[ad_1]

domin_domin/E+ via Getty Images

Author’s note: This article was released to CEF/ETF Income Laboratory members on March 9th, 2022.

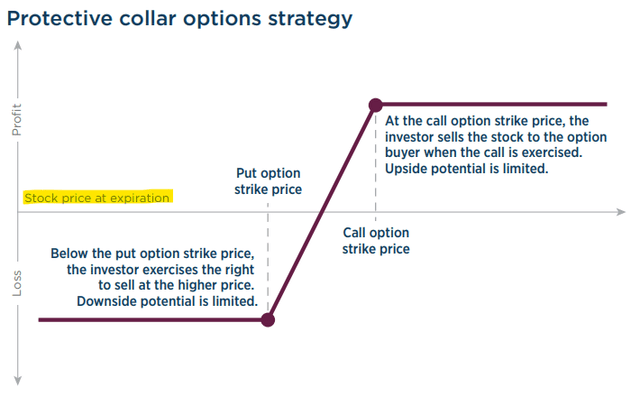

The Nationwide Risk-Managed Income ETF (NUSI) is a U.S. tech equity index ETF. NUSI employs a protective collar options strategy meant to reduce losses during downturns, at the cost of reduced upside potential. For the past few years, NUSI’s strategy has been a net negative, with the fund underperforming most broad-based U.S. equity indexes by double-digits. NUSI has performed worse than expected, and so I thought to write an article explaining just why that was the case.

NUSI’s options strategy limits both upside and downside potential to around 10% in one month.

There have been many periods of time during which equities have rallied by more than 10% in a short period of time, during which NUSI’s options strategy significantly limited returns.

There have been comparatively few periods of time during which equities have been down by more than 10% in a short period of time. Recent corrections have been relatively shallow, and short-lived, and so NUSI’s options strategy did not significantly limit losses during these.

NUSI’s strategy would work better during more severe downturns, and during less sharp market upswings. Currently, conditions are opposite of this, and so the fund significantly underperforms.

NUSI – Overview

NUSI is an ETF which invests in the tech-heavy Nasdaq-100 index (QQQ), and implements a protective collar options strategy. NUSI’s managers have an in-depth explanation of said strategy here, and I have my own here. In simple terms, we can say that NUSI’s investment strategy is meant to provide exposure to the Nasdaq-100 index, while limiting upside and downside potential on the same to around 10% on a monthly basis.

NUSI’s returns are strongly dependent on the performance of the Nasdaq-100 index. A quick graph showing said relationship.

NUSI Corporate Website

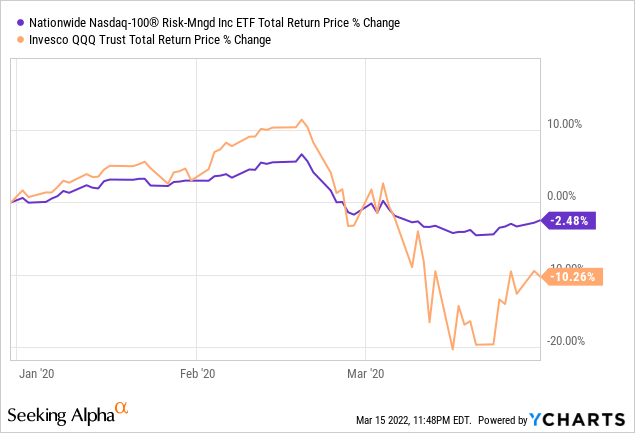

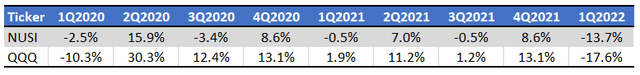

As can be seen above, as the Nasdaq-100 increases / decreases, labelled as stock price at expiration, so does the profits / losses of NUSI. Both of these are capped, at a price dependent on the specific characteristics of the purchased options. For NUSI, and as per fund filings, both upside and downside are capped at about 10%. In practice, the above functions as a soft cap, as option prices and profits are noisy and dependent on several variables, and as investment strategies are rarely implemented perfectly. Still, NUSI does more or less perform as expected. As an example, NUSI significantly outperformed its index during 1Q2020, the onset of the coronavirus pandemic.

