[ad_1]

Editor’s note: Seeking Alpha is proud to welcome Lee Bailey as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Hiroshi Watanabe/DigitalVision via Getty Images

The Invesco NASDAQ Next Gen 100 Fund (QQQJ) tracks a modified market-cap-weighted, narrow index of 100 non-financial stocks that are next-eligible for inclusion in the NASDAQ-100 Index. Think of it as the more recently founded and up-and-coming tech stocks that may have the potential to become the FAANGs of the next decade. Historically, about one out of every three members have eventually graduated to become members of the NASDAQ-100. Stocks tend to surge in price just before inclusion to a major index like the NASDAQ-100 which gives an additional boon to this ETF over time.

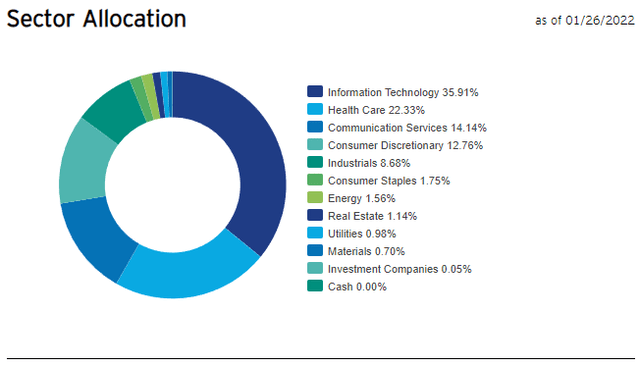

Invesco

We can see from the above chart that QQQJ is heavy in Information Technology and Health Care sectors, but it is better diversified than many would believe based on the description. These top two sectors comprise a mere 58% of total holdings, and Communication Services and Consumer Discretionary are also quite well represented. Overall, the ETF is mostly a conglomerate of younger tech and consumer companies that have huge total addressable markets (TAM) and have the potential to grow to be mega-caps over the long term.

Compared to Invesco QQQ ETF (NASDAQ:QQQ), QQQJ is underweight in Communication Services, Consumer Discretionary and Consumer Staples. Both ETFs have an approximate 50% allocation to the tech sector, but QQQJ is much more sector-diverse which can be partially explained by its lower market cap holdings. Since its constituents sit in a much smaller total market cap band than QQQ, no individual mega-caps dominate the fund and thus have no chance to overly skew the sector allocation.

Holdings

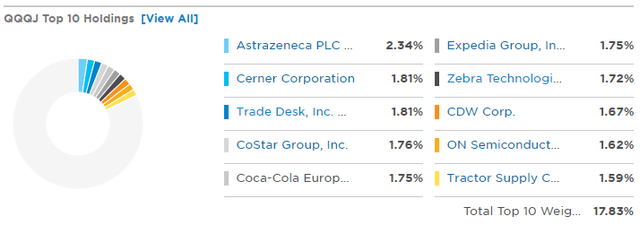

ETF.com

The ETF is much more diversified against individual company risk with the top ten holdings only comprising 17.83% of the 105 total holdings. Compare this with QQQ where the top 10 holdings comprise 52.3%. This means you are less likely to be individually hurt from any particular company’s failings, bad earnings or even bankruptcy; instead you get to benefit from survivorship bias through a tax-efficient ETF. Think of QQQJ as a macro play, betting on the concept of “software eating the world” as well as automation of vast portions of the economy most technologists are predicting to transpire over the coming years and decades.

Some of the names here are going to be very familiar to Seeking Alpha regulars, with Astrazeneca (AZN), the Trade Desk (TTD) and Zebra Technologies (ZBRA), among others, consistently receiving bullish articles based on their long-term growth prospects. Some of my favorite overall stocks that are largely represented in QQQJ are:

- Mongo DB (MDB) that sells a best-in-class NoSQL database and is growing at a break-neck 50.5% annually. Its total addressable market (TAM) is expected to reach $97B by 2023.

- The Trade Desk (TTD) that has built a revolutionary data-driven digital advertising platform and is growing at 39.3% annually. Its TAM is expected to reach $526B by 2024.

