[ad_1]

CreativaImages

Thesis

Global X Nasdaq 100 Covered Call ETF (NASDAQ:QYLD) is primarily designed for income investors as the fund’s strategy calls for it “to generate income through covered call writing.” However, by using a buy/write strategy with at-the-money call options, the ETF is not designed for investors whose primary aim is capital appreciation.

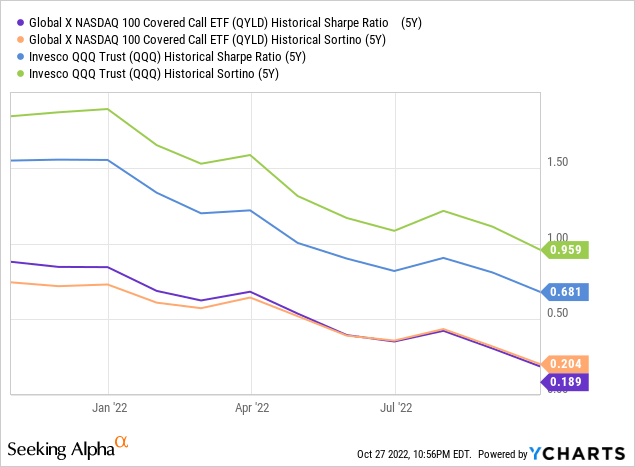

Therefore, investors comparing QYLD’s performance to the Invesco QQQ ETF (QQQ) may not be entirely appropriate, as the QQQ is primarily a tech-heavy, large-cap growth ETF.

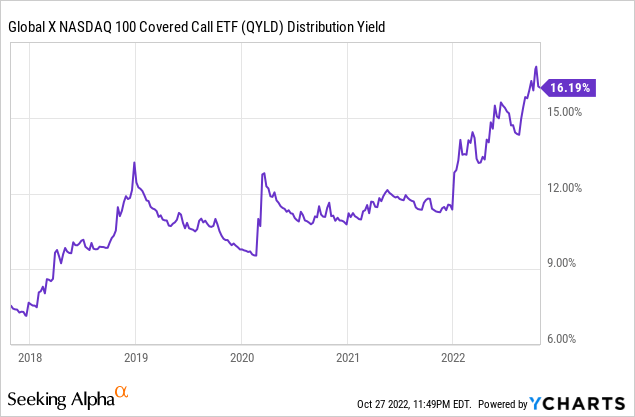

Our analysis suggests that investors in QYLD are well-positioned to leverage elevated implied volatility (IV) during bear markets with richer call premiums. As such, QYLD’s distribution yield reached a high of 17% at its October lows. But, of course, its yield was also lifted by the ETF’s rapid price descent from its November 2021 highs, falling nearly 35% to its October lows.

Therefore, the downside price risks of the QYLD are pretty similar to the QQQ over the past year. However, its current distribution yield of 17% helps to mitigate the significant impact of the decline, leveraging on rich call premiums during the protracted bear market to benefit its investors.

Our analysis suggests that a mean reversion opportunity in the QYLD could be unfolding. As such, IV could also fall as the market attempts to bottom. Hence, investors looking to capitalize on QYLD’s highly attractive yield should act fast and consider adding exposure.

As such, we rate QYLD a Buy for income investors.

High IV Means Richer Premiums

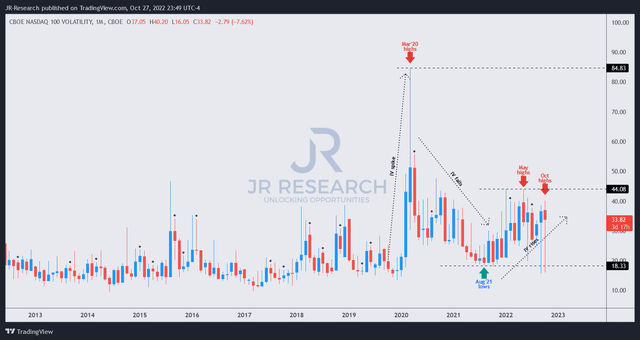

CBOE NASDAQ 100 Volatility price chart (monthly) (TradingView)

The implied volatility in the NASDAQ 100 (VXN) has remained close to its May highs. A high IV environment is good for premium sellers, with richer call premiums on tap. Therefore, investors in QYLD shouldn’t be overly concerned with the absolute price decline in the ETF, as that shouldn’t be the primary objective. These are appropriate times to be premium sellers.

As such, QYLD’s distribution yields rose to 17% at its October lows, even though it has come down slightly as the underlying NASDAQ (NDX) attempted to bottom in mid-October.

Our analysis suggests that market pessimism could have reached a peak. Therefore, the elevated yields seen in QYLD currently may no longer be on offer if the market continues to constructively base and bottom out.

QYLD Is Not Designed For Capital Appreciation

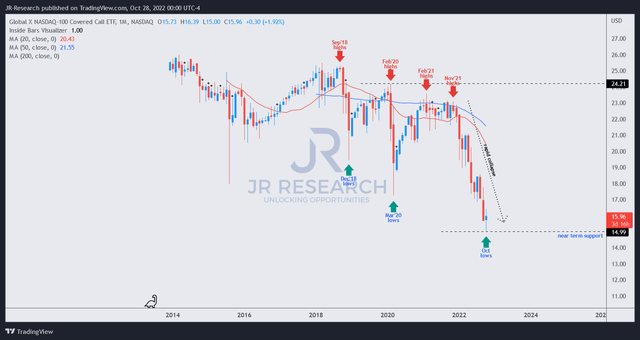

QYLD price chart (monthly) (TradingView)

However, it’s critical for investors to note that the QYLD is not meant to be a total return vehicle, given the fund’s design. Note that the fund managers accentuated: “By writing covered call options in return for the receipt of premiums, the Fund will give up the opportunity to benefit from potential increases in the value of the Reference Index above the exercise prices of such options but will continue to bear the risk of declines in the value of the Reference Index.”

Hence, investors shouldn’t expect to see a long-term uptrend in QYLD, given its structure. Notwithstanding, that doesn’t mean that astute income investors couldn’t cherry-pick attractive entry zones to benefit from the high IV market environment.

Still, we don’t encourage investors focused on capital appreciation to leverage the QYLD for their portfolios. As seen above, the QYLD has underperformed the QQQ significantly on risk-adjusted terms over the past five years.

Hence, growth-focused investors shouldn’t find the QYLD appropriate even as a portfolio diversification tool.

Is QYLD ETF A Buy, Sell, Or Hold?

We believe the QYLD ETF has a place for income investors, given its buy/write structuring. It’s also able to drive richer premiums in high IV market environments. However, partaking in a strategy that sells at-the-money calls means that the ETF is designed primarily for income-only investors.

Given the attractive yields, we rate QYLD as a Buy for income investors.

[ad_2]

Source links Google News