[ad_1]

bjdlzx

The Invesco S&P SmallCap Energy ETF (NASDAQ:PSCE) is exactly what it says on the tin: a small-cap energy index ETF. PSCE’s holdings are smaller and riskier than average, but see above-average revenue, earnings, and share price growth when oil prices are high and rising, and trade with comparatively cheap valuations as well. PSCE is a classic high-risk high-reward investment opportunity, and particularly appropriate for aggressive energy bulls. With a measly 0.8% yield, the fund is not an effective income vehicle.

PSCE and Energy Industry Overview

PSCE is a small-cap energy index ETF, tracking the S&P SmallCap 600 Capped Energy Index, an index of these same securities. The index first selects the 1500 largest U.S. companies, subject to a basic set of liquidity, trading, size, and shareholder rights criteria. It then selects the 600 smallest companies in this group, and then selects the energy stocks within said group. It is a market-cap weighted index, with issuer caps to ensure diversification. Due to the fund’s niche focus, S&P investment committees retain the right to modify index holdings to their discretion, although significant discretionary changes are rare.

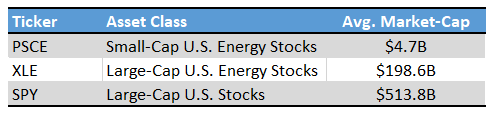

PSCE is meant to track the U.S. small-cap energy industry, and the fund does just that. It currently invests in 27 different U.S. energy stocks, all relatively small corporations. PSCE’s market-caps range from $4.7B, SM Energy Company (SM), to $550M, REX American Resources Corporation (REX). These are tiny figures compared to the market-caps of energy giants, including Exxon Mobil (XOM) and Chevron Corporation (CVX), both with market-caps in the hundreds of billions. The difference is even more stark compared to mega-cap stocks, with several tech companies being worth trillions. PSCE’s holdings sport a weighted average market-cap of $4.7B, significantly lower than the energy industry / equity average.

