[ad_1]

Last July, I wrote a long Poland article that described the favorable economic climate combined with low valuations that make for a strong long-term investment thesis in the country. Since then, the iShares Poland ETF (EPOL) is roughly flat, while most European equities are down 10% or more.

Following the recent selloff, I am neutral on global equities. For the long-term buyer, there are many fire sales as in Poland and Russia. But for an active investor who prefers to avoid recessions, further downside may be likely, as the global economy may deteriorate further.

Recession or not, I expect Poland to continue to outperform its European peers and see stellar performance during the next bull market. Last Fall, Poland became of the first former Soviet bloc states to become a developed country, as its real GDP growth is among the highest in Europe. It has low valuations, low consumer debt, and high growth potential. This is certainly a contrarian view, but I also believe that Poland has less political risk than most of Europe and has a superior pro-business stance.

Enter the EPOL ETF

EPOL is a passive fund that tracks the MSCI Poland IMI 25/50 Index that has been trading since 2010. The fund currently has net assets AUM of $283 million with options available, so it has ample liquidity for the majority of investors.

The fund currently holds 34 Polish equities on a market cap-weighted basis. The current expense ratio is a standard 0.65%, while its trailing yield is 1.5%. The equities are relatively cheap with a harmonic average P/E ratio of 11.8X and a P/B of 1.1X with a beta to the S&P 500 of 0.73.

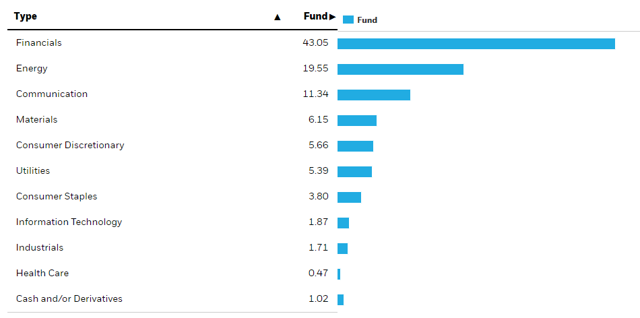

Here is the fund’s current sector breakdown:

Source (for above statistics as well): iShares

It is heavily weighted toward the financial sector, which is predominantly in retail banking. This means that overall the fund’s performance should be representative of the internal Polish economy and less affected by external factors.

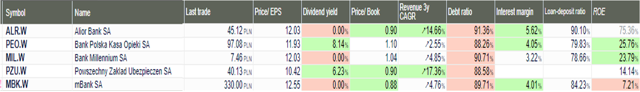

A quick check of the fundamentals of the largest financial holdings of the fund show that banks have adequate capital and high profitability:

(Source: Uncle Stock)

The banks are growing, have higher return on equity, interest margins, and are cheaper than most of their global counterparts. As interest rates inevitably rise, the banks could see significant growth as they potentially become major European players.

Direct Exposure Favorable

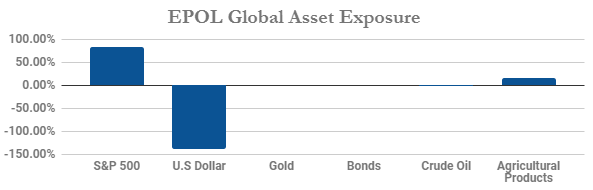

One of my favorite ways to understand single-country ETFs is to look at their exposure to major asset classes. I typically do this using “multiple least squares” to find the true beta of the fund to other assets. Often, a fund advertises a low Beta to the S&P 500, but when impacts from the U.S. dollar are added to the equation, one will typically find true exposure is much higher.

Here is the exposure for EPOL:

(Data Source: Google Finance)

Note, for example, “80%” for the S&P 500 indicates that the fund can be expected to move 0.8% for every 1% of the S&P 500.

Here we can see that the fund is exposed to the U.S. equity market (which is essentially a global benchmark for developed countries) but has an extremely negative correlation to the U.S. dollar. This is likely because the fund is so heavily weighted toward the financial sector.

I am personally slightly bearish on the U.S dollar at this level, but cede that this illustrates a major risk to EPOL investors. If the U.S. dollar breaks its current resistance level, then EPOL will fall. On a positive note, the fund has no exposure to gold, U.S. interest rates, and crude oil. Interestingly, it has some exposure to agricultural commodities, which I am slightly bullish on (for reasons outside the scope of this article).

Poland’s Relative Performance Indicates Support

A way I like to look at equity performance of these countries is to compare it to that country’s nearest neighbors. The logic is that neighboring countries will usually be of similar levels of economic development and have similar exposure to the global economy. By using neighbors as a benchmark, we can more clearly see if a country will likely over- or underperform.

