Brent crude futures, the international benchmark for oil prices, sank $3.12 cents, or 4.4%, or $67.87 per barrel around 10:20 a.m. ET (1420 GMT).

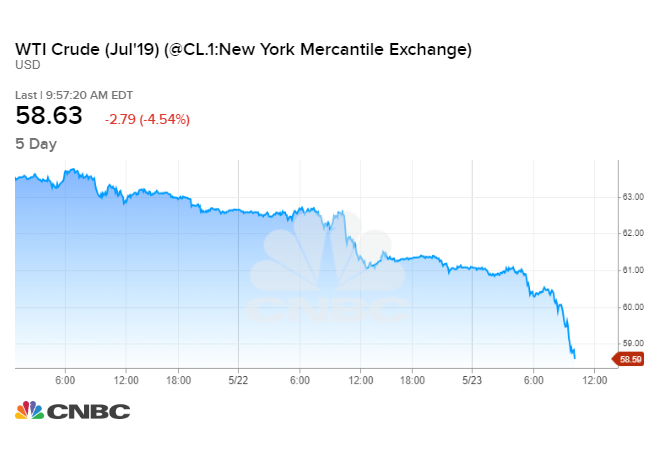

U.S. West Texas Intermediate crude futures tumbled $3.20, or 5.2% to $58.22 per barrel, after falling 2.5% the previous day. WTI dropped below $60 per barrel for the first time in nearly 2 months on Thursday.

“The $60 level is a critical support point,” said John Kilduff, founding partner at energy hedge fund Again Capital.

“After $60, really it’s right down around $58 or so. Theoretically, if this thing really becomes a washout, $52 is the downside objective,” he said, cautioning that the move would not happen overnight.

Crude futures fell with the stock market as the ongoing U.S.-China trade dispute entered a new phase. A wave of companies is suspending business with Huawei after the U.S. blacklisted the Chinese telecom giant.

Washington and Beijing are set to increase tariffs on hundreds of billion of dollars of one another’s goods, raising concerns about global economic slowdown and weaker demand for oil.

U.S. manufacturing activity grew at its slowest pace since September 2009 this month, according to IHS Markit.

Meanwhile, data released overnight showed Japanese manufacturing activity fell into contraction in May. Manufacturing activity for the European Union and Germany also came in below expectations.

“You’ve got the U.S.-China trade war just doing its damage across the board,” Kilduff said. “Crude was ready to take a hit on it all along except for the geopolitical tensions in the Middle East.”

Oil prices rose last week on rising tensions in the Middle East after the Trump administration tightened sanctions on Iranian oil exports. However, there are signs the Trump administration is trying to prevent further escalation in the region.

Politico reported on Thursday that Democratic Sen. Dianne Feinstein met with Iranian Foreign Minister Javad Zarif a few weeks ago during a dinner arranged in consultation with the State Department.

The news follow the President Donald Trump’s meetings last week with the Swiss president and Secretary of State Mike Pompeo’s phone call with Oman. Both countries have served as intermediaries between the U.S. and Iran, sparking speculationthat the White House is trying arrange negotiations.

“The president has made clear that at the right time negotiations are import,” Pompeo told CNBC’s “Squawk Box” on Thursday. “What the president has said is that he’s prepared at the right time, when the Iranians conclude that it’s in their best interest to negotiate, we stand ready to take their call.”

Pompeo also says the Trump administration has taken measures to prevent oil prices from spiking while it attempts to drive Iran’s crude exports to zero.

U.S. crude oil inventories rose last week, hitting their highest levels since July 2017, the government’s Energy Information Administration said on Wednesday.

Industry data had also shown a surge in U.S. crude stockpiles. Commercial U.S. crude inventories rose by 4.7 million barrels in the week ended May 17, to 476.8 million barrels, the EIA data showed.

Beyond weak refinery demand for feedstock crude oil, the increase also came on the back of planned sales of U.S. strategic petroleum reserves (SPR) into the commercial market.

Countering these bearish factors are ongoing supply cuts led by OPEC.

French bank BNP Paribas said high inventories meant that OPEC would likely keep its voluntary supply cuts in place beyond their current end-June deadline.

The United States Oil Fund LP (USO) was trading at $12.08 per share on Thursday morning, down $0.66 (-5.18%). Year-to-date, USO has gained 0.58%, versus a 6.22% rise in the benchmark S&P 500 index during the same period.

USO currently has an ETF Daily News SMART Grade of A (Strong Buy), and is ranked #1 of 110 ETFs in the Commodity ETFs category.

This article is brought to you courtesy of CNBC .