ETF.com – Chart by author

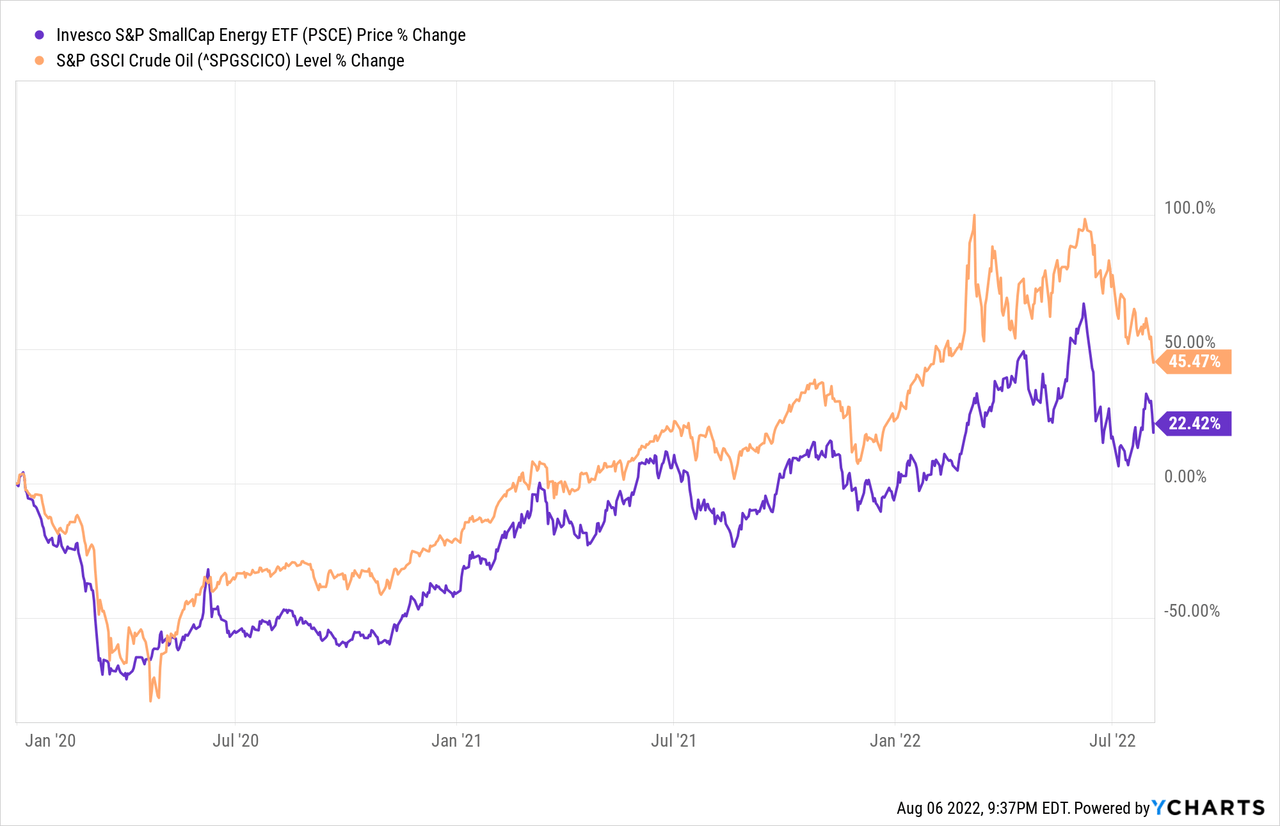

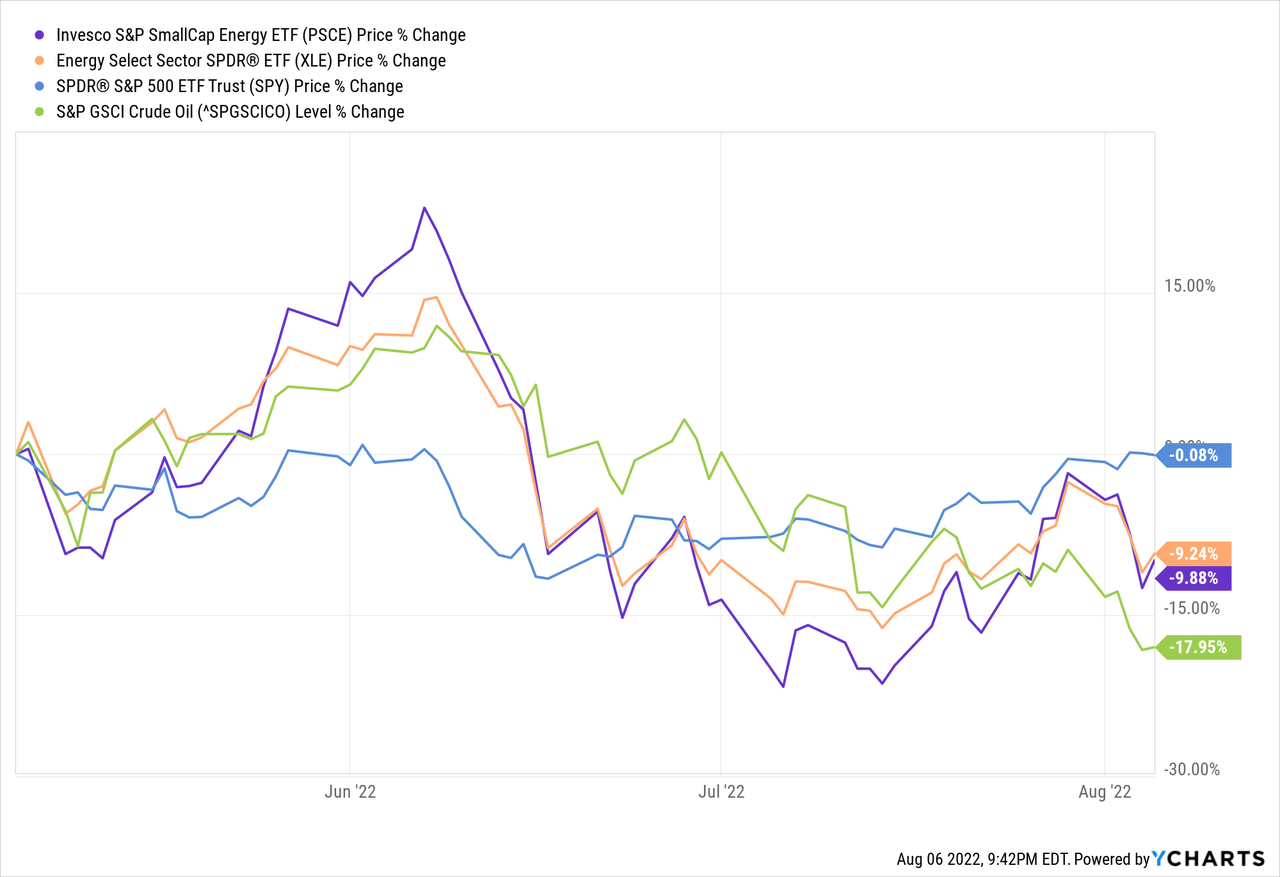

As with most energy funds, PSCE has significant exposure to energy prices. The fund’s underlying holdings should see significant revenue and earnings growth when oil prices are high and rising, large revenue declines and unprofitability otherwise. Share prices tend to track oil prices, for obvious reasons, but a large gap has materialized these past few years.

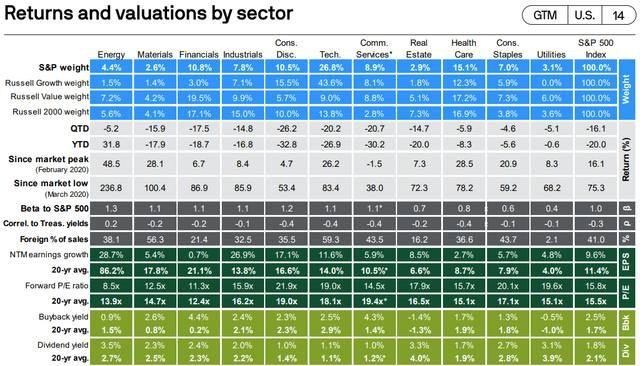

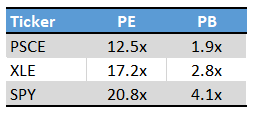

Due to the above, energy is currently the cheapest industry in U.S. equity markets, with a measly 8.5x forward P/E ratio. As a comparison, the S&P 500 sports an average P/E ratio of 15.8x, almost twice the energy industry average. Source is J.P. Morgan, although you might have to squint to see the figure.

J.P. Morgan

The above is the investment thesis for the entire energy industry. It is also, I think, common knowledge for most readers and subscribers, so won’t belabor the point. Instead, I want to focus on what differentiates PSCE relative to its peers, as the fund materially differs from its peers in several key ways. Let’s have a look at these.

PSCE – Peer Analysis

Small, Risky Holdings

PSCE focuses on small-cap energy stocks, which tend to be significantly riskier than the energy industry average.

