U.S. real estate market is stable with strong growth potential than many other international markets. This is because the U.S. real estate market is supported by a population that grows at a rate of about 0.6%-0.7% annually. Although this is not high, it is still much better than Europe’s growth rate of about 0.1%-0.15% annually. Other countries such as Japan even have a negative population growth rate (negative 0.23% in 2018).

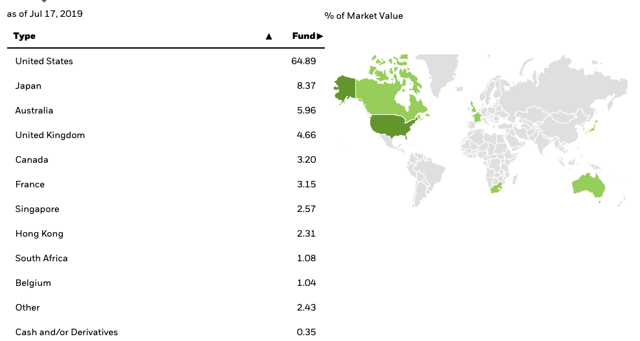

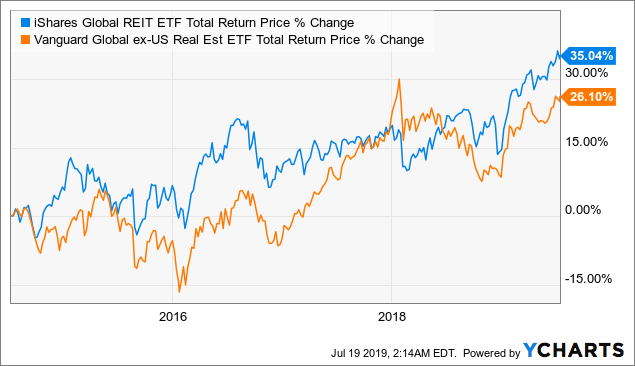

REET’s peer the Vanguard Global ex-U.S. Real Estate Index ETF (VNQI) has no exposure to the U.S. Instead, VNQI has much higher exposures to Europe (24.2% of its portfolio), and Japan (22.3%). As discussed earlier, these regions and countries have much lower population growth rates than the U.S. Therefore, REET’s exposure to the U.S. should allow it to enjoy better growth than VNQI in the long term. Perhaps this is one of the reasons why REET performed better than VNQI in the past 5 years. As can be seen from the chart below, REET’s total return of 35% is higher than VNQI’s 26.1%.

Data by YCharts

Data by YCharts

REET has considerable exposure to the retail sector

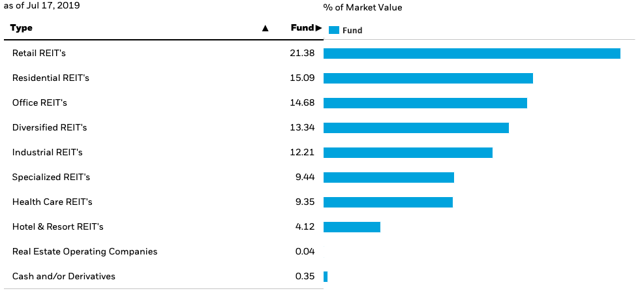

Retail REITs represents about 21.4% of REET’s portfolio (see table below). We do not like its exposure to the retail sector because retail REITs have been combating against the rise of e-commerce in the past few years. As we know, many brick-and-mortar retailers such as department stores have been struggling to survive. There have been numerous store closures from well-known store chains in the past. In 2017, U.S. retailers closed a record 102 million square feet of store space. In 2018, these retailers closed another 155 million square feet of store space. This trend is not changing anytime soon. There have been 7,500 store closures in 2019 already and the number could exceed 12,000 stores by year-end. In this challenging environment, it will be difficult for retail REITs to grow their revenue and maintain their bottom lines.

Source: iShares Website

We like its exposure to residential and industrial REITs

Fortunately, REET’s portfolio of REITs also includes other sectors such as residential REITs and industrial REITs. In fact, these two subsectors represent 27.3% of REET’s portfolio (15.1% for residential REITs, and 12.2% for industrial REITs).

