[ad_1]

The WisdomTree Europe Hedged Equity ETF (HEDJ) has been a great way to gain exposure to the EU’s economic core. It is light on UK assets and heavy on eurozone equities. Arguably, it can be seen as a bet on Britain’s economy faltering after Brexit is finalized, while the eurozone core of the EU might be expected to do alright. Latest economic news, however, suggests that the EU core is in fact suffering, not only due to internal EU economic weakness, but also due to external factors such as the on-going trade frictions we are seeing, which is impacting Germany to a great extent, given that it is the country with the biggest trade surplus on the planet. Germany’s economy can in turn drag down the entire core. In addition, we now have renewed Italian political drama, which is further impacting confidence in the region. To make matters worse, Norway’s Sovereign Wealth Fund is hinting at a further divestment process out of EU core area, which can really add to selling pressure on all assets in the region.

It was recently announced that Norway’s Sovereign Wealth Fund just posted its best quarter ever. It gained about $84 billion in value in the first three months of the year, helping it surpass the $1 trillion dollar mark in terms of its overall value. It has been noted that the main driver behind this spectacular gain has been the fund’s investment into US tech firms, which performed rather well during that period. Even though US equity has been the fund’s better performing asset class, US equities are by no means dominant in the fund’s holding.

Source: Norges Bank.

Source: Norges Bank.

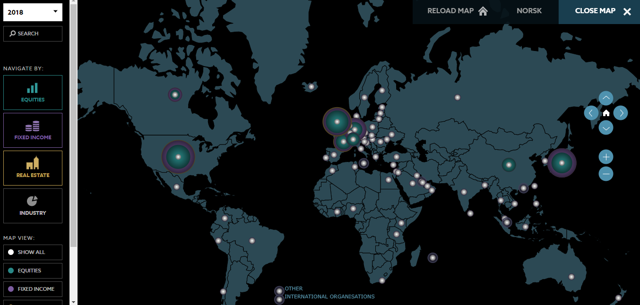

If we look at the map, which is valid as of the end of last year, we can see that Europe is still the biggest beneficiary of Norway’s fund investment. Should be mentioned, however, that its largest single stock holdings are Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL) (NASDAQ:GOOG) and Amazon (AMZN).

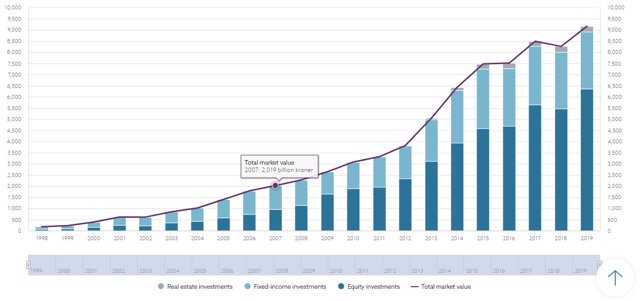

If we take a step back, and look at the bigger picture in regards to the investment history of the fund, we can pinpoint the decision that led to this success. It was when it was decided to start diversifying out of Europe back in 2012. This will not be lost on the Norwegian fund managers either as they now move to contemplate the direction it needs to head into next. Clearly, abandoning Europe worked for the fund, and it will probably be an even better bet going forward, especially if we take into account the latest economic metrics which have been coming out of the EU. Keeping this in mind, I think WisdomTree’s Europe ETF may be particularly vulnerable, as I shall explain. The fact that it is exclusively focused on eurozone investments could see it lose the most as Norway continues to divest from the region.

Norway may be looking to repeat 2012, but is interestingly sticking with UK investments.

Source: Norges Bank.

Source: Norges Bank.

As we can see from the chart, right after 2012, when Norway decided to diversify its holdings away from its main trading partners, the fund performed rather well, for the next few years. Now it is reported that it wants to take it further by investing more in the Americas and Asia. Personally, I think that this will be a huge blow to European equity markets because the Norway Sovereign Wealth Fund is not only massive, with a very significant presence in Europe, but it also has a massive effect on market sentiment. In other words, its moves can have an amplified effect on whatever it decides to buy or sell. But of course, Norway’s Sovereign Fund has to do what is best for the country and people of Norway. As the latest EU data suggests, the eurozone may not be the best place for Norway’s investments at the moment. Germany, the largest economy in the eurozone just experienced a quarterly contraction, while Italy is seeing flat growth on a quarterly and year-over-year basis.

