[ad_1]

Klaus Vedfelt/DigitalVision via Getty Images

The iShares Preferred and Income Securities ETF (NASDAQ:PFF) is the largest preferred shares ETF in the market. Although there is nothing significantly wrong with the fund, it does have several negatives, and compares unfavorably to other asset classes and peers. It is relatively expensive, with a 0.46% expense ratio. It is materially riskier than index funds focusing on high-yield corporate bonds, due to less diversification, and as preferreds are junior to bonds in the capital structure. It yields significantly less than several preferred share CEFs, including those of Flaherty & Crumrine, without being materially safer. PFF is a relatively subpar investment, and materially weaker than many of its peers. As such, I would not be investing in the fund at the present time.

PFF – Basics

- Investment Manager: BlackRock

- Underlying Index: ICE Exchange-Listed Preferred & Hybrid Securities Index

- Expense Ratio: 0.46%

- Dividend Yield: 4.69%

- Total Returns CAGR 10Y: 5.09%

PFF – Overview

PFF is an index ETF investing in U.S. preferred shares. It tracks the ICE Exchange-Listed Preferred & Hybrid Securities Index, an index of these same securities. Preferred shares are hybrid securities, with characteristics of both bonds and equities but, in practice, closer to bonds.

Preferred shares sports above-average dividend yield, PFF itself yields 4.7%, but potential capital gains are quite low, as is dividend growth. Preferred shares also sometimes have relatively unique characteristics. Some are callable (can be bought back by the issuer), some have cumulative dividends (missed dividend payments must be paid back), some can be converted to equities under certain conditions, etc. These characteristics are incredibly important when analyzing individual preferred shares, somewhat less so for a diversified fund like PFF.

Preferred shares are between equities and bonds in a company’s capital structure. Meaning, bond payments come first, then preferred shares dividends, and only then do equity holders get paid. As such, preferred shares are generally safer than normal equities, but riskier than bonds.

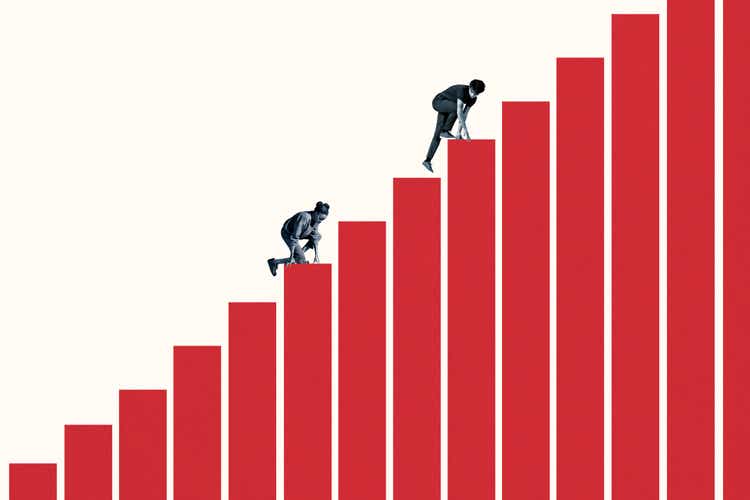

PFF’s credit quality is reasonably good, but not outstanding. The fund’s holdings sport an average credit rating of BBB, the lowest investment-grade credit rating available. Shares with a credit rating of BB, highest non-investment grade, and not rated securities account for most of the rest. As mentioned previously, these are reasonably good ratings, but not outstanding.

PFF Corporate Website

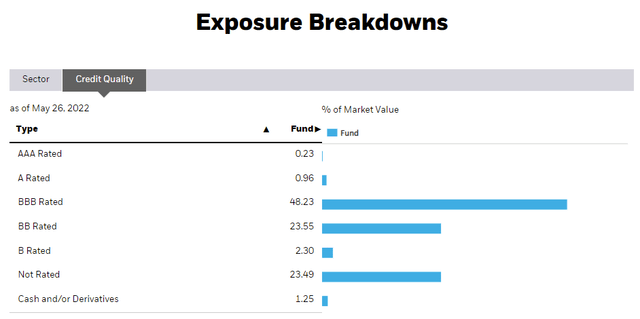

PFF focuses on preferred shares issued by financial institutions, mostly banks, as preferreds are a particularly common source of funding for these institutions, due to regulatory reasons.

