[ad_1]

Alistair Berg/DigitalVision via Getty Images

Investment Thesis

In my last article on the Invesco International Dividend Achievers ETF (NASDAQ:PID), I discussed how PID offered a better value for money than a plain vanilla S&P 500 ETF like SPY and how this strategy could provide diversification benefits. Since then, PID has lost ~3.5% vs. a loss of ~14.5% for the S&P 500 and has outperformed the US market.

PID is now trading at 14x earnings and has a TTM dividend yield of ~3.4%. Thanks to its cheaper valuation, I believe PID will continue to outperform the S&P 500 over the next couple of months. On top of that, more investors are now seeking income-yielding investments in order to tackle the inflation problem, which means PID could be one of the main beneficiaries of this shift. That said, I think investors need to be aware of the risks of investing in this fund today, and the threat of an important drawdown caused by a global recession.

What Has Happened Since My Last Article

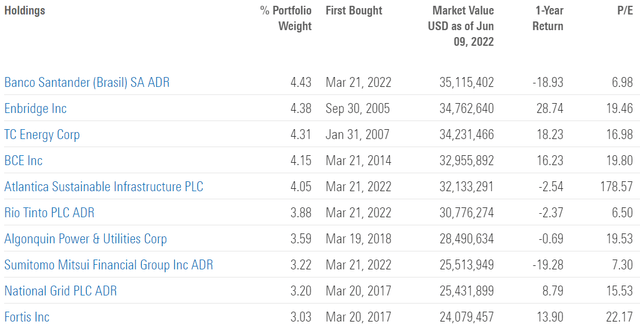

As a reminder, the Invesco International Dividend Achievers ETF tracks the performance of the NASDAQ International Dividend Achiever Index, which provides exposure to a basket of international dividend-paying common stocks. You will find below a recent breakdown of the top 10 holdings, and you can read more about the strategy in my previous article.

Morningstar

I have compared below PID’s price performance against the Vanguard Total World Stock ETF (VT) and the SPDR S&P 500 Trust ETF (SPY) over the last 6 months to assess which one was a better investment. Since my previous article, PID has lost ~4% and vs. a loss of ~14.4% and ~14.8% for SPY and VT, respectively. If we assume that VT is the appropriate benchmark for PID, the dividend strategy outperformed the market by ~11 percentage points. In my opinion, PID did exactly what was discussed in my previous article. The fund did offer a better value for money than a plain vanilla S&P 500 ETF and managed to protect investors from a larger drawdown.

Refinitiv Eikon

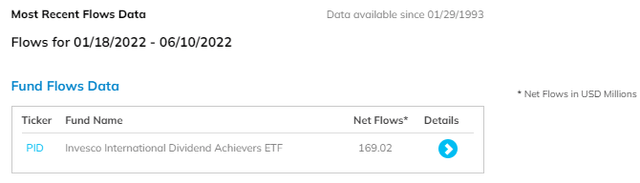

Investors have rewarded the strategy by adding more of their capital to it, as shown in the figure below. Since January 2022, PID registered nearly $170 million in inflows. I believe this is the result not only of a better-than-expected performance but of a fundamental shift from growth to value stocks in the face of high inflation and rising interest rates.

ETF.com

PID Is Attractively Valued But Beware Of Global Growth Risks

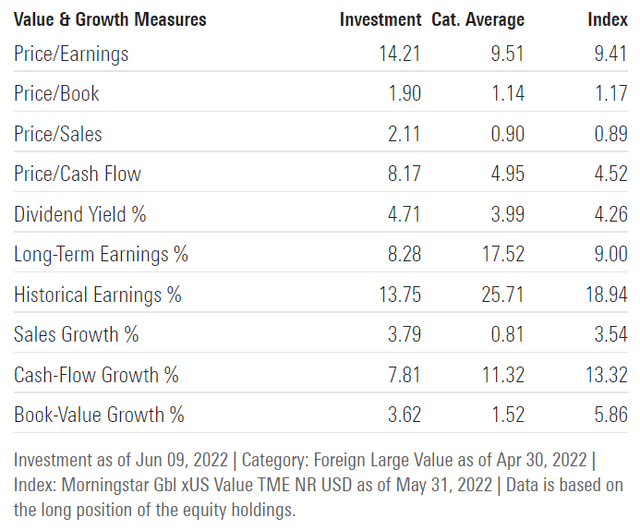

In my opinion, PID remains attractively valued from an absolute perspective. The fund trades at nearly 14x earnings and has a price-to-book ratio of ~2. On top of that, the portfolio has a TTM dividend yield of 3.4%.

