[ad_1]

iantfoto/E+ via Getty Images

Investment Thesis

In my last article on the Invesco Global Clean Energy ETF (NYSEARCA:PBD), I discussed how lofty valuations would likely be a drag on future returns, despite solid growth prospects for a large number of constituents. Since then, PBD lost ~22% vs a loss of ~10% for the S&P 500 and has clearly underperformed the market.

ESG stocks are now cheaper than 6 months ago, but PBD is still trading at over 20x earnings, which makes it overvalued from an absolute perspective. On top of that, flows are leaving ESG stocks and going into the cheaper traditional energy sector, which is the main winner year-to-date. Given the fact that traditional energy stocks continue to be attractively valued on a relative basis compared to renewable energy stocks, I expect PBD to underperform as investors will choose the cheaper alternative.

What Has Happened Since My Last Article

As a reminder, PBD tracks the performance of the WilderHill New Energy Global Innovation Index, which is composed of firms that are involved in the promotion of cleaner energy and conservation. You can read more about the strategy and the portfolio in my previous article.

I have compared below PBD’s price performance against the iShares S&P Global Clean Energy Index ETF (ICLN) and the SPDR S&P 500 Trust ETF (SPY) over the last 5 months to assess which one was a better investment. Since my previous article, has PBD underperformed the S&P 500 by a ~13 percentage points margin. It is interesting to see that both clean energy strategies had a rough time over the last 5 months compared to the market.

Refinitiv Eikon

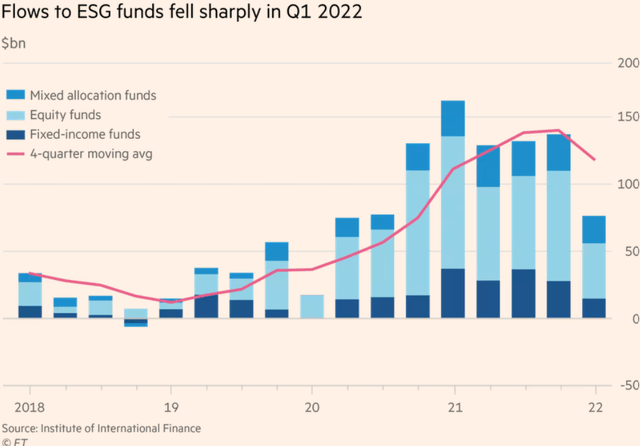

Q1 2022 represented the first quarter when flows to ESG funds fell sharply since 2020. What helped pump a large number of the ESG funds such as PBD is now slowing down, and interest for this theme is in a declining trend if we look at the 4-quarter moving average. I personally expect this decline in ESG fund flows to persist into this quarter and beyond.

IIF/FT

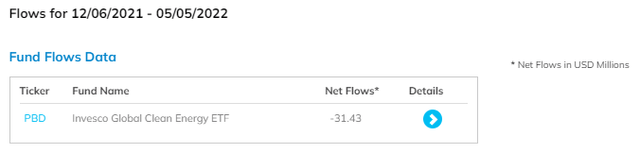

PBD hasn’t been spared by this trend. The fund registered ~$31.43 million in outflows since my previous article, with the majority happening in December 2021. A lack of interest in this strategy is in my opinion a critical risk given the fact that it generated the highest returns following the COVID-19 pandemic when the investment world became enthusiastic about ESG. A sentiment change could lead to the opposite effect.

ETF.com

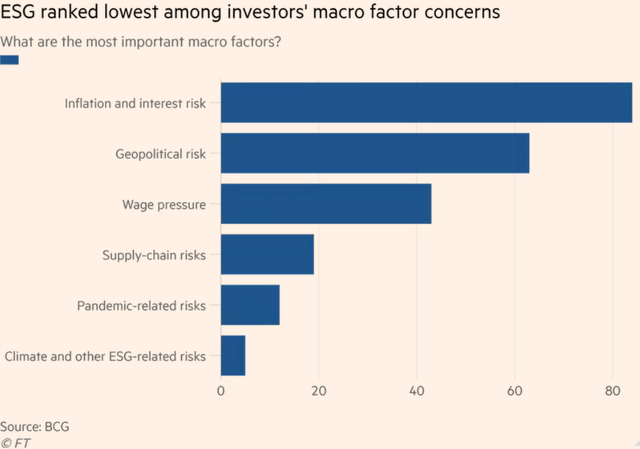

The reason we are seeing the shift is related to the fact that investors are now concerned by other macro factors. Inflation risk is the first topic of concern, followed by geopolitical risk. In my opinion, the market is focused on preserving wealth at the moment which means that its ability to finance ESG projects and investments is beginning to be limited given the fact that ESG is not a very efficient inflation and geopolitical hedge.