PFF Corporate Website

In general terms, the fund’s index, strategy, and holdings, are all reflective of the U.S. preferred shares investment universe. Although the fund does make some amount of sense for investors looking for broad-based exposure to said sector, it compares unfavorably to other asset classes and peers on several key metrics. Let’s have a look.

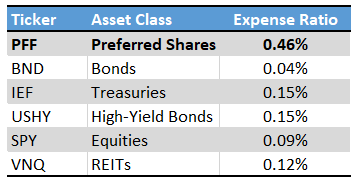

Expense Ratio Analysis

PFF sports a 0.46% expense ratio, significantly above-average for a simple, broad-based asset class index ETF, which tend to cost 0.15% or less. PFF is three times as expensive as the most expensive of its peers.

PFF Corporate Website

Higher expense ratios directly reduce shareholder returns, and are a straightforward negative for the fund and its shareholders. Excessive fees are particularly detrimental for fixed-income funds when rates are low, as gains / dividends are unlikely to significantly outpace these. Paying 0.46% for a +10.0% yielding fund might not matter too much, but PFF only yields 4.7%, so expenses do eat into the fund’s dividends and expected returns.

High expense ratios might be warranted for the best actively-managed funds. PIMCO funds are expensive, but their investment managers consistently generate outsized dividends and total returns for their shareholders. High expense ratios are almost never warranted for simple index funds, in which the investment managers simply blindly follow an index. No alpha means costs should be minimal, in my opinion at least.

PFF’s relatively high expense ratio is relatively rare for a fund of its kind, and a negative for shareholders.

Dividend Analysis

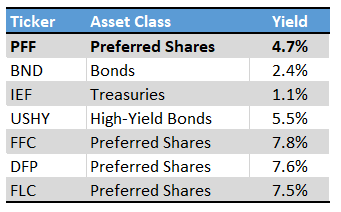

PFF currently yields 4.7%, quite a bit higher than most bonds, but slightly lower than high-yield bonds, and significantly lower than the Flaherty & Crumrine family of CEFs. Although the fund’s yield is not terribly low, it is lower than that of some of its peers, and that its most comparable asset class. I would be much more bullish about the fund with a comparatively higher yield, but these are simply not buy levels, in my opinion at least.

SeekingAlpha – Chart by author

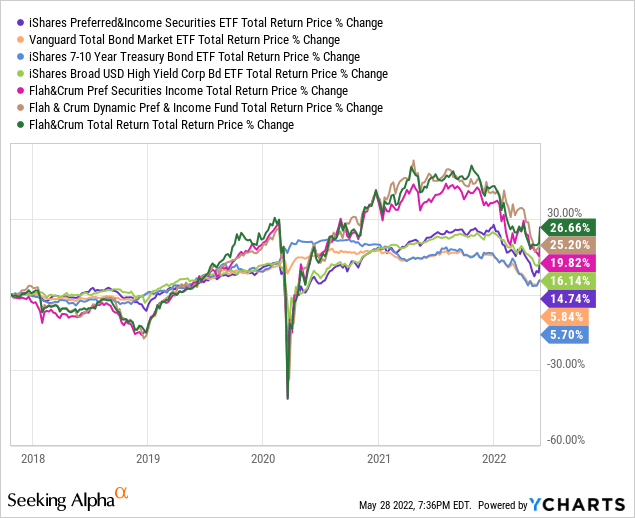

Preferred shares, bonds, and treasuries are all (mostly) income vehicles, whose overall performance is strongly dependent on yields. PFF itself has outperformed relative to bonds and treasuries, underperformed relative to high-yield bonds and its peers, since inception, as implied by the fund’s yield.

