[ad_1]

zodebala

The market’s topsy-turvy route has continued into this year’s back-end. However, considering the volatility of the macroeconomic variables in play, there’s no surprise in that.

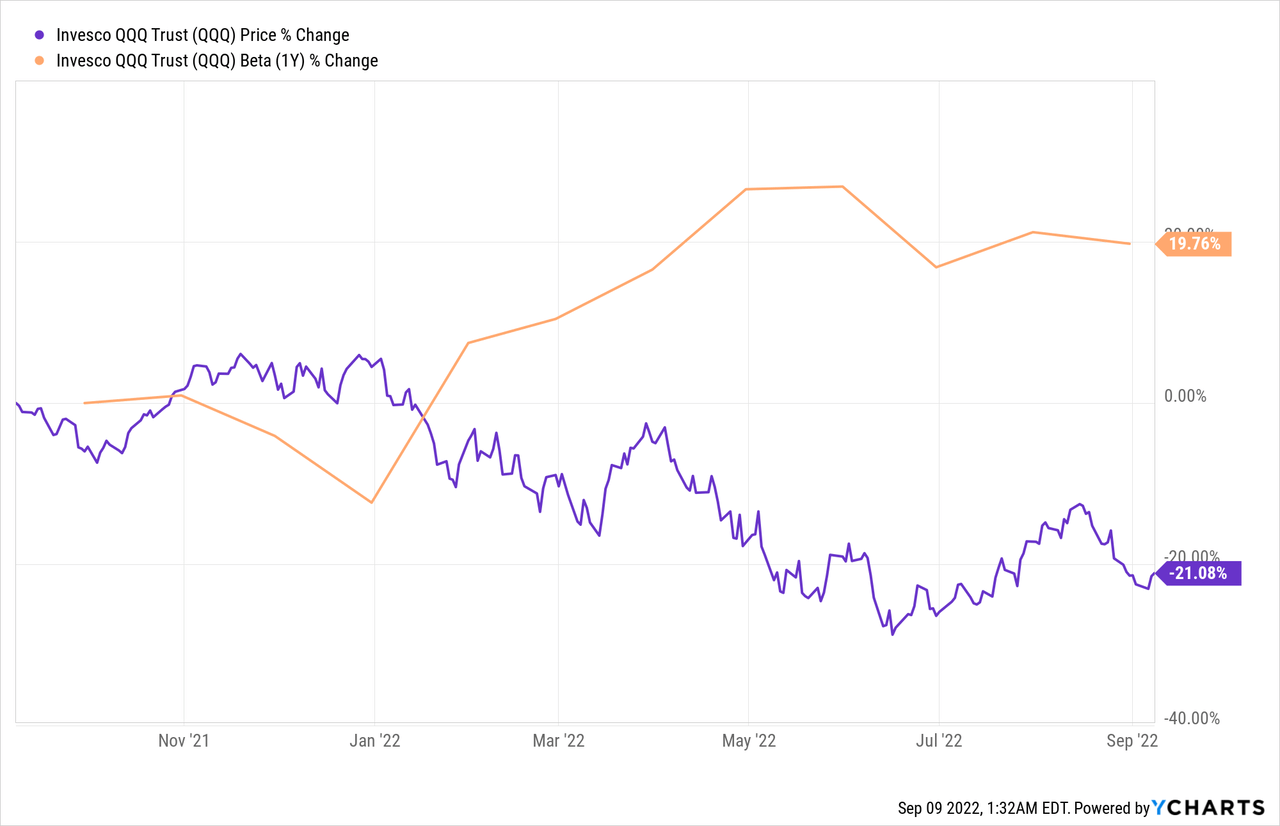

Looking at the current state of affairs, we believe that the Invesco QQQ ETF (NASDAQ:QQQ) (which is a Nasdaq 100 tracker fund) could be in more trouble than most believe; here’s why.

Statistical Observation

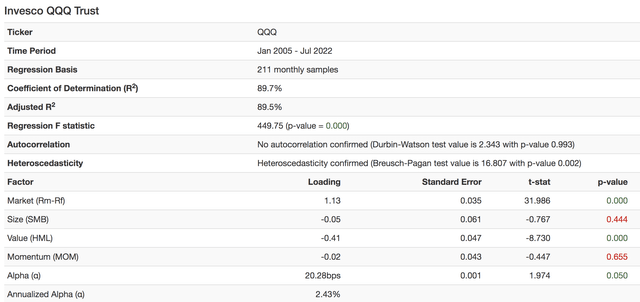

I ran a regression to see whether I could find a parsimonious description of the QQQ’s historical returns.

The regression tested the ETF’s performance in four different market environments, namely the general stock market (rm-rf), small-cap versus large-cap performance (SMB), low book value versus high book value (HML), and high momentum versus low momentum (MOM). Collectively I was able to find reasonably reliable results with the model explaining 89.5% of the asset’s historical returns. Additionally, the model detected inconsistent variance (heteroskedasticity) in the return distribution and corrected it by applying the Breusch-Pagan test.

