[ad_1]

Vertigo3d

The iShares Global REIT (NYSEARCA:REET) ETF gives you what you would expect, a relatively broad-based exposure to REITs. While we don’t have a problem with REITs at all, in fact we’ll explain why investors would be wise to consider them right now, we think the concept of a broad REIT ETF like this just doesn’t make too much sense. Some of its sectorial breakdowns individually might have been interesting, but with REITs being a portfolio already, we don’t see the point of diversifying on another stratum.

What’s in REET?

REET contains at the top of the holding list some familiar names. Prologis (PLD) could be called a specialty REIT, and it owns logistics and warehousing properties. At the moment, this sort of real estate is very valuable, and will likely continue to be as manufacturers around the world try to build more flatbeds at trucks, pushing hard up against the supply chain constraints that are limiting those assembly lines.

Otherwise, we get other familiar names like Equinix (EQIX) which owns colocation centers that allow for internet exchange between lower tier networks, and benefits from powerful network economics. So far, very resilient exposures.

Going down the list we get more storage REITs and even some casino properties, but being a pretty diversified portfolio, it’s the sectorial breakdowns that are going to give us a clearer picture.

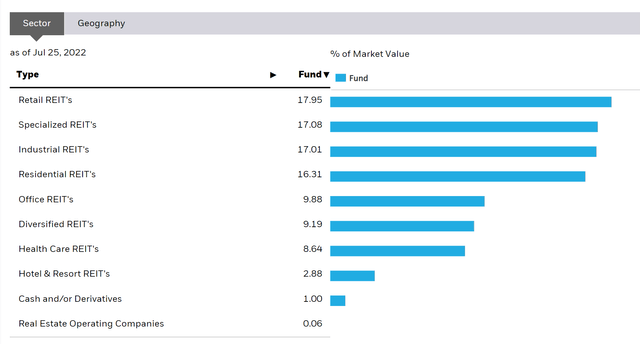

REET Breakdown (iShares.com)

Specialised REITs like some already listed generally are going to provide niche and resilient exposure. Where REITs are already resilient, the specific markets and niches here should generally put these property owners in an even better position. Residential REITs are one of the other major categories, and while asset values might fall, a housing shortage in many US means vacancies are going to be pretty unlikely. The geographic exposure is 70% US so we can be safe in assuming US housing dynamics prevail here. Industrial REITs should be pretty safe too, with leases to industrial companies probably providing a lot of value as manufacturing and capacity remains a key issue for global markets. However, note that industrial tenants might be suffering from inflation in their own businesses. Retail REITs is a little scarier, but many years have passed of ecommerce growth and while secularly not particularly interesting, the assets still in operation tend to be safe from any further oversupply dynamics that might be hitting the segment quite hard. In fact, retail is getting a little bit of a renaissance as people manage their shopping costs with shipping costs from ecommerce players (not Amazon Prime users), incentivising more of a mix between retail and at-home delivery buying.

Danger areas like office REITs sit lower in the portfolio. While this is a battleground topic, there are still some risks to office REITs especially as a great resignation persists despite macroeconomic concerns. Gubernatorial tax coffers are definitely beginning to feel the effects of many people not wanting to live in places like San Francisco anymore.

Conclusions

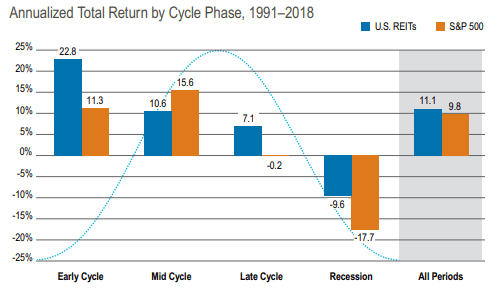

REITs in general are an area that people might want to look at. Because of the economics of owning real estate, the certainty REITs deliver in a lot of cases make them a resilient asset class and quite countercyclical. Entering into a recession they typically perform well, and they also perform well on the rebound after the dust settles. With the dividends, especially from US REITs, being very reliable, a head start on returns is delivered where capital appreciation becomes hard to earn.

REIT Returns (Cohen and Steers)

The thing is retail investors, especially in the US, are pretty familiar with the REIT asset class because pensioners depend on the market for dividends. Moreover, people are generally pretty handy with thinking about real estate. It strikes us as a really weird securitisation choice to make a REIT portfolio. We feel confident in picking a single REIT which is already a portfolio to make a narrower bet on a market that we are perfectly capable of understanding, and we’d expect people like parents and friends outside of the industry to be able to do that as well, which they do when buying their own property. When there are clear choices you want to make, for example choosing US REITs which are more committed to dividends, and avoiding sectors more at risk of capital impairment like offices, why not just go make them and buy a single REIT? You’d avoid the little 0.14% management fee too.

[ad_2]

Source links Google News