[ad_1]

peterschreiber.media/iStock via Getty Images

This article attempts to outline several reasons why I am moving my rating from Sell to Buy for the Big Tech sector in general.

I have been the contrarian knucklehead telling investors to avoid Big Tech since December 2020. Guess what? While I was a little early in my bearishness, the Invesco QQQ ETF (NASDAQ:QQQ) is now priced back to the level of 18 months ago! In other words, anyone that listened to my contrarian sentiment reasoning, and screams that P/Es were too high vs. rising inflation rates, was not cheated out of any money in the end.

You may even have sold and locked-in huge gains after my negative writeups on PayPal (PYPL), Coinbase (COIN), ARK Innovation ETF (ARKK), GameStop (GME), Apple (AAPL), Microsoft (MSFT), Adobe (ADBE), Tesla (TSLA), Alibaba (BABA), NVIDIA (NVDA), Advanced Micro Devices (AMD), Amazon (AMZN), and others written in the second half of 2021. No, the investors holding the bag on major losses in their investment accounts were the newbies and blind followers of Wall Street’s TINA logic last year.

So, with a little shred of credibility, I am now confident the risk/reward setup has improved dramatically for Big Tech in particular into May 2022. The 20% to 30% bear market over six months in all Wall Street equity indexes, using an equal weighting system, is actually a relatively normal occurrence every 3-5 years. This specific animal happened after an exaggerated and experimental money printing exercise by the Federal Reserve and U.S. Treasury to combat the COVID-19 economic slowdown.

The downside of crazy liquidity creation was a record bull run in stocks and real estate, with the crypto craze pumped into a bubble/mania range. Now we have a near doubling in many mortgage rates from last year, a crypto crash, and the leading Big Tech names busting in grand fashion. Many books will be written on the wild investor speculation of 2020-21, but I am moving on already.

The good news for sane investors with cash on hand is that the risk/reward setup for U.S. equities is now improving quickly. As soon as we get more data on a slowing economy and collapsing consumer confidence, the Federal Reserve will stop raising interest rates. We may even see a commitment by central bankers to support the economy first, and ignore inflation rates remaining in the 4%-7% range for the rest of 2022.

The dirty secret in financial markets today is everyone knows we need higher than normal inflation to reduce the size of our sovereign Treasury debt load above 120% of GDP output. I have growing confidence stocks will continue to outperform bonds in America and elsewhere in the world, because businesses can maintain and expand income in a rising inflation environment. Bonds yielding next to zero for interest rates may not be able to mathematically hold current prices. I talked about this idea several times in 2021 and early 2022 on Seeking Alpha, suggesting a bond market collapse in price was the most probable outcome.

I have found better investment values in numerous Big Tech names on the recent sell-off. My favorite large-cap technology name is Alphabet/Google (GOOG) (GOOGL), which I have mentioned in a few articles since 2020. Meta/Facebook (FB) and Netflix (NFLX) are definitely worthy of further research and a possible place in your portfolio today on massive price tanks in 2022, as I explained in articles the past couple of weeks. I upgraded Apple’s rating to a Hold from a Sell several days ago. Without doubt, the drawdown in mega-caps Tesla, Microsoft, Amazon and other smaller technology choices mean potential long-term rewards are much “smarter” now than 6-12 months ago.

