[ad_1]

NicoElNino/iStock via Getty Images

Since my last article on the ProShares Ultra Pro QQQ ETF (NASDAQ:TQQQ), shares of the ETF have sold off approximately 40%. I sold most of my tech exposure near the end of 2021 and I still hold a little bit of Amazon (AMZN), but I’m still patiently waiting to buy shares of TQQQ. I think the buying opportunity will show up at some point, but I haven’t seen the fear and capitulation that I am looking for as the contrarian indicator. While I’m not ready to pull the trigger, investors that are expecting a rally in the short to mid-term might want to consider a small position in TQQQ. We have had 7 straight weeks in the red for major indices like the S&P 500 and QQQ, so it is possible that we get a rally sooner rather than later.

Investment Thesis

TQQQ is the 3x levered ETF that follows the Nasdaq 100 index. It is very heavily weighted towards the large cap tech companies. The index composition has changed slightly since my first coverage, but it is still dominated by the biggest tech companies. The market selloff has hit the top 10 components to different extents, but the valuation is starting to get more attractive for long term investors. I’m not a buyer yet, but I think we are getting closer to a solid entry point. Investors that have a shorter time horizon (1 month to 3 months) might consider TQQQ if they are expecting a rally in the indices.

Index Composition

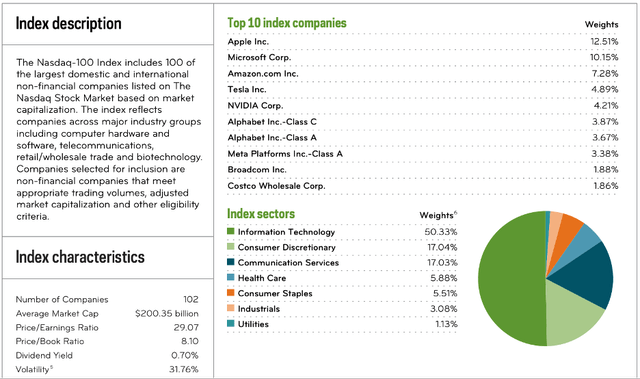

I haven’t included this chart in the last couple articles on TQQQ, but when I checked, I was surprised to see a couple changes since my December article. PayPal (PYPL) and Adobe (ADBE) have been replaced in the top 10 by Broadcom (AVGO) and Costco (COST). Apple (AAPL) and Microsoft (MSFT) also make up a larger portion now, with information technology accounting for over half of the ETF. There has been some reshuffling with the industries, but the weighting remains similar, with tech heavy industries including consumer discretionary making up around 2/3 of the index.

TQQQ Top 10 (proshares.com)

While tech hasn’t been in favor in 2022, I think investors will have a hard time shaking off their recency bias. I’m not saying that it’s automatically time to buy the dip in tech, but the last couple months has created a more attractive entry point based on valuations of the largest components.

Apple

Apple is one of the most widely owned stocks for good reason. I’m sitting here writing this on a MacBook Pro and have an iPhone, and the company has richly rewarded long term over the last decade. However, that hasn’t been the case in 2022. Shares are down approximately 20% in the last couple months, and they are still richly valued. With shares at 23x earnings and EPS growth slowing, I wouldn’t be a buyer yet. Buffett was adding to Berkshire Hathaway’s (BRK.A) (BRK.B) position, but another big name, Michael Burry of Big Short fame, is currently short Apple. It’s a great business, but that doesn’t make it a great stock right now.

Microsoft

Microsoft is another widely owned tech stock and the only component besides Apple with a double-digit weight in the ETF. Shares are down approximately 15% in the last couple months. I wrote an article on the company at the beginning of May explaining why shares weren’t a bargain. Their cloud business will continue to drive long term growth and they don’t have to deal with the supply chain issues as much as Apple. It’s another great business, but at 27.7x earnings, the stock is still too expensive.

Amazon

Amazon is the last big tech company I own, and shares are down approximately 25% in the last couple months. I explained in a recent article why I’m still bullish on the stock even after mixed earnings. AWS is firing on all cylinders, the advertising segment is growing rapidly, and if you look at the projected operating cashflows of the business over the next couple years, I think the stock will be higher than it is now. They also have a 20:1 split coming up that could be a short term catalyst. They have been investing heavily in the business over the last couple years and I think that is going to show up in a big way in the coming years.

Google is a high margin cash machine, but it’s a stock I avoid for several reasons. Shares are down approximately 25% in the last couple months and some investors view it as a bargain under 20x earnings. I think the cloud segment will continue to grow, and the advertising segment continues to throw off cash for the Other Bets segment. They are buying back stock rapidly, but I think that the upcoming 20:1 split could open up some liquidity and allow the options market to play a bigger role than before.

The Others

Tesla (TSLA) is still wildly overvalued, even after a massive decline in the last month from around $1,150 a share to $664 in the last month or so. Nvidia (NVDA) is starting to get closer to a valuation that could be interesting for long term investors, but it’s still a little rich for a huge company. Facebook (FB) is a value trap in my opinion, but many investors disagree and think it’s a great time to be buying the stock. The social media empire that Zuckerberg has built is showing signs of decay in my opinion, but time will tell if 14.7x earnings and a market cap over $500B will lead to attractive forward returns.

Costco is another high multiple stock that has sold off significantly, but it still has a way to go before reaching fair value. Broadcom would be the stock that I would be most likely to buy in the top 10 outside of Amazon for the 3% dividend and its growth potential. At 17x earnings it is a lot closer to fair value than most of the other top 10 components, but it is under 2% of the ETF.

Conclusion

I spend a lot of time watching YouTube videos and listening to podcasts about the markets, macroeconomics, geopolitics, and the U.S. economy. While they all have different takes or predictions on what is coming, they all are expecting a bumpy ride for the rest of 2022. Some have called for a melt up followed by a massive bust. Others think we will see a bear market rally this summer, followed by a blow up in bonds, equities, and real estate. I know that a recession is likely, and I have positioned my portfolio accordingly.

They say that generals are always fighting the last war. I think this can apply to investors as well. Some investors see the real estate bubble and financial crisis of 2007 and 2008 and compare it to today, ignoring the housing shortage that is a result of chronic under building. Some see echoes of the tech bubble of 2000, but the companies that make up TQQQ are very different from the early-stage companies in 2000 and the valuation multiples aren’t as absurd, especially after the market selloff to start the year. I’m not ready to buy TQQQ yet, but I think the time to buy could be coming this year. If you’re expecting a rally in the short to mid-term, TQQQ could be a good way to capture that upside. I’m still waiting for now, but it’s starting to tempt me after a 40% drop from my last article.

[ad_2]

Source links Google News