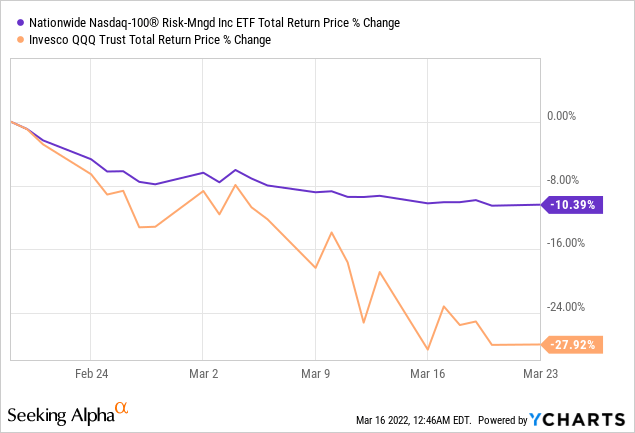

NUSI’s losses were significantly lower than the 10% soft cap, mostly because the specific time period selected had its fair share of gains too. NUSI posted losses of about 10.3% from peak to through, roughly consistent with expectations.

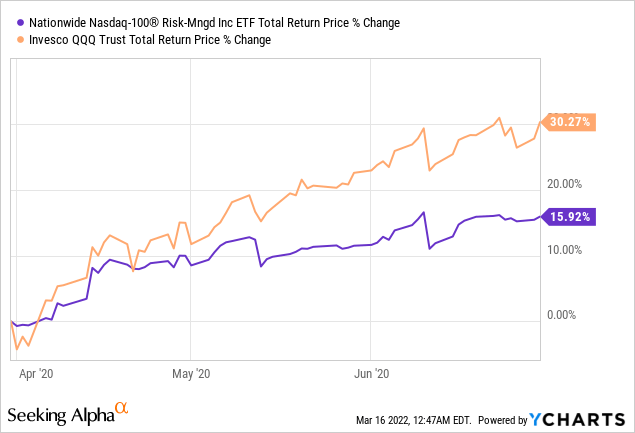

NUSI’s gains are also capped, and so the fund significantly underperforms during bull markets, recoveries, and periods of strong stock market gains. This has been the case during most time periods following the onset of the coronavirus pandemic, including 2Q2020.

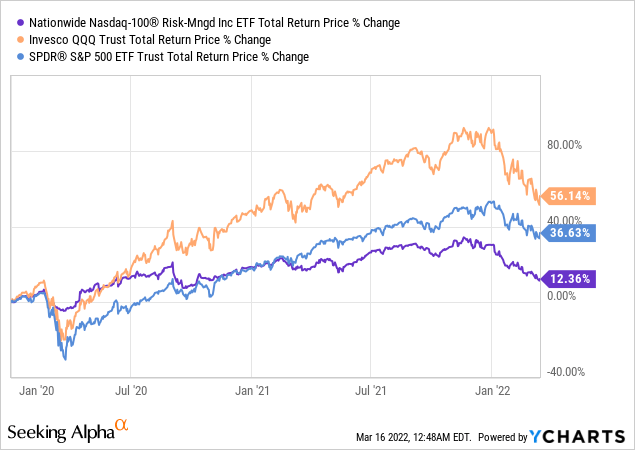

NUSI experiences lower gains and losses relative to the Nasdaq-100 index. The net effect should be negative, as gains are more common than losses. The net effect has been significantly negative for quite a few years now, with NUSI significantly underperforming relative to the Nasdaq-100 and the S&P 500 since 2020.

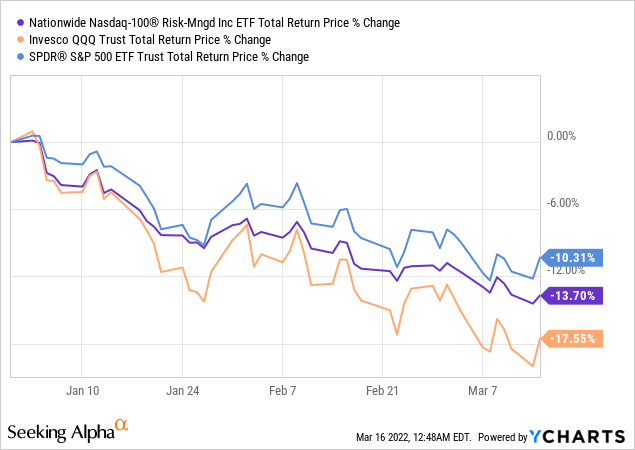

NUSI has also not fared terribly well during the current correction. The fund has posted losses of 13.7% YTD, slightly underperforming relative to the S&P 500, but moderately outperforming the Nasdaq-100.

