[ad_1]

Editor’s note: Seeking Alpha is proud to welcome William Mack as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Drew Angerer/Getty Images News

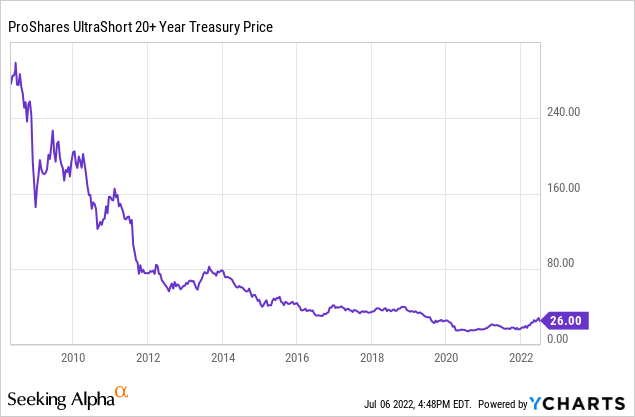

If you agree with me that we have an unaddressed inflation problem in the U.S. Economy, then an ETF like ProShares UltraShort 20+Year Treasury (NYSEARCA:TBT) might interest you. It tracks the ICE US Treasury 20+ Year Bond Index, investing in swaps and futures that track this index, to achieve -2x the daily return of this benchmark.

The modified duration of the this bond index is 19.46%. This means that a 19.46% decline would precipitate from a 1% increase in market interest rates. Because the fund uses -2x leverage, this implies a 39.2% appreciation in TBT. The fund has performed remarkably well lately, up over 45% YTD (the 30-year Treasury YTM is up more than a point YTD) but is still 12.5% lower than its 52-week high of $29.56/share on June 14, 2022.

I rate this fund a Strong Buy because it is an accessible vehicle to implement a bond short seller’s strategy amidst a global quantitative tightening cycle. Unlike many ETFs, the assets within the fund are difficult to track because few brokers advertise or even supply such products and data to their clients.

Why is bond shorting today’s “textbook” trade?

The strategy this ETF offers is “textbook” because modern finance and macroeconomic theory suggest:

- Interest and inflation are correlated on purpose

- Higher interest rates resolve inflation issues

- Bond prices fall when interest rates rise

How much more interest volatility might we expect in the current political economy, and how does it affect ETFs?

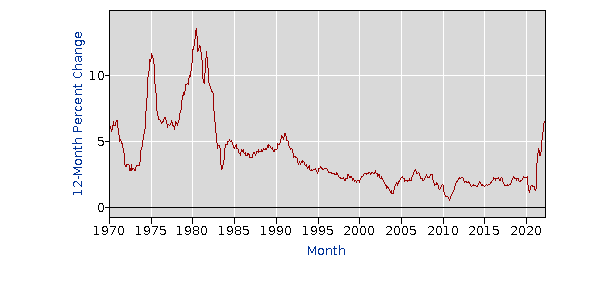

Since ETFs emerged as a popular investment security, we have not yet witnessed the full magnitude of interest rate cycles, like the highs of Paul Volcker’s chairmanship, when OPEC-related risk factors caused global oil supply contractions, elevating inflation and ushering in a massive interest rate reaction. In some ways, we are in uncharted territory but international conflict hasn’t bode well for the inflation rate historically in my opinion. WWII is another example. It is my opinion that interest rates should offer real returns in order to turn savings into investments in the real economy.

Why is TBT ETF a good instrument to use for a portfolio manager?

Raising interest rates, and the cost of capital more generally, mean different things to different investors. I see at least these options as viable portfolio strategies that don’t involve any exposure to the bond market:

- Stay long stock indexes and focus on the long run

- Move assets to cash indefinitely

- Sell short stocks/ETFs against cash collateral

- Long some stocks and establish net neutrality by short selling others

In my opinion, Treasury exposure is lower risk at the moment because it feels certain that we have a systematic problem. Inflation numbers are severe, with the CPI Inflation rate at 8.6% YoY in May. The fact is that any lesser ROI marks a real loss – not the worst outcome for those traders and investors who have some of their best-performing stretches in stocks in their rear view, but I prefer consistency over starts and stops.

How might FOMC disclosure be helpful/unhelpful for an investor?