The main inferences we can draw from the regression results are that QQQ outperforms the market in stable economic conditions, outperforms when small-cap stocks are favourable, and is aligned with growth stock performance. However, on the flip side, QQQ hasn’t stimulated any appetite from investors whenever growth stocks have underperformed, nor has it sustained momentum for prolonged periods.

PortfolioVisualizer

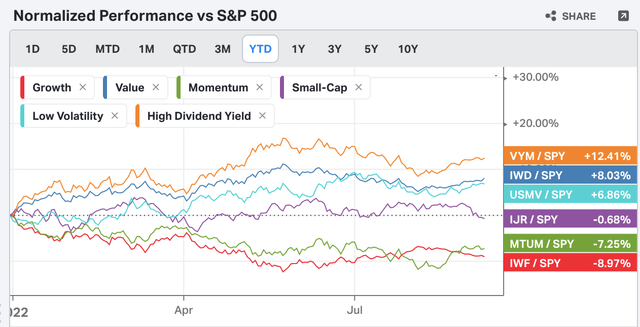

Combining the inferences drawn from the regression with a few different stock classifications, it’s clear that growth stocks have been battered lately, possibly explaining the QQQ’s demise.

KoyFin

The regression analysis explains ex-post returns. However, it’s necessary to look ahead for to formulate an objective price-setting conclusion; let’s get stuck into a few fundamentals and how they coalesce with QQQ.

Exploring the Fundamentals

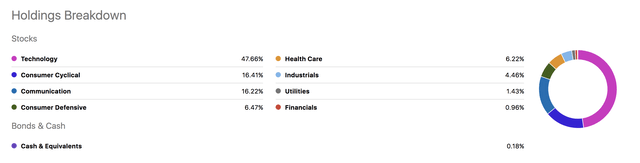

The two figures below show QQQ’s portfolio allocation. The first reveals its allocation by sector, while the second displays its stock-specific distribution.

It doesn’t matter how you slice it; recession risk is destined to ruin this ETF because of its cyclical exposure. Sure, you could argue that some technology bets are secular in nature and that consumer cyclical stocks could be offset by communication stock performance in rising interest rate environments. However, the bottom line is that recession risk is high (60% according to UBS), and QQQ’s portfolio composition isn’t appealing to any risk-off sentiment.

Seeking Alpha

Even a quick summation of the ETF’s key holdings conveys a gloomy picture. For instance, in the latest earnings season, the likes of Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), Alphabet (NASDAQ:GOOG) (GOOGL), and NVIDIA (NASDAQ:NVDA) all missed their normalized earnings-per-share targets as rising inflation, and weaker demand continues to wane on income statements.

Many of the ETF’s holdings hold down solid market share in their respective industries, allowing for latitude during turbulent economic times. Nevertheless, with bottom-line earnings dipping below estimates, none of the big technology companies will likely perform soundly for some time.