Valuation Picture Improvement

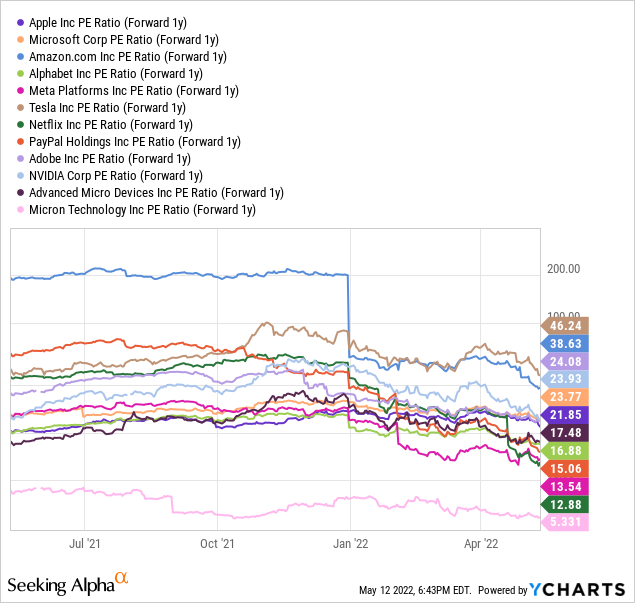

Increasing earnings and slashed stock quotes upfront mean forward P/Es are getting closer to my projected long-term annual CPI inflation rate of 5% over the next 3-5 years. On a 1-year forward estimated basis, the QQQ average has declined from nearly 40x last autumn to under 20x today. You can visualize the sizable rebalancing of underlying fundamental Big Tech discount ratios below.

YCharts

The wildcard for a reversal in price for U.S. equities is the Fed must realize it cannot control inflation when shortages exist for oil/gas, grains, metals, other commodities, and many produced goods during a period of war and pandemic in the world. To truly drive inflation down, a shock to consumer demand including a deep economic recession would be necessary to properly balance less production with less spending.

If the goal is full employment and some sort of economic growth in output, inflation will be a side-effect in 2022-23. American leaders need to be frank with citizens, explaining the 2020-21 span of “free lunch” money printing has now ended. Harder choices are the current reality. With $30 trillion in Treasury debt having no mathematical way of being repaid in constant value dollars, a “soft default” scenario of repaying debts with devalued currency is the ONLY way forward. Honest economic analysts understand this fact.

Inflation will be less painful for society at large than a deep recession, while utterly chaotic and troubling for fixed-income pensioners and low-wage earners owning few assets. The other option is a deflationary bust, with a stock market crash, perhaps an economic depression, where all Americans become poorer almost overnight. Which would you choose, if you had access to the levers of power? Time and again, since Chairman Greenspan’s response to the 1987 stock market crash, our leaders have responded to every economic slowdown with expanding rates of money printing, QE buying of Treasury securities since 2008, and now wild Treasury borrowing to prevent mass defaults and deep recession in the pandemic.

Oversold Technical Condition

Believe it or not, the current NASDAQ decline of 30% has been more catastrophic to shareholders than the 2020 pandemic crash of February-March 2020. Price losses are larger and volume selling has been far greater, for a longer period of time. Fast-money traders, the leveraged crowd, and speculators/gamblers of all types have encountered amazing dollar losses in 2022, incorrectly assuming the Fed would never allow stocks to fall again. Huge excesses and overoptimism have been squeezed from the financial system, as the Fed projects material tightening from rates of 0.5% months ago to dot-plan estimates of 2% to 3% by late 2022.

On the 5-year weekly below of weekly changes, we can review the QQQ product is just as oversold (if not more stretched) than the late 2018 bottom after a 20% selloff, or 2020 liquidation of 30% in the early days of the pandemic-induced economic shutdown (marked with green arrows).

5-Year Weekly Chart with Author Reference Points, StockCharts.com

On the intermediate weekly chart above and daily one drawn below, the Relative Strength Index and Money Flow Index creations are clearly in oversold territory vs. past norms. What does this mean? Well, as we have witnessed in April-May, oversold conditions can remain oversold for some time. The good news is the sharp drop in price should level out or reverse higher soon. Panic selling does not last forever, although, for many investors getting wiped out by the drop in speculative names, mass liquidations can take most of your capital.

Even if you are bearish long-term on valuations and the future of our economy, a bounce of 10% or 20% higher first may be the next move for the market. I have drawn a minimum target zone in green for a QQQ retracement move, or the initial wave of buying after a major bottom possibly reached this week or next. Either way, I am not super-excited about QQQ’s prospects, and not expect a roaring up-move to new all-time highs later this year. I am in the camp projecting a protracted flat period of zigzags is coming in 2022-23.

18-Month Daily Chart with Author Reference Points, StockCharts.com

Final Thoughts

I am thinking very soon the Fed will have to give up the inflation fight to prevent an economic calamity later in the year. Self-inflicted chaos similar to the aftermath generated by the 2008 Lehman failure in the banking system is a cautionary tale of what might happen, if we continue to raise short-term rates no matter the consequences. At least that’s the policy risk in my view. We all want to “have our cake, and eat it too.” Yet, those days appear to have passed for America. A strong stock market and economy without inflation are no longer possible.