Odds of improvement are low as the eurozone faces a number of potential crisis situations. Italy is not only economically stagnated but it is also caught in a new round of political turmoil. Germany has plenty of room for fiscal stimulus, given that it is currently running a budget surplus, and it will probably start to loosen the purse strings soon. But there will be little help from the ECB, given that it is already offering negative rates and is still engaged in QE policies. No matter how we look at it, it is a difficult situation, with no easy solutions.

Interestingly, Norway’s sovereign fund does not seem eager to divest from Britain, despite all the worries about what Brexit will do to that economy. As the map above shows, Norway is more heavily invested in Britain than it is in any other country in Europe. At the beginning of the year it was planning to increase its UK holdings. It is unclear whether recent signaling of its intent to further divest from Europe includes Britain, but it seems to me that the euro core is what the Norwegians have in mind. WisdomTree’s Europe ETF is therefore likely to fully experience the hit that the old continent will take as a result of Norwegian money outflows.

WisdomTree Europe Hedged Equity ETF Is wrongly positioned for current situation from every perspective

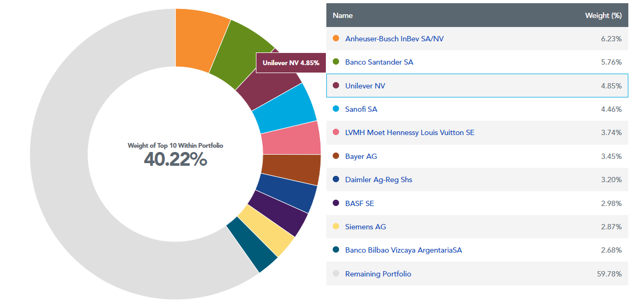

The fund is focused on eurozone equities, with a strong focus on export-oriented companies. As we already know very well, EU exports are currently being hit hard by continued trade frictions, especially between the US and China. If we look at some of the companies which make up a significant portion of the fund, there is a clear danger of exposure to not only the continued slowdown in the EU economic core, but also in regards to further trade disruptions.

Source: WisdomTree.

Source: WisdomTree.

The fund’s top holding, Anheuser-Busch InBev (BUD) is what one would consider a solid investment in turbulent times. After all, drinking some beer is just the thing to do in times of stress. Much of the rest of the names on the list, however, are less than ideal in this respect. Daimler (OTCPK:DDAIF) is heavily dependent on exports to both China and the US; thus it has trade disruption exposure, as well as being exposed to an EU core slowdown. Banco Santander (SAN) has already been crushed in the past decade, thanks in large part to the low interest rate environment that prevails in Europe. A further decline in European economic fortunes will come with interest rates going even lower, which will affect all European banks. This is just a sample of the particular way that the current economic environment in Europe and across the world makes this fund already less than desirable as a long-term hold.

Aside from the company-specific allocation of the fund, looking at the country-specific allocation, it is heavily focused on the eurozone core of the continent, which is where I believe Norway’s sovereign fund is looking to divest from the most. Half of the assets are German and French, with most of the remaining allocations spread across the eurozone. Norway’s sovereign wealth fund held 34% of its equity holdings in Europe as of the end of 2018, which amounts to roughly $240 billion. If it starts selling a portion of these assets, it will add to the other selling pressures, such as the further economic deterioration of the economic situation in the EU. And as I already pointed out, Britain will likely not be the target of this divestment, given earlier stated intentions of the fund to actually increase its UK exposure. The most likely target will be the eurozone core, where this particular ETF is heavily positioned. The Norway fund is not heavily invested in the Eastern EU periphery, and I doubt it will sell that region, given that it is the only EU economic bright spot at the moment, as the latest Eurostat data shows. This all leaves the same region that the WisdomTree Europe fund gives overwhelming coverage to, as the main likely target of Norway’s Europe divestment plans.

While the Norway sovereign fund does not seem to have a great deal of exposure to some of the top ten names held by the WisdomTree fund, if it becomes a net seller of its assets in Europe and the core in particular, this will put further pressure on the assets that the WisdomTree fund holds, which is the last thing it needs, given all the other issues surrounding the markets that this company offers exposure to. It is therefore a potentially risky asset to buy and hold at this time in my view, because it is most likely in for a very rough few years.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News