Risk Analysis

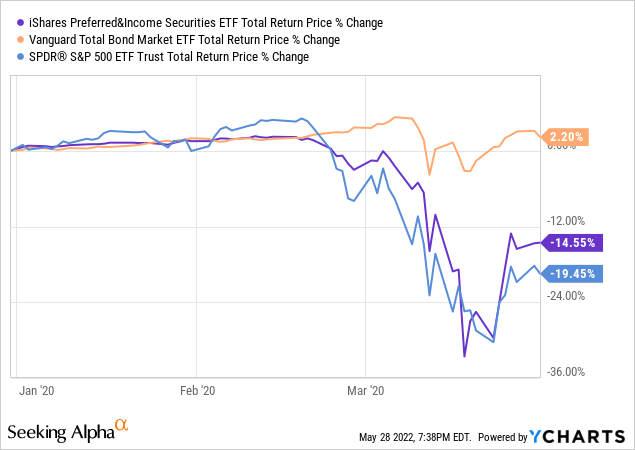

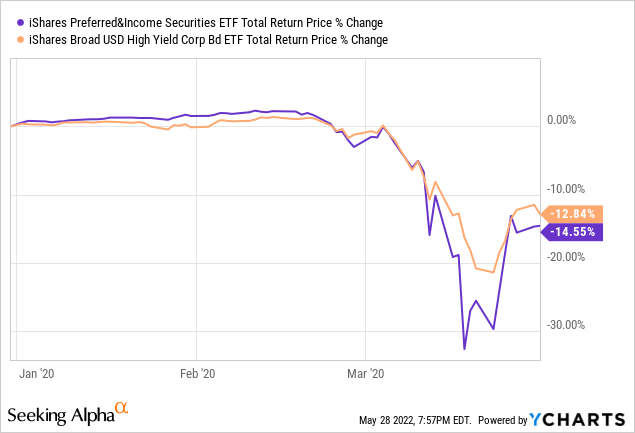

PFF’s risk, volatility, and expected losses during downturns are somewhere between those of bonds and equities, but leaning towards equities. As an example, the fund suffered losses of 14.5% during 1Q2020, the onset of the coronavirus pandemic, compared to losses of 19.5% for equities, and gains of 2.2% for bonds. PFF’s performance was technically between the performance of these two asset classes, but much closer to higher-risk equities than lower-risk bonds.

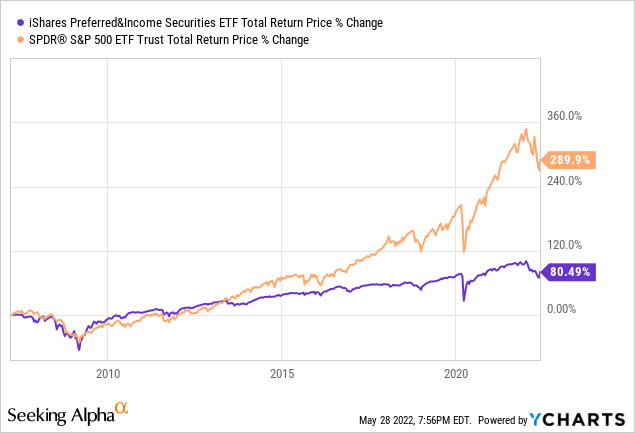

Although PFF is not an excessively risky fund, the level of risk seems higher than warranted. PFF only yields 4.7%, has little in potential capital gains, but is only somewhat less risky than equities, not a particularly strong combination. PFF’s total returns have significantly lagged behind those of the S&P 500 since inception too. Significantly reducing your gains for a slight reduction in risk is simply not a good tradeoff, and makes for a subpar risk-return profile.