I suspect U.S. equities will rise quickly in the coming weeks if the Fed raises the white flag on the inflation fight. Another consequence may be a rush to hard money alternatives like gold/silver/platinum as investors and banks worldwide realize inflation is here to stay. I am projecting both precious metals and equities would climb materially in U.S. dollar price, assuming a faltering economy causes the Fed to back off further rate hikes.

This “upside” risk for investors selling stocks in May is something worth contemplating. In a sense, selling after a Big Tech rout of 30% may be exactly the wrong decision to make. You may be doubling down the stupid move of rushing into Big Tech in 2021 near an important long-term top. My experience and research suggest owning the mega-cap technology leaders represented by the QQQ ETF has similar rationale to the bullish setup 18-24 months ago.

Could Wall Street stock prices dump another 10% or so in the coming month? Sure, that’s one possible scenario if the Fed keeps tightening. But pressure from corporate managers, billionaires, bankers, even small investors and Democrats in D.C. power before the midterm elections in November could sway views at the Fed.

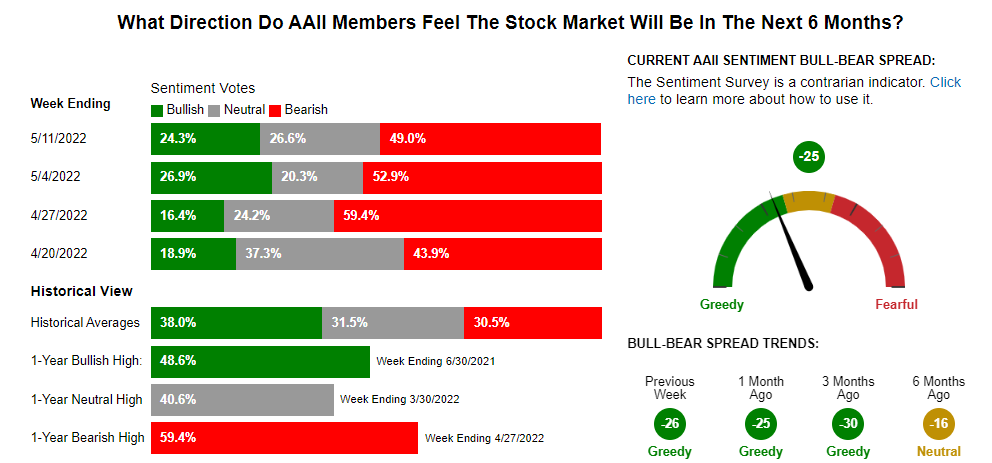

Small investors are the most bearish on the U.S. stock market since the end of the Great Recession bust in early 2009. AAII Survey (American Association of Individual Investors) numbers for many weeks are highlighting an excessively negative outlook that could reverse into a bull trend without much warning. Contrarian thinkers understand major bottoms on Wall Street are often a function of fear and pessimism, like today. Historically, buying the U.S. market after weeks of bearish survey numbers similar to May 2022 has produced solid profits months later.

AAII Investor Sentiment Survey

Again, I am not wildly bullish on Big Tech, but looking for a slow zigzag higher into late summer. At that time, I may downgrade my outlook depending on the economic tea leaves present. A mild recession may be in the cards this summer. However, I suspect the Federal Reserve may quit raising rates and stop fighting inflation to support the economy soon. Such a reversal in policy would support equity prices and corporate income while allowing inflation to remain higher than the current prognostications by Wall Street experts.

All told, owning/buying QQQ looks to be a safer investment proposition today than any other time since 2020. The next 20% move is heavily tilted to the upside statistically after a 30% liquidation phase. You have to go back to the 2007-09 Great Recession period to find a drop greater than 30%. Of course, if a deep recession is next in 2022, all bets are off on predicting upside. Under this scenario, another 10% or 20% of QQQ downside could hit during the summer. That’s exactly what the Fed is trapped into preventing, no matter the future inflation rate.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

[ad_2]

Source links Google News