[ad_1]

For holders of the Tortoise Energy Independence Fund (NDP), it’s been a hard month, with shares falling by over 16%. In this article, I will dig into the fundamentals underlying the holdings of NDP to explain both why the price of the ETF is falling as well as why it is likely to keep falling in the future.

The Instrument

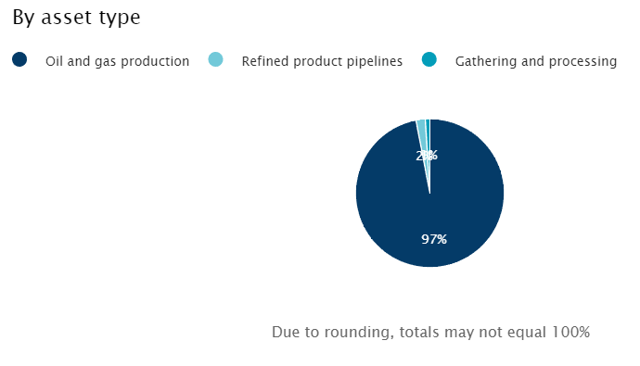

To start this piece, let’s dig into the mechanics of the fund. NDP is an ETF which holds a basket of energy companies, the business of which is largely E&P, as seen in the following chart created by Tortoise Advisers.

A look at the top 10 holdings shows two main things. First, as seen above, this ETF is primarily a play on the exploration and production industry; and second, it is broadly diversified.

Some ETFs weight exposure directly by market cap, which can result in lopsided returns, as one company’s movement explains most of the market action. In NDP’s case, the largest exposure is around 8% and 56 separate companies are held, which means that the fund gives good exposure to the underlying fundamentals of the E&P industry rather than any specific firm. So, without further delay, let’s jump into the fundamentals of energy in North America. If we can understand the fundamental picture and where it is likely headed, we can get a pretty good idea of where NDP is headed in the coming weeks and months.

Natural Gas Fundamentals

In recent weeks, I’ve covered a variety of ETFs which invest in the energy industry, and I typically start my analysis at the top of the barrel and work downwards. In this article, I’d like to take the opposite approach and start with what is perhaps the smallest overall share of the earnings slate for E&Ps in North America: natural gas.

The fact that natural gas is in decline should be of no surprise to investors in the energy industry. Charts abound of natural gas prices at Henry Hub continuing to hit fresh multi-year lows on the news of ever-growing supply.

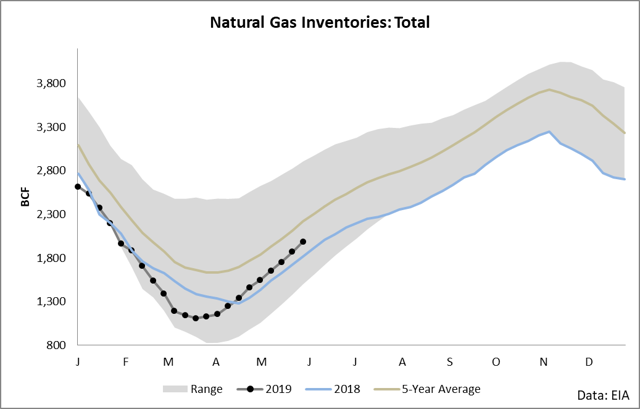

To understand why prices are falling, we simply have to take a look at the inventory balance of gas to see the basic message across North America: we are oversupplied.

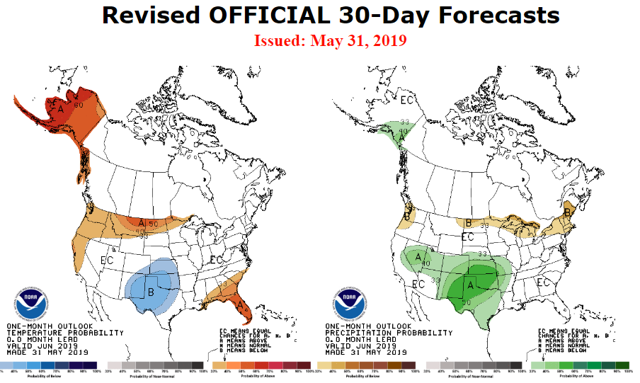

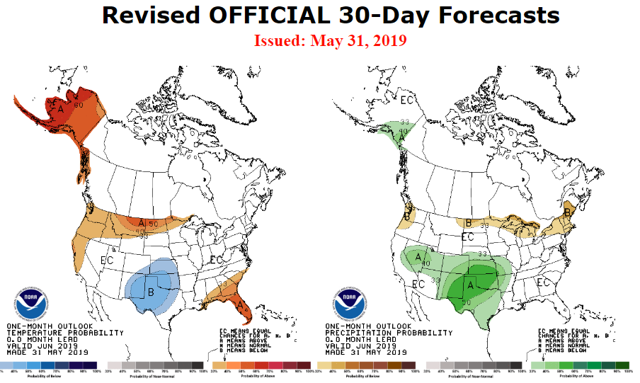

Since the end of winter, there has been an incredible weakness seen in natural gas demand, coupled with continued growing supply. This time of year, the primary source of demand for gas is power generation, and this power generation is dependent on high temperatures. Unfortunately for gas bulls, weather remains subdued, while the CPC is calling for average temperatures across most of the demand centers (Gulf Coast, Northeast, and West Coast) for the next month.

