[ad_1]

nesneJkraM

Invesco Global Water ETF (NASDAQ:PIO) is yet another niche exchange-traded fund I would like to discuss today.

This year has vividly illustrated that investing in a scarce commodity is a grossly lucrative strategy capable of delivering sizeable alpha if timed right. As I discussed in the article on the Invesco S&P Global Water Index ETF (CGW), water is a vital asset in short supply. But unfortunately, the water industry is different from oil, gas, or timber, and investing in this essential asset is not as simple and lucrative as it might seem upon cursory inspection. So in the article, I would like to elaborate on a few vulnerabilities the fund has, explaining why it is not worth investing in at this juncture, while also briefly touching upon the silver lining.

What is PIO’s strategy basis?

PIO’s investment mandate is to track the NASDAQ OMX Global Water Index. This benchmark targets companies designing products necessary for the purification and conservation of water for homes, enterprises, and industries. Another way of saying, this implies the portfolio should have exposure both to the residential as well as industrial end-markets, with the performance of underlying holdings being influenced by discretionary spending of households as well as capital investment plans of businesses; that is to say, the economic cycle is of paramount importance for it as it has a direct impact on both, bolstering or reducing cash flows available for spending and investing, so capital scarcity emerging amid higher interest rates necessary to curb inflation coupled with growing U.S. recession fears are the main reasons why the fund’s performance has been so lackluster this year.

When it comes to constituent selection, there is a requirement that a candidate must be a part of the Green Economy as defined by SustainableBusiness.com LLC, a matter ESG-focused investors should pay attention to. In terms of the listing, a stock must be traded on a global exchange from the eligible group, i.e., aside from major U.S. exchanges, Hong Kong, Tokyo, London, etc. are also welcome. Micro-caps with market values south of $50 million are shown the red light; there are also liquidity requirements.

To ensure adequate diversification, there are sophisticated rules limiting the number of equities from one country, as well as their weights, e.g., the share of one country cannot exceed 40%, while the weight of a single security is capped at 8%. More details on that are available in the index methodology document and the prospectus.

What is under the hood?

As of October 7, PIO was long 42 stocks, with ~57% deployed to the ten main holdings.

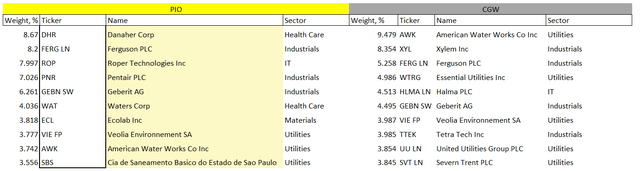

For better context, I compared the top ten investments of PIO and CGW below.

Created by the author using data from the funds

In the current version, the PIO portfolio is U.S.-heavy, with close to 56% allocated, yet also with large exposure to the U.K. (13.2%) and Japan (8%), which reminds me of CGW’s similar country mix, noticeable for the U.S. dominating the portfolio (~62%) and the U.K. being in second place (13.6%).

Large exposure to London- and Tokyo-quoted names has certainly been a meaningful detractor from PIO’s performance this year amid slipping global currencies dented by rising interest rates in the U.S. Britain and Japan have been among the most afflicted, due to antithetical reasons. For the former, it has been the recession risk and excruciating inflation that pushed the pound lower, for the latter, it has been an ultra-dovish stance amid anemic inflation that engendered the yen depreciation vs. the USD.

Speaking about other currencies influencing its returns, only the Brazilian real has been somewhat immune to the strengthening dollar, thanks to the country’s massive oil revenues and hawkish monetary policy, yet the fund has only one Brazilian company in the portfolio, Cia de Saneamento Basico do Estado de São Paulo (SBS), a water and sewage services provider with a weight of just ~3.6%, and the impact of the real’s performance on the NAV was fairly minimal.

Next, industrials (46.3%) and utilities (25.6%) dominating the portfolio are barely surprising owing to the investment mandate of the fund. Its peer CGW has a similar sector mix, except for one meaningful difference: it steers clear of healthcare stocks.

