[ad_1]

In the words of “Junk Bond King” Michael Milken:

“Junk bonds? Perhaps there’s a better name for the bonds that fuel 95 percent of American business.”

Investors like yield and junk bonds offer them. Described as bonds generally carrying a rating below BBB, they are considered not “investment grade” due to the risky financials of their issuers and thus non-negligible possibility of bond default. In past decades, they were largely inaccessible to the ordinary investor, but now with the advent of ETFs are available just a click away with ETFdb currently listing 43 US-traded junk bond ETFs.

The span of junk bond ETFs available vary significantly in their structure as well as the nature of the underlying bonds themselves. For example, the VanEck Vectors Fallen Angel High Yield Bond ETF (ANGL) consists of bonds which, when originally issued, were investment-grade, but then as their backing companies’ credit worthiness deteriorated, the price of the bonds, and thus yield on them, fell to junk-level status. Other junk bond ETFs differ in ways more similar to their non-junk bond counterparts, such as by average maturity date.

Junk bonds are risky – in the midst of the 2008 financial crisis as company defaults become not only a serious risk but material reality for many companies, the junk bond market rate soared up to over 23% (as compared to the current market rate of about 5.9%). With yield comes costs.

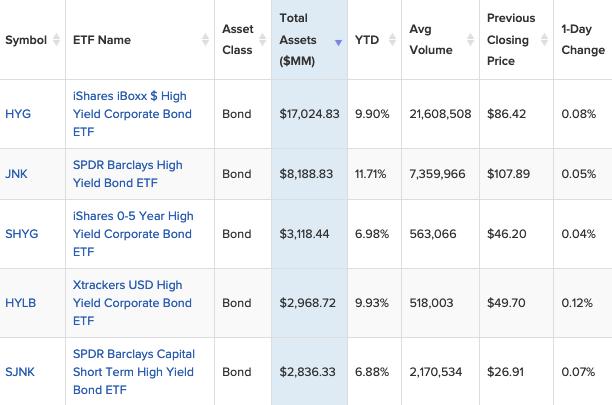

The market for “safe” junk bond ETFs is rather small. I believe that an ETF for a longer-term investment strategy, as compared to trading, and in such a narrow sector should have several characteristics that ensure its stability and liquidity. As a bar, we can say that this means at least $1 billion in ETF assets, reducing event horizon dangers as ETF funds dwindle, and liquidity of at least 500,000 shares a day.

By this measure, there are only five junk bond ETFs fitting that “safe” criteria where one can worry less about the structure of the ETF affecting one’s investment strategy and rather focus on the characteristics of the fund composition itself.

These are, at the moment, the following:

(Source: ETFdb.com)

1. iShares iBoxx $ High Yield Corporate Bond ETF (HYG)

HYG, by BlackRock (BLK), is the largest junk bond ETF out there with currently about $17.024 billion in assets and a huge recent average daily volume of about 21.6 million shares. Begun in 2007, it currently has over 994 holdings, a weighted average maturity of 3.61 years, 30-day SEC yield of 5.25%, and total expense ratio of 0.49%.

The credit quality of the ETF is over 50.36% BB-rated and 36.69% B-rated. It has a drop of riskier junk bonds, with 9.57% being CCC. In terms of the sectors of the bond issuers, the ETF is well-diversified with the largest sector being communication services (24.96%), followed by consumer non-cyclical (15.59%), consumer cyclical (13.53%), energy (12.06%), and capital goods (8.35%). The top ten issuing companies account for only 15.64% of the ETF’s value.

Undoubtedly, it is a strong, diversified, and balanced ETF and that’s why it has grown to the immense size it is. The ability of the ETF to retain average junk bond level yields while keeping large issuer and sector diversification, not too long yield to maturity, and a relatively high issuer credit rating range makes the ETF a worthy option for those who seek to have general and broad exposure to the junk bond sector without significant overweighting or underweighting.

2. SPDR Bloomberg Barclays High Yield Bond ETF (JNK)

JNK, by State Street (STT), is the largest competitor junk bond ETF to HYG with a different, but still enormous, net asset size at about $8.19 billion and an average recent daily volume of 7.36 million shares. At a gross expense ratio of 0.40%, 894 holdings, roughly similar credit worthiness distribution, and 30-day SEC yield of 5.60%, it initially may not seem too different from HYG.

However, the difference comes in its longer weighted average maturity, at 5.86 years. The fund has far more bonds with a higher years to maturity, including even a smattering of those with 10-15 years or more. Due to differences in sector classification, it is also unclear how the sector distribution differs as compared to HYG.

