[ad_1]

(Source – Sohel Patel/Pexels)

The iShares MSCI Qatar ETF (QAT) has to be one of the most interesting single-country ETFs on the market today. Although it is an equity ETF, it has almost no daily correlation with the S&P 500 or other major indices. Despite its lower systemic risks, it has low valuations and pays a dividend yield of over 5%. Even better, it is in one of the fastest-growing areas of the world.

That said, everything is not perfect with Qatar’s economy and geopolitical position. The ETF is highly exposed to the financial sector and the country is currently in a deflationary recession. Further, the country is highly dependent on crude oil and has struggled to see economic growth for the past seven years. And, of course, we cannot forget the ongoing Qatar-Saudi Arabia diplomatic crisis.

Let’s dig into the financial and economic data and see if Qatar is the highly diversified value buy it appears or yet another value trap that could be catalyzed by geopolitical tensions.

The iShares MSCI Qatar ETF

As I often say, it is as important to know your product as it is to have an opinion on it, particularly with single-country ETFs. Too often, investors buy a fund only to find it does not hold exactly what they expect.

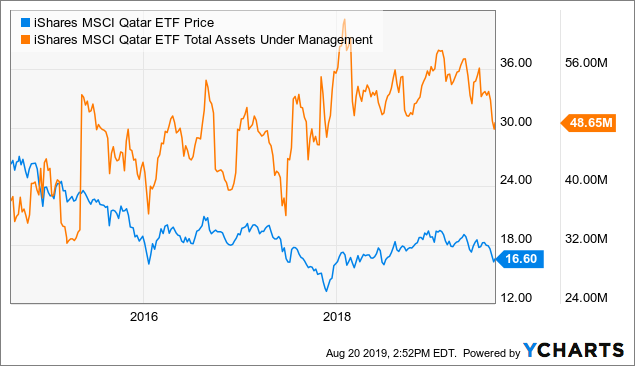

QAT is relatively new (inception 2014) and still largely unknown by the broad investment community. The fund currently has $48M in assets under management and does not have options available so it is less liquid than most funds. Let’s take a look at the trend in its AUM to see what fellow ETF investors are up to:

Data by YCharts

Data by YChartsHere we can see that the ETF’s AUM is floating just around $50M. In my opinion, if that crosses below $30M, then the fund has high closure risk. We can also see that its AUM has declined to a low since 2018 recently. This may be a sign that the fund is oversold.

A Bet on the Banks

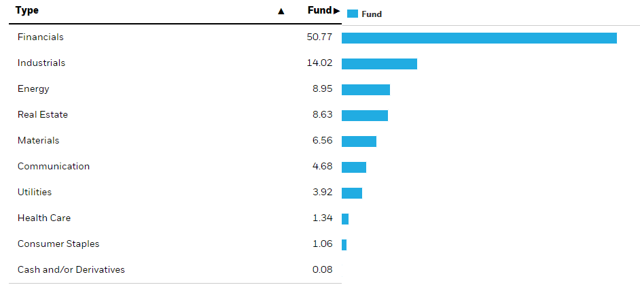

You would probably think that a Middle Eastern single-country fund would have high direct exposure to crude oil. This is not necessarily true in the case of QAT. Here is the fund’s current holdings’ sector breakdown:

We can see here that the fund is primarily exposed to the country’s banking sector as seen by its huge allocation toward financials. This helps explain why the ETF has a low weighted average P/E ratio of 12X and a P/B ratio of 1.4X. Financial stocks globally have valuations at or below these levels.

The largest single holding is the Qatar National Bank which makes up a very high 23% of the fund’s holdings. This is a key point because, as with many of the ETF’s other holdings, this bank is 50% owned by the Qatari government. If you’re betting on this ETF, you are also betting on the Qatari government.

As with most of the Middle East, the Qatari government wants to diversify away from crude oil into the banking sector. Indeed, one of the major drivers of continued economic growth in the country is its non-oil sector that has seen 4%+ annual growth over the past decade. Overall, the country’s high finance exposure is positive as long as Saudi relations do not continue to deteriorate because that would likely hurt deposits and new lending.

