[ad_1]

Since the launch of the Global X MSCI Nigeria ETF (NGE) in 2014, the fund has declined pretty consistently from $60 to $12.4 today. I want to like the fund. It has extremely low valuations, is in a country with immense long-run growth potential, and typically maintains a U.S. dollar currency peg.

That said, the risks in investing in the fund are high. Nigeria is one of the least developed countries available for ETF investment. The country is prone to large economic swings and is extremely dependent on the price of crude oil. Nigeria is also not known to be politically stable and is struggling to fight terrorism at home. Further, funds have been leaving the ETF at a rapid rate which could cause fund closure.

NGE is best suited for very long-term investors who are willing to weather 50% declines. In my opinion, the economic and financial climate in the country is rapidly improving from its 2016-2017 levels and investors may be in for an upward surprise. It has high long-run growth potential in manufacturing as the country continues to diversify away from crude oil. It is the largest economy in Africa and has a huge population of nearly 200 million people whose income is rising rapidly. While the risks are high, the long-run rewards appear to be higher.

The Global X MSCI Nigeria ETF

The Nigeria ETF is probably the most exotic single country ETF on the market today. It tracks the MSCI Nigeria 25/50 index which is designed to represent the broad Nigerian equity universe and currently has twenty holdings. The largest holdings are Dangote Cement (16.8%), Guaranty Trust Bank (15.5%), and Nestle Nigeria (14%), so the fund is pretty heavily concentrated in a few big names. The average market cap of the holdings is $1B, so overall, these are larger companies for a frontier economy.

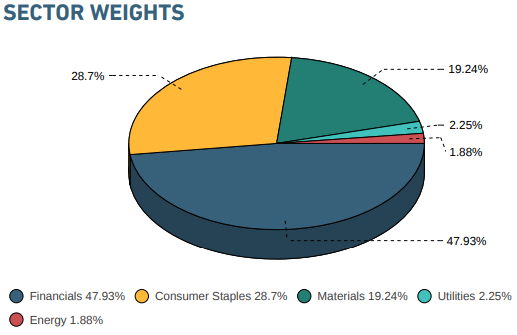

The fund is heavily weighted toward financials with a 48% allocation. Take a look at the index’s current sector composition below:

(Source: MSCI)

Overall, I see the sector weighting as a positive. When I’m analyzing frontier market ETFs like NGE, I want to see low weighting toward sectors with high exposure to the global economy. This usually comes from high allocations toward energy and mining companies that are export-dependent.

Its consumer staples and materials holdings cater primarily to Nigeria and sub-Saharan Africa. The banks in the ETF are subject to Nigeria’s very high 22.5% cash reserve ratio and, after looking at their financial statements, appear to be surprisingly safe. Those banks have also been growing at a fast rate and have benefited from increased financial activity.

On a positive side, the ETF has extremely low valuations with a weighted average P/E ratio of only 4.6X and a weighted average P/B ratio of 0.70X. Usually, this would signal capital problems, but the holdings have a high averaged weighted 15%. Clearly, investors expect a major economic decline in Nigeria or are simply too busy buying bonds to invest or have lost confidence due to poor returns. Take a look at the fund vs. its AUM in recent history:

Data by YCharts

Data by YChartsWhat I see here is a typical sign of speculative over-selling. While ETF prices were declining from 2015 to 2017, the fund saw slow but stable inflows. Once the fund saw an upward performance, foreign investment poured in via the ETF. As prices turned back south, all of that money has been racing to get out.

The question on my mind is, is the country’s macroeconomics so bad that investors require a 4X+ earnings yield premium compared to what they’d find in the developed world.

Improving Economic Backdrop

The core issue in the Nigerian economy is poor investor sentiment. In the 2000s, investors were pouring money into frontier economies like Nigeria’s and got burned following the financial crisis. Since then, capital flows have consistently been poor for most of these economies. Investment is required for industrialization.

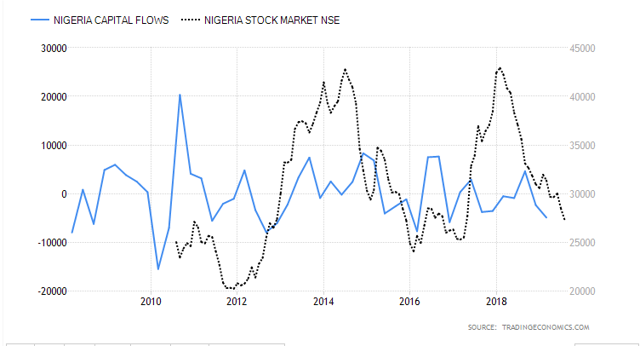

Take a look at the Nigerian stock market vs. capital flows since the last recession:

(Source: Trading Economics)

As you can see, the country’s stock market is tied directly to capital inflows which have been essentially zero over the past decade.

