[ad_1]

In some recent articles, I have presented outlooks for the probabilities of future index and stock returns using options prices. I developed this model and I have been running it for a couple of years now. The basic concept is that, by combining options prices at a range of strikes, you can infer the probability distribution of future returns implied by the options markets. I have writeups with academic references and general descriptions of this method here.

In this article, I perform the same analysis for options on QQQ, which tracks the NASDAQ 1000. I have analyzed options expiring on December 20, 2019, so this is essentially the outlook for QQQ for the rest of 2019. The probability distribution of returns implied by the options prices is nice and smooth and the average error in options prices derived from this distribution, as compared to the actual mid-point prices of calls and puts, is 0.6%.

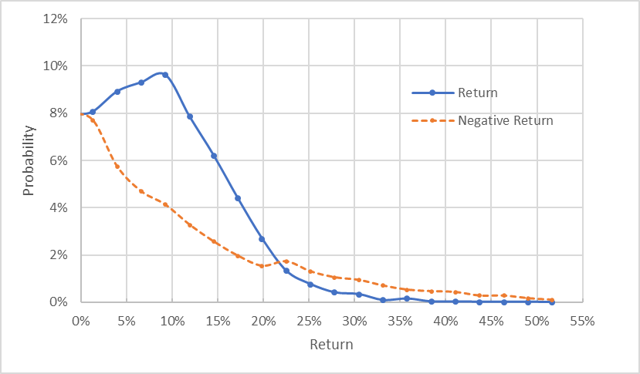

Options-based outlook for the probability distribution of QQQ between May 6th and December 20th, 2019

I find that it is easier to interpret the probabilities when the negative returns are reflected onto the positive axis (as shown above). This chart has the standard characteristics that we expect to see for the implied distribution of a stock index, with a positive mode (the peak in the distribution) and negative skewness, so that the probability of extreme negative events is higher than the probability of extreme positive events of the same magnitude. In this case, the mode price return is 9.3% between now and December 20th. The annualized volatility of this distribution is 18%, slightly higher than the trailing 15-year realized volatility of QQQ (17%).

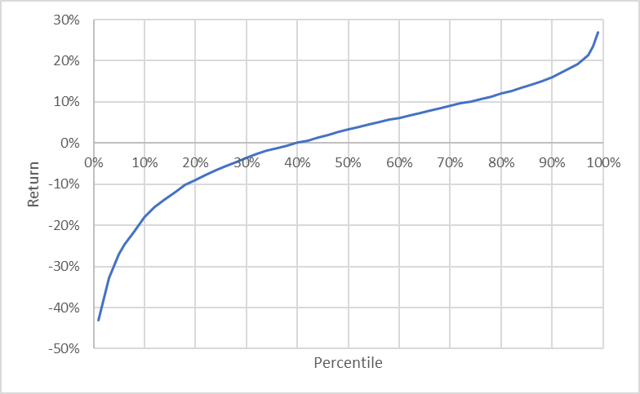

Another way to look at the option-implied probabilities is in terms of the percentiles of return (the cumulative probability distribution).

Percentiles of price return for the QQQ options-based outlook between May 6th and December 20th, 2019

The skewness evident in the asymmetry of the extreme positive returns (high percentiles) and negative returns (low percentiles). The estimated 5th percentile price return for QQQ until December 20th is -27%, while the 95th percentile return is 19%. The compensation for the skewness is that the price returns are expected to be greater than zero with a 60% probability (the percentile curve crosses zero at the 40th percentile). As a measure to expected return to risk, I often compare the most likely return, the mode, (9.3%) to the 5th percentile as a measure of downside (-27%). For context, the mode and 5th percentile of the options-based outlook for SPY in my recent analysis were 6.5% and -25.7%, respectively. The QQQ outlook is for markedly higher expected return and slightly higher risk than I obtained for SPY. These results are bullish for QQQ.

It is worth noting that the downside risk, while reasonable relative to the most-likely return, is still substantial (the 1st percentile is -43%). One way to manage this downside risk is to purchase put options. A put option with a strike of $155 can be purchased for $2.14 (the ask price), about 1.1% of the cost of a share of QQQ. Purchasing this put limits the maximum loss on QQQ to 19.5% (including the cost of the put option). Given the long negative tail on QQQ, this seems like a reasonable price.

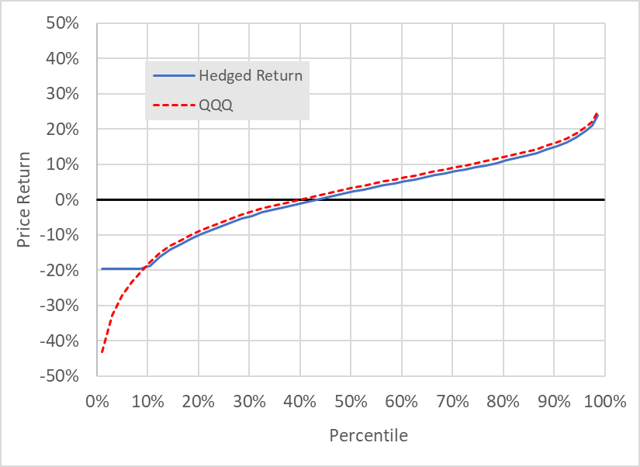

Percentiles of price return until December 20th for QQQ (—) vs. QQQ plus a $155 put expiring on December 20th (___}

The purchase of the $155 put truncates the loss potential at the 10th percentile, while retaining almost all the upside potential (but reduced slightly because of the cost of the put).

In conclusion, the options-based outlook for QQQ presents an attractive value proposition, with a most-likely (mode) price return of 9.3% for the balance of the year and a 5th percentile return of -27.5% and a 1st percentile of -43%. One would have to be very risk averse to turn down a most-likely return of 9% for taking a 1-in-20 risk of a -28% loss (or a 1-in-100 chance of a -43% loss). That said, losses of these kinds of magnitude are painful and we must acknowledge that our ability to estimate their probability is very poor. To compensate for the long tail, buying out-of-the money puts is a reasonable option.

Disclosure: I am/we are long QQQ. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News