JNK is an enormously popular junk bond ETF because it is a solid, viable option with slightly greater exposure to the full spectrum of the junk bond yield curve. In a yield starved world, the 0.09% difference in expense ratio and 0.35% premium in yield may make a substantial difference too, although it does not come risk-free as the difference in holdings maturity demonstrates.

3. iShares 0-5 Year High Yield Corporate Bond ETF (SHYG)

While SHYG comes from the same issuer as HYG, it nonetheless contains substantial differences worth noting. On the positive end, these include a lower expense ratio at 0.30%, lower weighted average maturity at 2.08 years, and higher 30-day SEC yield of 5.43%.

On the negative end, SHYG also features substantially lower net assets, at about $3.12 billion, fewer holdings at 639 holdings, and substantially lower volume at an average of about 563,000 a day recently. In terms of top 10 issuer concentration, bond credit worthiness, and sector distribution, it actually is about the same as its HYG counterpart.

The SHYG nonetheless can remain beneficial as it purposefully is constrained by lower bond maturity timelines and thus reduces interest rate risk significantly. We see this most notably when comparing the bond maturity distribution of the two ETFs, with SHYG’s maturities all being below 5 years while HYG has a substantial amount of holdings with maturities of 5-7 years (18.26%) and 7-10 years (7.77%).

4. Deutsche X-trackers USD High Yield Corporate Bond ETF (HYLB)

HYLB, issued by Deutsche Bank (DB), differs slightly from the other ETFs on the list. Most notably, it comes with a highly reduced net expense ratio at currently, after fee waiver, 0.15%. With $2.97 billion in assets, it is a viable alternative for those seeking a firm junk bond ETF outside of SPDR and iShares.

Furthermore, it has over 1,035 holdings, immense sector diversity, and a 12-month yield of 5.77%.

On the negative side, it has only a recent daily average volume of just over 518,000 shares a day for a broad-based junk bond ETF. Furthermore, it lacks the transparency of many other major junk bond ETFs as it is unclear on its face – without digging into the fund’s quarterly reports – key items such as the average maturity, concentration of issuers, and credit worthiness of the bonds.

Based on the most recent report, from Q2 2019, the bonds appear to have a longer average maturity at over 5 years, a high concentration to BB and B bonds, and substantial international exposure with only 84.34% of the bonds coming from/based mostly in the United States.

Undoubtedly, the HYLB is quite different from many other junk bond ETFs available – but remains an attractive option for international ‘safer junk’ bond exposure.

5. SPDR Barclays Capital Short Term High Yield Bond ETF (SJNK)

SJNK is similar in relationship to JNK as SHYG is to HYG in that its primary difference is a shorter average years to maturity. At 3.17 years, this is a substantial difference as compared to JNK and reduces exposure on the yield curve, and thus interest rate risk, to a far narrower time frame.

At a 0.40% gross expense ratio and 30-day SEC yield of 5.58%, it appears to have achieved a near similar net yield with a substantial reduction in maturity. This does not come without cost, however, as a substantially higher portion of SJNK’s holdings are CCC (15.16%) as compared to JNK (12.65%).

Nonetheless, at $2.84 billion in assets and a large daily trading volume of 2.17 million shares, it remains a strong option for those who want junk bond ETF exposure to a smaller segment of the yield curve but to a greater segment of bond credit worthiness.

Junk Is Junk – But It Can Be Profitable

Junk bond ETFs open up a world of distressed – whether majorly or slightly – securities investing previously inaccessible to all but a select few deep in the financial world. However, the reasons these bonds were previously limited in distribution still are valid, as they contain far greater volatility and risk – particularly when said distressed companies do default – than your regular bond ETF or fund.

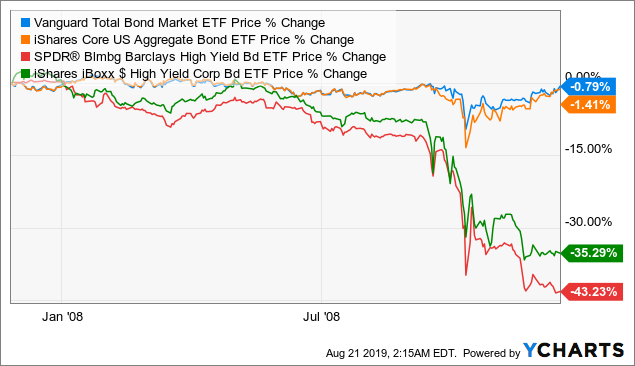

For example, during the depths of the 2008 financial crisis, junk bond prices – and their respective ETFs – fared not only worse than their ordinary bond counterparts but dramatically so.

Data by YCharts

Data by YCharts

Nonetheless, under the right circumstances, junk bonds – and their juicy yields – can also be a great boon to you and your portfolio.

Disclosure: I am/we are long SJNK. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News