Thursday’s trading session was a reminder of how volatile the equities markets can get, particularly when it comes to their sensitivity regarding inflation data.

The capital markets were awaiting inflation numbers evident in the latest consumer price index (CPI) data. It’s no secret that inflation has been on the move higher, but just how much higher would determine the Federal Reserve’s hawkishness with respect to rate hikes.

With inflation running hotter than anticipated, it looks like the Fed will be more hawkish than original forecasts. That sent the equities markets in a daze with the major stock indexes getting roiled with more volatility.

“U.S. Labor Department data showed consumer prices surged 7.5% last month on a year-over-year basis, topping economists’ estimates of 7.3% and marking the biggest annual increase in inflation in 40 years,” a Reuters report says.

Furthermore, St. Louis Federal Reserve Bank President James Bullard said that the latest inflation data caused him to be more “dramatically” hawkish, according to the Reuters report. Bullard called for a full percentage point of rate hikes by the beginning of July.

“Inflation tends to be kryptonite to valuations. Higher inflation causes multiples to compress, and that’s what we’re experiencing right now,” said Terry Sandven, chief equity strategist at U.S. Bank Wealth Management in Minneapolis.

Riding the S&P 500 Roller Coaster

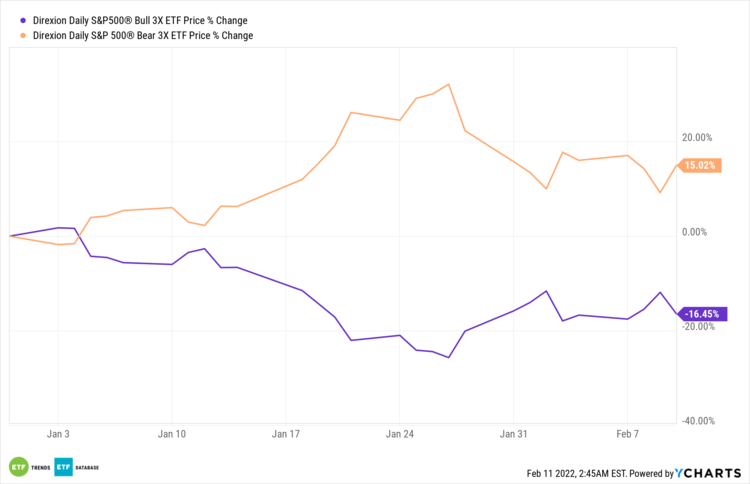

When it comes to trading the S&P 500, investors don’t have to wait idly and buy the dips, then wait for the next bullish move higher. Advanced investors can trade both bullish and bearish moves using Direxion leveraged ETFs.

To profit on the downside in the short term, traders can use the Direxion Daily S&P 500 Bear 3X ETF (SPXS ). SPXS seeks daily investment results equal to 300% of the inverse of the daily performance of the S&P 500 Index.

On the flip side, when the S&P 500 rises, traders can play to the upside with the Direxion Daily S&P 500® Bull 3X Shares ETF (SPXL ). Both ETFs offer thrice the leverage, so seasoned traders only should use these products.

Thus far into 2022, it’s the bears that are on the winning side. Inflation fears have been persistent through the beginning of the new year, and as such, SPXS is up 15%, while SPXL is down close to 17%.

Content continues below advertisement

For more news, information, and strategy, visit the Leveraged & Inverse Channel.