[ad_1]

Investment thesis

The bullish scenario on The United States 12 Month Oil Fund LP (USL) strengthens, following improving American crude storage picture and growing global crude supply risks. Therefore, I expect USL to push toward fresh yearly highs until the next OPEC meeting scheduled on June 23.

Source: Tradingview

USL – The United States 12 Month Oil Fund LP

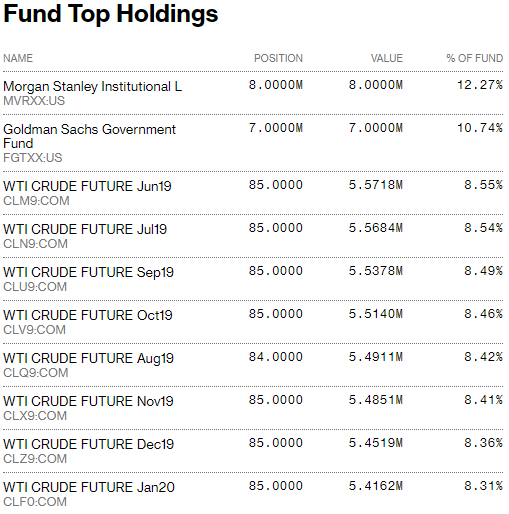

USL is a commodity pool measuring the daily changes of US spot oil prices and is averagely exposed in the 12 nearest-month NYMEX WTI crude oil futures contracts. Compared to its biggest competitor, USO, the Fund diversifies its exposition on 12 different futures contracts, making it less sensitive to contango.

Source: Bloomberg

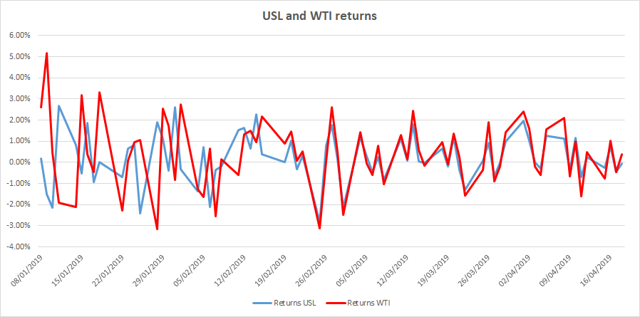

While the fund’s strategy is less risky than that of USO’s, USL is less sensitive to short-term moves in spot oil, as can be seen in the chart below:

Source: Nasdaq

In term of incurred costs, USL is in the average of the market, offering an expense ratio of 0.86% and an average spread in the last 60-day of 0.26%. USL doesn’t measure up in size and liquidity to its big sister USO, but it brings an alternative futures strategy that’s less volatile and that provides adequate liquidity for retail investors.

Crude and petroleum stocks

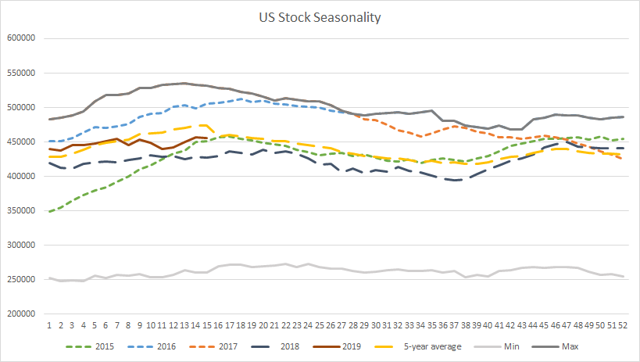

Latest crude oil storage report published by the EIA on the April 5-12 period shows a marginal decline in crude inventories, down 0.31% (w/w) to 455.2m barrels, whereas USL performance posted a moderate advance, up 2.32% (w/w) to $23.71 per share. With this slim decline, crude oil seasonality steadies compared to the last year’s stocks, still establishing in a surplus of 6.5% or 27,587k barrels; however, oil stock shortage widens compared to the 5-year average, reaching 4% or 19,096k barrels. This brings marginal positive winds to USL shares and its underlying oil futures contracts, given that it’s the first time in the last month that US crude stock dropped.

Source: Historic Stocks of Crude Oil Report – EIA

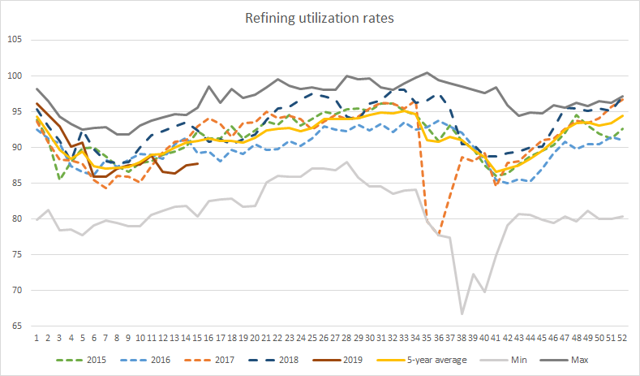

On the other hand, refined product storage deteriorated further on the reported period, posting a 5-week decline in a row. While the decrease has been marginal, gasoline and distillates stockpiles dipped concomitantly, by respectively 0.51% (w/w) to 228m barrels and 0.28% (w/w) to 127.7m barrels. Low refining utilization rates, turning below the seasonal mean, following rising maintenance work partly explain this deficit, contributing to US supply squeeze, tightening of American crude market, and sustaining of USL shares.