Morningstar

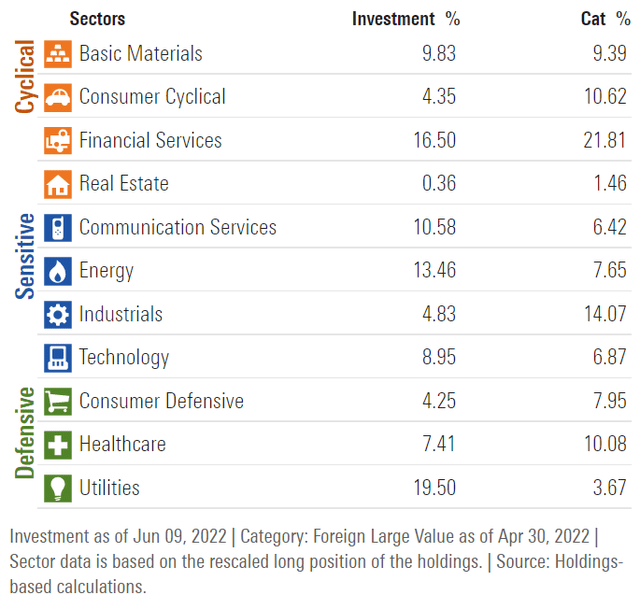

That said, I believe investors need to pay attention to the risks of a global recession and how that could affect PID. Nearly one-third of the portfolio is invested in cyclical industries such as Financial Services, Consumer Cyclical, and Real Estate. As a result, this portion of the portfolio is likely to be more vulnerable to an economic downturn. I think the odds of a global recession are now much higher than a few months ago, which means investors will probably face higher volatility in the months ahead.

Morningstar

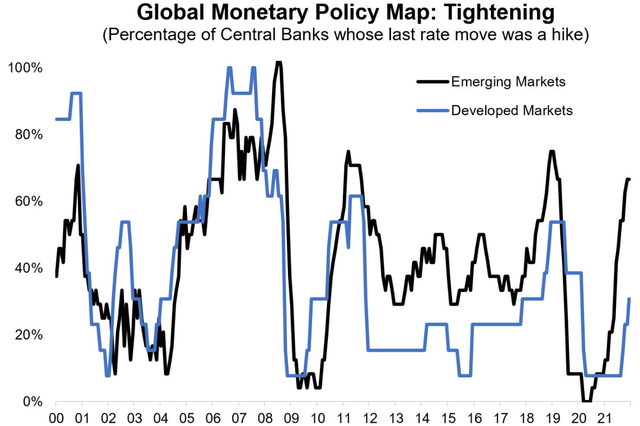

A recession is now more probable due to the way inflation has impacted policymakers’ expectations around the world. While liquidity was plentiful 12 months ago, we are now in one of the most aggressive tightening cycles in both emerging and developed markets, which makes liquidity much more expensive. In my opinion, the problem isn’t necessarily related to higher rates, but to the pace of tightening. Interest rates work like gravity on stock multiples, and I expect higher rates to drive valuations lower around the world.

Refinitiv/TopDown Charts

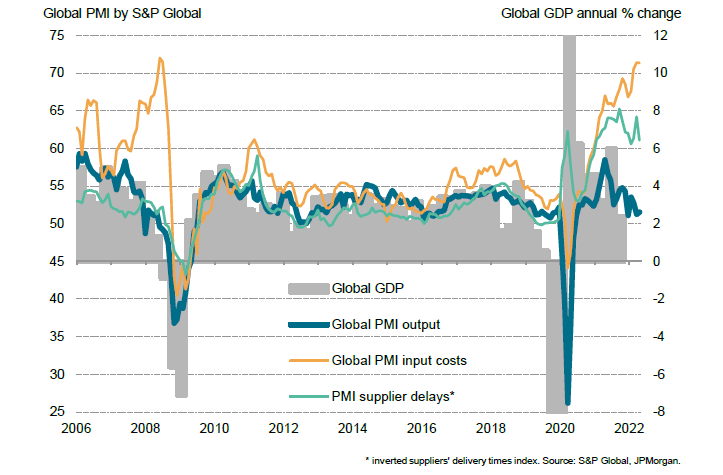

Moreover, the latest PMI data revealed a mix of sluggish global growth and soaring business costs in May 2022, with input price inflation hitting the second-highest since the commodity price surge of 2008-09. I expect inflation to hit profit margins over the next quarters, which should lead to a downward revision in expected EPS.

S&P Global

Lastly, the dollar is now at a decade high compared to other developed market currencies which accentuates some of the inflationary pressures that we have seen in Europe, Japan, and Canada. For instance, the price of oil has exceeded the 2008 high in both Euros and Yens, while it is still below that level in US dollars. Higher rates in the US are attracting more foreign capital, which pushes the demand for dollars higher. As many companies rely on the dollar to issue debt, I think some overleveraged sectors of the economy could enter a debt crisis, sparked by higher refinancing costs. The recent US CPI data suggest the Fed is nowhere near done hiking for the next couple of months, putting more pressure on foreign exchange rates and leveraged businesses.

TradingView

Key Takeaways

It’s good to see that this fund did relatively well compared to other strategies since my previous article. PID is currently trading at 14x earnings, with a TTM dividend yield of 3.4%. Because of its lower valuation, I believe PID will continue to outperform the S&P 500 over the next few months. However, that doesn’t mean PID is immune to a potential drawdown caused by an economic recession. On the contrary, I think volatility will be one of the main themes going forward and investors need to be ready for that.

[ad_2]

Source links Google News