[ad_1]

vchal/iStock via Getty Images

By Somya Sharma

Now is an exciting time to invest in clean energy funds. On one hand, oil and gas prices are rising, and policymakers are looking for alternatives. On the other hand, on Aug. 16, 2022, U.S. President Joe Biden signed the Inflation Reduction Act 2022 into law. The legislation allocates billions of dollars to fight inflation, lower healthcare costs, and fund green energy technologies. The funding goal is to develop green technologies, increase the pace of decarbonization, and reduce energy costs.

We rate the Invesco WilderHill Clean Energy ETF (NYSEARCA:PBW) as a buy for those looking to own it long term. However, given our very cautious near-term broad stock market outlook (based in large part on technical and sentiment analysis), this ETF is rated a hold for short-term purposes.

Strategy

PBW was launched on March 3, 2005, and is managed by Invesco. It tracks the investment results of the WilderHill Clean Energy Index. The index is composed of companies that are involved in developing and commercializing clean energy technologies. These technologies include solar, wind, biomass, fuel cells, and geothermal energies.

As of Oct. 5, 2020, the fund has $1,113.6 million in assets under management and an expense ratio of 0.62%. The fund is heavily weighted toward U.S. stocks, with 70% of its assets invested in U.S.-listed companies as of May 2020. Top holdings include Vertical Aerospace Ltd. (EVTL), Energy Vault Holdings, Inc. (NRGV), and ReneSola Ltd. (SOL).

Proprietary ETF Grades

- Offense/Defense: Offense

- Segment: Aggressive

- Sub-Segment: Clean Energy

- Correlation (vs. S&P 500): High

- Expected Volatility: Very High

Proprietary Technical Ratings

- Short-Term Risk (next three months): High

- Short-Term Reward (next three months): High

- Long-Term Risk (next 12 months): Moderate

- Long-Term Reward (next 12 months): High

Holdings Analysis

PBW comprises firms that are leaders in a wide array of clean energy subsectors. This diversification exposes investors to a diverse mix of clean energy companies, which helps reduce stock-specific risk.

As seasoned investors know, greater potential rewards often entail greater risk of capital loss, particularly over shorter time periods. Volatility is generally higher in growth stocks, which are the majority of PBW’s holdings.

YCharts

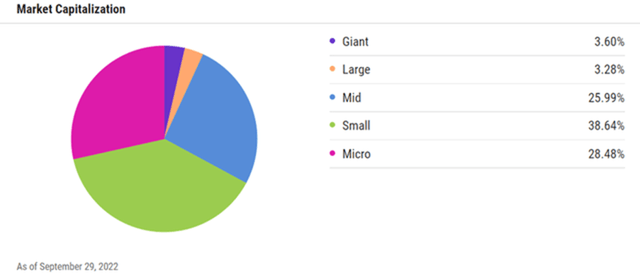

More than 65% of the fund’s assets are invested in micro-cap (28%) and small-cap (39%) stocks. In addition, 26% of the assets are invested in mid-cap-sized companies. These offer a higher potential for growth than their large-cap counterparts.

This capitalization mix provides PBW with more agility, room to grow, and an opportunity to find mispriced securities through its index construction methodology.

Strengths

The global market for clean energy is growing rapidly, driven by concerns about climate change, air pollution, and energy security. More and more countries are setting goals to increase their use of renewable energy to reduce their reliance on fossil fuels. This shift presents a significant investment opportunity for those looking for diversification, as parts of the globe move toward renewable energy sources.

While traditional oil and gas remain sound investments, the clean energy industry is rising. What does this shift mean for investors? In the last decade, the renewable energy industry has proliferated, with new technologies and businesses emerging rapidly. And this trend is only set to continue in the years ahead.

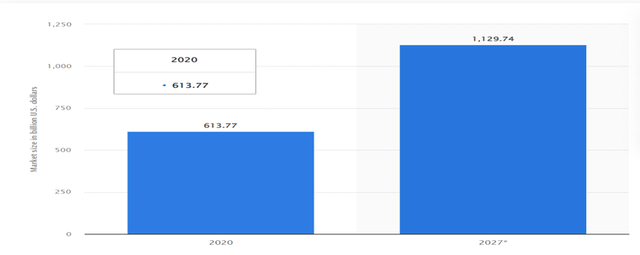

The global renewable energy market was valued at $613.77 billion in 2020 and is projected to reach $1,129.74 billion by 2027, growing at a CAGR of 9.11% from 2021 to 2027. (Statista 2022)

Why is the clean energy industry booming, despite continued controversy and pushback from the fossil fuel industry? First, there’s been a sharp increase in global demand for clean energy sources like solar and wind power. This increase in demand is driven by several factors, including the growing awareness of climate change and the need to transition away from fossil fuels.