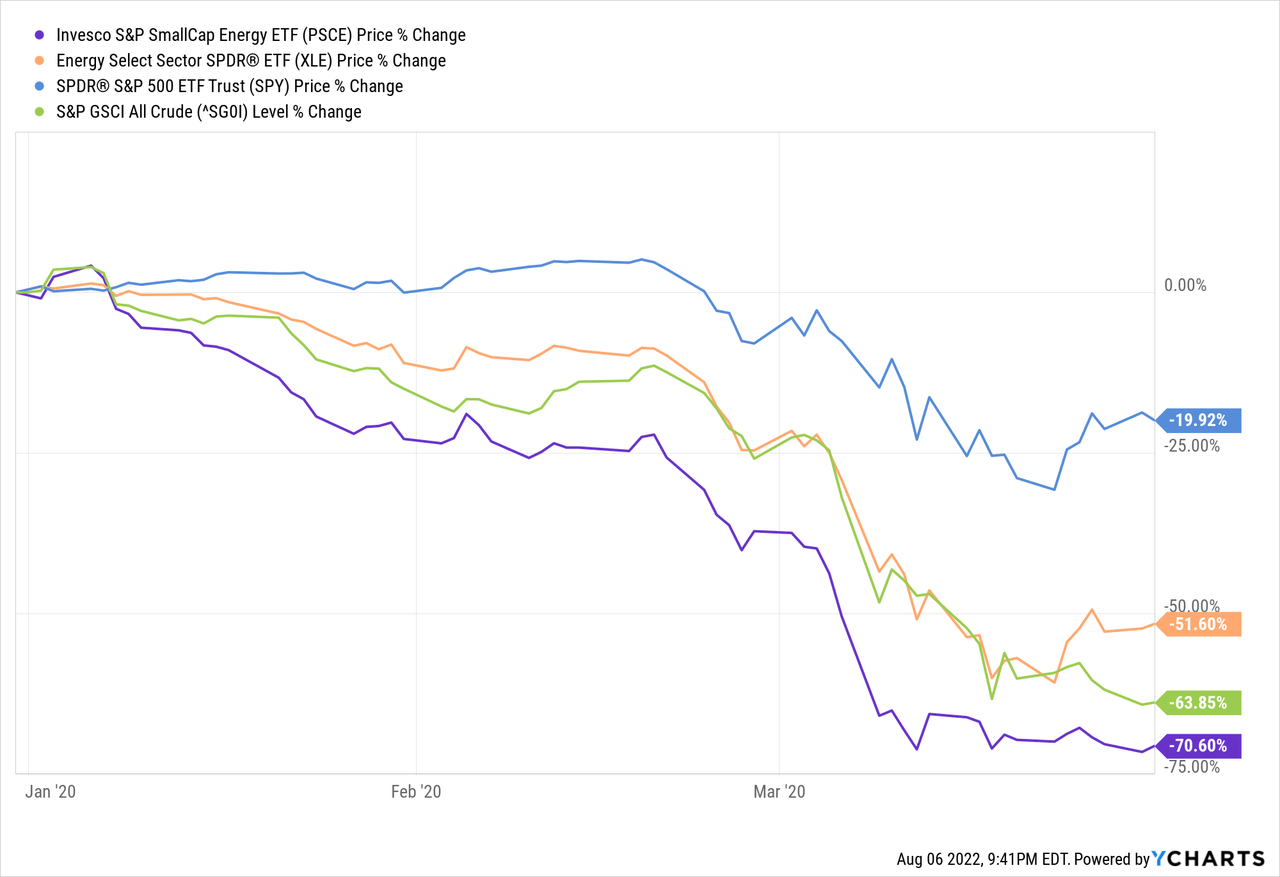

Risk is operational and financial. Small-cap energy stocks tend to focus on more marginal oil wells, with greater operational expenses and higher break-even oil prices. Smaller oil producers also tend to have weaker balance sheets and financials, some have very reckless management teams too. These issues significantly increase risk and volatility, especially when oil prices start to decrease. Exxon and Chevron might see significant losses if oil prices plummet, but smaller oil producers might go bankrupt, as happened to dozens of such companies in 2020. Some small-cap oil producers are hanging by a thread, so are extremely dependent on strong, sustained oil prices for survival.

Risk is also linked to issues of market perception and risk. Investors sell energy stocks when energy prices decrease, but the effect is magnified for small-caps. There are simply very few investors with the stomach or inclination to hold these stocks when times are tough. Many investors will simply cut their losses, sell, causing stock prices to tumble by more than expected. This was, for instance, the case during 1Q2020, the onset of the coronavirus pandemic.