Seeking Alpha

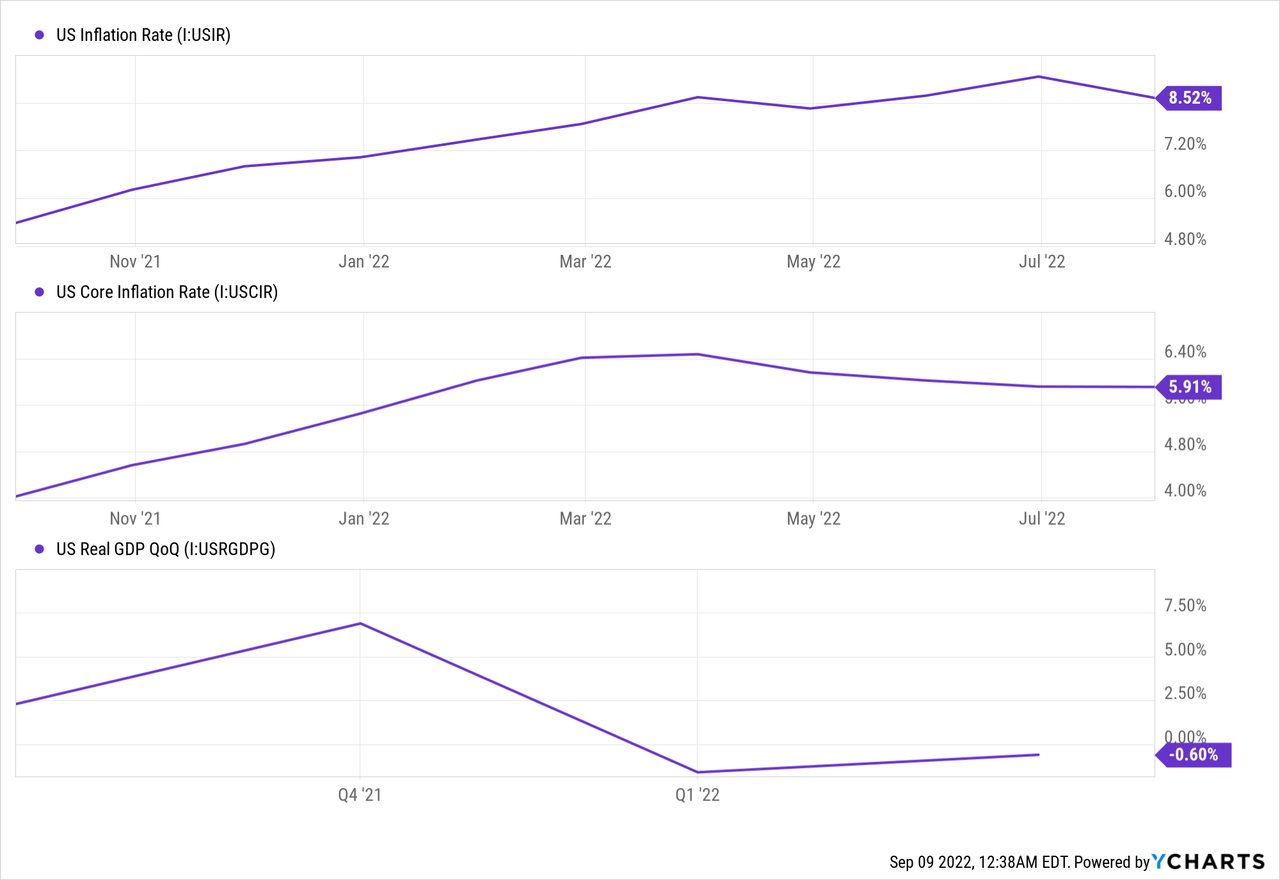

To elaborate on the current state of the economy, I chose to discuss inflation, GDP, and the yield curve of the United States.

Firstly, it’s necessary to point out the negative growth in GDP, which is, by definition, a recession (as it’s sustained for successive quarters). However, if you don’t believe the U.S. is in a recession just yet, I’d refer you to the 60% probability mentioned earlier. Regardless of the terminology used, it’s clear that the U.S. economy is in negative growth and that core inflation is receding faster than broad-based inflation, meaning that energy and food prices remain a problem.

What does all this mean? It means we’re likely to see consumers scale back on non-essential purchases such as higher-end technology and online shopping. As a result, the likes of Amazon, NVIDIA, Apple (AAPL), and Microsoft might all suffer from softening demand.

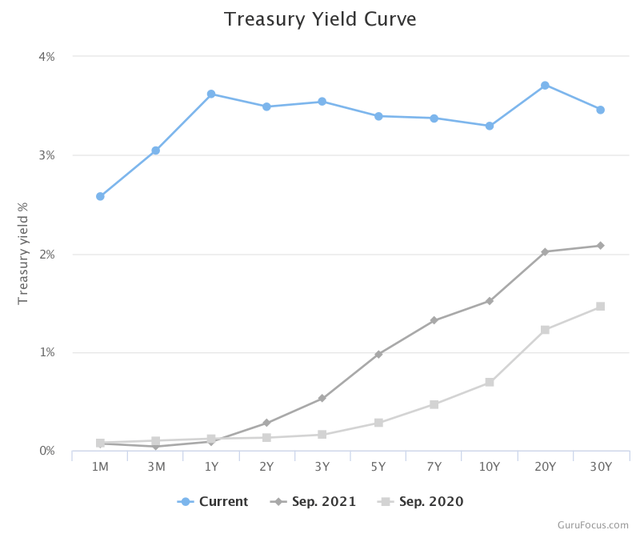

Let’s jump in on the deeper end. The chart below shows the current Treasury yield curve, which is a distribution of the implied interest rates in the United States. In my opinion, we’re seeing bearish flattening in the curve, meaning that short-term interest rates are likely to rise faster than longer-term rates. Therefore, a sustained slowdown in economic growth is the most likely outcome at the moment.

Once again, if the implied interest rates came to fruition, the QQQ ETF is likely to be pegged back as it’s built up on stocks that are sensitive to short-term economic cycles.

GuruFocus

A Counterargument

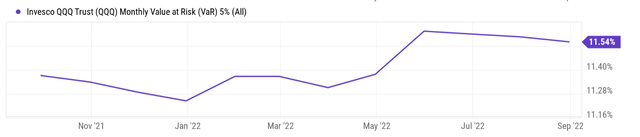

Although we’ve been in a relatively severe bear market, the approximate 25% drawdown of QQQ seems exaggerated, given the fact that its 5% historical monthly value at risk is only 11.54% (This means that QQQ will likely drawdown by more than 11.54% of its traded months).

Seeking Alpha

Furthermore, the stocks hosted in the ETF hold “best-in-class” status. As such, we could see them outperform their industries on a relative basis, meaning that some of the existing growth stock investors could purely circle out of higher-beta assets and into the likes of Microsoft, Apple, NVIDIA, and Amazon.

Lastly, consideration needs to be given to the fact that the stock market has already priced the prospective economic headwinds and that we could see a rebound in mid-recession, providing investors with an excellent opportunity to “invest in the dip”.

Concluding Thoughts

A statistical regression and a fundamental overview convey that Invesco QQQ ETF could sustain its recent drawdowns. The ETF’s key influencing variables are bearishly aligned with the current state of the economy. Furthermore, the bearish flattening of the yield curve and the ETF’s composition suggest that it’s an asset you ideally don’t want to own at this stage.

[ad_2]

Source links Google News