[ad_1]

ArefBarahuie/iStock via Getty Images

There are a lot of reasons why you might want to invest in something related to nuclear power, with energy being such a core issue in today’s market. While there are ways to play nuclear, including buying Uranium commodities or uranium miners, we are not as excited about exchange-traded funds (“ETFs”) like VanEck Vectors Uranium+Nuclear Energy ETF (NYSEARCA:NLR), which hold mostly utility companies that happen to have some nuclear exposure. Politics is of key concern around the issue of nuclear, so there isn’t a good reason to not be selective and go with an ETF like NLR. We’d much rather invest in geographies where we know there is nuclear support for producing nuclear energy as a utility company. Moreover, there are better ways to play nuclear than with utilities.

What’s in NLR?

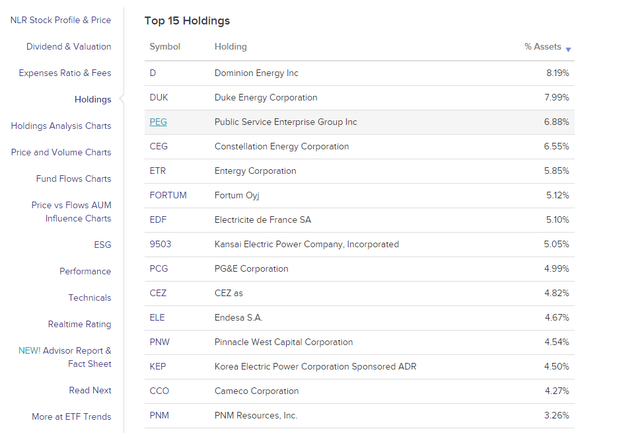

NLR contains utility companies with nuclear energy producing assets and exposures, at least that’s what dominates the top of the holdings.

NLR Holdings (ETFDB.com)

Dominion Energy (D) has a major share of its energy generation coming from nuclear assets, with its VA market being supplied 90% with nuclear energy. Nuclear assets are seeing life extensions here, which is more than can be said for a company like Endesa (OTCPK:ELEZF, OTCPK:ELEZY), which has 50% of its generation from nuclear assets but is in a more tricky regulatory environment. Plans are to phase out nuclear over the next 10 years completely, and the licenses for some of Endesa’s key facilities are running out mid-decade, and won’t be renewed.

Electricite de France (OTCPK:ECIFF) is in a more favorable position, where the French accept their reliance on nuclear energy with worries around EDF’s nuclear position being less pronounced, but still of a concern. Plenty of fund mandates preclude nuclear due to the political risks, and indeed, EDF trades at very low multiples for a utility company partially on account of the cleanup provisions but also because of apprehensiveness around nuclear. Much like the French’s defense policies relying on self-sustainability, so do energy policies, and with more than 70% of France’s energy coming from nuclear, there really shouldn’t be a risk here.

The rest of the portfolio consists of nuclear utility companies with either supportive or relatively unsupportive political backdrops, and as you go down you begin to get more of the uranium commodity exposures with companies like Cameco Corporation (CCJ). But, ultimately much of the portfolio is dominated by utility companies which are going to have their own share of problems. Some depend on spot prices for natural gas in their gas turbines, which is a major negative with gas prices being what they are right now, and others are hamstrung by governments who institute price caps on energy prices for the retail market in order to protect households.

Overall, utilities are not such a fantastic bet on the energy prices because of all of these stabilizers. While nuclear assets have low variable costs and can sustain margins despite input price increases, giving nuclear assets and advantage, the political situations confound their prospects.

Conclusions

There are some advantages with NLR. Trying to get exposure to uranium as a commodity, for example, is costly due to the costs with keeping custody of uranium. Expense ratios for the Sprott Physical Uranium Trust (OTCPK:SRUUF) are quite high at over 1%. NLR only has a 0.68% expense ratio, mainly because it’s not focused on the commodity but utility companies. The dividend is also passable at almost 2%, but again, this is not finding income at the intersect of a strategic uranium play, it is because the holdings are substantially skewed towards utility companies.

Overall, we have the issue with NLR that it is substantially a portfolio of utility companies that are holding all sorts of assets, many renewable and lots nuclear, but also things we don’t necessarily want in such a bifurcated energy environment like gas turbine plants. Moreover, political considerations differ massively between countries. We see no point in taking an ETF approach to something as politically idiosyncratic as nuclear and uranium. We’d rather just invest in the uranium commodity or one producer, where we know the situation with their provisions, closure timelines, and political backdrops to make a rational value decision. We pass on NLR.

[ad_2]

Source links Google News