Highly Idiosyncratic Asset Exposure

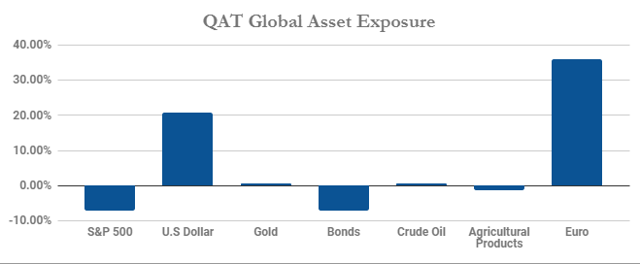

To me, QAT’s relatively low valuation and the high dividend is simply a sign that the ETF is fairly valued in a world where most assets are overvalued. The biggest positive factor weighting on the ETF is its very low exposure to global assets and even its neighbors. Take a look at the fund’s correlation to other major asset classes:

QAT is the only long equity I know of to have a negative correlation to the S&P 500. Since the measure is above -10%, it is probably more of a statistical fluke than truly negative, but it is true that QAT has little systemic equity exposure.

The biggest factor weighing on the fund is its currency exposure. Qatar uses the Qatari Rial that is pegged to the U.S dollar. This peg has generally been safe besides a brief 5% crash in November 2017 following the end of Saudi diplomatic ties that was quickly restored.

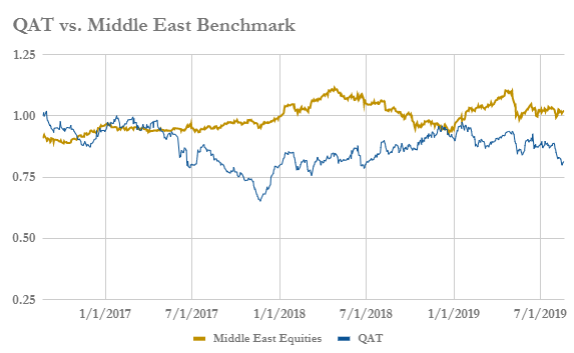

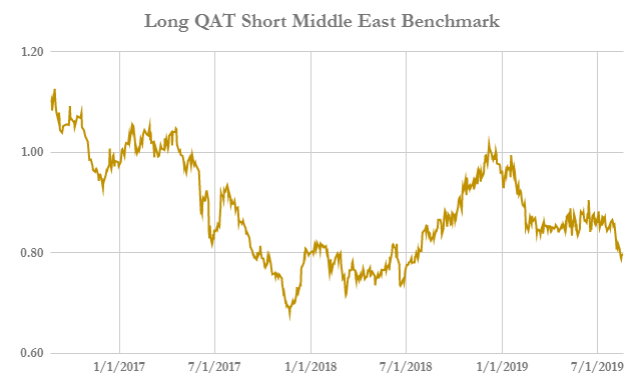

While equity exposure of the ETF may be low for now, it may be on the rise. Take a look at QAT performance vs. a basket of Middle Eastern single-country equities.

Note, the benchmark is equal-weighted WisdomTree Middle East Dividend Fund (GULF) – Saudi Arabia (KSA), UAE (UAE), and Egypt (EGPT).

(Data source – Google finance)

As you can see, the correlation was not existent in 2017 and 2018 but seems to be closer this year as the Middle East Equities benchmark has been sharing selloffs with QAT. This is seen more clearly in the pair trade performance between the two. By dividing the QAT performance by the Middle East benchmark, we can see how a long QAT, short benchmark trade has performed:

(Data source – Google finance)

Notice how the line went completely flat from February to July this year? That is a sign that QAT traded in-step with its regional peers over that period only to break lower over the past month.

In my opinion, this pair trade is a buy at this point. Because the global economy is looking questionable, I personally would not want to go outright long this ETF. That said, after looking at the chart and due to improving macroeconomic conditions/superior valuations, I do expect QAT to outperform KSA, EGPT, and UAE over coming months unless Saudi Arabia puts new pressure on Qatar’s economy.

Likely Improving Macro Backdrop

I think it’s safe to say QAT is a pretty good long-term investment. It pays a high dividend and is generally less correlated to the global economy. Its government wants to promote non-energy growth. Even better, the country is slated to host the 2022 World Cup and, because the country is quite small, the event will probably boost investment and infrastructural development.

So what can we expect over the next year? This is where the investment picture becomes more questionable. Let’s begin with my favorite economic indicator: Manufacturing PMI. This measure has been falling and is now indicating prolonged poor or negative GDP growth.