- Zebra Technologies (ZBRA) that has built high tech solutions that provide businesses with better operational visibility and is growing at 26.9% annually. Its TAM is expected to reach $33.85B by 2025.

- AppLovin Corp (APP) that has built a leading platform to assist mobile app developers to enhance the marketing and monetization of their apps and is growing at a whopping 90.4% annually. Its TAM is expected to reach $283B by 2024.

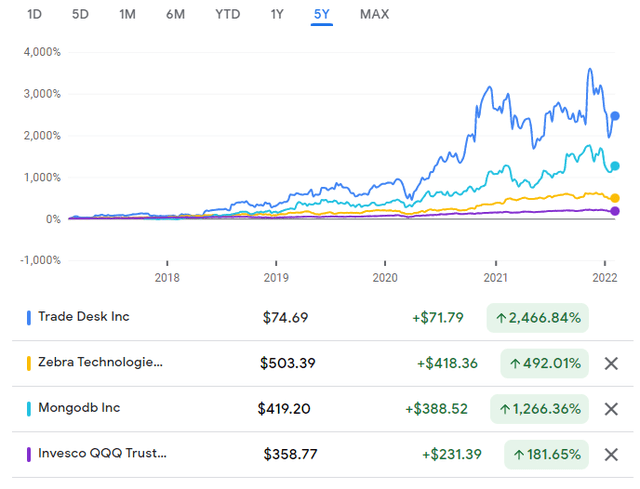

Google Finance

As you can see by the stats and performance chart above, these fast-growing companies have huge addressable markets and very high sales growth rates. Though QQQJ was established less than two years ago, I charted a few its holdings above that have been around for a five-year performance comparison against QQQ, and each has easily outperformed the large-cap tech index.

There is of course no guarantee that such outperformance will continue in the future, but much of the underlying factors that led to it are still in tact (high growth rates, huge TAMs still untapped, excellent founder-CEOs at the helm). Many people mistakenly believe that the COVID-19 work-from-home boom is the only reason these companies have outperformed, but a quick glance at the chart shows that they were consistently outperforming long before 2020. This further solidifies our thesis that QQQJ exhibits structural alpha characteristics, rather than being a mere investor fad.

This ETF is full of similar hyper-growth stories like this that have potential to become the FAANGs of tomorrow if their growth stories come to fruition and they continue to innovate and execute impeccably. Many of them are down 40-50% from their all time highs as the initial IPO hype and short-term overvaluation has worn off, making now a great entry point.

Performance

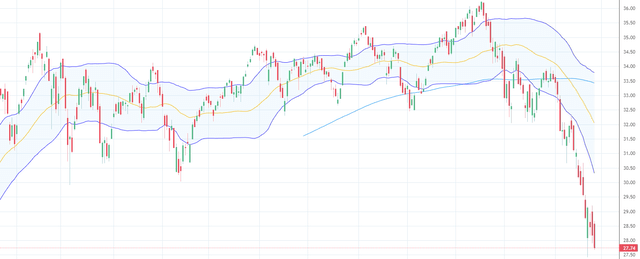

Trading View

The ETF debuted October 13th, 2020. After a strong start, the performance has been relatively weak over the last year. It is now deeply oversold nearly -25% below its all time high set last November and a whopping -17% below its 200-day simple moving average. Its also remained below the lower Bollinger band for the past two weeks, indicating a mean-reversion re-entry is highly likely in the near term.

QQQJ has underperformed recently as expected rate increases and asset purchase tapering from the Fed hit high flyers in general. However, I believe the market is improperly discounting the massive future growth potential of this basket, and the lower relative valuations of this group in 2022 vs. 2021 build a margin of safety into my thesis. Given the ETF is trading near its all-time-lows, there has never been a better entry point to buy this ETF than right now. The fundamentals and growth prospects of these well-funded companies are too good to ignore.