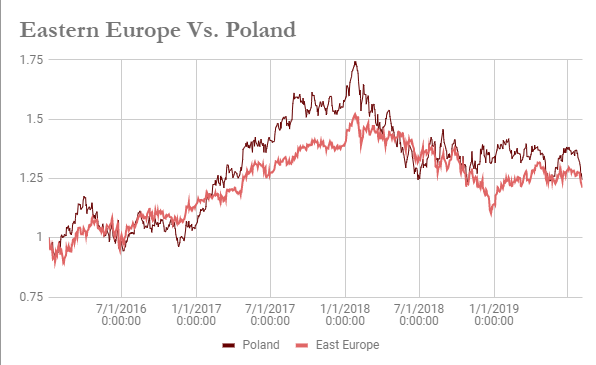

Here is Poland (EPOL) compared to an equal-weighted benchmark of Germany (EWG), Finland (EFNL), Russia (RSX), and Austria (EWO). We will call this the “Eastern Europe” benchmark:

(Source: Google Finance)

As you can see, Poland has very similar performance to this benchmark but at higher volatility. The country also led its benchmark to the downside during the first six months of last year but has remained roughly flat since then, while the East Europe index has continued to the downside.

An even more clear way to analyze this is by taking the Poland index and dividing it by the East Europe index. This lets us see what the hedged strategy of “long Poland-short benchmark” would look like. This can also be thought of as an “alpha” delivered by Poland:

(Data source: Google Finance)

Per usual, this chart has a high degree of mean reversion. This is common among single-country ETFs, as they tend to outperform their peers following periods of underperformance (and vice-versa).

Here we can see that although there is a slight long-term upward trend, Poland has been underperforming its peers recently. This is good news for investors, because oftentimes performance turns up after sharp underperformance. That said, the index is above its support level of roughly “1,” which indicates there may be more downside.

Comparative Fundamentals Strong

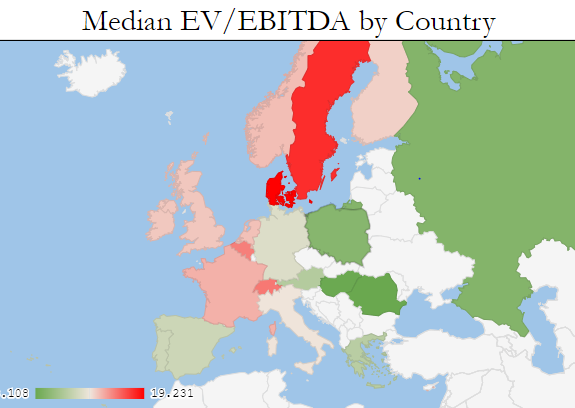

Subscribers to our marketplace service The Country Club will soon have access to our Global Fundamentals Dashboard that allows them to see over 50 statistics on countries collected over 4,000 equities. One of those statistics is “Median EV/EBITDA” by country.

Here is the chart of Europe with reference to Poland from our dashboard:

(Self-sourced)

As you can see, Poland (directly below dark red Sweden) is one of the most green (undervalued) countries in Europe. Polish equities had a median “EV/EBITDA” of only 4.8X. Russia was lower at 4.6X, but I think it’s fair to say Russia has slightly more geopolitical risks. Hungary and Romania were also both under 3.2X. (ETF issuers have, unfortunately, yet to create a U.S.-based ETF for those countries.) For comparison, the U.S is currently at 14.2X and Sweden is at 17.6X.

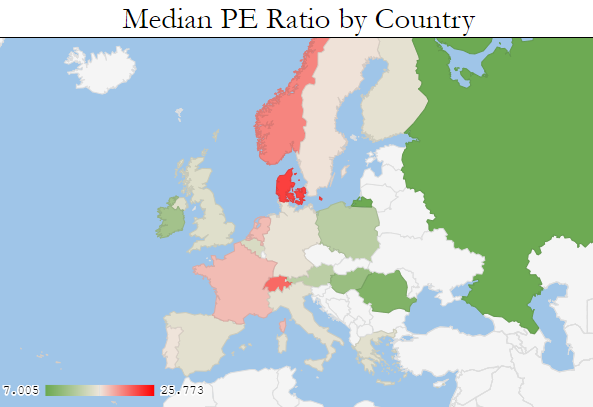

This “East-West” divide is reflected even more clearly in the median “P/E” map:

(Self-sourced)

In this case, Poland came in higher at a median “P/E” of 12.5X, which still put the country in the top-five lowest median valuations in Europe.

