[ad_1]

DanielPrudek/iStock via Getty Images

The Invesco High Yield Equity Dividend Achievers ETF (NASDAQ:PEY) is an exchange traded fund launched and managed by Invesco Capital Management LLC. The fund has an asset under management (AUM) over $1.14 billion which it has invested in public equity shares of companies primarily engaged in the business of utilities, financials, energy and consumer staples. Together these four industries account for approximately 75 percent of PEY’s portfolio. Remaining funds are invested in companies in industrial, information technology, healthcare, materials, real estate, communication services, and consumer discretionary sectors.

Interestingly about 10% of PEY’s funds are invested in stocks of tobacco manufacturers. This ETF targets dividend paying stocks and fully replicates the composition of the NASDAQ US Dividend Achievers 50 Index (DAYTR). “The Index is composed of 50 stocks selected principally on the basis of dividend yield and consistent growth in dividends. The Fund and the Index are reconstituted annually in March and rebalanced quarterly in March, June, September and December”.

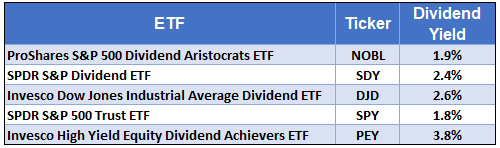

As the name suggests, Invesco High Yield Equity Dividend Achievers ETF seeks to be a dividend paymaster. This ETF has been paying monthly dividends since May 2006. The fund was incepted on December 09, 2004, and during the first 16 months of its operations, it paid regular quarterly dividends. PEY’s current yield is 3.91 percent, and it has recorded an average yield of 4.06 percent over the past four years. Throughout its annual yield has ranged between three percent to four percent. There are income generating ETFs which consistently generate a yield between 7 to 8 percent. From that viewpoint, PEY’s yield may seem a bit lower. At the same time, there are enough income generating ETFs whose yield is half that of PEY.

Yield comparison (Seeking Alpha)

(This image was sourced from here)

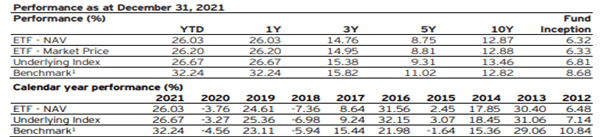

Anyhow, PEY’s price returns have been strong. Since its inception in May, PEY generated an annual average return of 6.33 percent, compared to 6.81 percent of its underlying Index. The small difference is due to PEY’s expense ratio of around 0.5 percent. Over the past 10 years, PEY successfully mimicked its benchmark index – Dow Jones U.S. Select Dividend Index, which measures 100 leading US dividend-paying companies. During this period, PEY’s market return was very healthy at 12.87 percent compared to 12.82 percent of its benchmark index. Over the past 3 years and 5 years, PEY has recorded an average market price growth of 14.76 percent and 8.75 percent respectively. During the same periods, the benchmark index had an annual average growth of 15.82 percent and 11 percent.

PEY performance (Invesco)

Price growth during the medium term seems impressive too, if we consider the pandemic related market crash during March & April 2020. During 2021, PEY recorded an impressive price growth of 26.2 percent. Throughout the years, PEY’s stock traded at a minor premium over its net asset value (NAV). In the past 10 years, PEY has recorded a double digit NAV growth five times, and recorded negative growth only in 2020 (due to pandemic) and 2018 (due to higher tariff, interest rate hikes, and tax cuts).

A detailed analysis of 50 stocks that PEY holds at present reveals that the growth is being generated from the basic industries – Materials, Utilities, Industrials, Energy, Real Estate and Consumer Staples. These companies derive their revenues from basic consumer needs (e.g. foods, construction, gas, minerals and electricity), so they are generally less impacted by an economic downturn and hence able to generate steady dividend yield. PEY’s current investment in these basic sectors is around 57 percent in 28 stocks. Since the inception of PEY, these 28 stocks generated an average growth of 128.5 percent over 17 years, which comes to around 5 percent CAGR. Barring Kellogg Company (K), and Universal Corp (UVV), all other stocks have outperformed the returns of Invesco High Yield Equity Dividend Achievers ETF.

Out of these 28 stocks, 16 stocks generated growth in excess of 111 percent, i.e. 4 percent CAGR. These stocks can also be termed as safe stocks. They were -LyondellBasell Industries NV (LYB), Altria Group Inc (MO), Chevron Corporation (CVX), OGE Energy Corp. (OGE), Healthcare Services Group, Inc. (HCSG), Kennedy-Wilson Holdings, Inc. (KW), UGI Corporation (UGI), Avista Corporation (AVA), Duke Energy Corporation (DUK), Clorox Company (CLX), Spire Inc. (SR), Edison International (EIX), Consolidated Edison, Inc. (ED), Southern Company (SO), Northwest Natural Holding Co. (NWE), and Sonoco Products Company (SON). Interestingly, approximately 35 percent of PEY’s investments are in these 16 stocks.

On the other hand, the remaining 22 companies belonging to consumer discretionary, financial, healthcare, communication services, Information Technology – had an average growth of 75 percent over the past 17 years, which comes to around 3.3 percent CAGR. Out of these 22 stocks, only 5 stocks – V.F. Corporation (VFC), Amgen Inc. (AMGN), Fidelity National Financial, Inc. (FNF), Merck & Co., Inc. (MRK), Prudential Financial, Inc. (PRU) – generated growth in excess of 4 percent CAGR, and another four stocks – Premier Financial Corp. (PFC), Pfizer Inc. (PFE), Principal Financial Group, Inc. (PFG), Unum Group (UNM) – were able to outperform the returns of PEY.

One important thing is to understand that all these stocks were not held by PEY for these entire 17 years. They were bought when the price was low and liquidated as they generated significant growth. The returns only suggest that the stocks of basic sectors are more steady and less likely to be impacted by an economic recession. There is always a likelihood that Invesco High Yield Equity Dividend Achievers ETF may increase its holdings in the companies engaged in materials, utilities, industrials, energy, real estate and consumer staples.

As a company grows, its revenue and profit also tends to grow. The company can therefore distribute more to the shareholders in the form of dividend. There is a common belief that the more an organization reinvests, the more it can grow. However, that’s not necessarily true. Various studies have revealed that companies that choose to distribute a reasonable portion of their profits instead of reinvesting in greater proportion, tend to experience greater long-term stock price appreciation vs. companies that only maintain their dividends or don’t pay one at all. At least that is what a 2013 paper from JP Morgan found; the paper found that “returns of S&P 500 dividend-paying stocks significantly outperformed those of non-dividend paying stocks from 1973 to 2013.” Now, there could be other reasons for this, and dividend payment may not be causally related to performance. However, the long period and vast number of companies studied make the paper convincing.

Invesco High Yield Equity Dividend Achievers ETF is a fund which will continue to provide a yield around 4 percent, and that will increase with time. With an average P/E of 15.64 and a P/B ratio of 2.84 this diversified ETF is moderately valued compared to the stock market in general.

Despite being well diversified, and selecting high dividend paying stocks, the portfolio has generated strong and steady growth. Historically it has generated a price growth between 9 to 15 percent over the medium term. As this ETF is focusing on basic sector stocks, the returns are less volatile, and less susceptible to an economic downturn. Thus, there is no reason why this ETF will not be able to continue its historical growth, and generate a steady double digit total return over a longer time horizon. Although presented as an income generating stock, I thus find this fund more suitable for growth seeking investors, with moderate risk bearing capacity.

[ad_2]

Source links Google News