Source: Weekly U.S Refining Utilization Rate

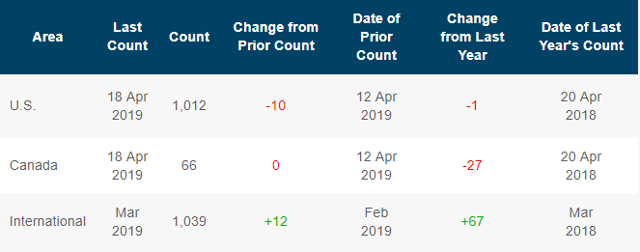

Furthermore, US oil output weakened over the week, down 0.82% (w/w) to 12.1m barrel and newest Baker Hughes oil rig count indicates that the slowdown might not be over. Indeed, during the latest count, the oil service company indicated that 10 new rigs have been withdrawn on the April 12-20 period, bringing additional headwinds to US oil production.

Source: Baker Hughes Rig Count Report

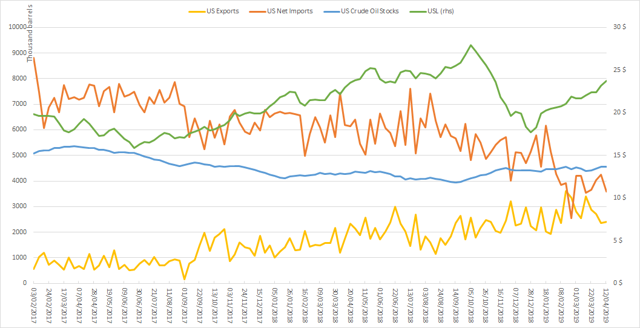

Furthermore, American crude balance improved significantly over the week, posting the first advance in the last month. US net imports strongly declined, down 15.51% (w/w) to 3.59m barrels, whereas exports lifted 2.21% (w/w) to 2.4m barrels.

Source: Weekly Imports & Exports Report – EIA

In this context, the fundamental picture of crude markets and its proxy USL shares is improving, partly recovering from last week’s dull reports and bringing fresh catalysts to sustain oil markets’ advance.

Speculative positioning

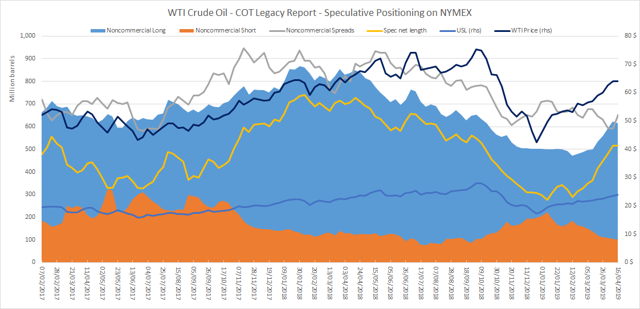

Source: CFTC

Latest Commitment of Traders Report published by the CFTC indicates a net speculative positioning stabilization on the April 9-16 period, subsequent to strong builds in the last two months. During the reported week, net speculators marginally decreased, down 0.27% (w/w) to 515,258 contracts.

This has been attributable to long speculators reducing slightly their bets, down 0.91% (w/w) to 616,110 contracts and was partly counterbalanced by short coverings, down 4.05% (w/w) to 100,852 contracts.

That being said, this week’s net spec stabilization indicates that speculator’s bullish view on crude markets is waning, given the huge 5:1 long ratio and could signal the beginning a strong long unwinding, which will weigh on USL performance.

Since the beginning of the year, net speculative positioning on Nymex crude climbed 85.87% or 238,047 contracts, whereas the USL’s YTD performance lifted 22.6% to $23.87 per share.

Backdrop developments

Since my last article, published on April 17, my bullish view on crude oil markets strengthens, amid Washington’s announcement to put an end to all waivers on Iranian crude imports and given an improving US crude storage picture.

While the announcement is expected to take effect by May 1, rumors suggest that Iran’s eight biggest crude buyers, most of them in Asia will continue to import Iranian crude, as is the case currently with Venezuela’s oil exports.

Nevertheless, spare capacity from OPEC members and especially from the de facto leader, Saudi Arabia, could fill in the gap, increasing global supply and maintaining a balanced crude market. While this currently is the most probable scenario, until OPEC’s next meeting at the end of June, oil markets could significantly tighten.

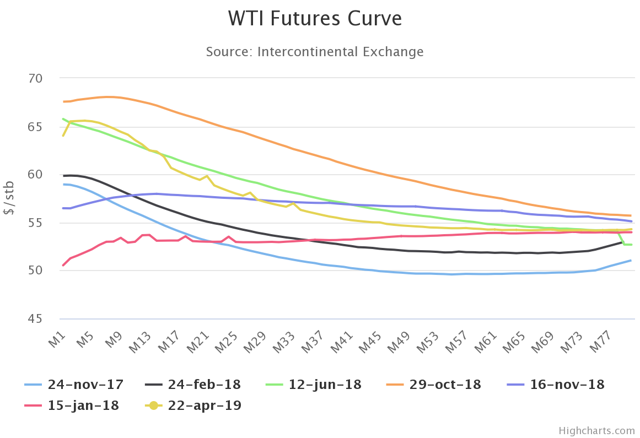

Meanwhile, the WTI crude future curve contango slope intensifies on close-by maturities, signaling an oil oversupply in the short term, which could trigger a technical correction on crude futures; however, the curve’s backwardation steepens on following deliveries, which is constructive for the medium-long term appreciation of USL shares and provides an interesting roll-yield.

In this context, I initiate a long positioning on USL shares, amid US crude storage improvement and global supply tightening induced by US announcement to end waivers on Iran’s oil imports.

I look forward to reading your comments.

Disclosure: I am/we are long USL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News