NUSI has not performed particularly well these past few years, underperforming expectations. Let’s have a look at why this has been the case.

NUSI – Underperformance Explained

NUSI has underperformed because its investment strategy has been particularly ineffective under current market conditions, and sequence of returns.

Gains are more common than losses, so capping both is almost always a net negative. Gains have been significantly more common than losses these past few years, so the net effect has been significantly negative. As an example, since 2020 the Nasdaq-100 has been down 2 quarters, but has been up 7 quarters. NUSI outperformed during the 2 down quarters, underperformed during the other 7, with the net effect being decisively negative.

Seeking Alpha – Chart by author

Stocks mostly go up, so capping equity upside and downside is almost always a net negative. As such, investors should expect NUSI to continue to underperform the Nasdaq-100 index on a total return basis moving forward. Still, the fund does outperform during downturns, and so is a safer investment relative to most equity index funds.

Gains have also been larger and sharper when compared to losses. As an example, the biggest quarterly movement in the Nasdaq-100 occurred in 2Q2020, during which tech mega-cap stocks rallied as investors realized tech would benefit from several pandemic trends, including working from home, greater reliance on online services and offerings, and the shutdown of many real-world locations, industries, service providers, and the like. The Nasdaq-100 was down by just 10% in the first quarter of the year, before rallying more than 30% in the next. Gains vastly outpaced losses, so capping or significantly reducing both was a negative for NUSI and its investors. Other quarters show similar patterns: massive gains, small losses.

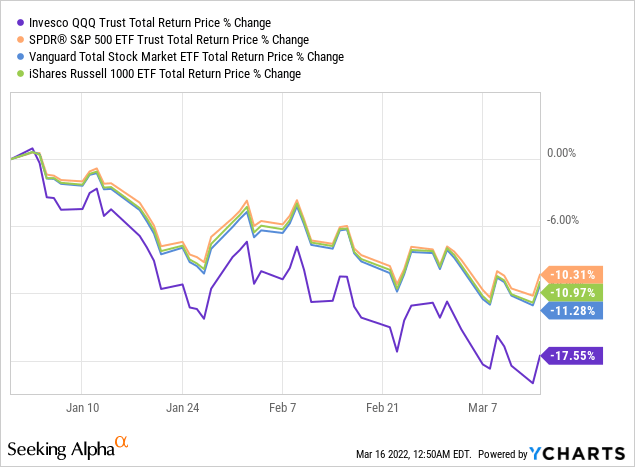

Finally, NUSI underperformed as the fund is indexed to the Nasdaq-100, the worst-performing broad-based U.S. equity index YTD.

NUSI’s options collar strategy is meant to reduce losses during downturns, and said strategy does work reasonably well, but the effectiveness is limited when the underlying index underperforms by so much. NUSI’s options reduced losses, its index had above-average losses, and the net effect was approximately zero. Investors were left with a fund whose main characteristic is capped upside, hence NUSI’s underperformance these past few years.

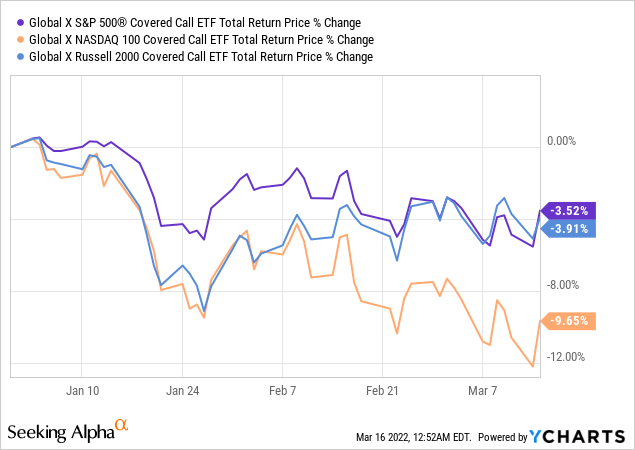

As a quick aside, other covered call funds focusing on the Nasdaq-100 index have seen sub-par performance YTD. As an example, the Global X NASDAQ 100 Covered Call ETF (QYLD), a Nasdaq-100 covered call index fund, has underperformed other covered call index funds focusing on other indexes. It has been a tough year for the Nasdaq, and for most funds focusing on said index.

Conclusion

NUSI’s protective collar options strategy is ineffective during shallow downturns and significant market upswings, both of which have been common occurrences these past few years. Although the fund has underperformed in the past, performance could improve if market conditions were to change.

[ad_2]

Source links Google News