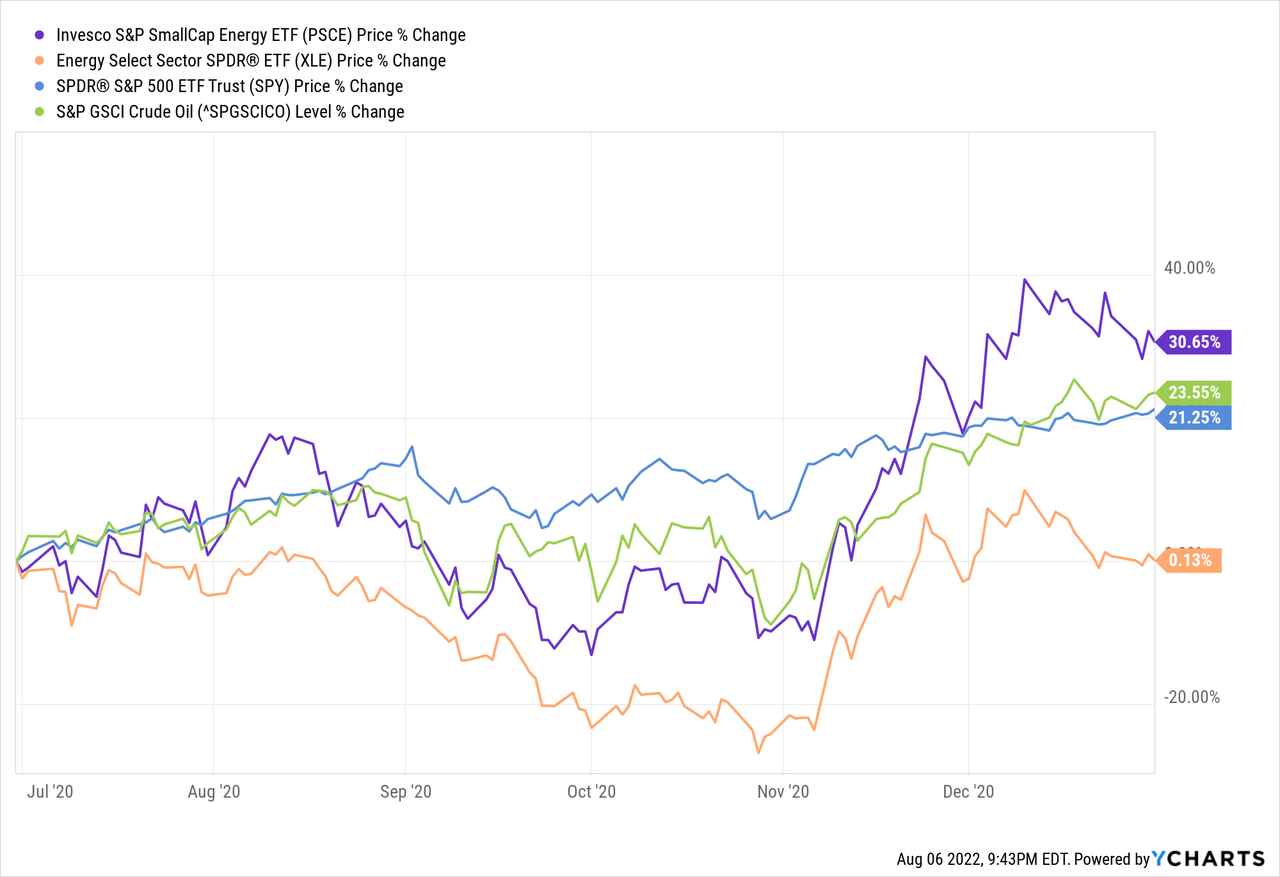

Due to the above, small-cap energy stocks tend to see significant gains and outperformance when energy prices increase. In simple terms, the harder the fall, the higher the bounce. As an example, PSCE’s share price more than doubled in the second half of 2020, during which the pandemic started to subside, through mass vaccination campaigns and natural immunity. PSCE outperformed energy industry indexes, as well as the S&P 500, during said time period.

As should be clear from the above, PSCE is an incredibly risky fund, and riskier than most energy funds. Significant losses during oil price crunches have been the case in the past, and will almost certainly be the case in the future. PSCE does have its benefits, but the risks are real, significant, and materially greater than average.

Stronger Energy Exposure

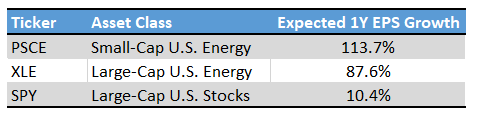

PSCE’s underlying holdings tend to see above-average losses when oil prices decrease, but also above-average gains when oil prices increase. The symmetry is only natural. Marginal oil producers avoid (the risk of) bankruptcy when oil prices are high, and so see significant gains when this is the case, although starting from a low base. For companies with greater operational expenses, rising oil prices leads to higher-than-average expansions in margins and EPS too. Market sentiment also plays a role, as investors are more willing to risk an investment in small-cap oil producers when oil prices are high.

Due to the above, small-cap energy stocks tend to see significant gains and outperformance when energy prices increase. As an example, PSCE’s share price more than doubled in the second half of 2020, during which the pandemic started to subside, through mass vaccination campaigns and natural immunity. PSCE outperformed energy industry indexes, as well as the S&P 500, during said time period.

Fund Filings – Chart by author

PSCE’s energy exposure is quite strong, significantly higher than average, and the fund’s key differentiator. All energy funds see significant gains when energy prices increase, but gains tend to be materially higher for PSCE than for its peers. As such, PSCE is an appropriate investment for more aggressive energy bulls, in my opinion at least.