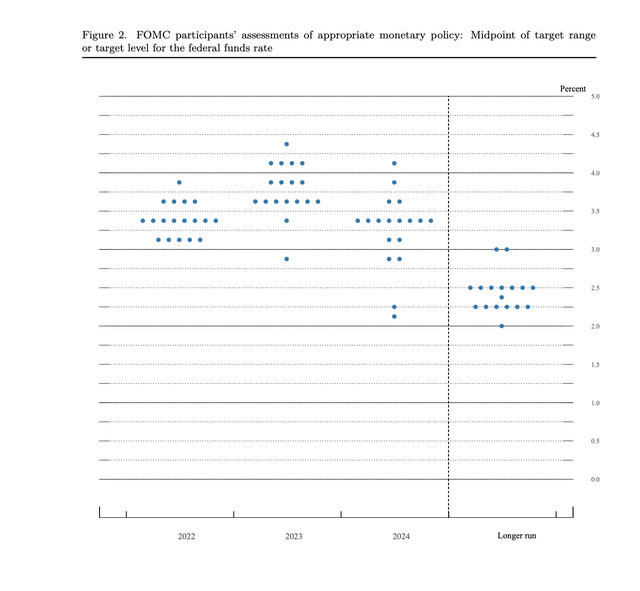

It is my view that the Federal Reserve has not communicated the most probable future policy rates. There is a large academic discussion about central banking and the credibility of their forward-looking statements. Perhaps the public should not always know the Fed’s best insight or their full picture. The entity is legally mandated to represent the public interest in matters of both inflation and unemployment rates. Sometimes not sharing information may be to their regulatory advantage. The target inflation rate is often characterized as a low single digit and stable. Neither describes the May CPI, while May unemployment was quite low.

What is the Treasury market telling us about future bank rates?

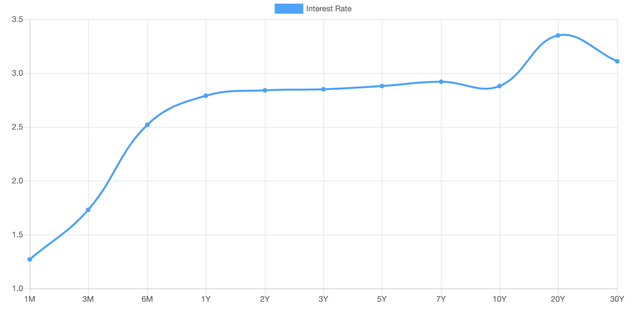

If relevant market participants were actively taking the Fed at their word, the yield curve would not slope upward, but rather conform to the dot plot, in which you can see an inversion marking a pessimistic economic outlook.

7/15/22 Dot Plot (Summary of Economic Projections)

7/1/2022 Treasury YTM (ustreasuryyieldcurve.com)

Why TBT ETF in particular?

The index tracked by the fund, ICE US Treasury 20+ Year Bond Index is a good candidate for shorting. The maturity of the bonds in the index are long, and the coupons are small. Bond duration, the sensitivity of a bond’s market price to market interest rates, increases with maturity and decreases with coupon payment rate. This means that a small increase in market rates can send this index lower than other bond indexes. There are also no company-specific or industry-specific factors to take into consideration because the Government backs the securities in this index.

What is TBT Fund’s valuation?

TBT currently has $1.76 billion in assets under management. As of July 1, 2022, ProShares data shows that shares are currently trading at a $0.07 discount to NAV/share, meaning that you get more in assets than you pay per share, before accounting for expenses, which are 90 BPS. As another SA contributor has pointed out, there may be limited upside. Technically speaking, I don’t think it will be long before the fund is trading between $40/share and $45/share because it was stable at those levels in the pre-pandemic market, and the chance of rates being any lower than they were at that time is very small because inflation was stable around 2% between 2017 and 2019.

My highest price estimate uses this information and assumes a linear relationship between share price and the inflation rate. Extrapolating from 8.6%/2% target inflation rate gives a factor of 4.3, and 4.3x the current share price equates to $111.76/share potential if the proportions were to remain. This fund was stable at $40/share at a far less concerning 2% rate of inflation! Assuming that there is a 10% chance of running to $111.76/share, a 10% chance of a decline by as much as 20% at a stop, a 40% chance of surpassing $50/share, and another 40% chance it passes $75/share, the expected value is about $63/share, or about 59% upside potential in a two-year horizon. The 30-Year Treasury yield peaked around 15% in the 1980’s, when inflation had a similar peak. I doubt any Treasury maturity would need to rise all the way to 8% to bring interest and inflation into balance, but there is still potential for yields to double or even triple before we achieve equilibrium. Based on the modified duration of the index, this translates to 75% or 100% upside in TBT.

CPI Inflation Rate (data.bls.gov)

What are some risk statistics and potential risk management options?

TBT has a high short interest at 7% and roughly 70% more volatility than the median ETF. There are other ETFs with similar profiles to TBT, like ProShares Short 20+ Year Treasury ETF (TBF). TBF is a lower risk fund that tracks just -1x the ICE US Treasury 20+ Year Bond Index. Its short interest is only .20% and its volatility is 16% less than the median ETF. With inverse instruments, keep in mind also that a liquidity event is a liquidity event, and TBT prices could be adversely affected even when market interest rates are rising. This overlaps with the risk that the fund fails to meet their investment objective.

Conclusion

TBT is a Strong Buy as interest rate changes present opportunities worth leveraging. Given the current inflation and employment imbalance, as well as the Fed’s communication challenges, short bond exposure is a promising portfolio strategy. YTD, TBT holders have a 45% pre-tax return. Seeking Alpha Quant analysis agrees with me, rating asset flows an A and momentum an A+. I believe there is room for the trend to continue because the CPI numbers still seem too hot and rates too low given our historical context.

[ad_2]

Source links Google News