BCG/FT

Valuations Are Still High

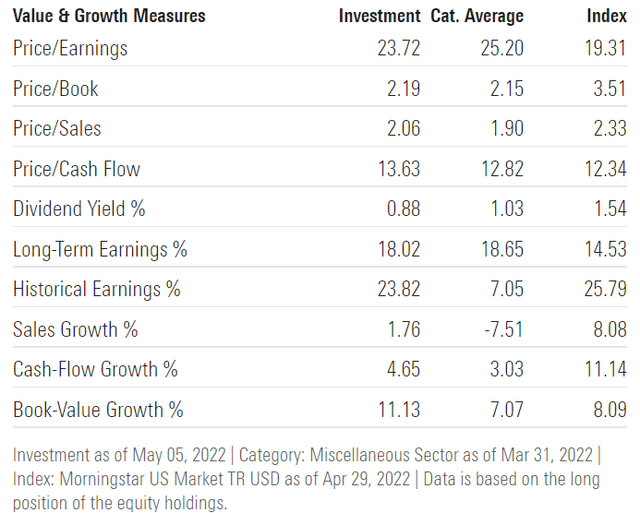

Despite the recent sell-off, PBD continues to trade at a lofty valuation in my opinion. The P/E ratio, for instance, is still above 20x, which is much higher than on a plain-vanilla S&P 500 ETF. Similarly, the dividend yield is lower, and I suspect the level of tangible income an investment generates will become increasingly important as rates go higher for the market.

At the same time, inflation is now higher than in December 2021 and probably more entrenched. This doesn’t bode well with high PE stocks as previously mentioned in my articles. From a historical perspective, you should expect lower valuations than we have at the moment when the CPI is high.

Morningstar

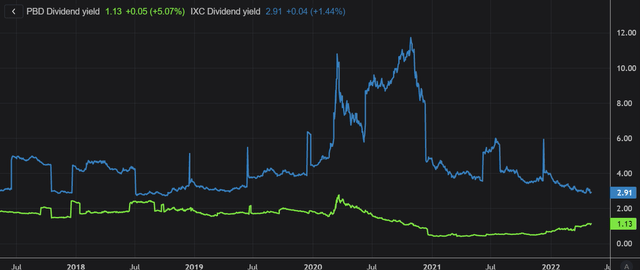

Another factor that makes me think PBD will underperform over the next months is related to the comeback made by traditional energy stocks. If we look at the iShares Global Energy ETF (IXC), it is trading at ~15x earnings and has a price-to-book ratio of less than 2. On top of that, it has a ~3% dividend yield, which is almost 3x higher than what you can earn on PBD. Unlike renewable energy stocks, traditional energy companies provide good inflation and geopolitical hedge, and that is another reason why the market is now taking a second look at this sector.

Refinitiv Eikon

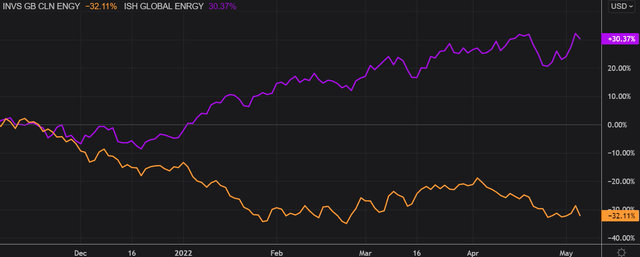

As a result of higher commodity prices, the energy sector did very well over the last six months. If we look at IXC’s returns since November 2021, it outperformed PBD by more than 60 percentage points. I believe the energy sector will continue to deliver good results over the next months despite fears of a global economic slowdown.

Refinitiv Eikon

Key Takeaways

PBD trades at over 20x earnings, which is expensive, and I believe the current price doesn’t provide a good margin of safety. There might be more downside risk from the current level for PBD given the investors’ shift from ESG to traditional energy stocks in the face of high inflation and geopolitical risk. As a result, I believe that PBD will continue to underperform the market in the coming months.

[ad_2]

Source links Google News