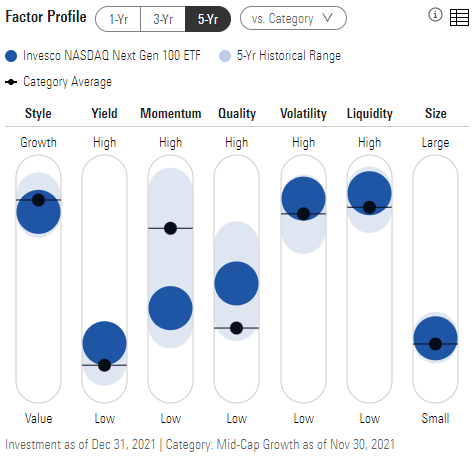

Factor Profile

Morningstar

We can see QQQJ leans toward smaller growth companies, but with much higher quality and yield than the category averages. Do not mistake this for a small-cap ETF though; even after the recent sell-off, the weighted-average market cap is $24.2B. The distribution yield is 0.98%, significantly higher than QQQ’s 0.48% despite the smaller companies historically outperforming larger companies over the any time period measured in multiple decades. This yield is a nice side benefit to collect while waiting for the long term growth stories to come to pass.

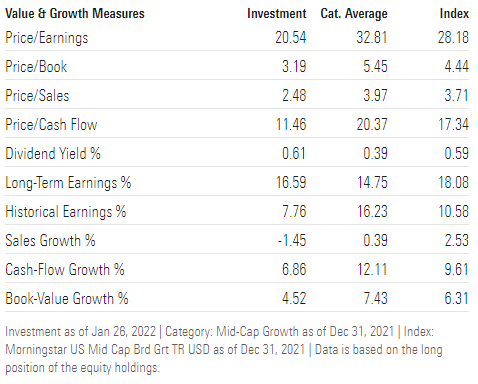

Valuation

Morningstar

Perhaps unsurprising after the recent sell-off, QQQJ is cheap. Despite these companies having larger long-term growth prospects than QQQ due to being so early-stage, QQQJ actually has a lower P/E at 28.18 compared to QQQ’s 33.8. Its P/B is remarkably lower as well at just 4.44 compared to QQQ’s astronomical 9.10. QQQJ is simply too cheap to ignore.

In the short run, the market is like a voting machine, but in the long run it’s like a weighing machine

–Benjamin Graham

While Mr. Market may continue to unfairly punish QQQJ in the short term, in the long run the sales and revenue growth of this group of promising midcaps will determine the ETF’s performance. Their products, services and business models are very innovative, and the huge secular tailwinds of software eating the world, automation replacing many traditional jobs, the rise of the metaverse, etc. show no signs of slowing down.

Risks

QQQJ has been more volatile than QQQ overall since its inception. This is to be expected as small-caps and mid-caps have historically experienced more volatility than large-caps due to less market share and stability during the growth phase compared to more mature companies. As such, this ETF is not for the faint of heart as the recent -25% correction (compared to QQQ’s -19% and SPY’s -12%) illustrates.

This ETF is best suited for long-term investors with investing timeframes measured in decades that want to bet on innovative and fast-growing companies. If you are nearing or in retirement, you could still consider owning this ETF as a smaller allocation in your portfolio. It would compliment other more stable, risk-averse ETFs such as iShares Core Dividend Growth (DGRO), Vanguard Dividend Appreciation (VIG) or iShares MSCI USA Min Vol Factor (USMV) nicely.

Conclusion

Picking long-term individual stock winners is a nearly impossible task. There’s simply too many variables at play, too many senior managers to track, too many products and too many pivots to constantly track. Instead, I think it’s much easier (and more tax-efficient) to take a broader view of the market, think long-term, and bet on secular growth narratives.

With its innovative companies producing new revolutionary technologies, products and services, QQQJ embodies everything that makes long-term multibaggers possible. Of course not every company within it will succeed, but by buying the ETF instead of the individual companies you will have survivorship bias and tax efficiency at your side along with the benefits of greater diversification, protection from individual company risk and overall lower portfolio volatility. Different factors and sectors come in and out of favor as the macro-environment and investor sentiment changes, but if I could only own one ETF over the next couple of decades, it would be QQQJ. The fund’s extremely low expense ratio of just 0.15% is just icing on the cake.

[ad_2]

Source links Google News