[ad_1]

Intro

After increasing over 20% since the month of July, silver has outpaced gold in recent weeks and could still see significant growth. Due to an increase in economic uncertainty, investors have found shelter in precious metals such as gold and silver.

During my last article about silver, I highlighted how the gold-to-silver ratio was reaching historically high levels and needed a correction. The ratio did fall, and now, silver has been on a bull run, reaching prices not seen in almost three years. I believe that this trend can continue, and I will convey why the Sprott Physical Silver Trust (PSLV) is the most attractive vehicle to trade silver.

PSLV

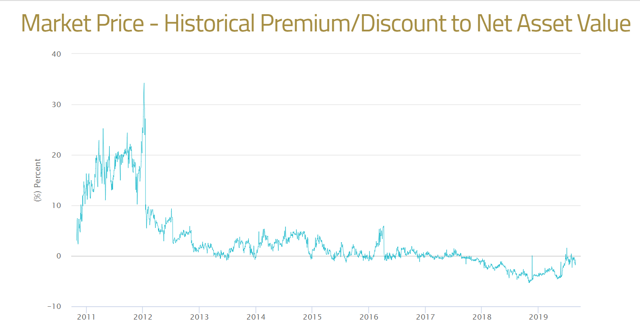

To start with, PSLV has a couple of major advantages over physical silver and other trusts, such as the iShares Silver Trust ETF (SLV). PSLV is currently trading under its current net asset value, meaning that for every dollar of silver an investor purchases, they receive over $1 of silver.

I have used this as a barometer to the market’s perception of silver, where anything under the NAV (Net Asset Value) is perceived as a bearish outlook on this commodity and anything over is seen as bullish. Currently, PSLV trades at less than a 1% discount to its current NAV, conveying that there is no extreme bearish or bullish bias towards this trust.

What is interesting is that PSLV has been selling at over a 4% discount as recently as late 2018, and has now made its way closer to its actual NAV, signaling that investors no longer have a severe disdain for silver.

On the other hand, when silver was in the midst of its bull run, PSLV was trading at over a 30% premium to physical silver. This means that these investors not only enjoyed a dramatic increase in the physical price of silver, but were rewarded an extra 30% due to the increased demand from investors.

This is one of the major potential benefits over physical silver, but an advantage over SLV is that PSLV is redeemable for physical silver at a much lower volume.

Source: Sprott

PSLV’s minimum share requirement allows everyday investors to take advantage of this service. With SLV, an investor must purchase 50,000 shares to have it redeemable for actual silver, which would cost around $850,000. PSLV deals in a much smaller increment, as one would only have to purchase a London Good Delivery silver bar, which costs about $18,500.

Gold-to-Silver Ratio

Although the gold-to-silver ratio has decreased by about 7%, it is still way above its average and could see a significant drop. As seen below, the gold-to-silver ratio has fallen from above 90 to about 84, as silver has outpaced gold in the past weeks. Even as gold has surpassed the critical $1,500 threshold, it has traded relatively flat throughout the last three weeks of August. This has allowed silver to drag down this ratio, as investors are seeking relatively safe investments that still have room to grow.

Source: Macrotrends

While gold is consolidating, I could see silver increasing in price and lowering the ratio to 80, which would represent a 5% increase. This level has served as a support for silver for the past 15 years and should now act as resistance if silver trades higher.

Current Risks with Silver

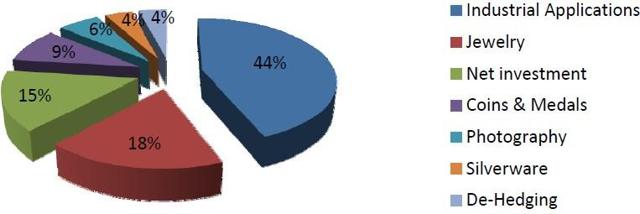

Now, although the current economic conditions are great for commodities to thrive, the majority of silver mined is for industrial use. To really see silver and PSLV appreciate in price, investors need to provide an influx of cash to make up for the projected declining economic growth.

Source: Klondike Silver website

The majority of silver is used for industrial applications, which means that the metal is tied to the growth of the economy. Only 15% of silver’s usage is from investments, conveying that investors would need to significantly increase their net investments to make up for the slowing of economic growth.

In the industrial application category, this includes silver’s use as a reflector for the solar industry. This is what sparked the massive growth in 2011 as these solar companies were being subsidized and started to purchase the metal at astronomical rates, pushing the price per ounce north of $50. Even as the solar industry continues to grow, companies are finding new ways to recycle old silver and use less of this precious metal.

Final Thoughts

So, even though downward pressure from a potentially slowing economy is present, I believe that silver still has some room to grow as investors begin to increase their positions in the metal as economic uncertainty looms overhead. As for a near-term price target, I would like to see the gold-to-silver ratio around the 80 level. I see gold consolidating for a while longer, so this would represent at least 5% growth in PSLV and the underlying silver price.

Disclosure: I am/we are long PSLV. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News