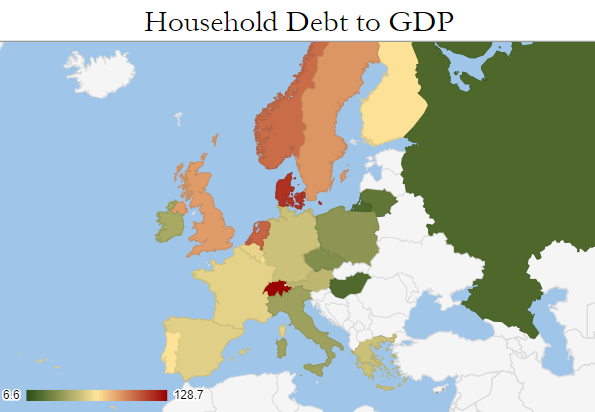

Interestingly, this is also reflected in Household Debt-to-GDP by country in Europe:

(Data source: Trading Economics)

On the whole, Eastern European countries have lower valuations and higher credit expansion potential than Western European countries. Low valuations are key over a three-five year time frame, as “P/E” valuations tend to revert toward 15X slowly over a business cycle. Low household debt is good over a five-ten year time frame, as it allows the country to raise its GDP growth by issuing new debt to consumers.

It is safe to assume long-run performance will be strong as valuations rise toward typical levels for developed nations and household credit expansion grows. That said, we need to estimate how Poland will perform in the short run. A good way to estimate short-run performance is the Manufacturing PMI.

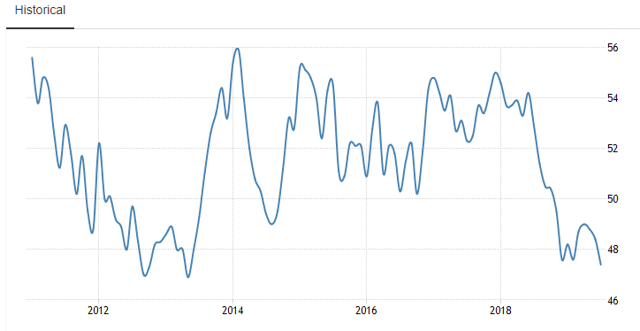

Here is the current Manufacturing PMI for Poland:

(Source: Trading Economics)

Without a doubt, it is at a weak level and looks to be trending lower. This is a signal for caution on behalf of investors, as it does appear that Poland could be headed for lower-than-expected GDP growth.

That said, if you are a long-term investor who is willing to wait it out, then it may still be a good time to buy. The economy appears to be weak now, earnings are being revised lower, and long-term investors get in at a discount.

The next key factor for estimating short-run performance is the Polish zloty that investors are highly exposed to when owning EPOL.

Zloty at Support with Decent Fundamentals

EPOL is a non-hedged, single-country ETF, so investors are fully exposed to the zloty. While some see currency exposure as a negative, it can make for extra alpha if the currency and equity market rally together.

Here is a chart of EPOL vs. PLN/USD since 2016:

(Source: Trading View)

Clearly, the two are highly correlated. Both rose dramatically in 2017, only to fall in 2018 and be in a tight trading range since then. Both the zloty and EPOL are at the support levels they have held over the past year. This is a sign that it could be a good time to buy if you’re bullish, but also that a sharp sell-off could occur as EPOL breaks lower.

The National Bank of Poland held the interest rate at 1.5% in July, compared to a 2.9% YoY inflation rate. This gives us a low real interest rate of -1.4%. To compare, the euro area has a deposit rate of -0.4% and an inflation rate of 1.1%, giving a real interest rate of -1.5%. In my opinion, real interest rates are some of the best currency indicators. In this situation, they suggest that the zloty is fairly valued if no changes to inflation or interest rates occur.

Because inflation is rising in Poland, I expect the government to raise interest rates soon. Because the ECB keeps rates so low in Europe even as inflation has risen, I expect the zloty to gain over time and potentially become a carry trade target.

Risks and the Bottom Line

Overall, I am bullish on Poland with a long-term time horizon of three years or more. I expect the country to perform well over the next bull market and fall less in the event of further economic downside. I would place a small position now and a larger one if the equities decline lower.

The primary risk to betting on Poland is, obviously, a recession. That event could cause another 10-25% in downside, or more if the zloty is harmed. The next major risk is a continued breakout in the U.S. dollar. The dollar is currently at a high point and has created risks for non-hedged equity investing. That said, the dollar is at a resistance level, and if it falls, that will certainly be a positive for equity investors.

If EPOL holds steady, I expect the fund to rise back to its $24 support level (a 12% gain). If the global economy rebounds, then I expect the fund to rise past its 2018 peak to $35 (a 65% gain) over the course of 12 months.

Interested In Closely Following Global Events?

We will soon be launching our first marketplace service, “The Country Club.” This will be a dedicated service that focuses on single-country and regional ETFs with the goal of helping our subscribers diversify globally and get a better grasp on how world events will affect their portfolio. We keep a close eye on Poland and the zloty, and will be providing subscribers further updates on this idea. Please give us a “Follow” if you would like to be notified upon our launch!

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in EPOL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News