Cheaper Valuation

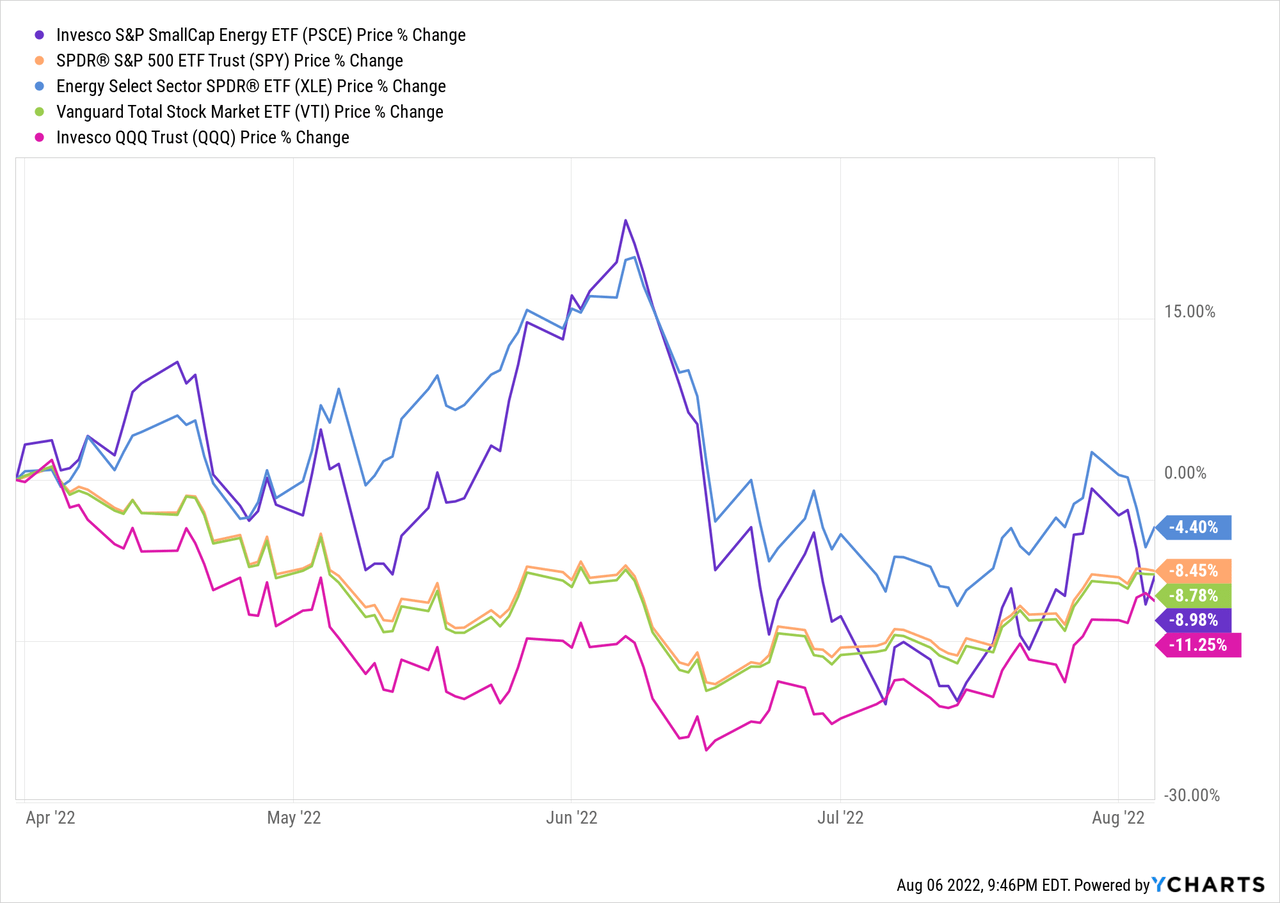

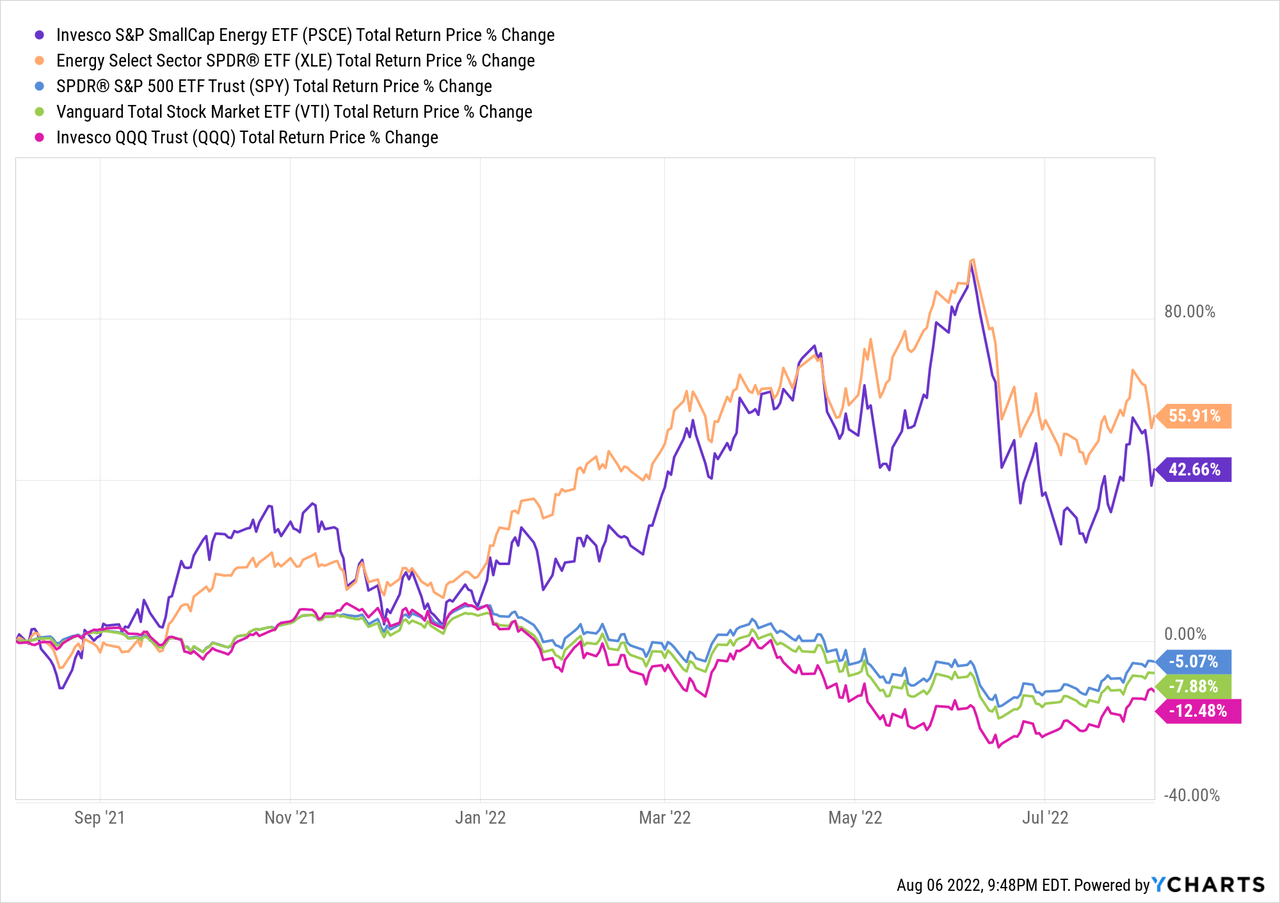

Equity markets have tumbled down in the past few months, as skyrocketing inflation, increased interest rates, and slowly worsening economic conditions turn investors bearish. All major asset classes, equity indexes, and equity industries are down, although there has been a relatively swift recovery these past few weeks. PSCE is down since around April, although remains up YTD.

Importantly, it seems that PSCE’s losses have outpaced declining fundamentals. From what I’ve seen, oil prices remain reasonably elevated, oil company profits remain strong, and growth is expected to be extremely high as well. Some of PSCE’s share price decline makes sense, oil prices have decreased, but the magnitude seems a bit higher than expected, especially when looked in context. PSCE has seen lackluster returns this past year, below those of the broader energy industry, even as oil prices have skyrocketed.

Fund Filings – Chart by author

PSCE’s comparatively cheap valuation is a benefit for the fund and its shareholders, and could lead to strong, market-beating capital gains. Gains are dependent on valuations normalizing, which are dependent on both fundamentals and market sentiment. Sentiment is broadly bearish, so I don’t foresee gains for quite a while. Once economic conditions normalize, sentiment should improve, and PSCE should outperform, in my opinion at least.

As a final, more negative note, PSCE would be less reliant on market sentiment for returns if the fund sported a strong dividend yield. As the fund only yields 0.9%, returns will almost completely consist of capital gains, and so are very dependent on fickle market sentiment.

Conclusion

PSCE is a small-cap energy index ETF, a high-risk high-reward investment opportunity, and appropriate for more aggressive energy bulls.

[ad_2]

Source links Google News