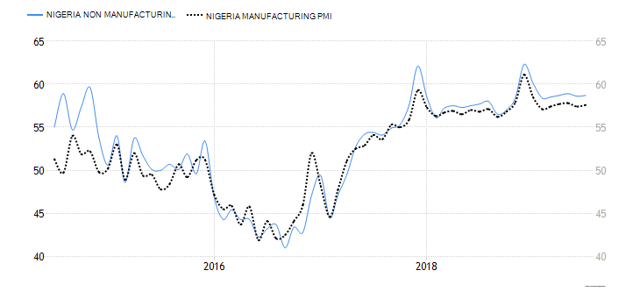

Despite investment weakness, the country’s underlying economy is actually pretty strong. While the rest of the world’s PMI numbers have been declining to or below 50, Nigeria’s is remaining steady:

(Source : Trading Economics)

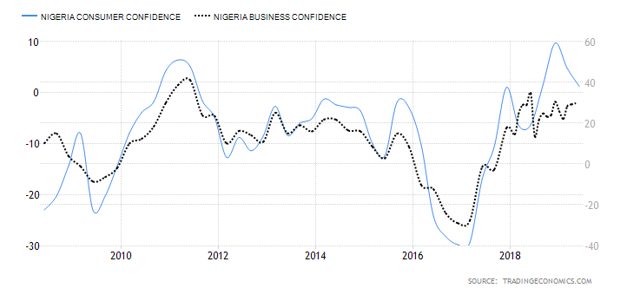

Business confidence and consumer confidence are also very high by historical standards:

(Source: Trading Economics)

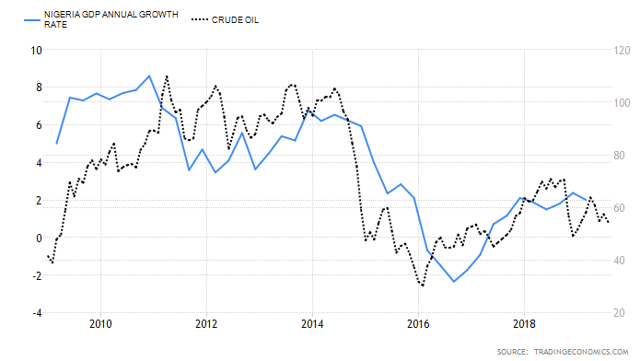

The more I look the more I find indications of higher GDP growth in Nigeria. As seen in the above PMI and confidence data, the country did suffer from a recession from 2016 to 2017 and has since recovered. GDP growth is currently at a low 2% year-on-year growth, but I expect that figure to pick up over the following years as the oil market stabilizes. The country’s GDP growth tends to lag oil prices as shown below:

(Source: Trading Economics)

The crash in oil prices sparked a recession that created a period of financial stability for the country. The Nigerian government briefly lost control of its U.S dollar peg which caused a currency devaluation in 2016 that resulted in a 43% decline in NGE. The government intervened by raising interest rates to stop inflation. This is good as inflation is 11% compared to a 13.5% interest rate which indicates currency risk has fallen.

The Bottom Line

Nigeria is a clear “high-risk, high-reward” investment. The country’s equity market sees 30-50% yearly swings and is prone to high political and economic risk. That said, I believe that risks have been more than priced into the country as seen by its extremely low valuation measures.

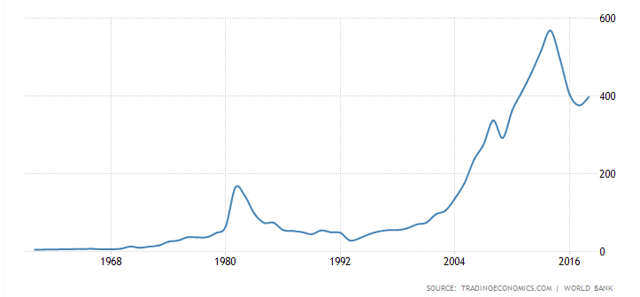

The reality is simple. When investors think of Nigeria, they think of losses in exotic markets in 2008, terrorism, poverty, and corruption. What they don’t see is a rapidly modernizing economy and improving democracy. Just look at the country’s long-run GDP growth trend:

(Source: Trading Economics)

As long as crude oil prices remain above $50, I expect the old steep upward trend to return.

While NGE’s volatility is high, its correlation to other equities is extremely low with a beta to the S&P 500 of only 0.07. This is why I like the fund, in itself, it has a lot of risks but offers accordingly high returns but is also uncorrelated to the U.S. stock market. This way I can be long equities, but without the systemic risk.

It is frankly difficult to calculate the expected return on this ETF because its returns are very extreme and depend on difficult to measure variables. The ETF could probably command a valuation of 7X considering its risks and the companies in the ETF can be expected to grow at their ROE rate of 15%. So, barring another unexpected currency devaluation, I give the fund a rough price target estimate of $20 over the next two years.

The fund is best suited for investors looking to “buy and hold forever”. Nigeria has a high GDP per capita and population growth and could very well become a major global manufacturer. Betting on Africa has been a great difficulty for hundreds of years, but I think most investors are underestimating Sub-Saharan Africa’s potential. As industrializing economies like China come-of-age, East Asia’s manufacturing base will probably leave to Africa and the Middle East.

So, if you’re willing to buy now and hold for twenty or even thirty years, I bet you will beat the S&P 500 by a significant margin. Of course, that is an extremely long investment time frame. In the meantime, I still expect strong performance but would not be surprised by high volatility.

I’ll be waiting to make an investment for this current downtrend to end. The fund appears to be cratering and is seeing higher than usual short interest. This has also pushed AUM down to $30M which makes for high closure risk. Once I see buyers enter the market, which I expect to occur in the next month or two, I will likely make my initial position. Still, with valuations as low as they are, I may just try to catch the knife.

Interested In Closely Following Global Events?

“The Country Club” is a dedicated service that focuses on single-country and regional ETFs with the goal of helping our subscribers diversify globally and get a better grasp on how world events will affect their portfolio. We will certainly be providing subscribers further updates on this idea.

Subscribers receive exclusive ideas, model portfolios, and a wide range of tools including our exclusive “Country Club Dashboard” which allows them to visualize global financial and economic data. If you haven’t already, please consider our 2-week free trial and get your passport to global markets today!

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in NGE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News