Second, the cost of clean energy technologies has fallen sharply in recent years, making them more affordable and accessible. And, governments worldwide are investing heavily in clean energy, providing a significant boost to the industry. Such actions provide a backstop for these industries.

Weaknesses

The compound factors of smaller companies and a growing, yet controversial, industry present an intermediate-term weakness in the PBW story. With the traditional vs. alternative energy debate now becoming mature (though not resolved), the degree of acceptance of clean/green energy firms as part of the long-term global energy mix should be clearer as this decade continues. The potential for this to resolve itself favorably long term contributes to our buy rating. However, in the current investment climate, investors might hesitate to invest in small companies. These firms can become riskier and less liquid during financial crises, which can cause severe selloffs in ETFs like PBW – thus our short-term concern and rating, despite the longer-term investments case.

Opportunities

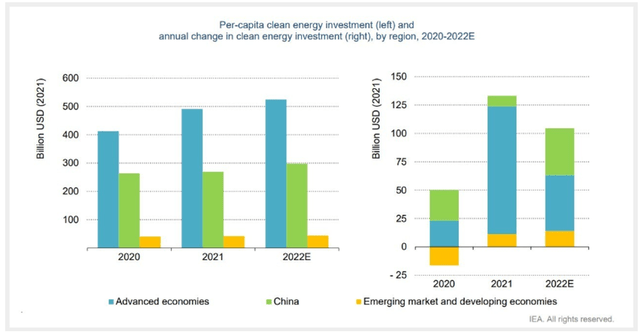

Clean Energy Investment Overview (IEA (International Energy Agency))

With the recent shortage of oil and energy resources around the globe, the demand for alternative energy sources is increasing. Advanced economies such as the U.S and the E.U. are forging ahead and investing in renewable energy. New firms and technologies are entering the market, and there is a growing demand for clean energy. More than 350 companies have joined the RE100 pledge to procure 100% clean energy.

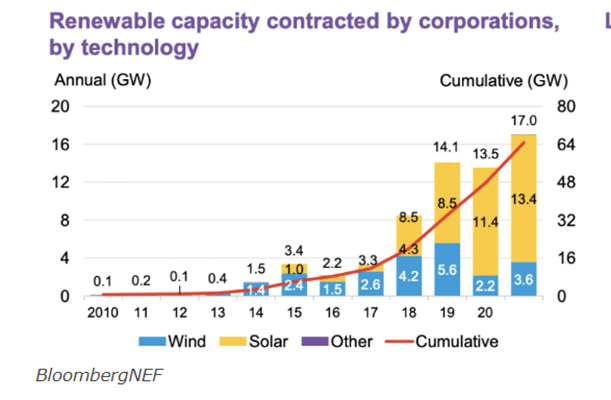

BloombergNEF

California, Massachusetts, New Jersey, and Connecticut are just some of the U.S. states passing bills/projects to invest in clean energy, thus increasing the scope of the industry. As many as 22 states in the U.S. have a target for 100% renewable energy or 100% carbon-free electricity. As public awareness about environmental issues continues to grow, there is increasing pressure on businesses to adopt sustainable practices.

Threats

While there are certainly opportunities for growth in PBW, risks also need to be managed. The industry in which this fund focuses is still evolving, so PBW is more sensitive to changing market conditions.

Some types of clean energy technology are still relatively new and unproven, so there is always the possibility that they will not live up to expectations. Additionally, government policies and regulations related to clean energy can be subject to change, which could impact demand for certain types of technology.

Conclusion

PBW has the potential to generate superior returns to the broad stock market over time. However, it’s important to remember that these types of investments come with greater risk than other types of funds.

As a stark example of this, after surging in price by 119% in the last five years, PBW dropped by over 26% during 2022. While this decline is in the neighborhood of that of the broad stock market, PBW’s long-term growth potential is well above that of the broad market. So, we believe that a good deal of the core risks of investing in alternative energy are already priced into PBW’s current valuation. That allows us to rate it a long-term buy at a time when most equity market segments look worse to us by comparison.

We see PBW as a specialized product that could help “energize” long-term growth portfolios. In the long run, those willing to pursue a higher reward/risk tradeoff could benefit from owning a portion of PBW.

[ad_2]

Source links Google News