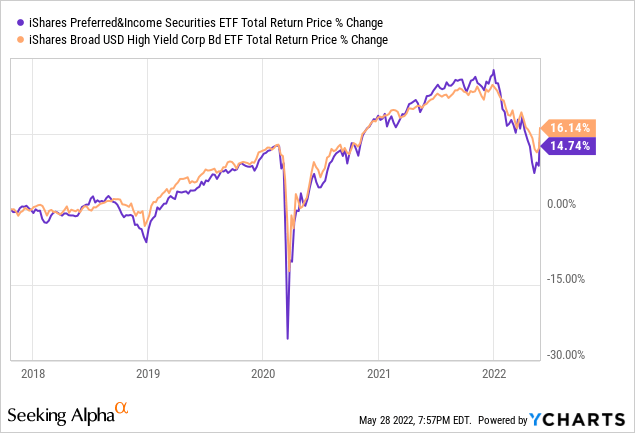

PFF’s risk-return profile is closer to that of high-yield bonds, but still slightly worse. The fund yields slightly less than most broad-based high-yield corporate bonds, with a 4.7% yield versus a 5.5% yield for the iShares Broad USD High Yield Corporate Bond ETF (USHY). PFF slightly underperformed relative to USHY during 1Q2020 as well.

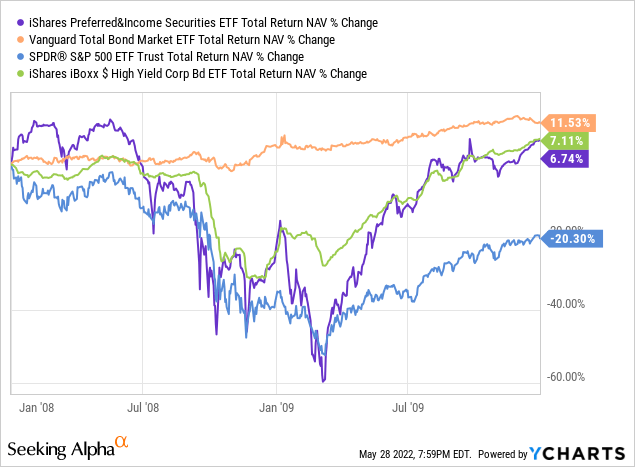

And has underperformed since inception, too.

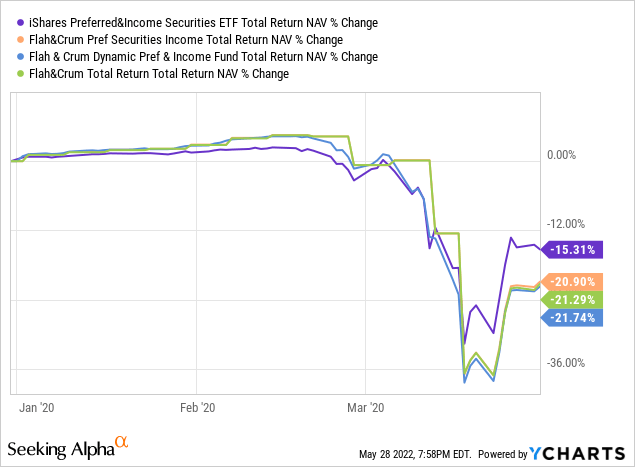

On a more positive note, PFF is definitely safer than the Flaherty & Crumrine family of preferred CEFs, as these funds use quite a bit of leverage. I think PFF’s weaker dividend yield and performance track-record more than outweigh the fund’s comparative safety, but others might disagree.

As an aside, PFF’s focus on financial institutions serves to increase risks further, and exposes the fund to the possibility of significant losses and underperformance if said sector performs particularly badly. This was the case during the past financial crisis, during which PFF’s losses temporarily exceeded 60%. Massive losses, although temporary, with the fund having mostly recovered by late 2009. In general terms, I don’t think that a repeat of the past financial crisis is likely, but the fund’s industry concentration is a negative regardless.

Conclusion – Better Choices Out There

PFF is the largest preferred shares ETF in the market. Although, there is nothing significantly wrong with the fund, it compares unfavorably to its peers on several key metrics. As such, I would not be investing in the fund at the present time.

[ad_2]

Source links Google News