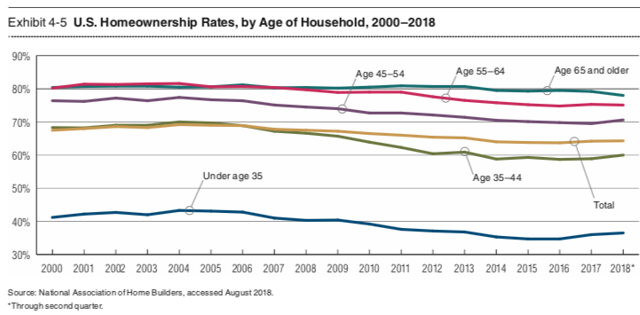

Residential REITs should continue to benefit from the trend of declining homeownership. In PwC’s latest report, the organization also observed the trend of younger generation population that seems to prefer rent to owning homes. As can be seen from the chart below, homeownership rates by age of household in the United States have gradually declined in the past two decades. PwC believes that this has to do with many people, whether retired or millennial, who prefer to live in “high-end, highly amenitized, connected, urban-chic communities.”

Source: Emerging Trends in Real Estate 2019

Industrial REITs should also perform well thanks to the rise of e-commerce. Although valuation of industrial REITs has expanded considerably in the past few years, we think this trend will continue. This is because consumers increasingly demand quick delivery once they ordered their products online (e.g. within 24 hours). In order to satisfy the demand, the need for more warehouse and distribution centers closer to customers will not diminish any time soon. As an article published by National Real Estate Investor states:

We are likely still in the middle stages of building out the necessary infrastructure to continue to meet growing consumer demand and thus the industrial sector likely continues to expand (albeit at a much slower pace) even in the face of a minor recession.”

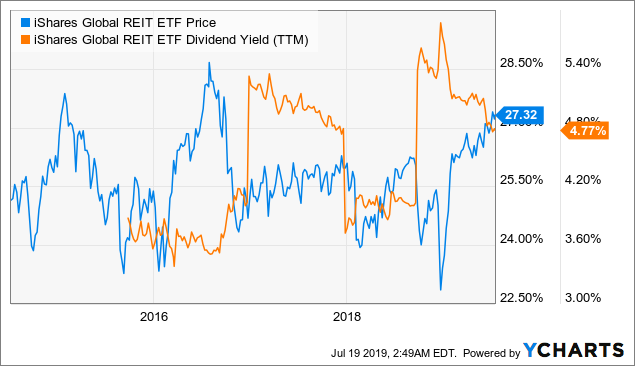

A 4.8%-yielding dividend

REET pays a 4.8%-yielding dividend. As the chart below shows, its dividend yield is towards the low end of its 5-year yield range.

Data by YCharts

Data by YCharts

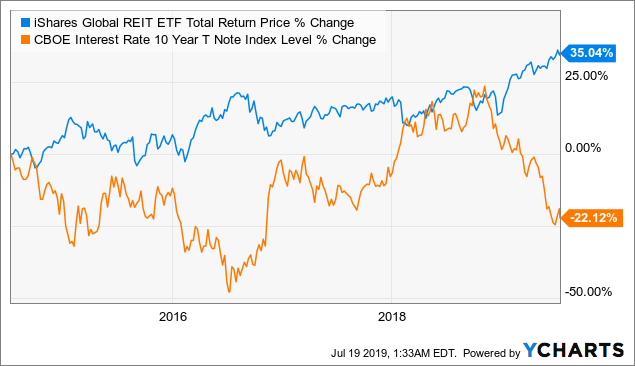

REET is rate sensitive

REET’s fund performance is sensitive to the interest rate. As can be seen from the chart below, its fund performance is inversely correlated to the 10-year treasury yield. As the treasury yield drops lower, REET’s fund price increases. On the other hand, when treasury yield rises, REET underperforms.

Data by YCharts

Data by YCharts

Is this the time to invest now?

The current economic cycle has been well into its 10th year. Nevertheless, there are already many signs that we are in the late cycle environment. For example, we are seeing signs of investors rotating from riskier assets (e.g., energy, industrial, etc.) towards defensive sectors (e.g. telecom, utilities, some REITs, etc.). We believe investors are concerned that the escalation of the global trade tensions will lead the U.S. and global economy into a recession. However, we believe a large portion of this concern is reflected in the treasury yield already. The decline in treasury yield recently suggests that the market has already priced in 1 or 2 rate cuts in the U.S.

Perhaps, the Fed may need to cut its interest rate to boost business confidence. However, what if the economy proves to be stronger than the market thought? In that case, there is no reason for the Fed to cut its interest rate once or even twice. In that case, the treasury yield will likely trend higher. Since REET’s fund performance is inversely correlated with the treasury yield, its fund price will likely decline.

Investor Takeaway

We like REET’s exposure to REITs in the U.S. However, the market appears to have already priced in a few rate cuts already. Therefore, we do not think it is the right time to invest now. We recommend investors to wait on the sidelines.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

[ad_2]

Source link Google News