Here is Qatar’s current manufacturing PMI:

(Source – Trading Economics)

This is a sign that businesses are seeing less new orders and possible inventory problems.

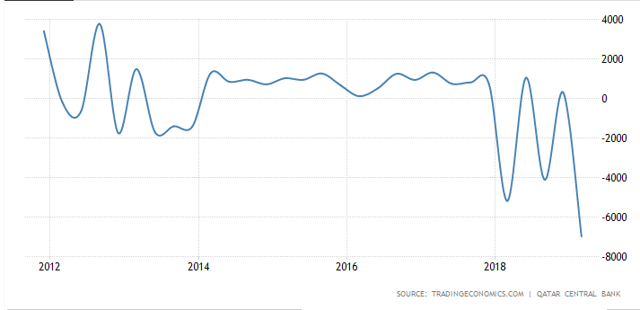

Another major immediate problem is the country’s huge negative recent FDI flows. Here is Qatar’s current FDI data:

(Source – Trading Economics)

The country is unlikely to see major growth in its banking sector or infrastructure if capital flows and FDI continue to be negative. The large negative investment was due to outflows on behalf of Saudi Arabia and its allies. While negative flows are bad in the short-run, they also imply demand for investment is likely quite high. When businesses need investment, investors are often rewarded for filling in the gap.

The Bottom Line

Overall, I am bullish on QAT in the long-run but am neutral over the next twelve months. I expect QAT to outperform its peers, but would not be surprised to see the fund fall in value due to the ongoing tensions in the Middle East and global economic slowdown.

Tensions in the developed Gulf region countries is the most serious cause for concern. Qatar has become diplomatically aligned with Turkey and Iran and less aligned with Saudi Arabia and its allies. Tensions have been building between Iran and the U.S./Saudi Arabia. Indeed, it appears that two “teams” have been forming in the Middle East who have been reducing economic ties to each other.

Saudi Arabia already has essentially cut off investment into Qatar and now the U.S. is one of the major sources of foreign investment. In general, the U.S has had decent relations with Qatar, but after the 2017 diplomatic crisis, President Trump said via twitter:

“During my recent trip to the Middle East, I stated that there can no longer be funding of Radical Ideology. Leaders pointed to Qatar – look!”

I see the odds of negative U.S. tone toward Qatar as low, but if an economic fallout occurred, it would be very difficult for Qatar and QAT. That said, the U.S. is only 2% of Qatari exports. Asia, specifically China, South Korea, and Japan, makeup over 81% of Qatar’s exports and will likely be key economic ties going forward.

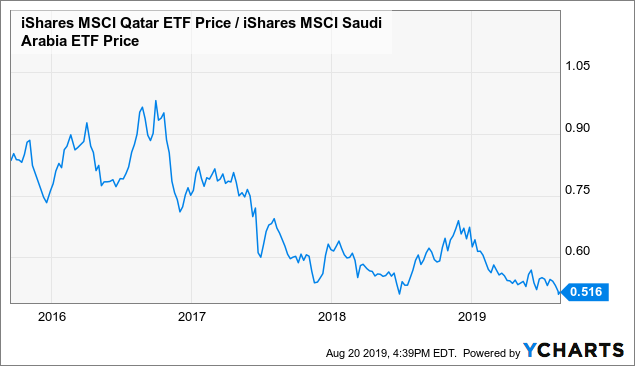

Due to these risks and the current economic slowdown in Qatar, I’d wait to invest unless I’m in a hedged position. Long QAT, short iShares MSCI Saudi Arabia ETF (KSA) looks like it has potential. Take a look at the chart of that trade’s recent performance:

Data by YCharts

Data by YChartsThe trade is at its 2018 support level and looks concave up, signalling that we may see another late 2018-style rise. I have no price expectations for QAT, but expect to see this pair trade ratio hit 0.60 (a 16% return) by the end of the year.

Interested In Closely Following Global Events?

“The Country Club” is a dedicated service that focuses on single-country and regional ETFs with the goal of helping our subscribers diversify globally and get a better grasp on how world events will affect their portfolio. We will certainly be providing subscribers further updates on this idea.

Subscribers receive exclusive ideas, model portfolios, and a wide range of tools including our exclusive “Country Club Dashboard” which allows them to visualize global financial and economic data. If you haven’t already, please consider our 2-week free trial and get your passport to global markets today!

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a short position in KSA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News