Meanwhile, PIO has a substantial allocation to the sector, of approximately 12.7%, with Danaher (DHR) being the major investment accounting for around 8.7%. This matter deserves closer attention for two reasons. First, DHR is certainly not a pure water play, operating via Life Sciences, Diagnostics, and Environmental & Applied Solutions, with the latter being directly connected to the water purification & conservation theme due to its vast portfolio of analytical instruments and related consumables, chemical treatment solutions intended to address corrosion, ultraviolet disinfection systems, etc. However, the segment brought just ~15.7% of its Q2 2022 total sales. This nicely illustrates why the fund’s returns are not driven purely by demand for water-related (purification & conservation) equipment and materials, contrarily, there is a multitude of factors in the mix, both bullish and bearish. Second, the company decided to spin off EAS, with the deal anticipated to be completed in Q4 2023. So it’s more likely that DHR will be no longer among PIO’s holdings next year.

Is it worth investing in PIO right now?

There is no denying that the sprawling global population is supportive of a multi-decade bullish thesis for agriculture and water companies. But though the commodity is clearly vital, and the emerging water scarcity, especially when it comes to less developed countries, demanding enormous capital investments in infrastructure over the long term to avoid humanitarian issues, is barely debatable, capitalizing on this trend via equity investments is not necessarily achievable, as distilling a water pure-play portfolio is close to impossible (see DHR’s case).

For PIO, as well as CGW, the First Trust Water ETF (FIW), and other funds with akin strategies, the stage of the economic cycle, and the capital scarcity problem investors now have to adapt to (financing becomes harder as the cost of capital inches higher) are the issues of paramount importance, principally when it comes to the valuation and the FX factor.

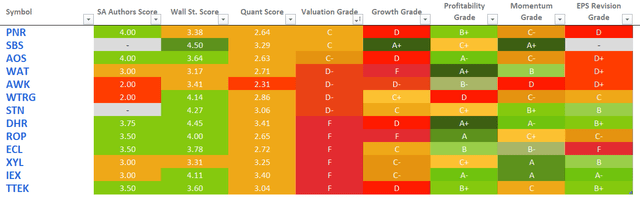

To demonstrate what is wrong in terms of valuation, I took a sample from the PIO portfolio, namely thirteen U.S. companies with a Quant rating, accounting for ~51% of the net assets; in this set, five are mid-caps, with the rest being either large- or mega-size companies, like DHR. The table below summarizes the Quant grades for them, and the Valuation column fairly speaks for itself.

Created using the data from Seeking Alpha and the fund

None of the selected stocks possess value characteristics, with most in the sample being comparatively overvalued; nine names in the group sport close to perfect profitability ratings, yet it is insufficient to justify a Buy rating for the fund.

Next, it would be pertinent to mention that PIO’s P/E ratio is ~18x, according to the fund itself. And this is surprisingly almost on par with the tech-heavy iShares Core S&P 500 ETF (IVV).

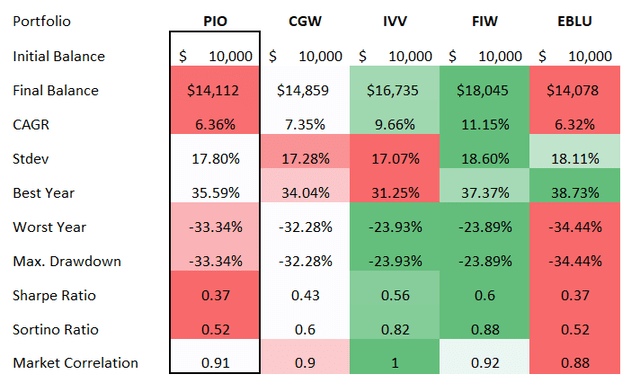

Additionally, it is worth touching upon the historical performance, which also does not speak in its favor. The following table includes the returns data for PIO, CGW, FIW, and Ecofin Global Water ESG Fund (EBLU) over the March 2017 – September 2022 period (since EBLU has the shortest trading history). In this cohort, PIO looks fairly bleak.

Created by the author using data from Portfolio Visualizer

There is also a silver lining, as usual. Given large exposure to developed world currencies, PIO might outperform thanks to the FX factor contributing to returns when the hawkish period in the U.S. is over. However, I would opt not to forecast when the pound, yen, and euro will finally start recovering.

All things considered, I assign a Hold rating to this vehicle owing to vulnerabilities.

[ad_2]

Source links Google News