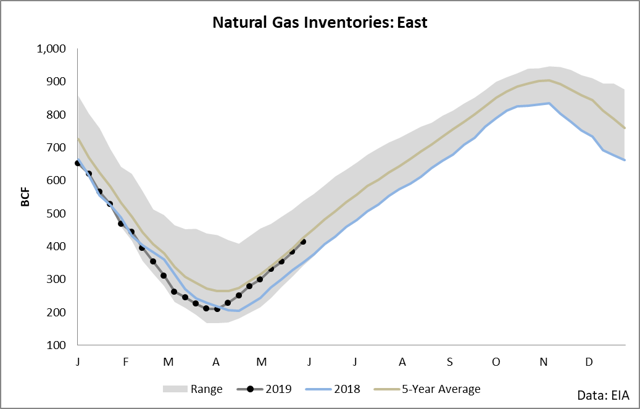

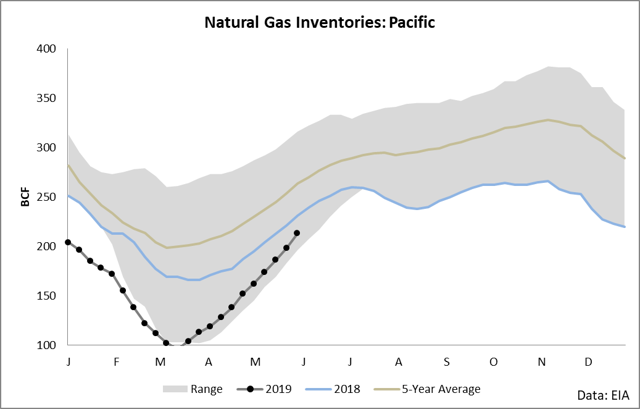

Unfortunately, these regions continue to see elevated stocks, with the east region in particular seeing stocks approaching and about to breech the 5-year average.

Perhaps we will see added demand along the Pacific Coast due to the above-average temperature forecast, but hydro demand could potentially suppress gas burn, since above-average precipitation is expected in the region. However, if you’re bullish gas based on added Pacific demand, know that we are seeing some of the fastest rates of replenishment in many years in overall stocks.

How this relates to NDP is this: the E&P sector is highly exposed to the direct price of the commodities that it produces. The NYMEX Henry Hub contract sets a general benchmark around which a number of regional gas prices trade, and as goes NYMEX, so go a number of different price benchmarks and, therefore, the revenues of the E&P sector and the shares of NDP. Natural gas is undoubtedly bearish in that supply is growing at a rapid clip and power burn is likely to simply average, which means that we will probably see inventories continue to grow and the price of gas stay flat or continue to fall.

Crude and Products

For holders of NDP, the biggest revenue source is crude oil. If you’ve followed along with my recent articles, you’ll see that I’m very bearish crude oil right now. The reasons are pretty simple and straightforward and we will discuss them in a second. Before jumping into the crude fundamentals, however, we need to take a quick look at the refining industry. This is the major source of demand for crude, and if we understand United States refineries, we can understand where demand for crude is likely to go and, therefore, where price is likely to go.

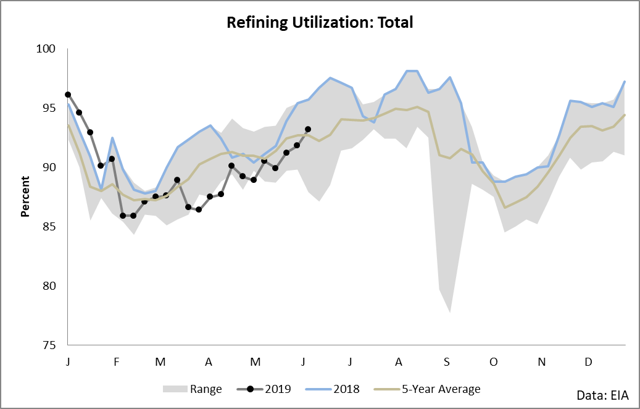

Refining demand has been very weak for the majority of this year, with utilization only recently stepping above the 5-year average.

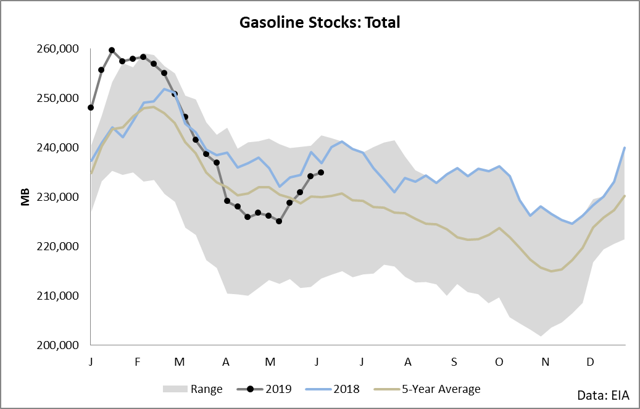

The reason utilization has been tepid this year is that we started the year with an incredibly product overhang through overproduction, which took several months to work off. However, as you can see in the following chart, gasoline inventories are now replenished on the back of a month straight of strong builds, and we are approaching the territory of oversupply once again.

This said, the refining sector will likely not see too strong demand going forward. The reasoning is pretty simple – if you overproduce in a market which is already oversupplied, your margins collapse. It is true that we are entering driving season, but we are doing so from a place of weakness in which stocks are already above the 5-year average. For this reason, I’m bearish demand for crude oil: the market just doesn’t need an above-average level of production.

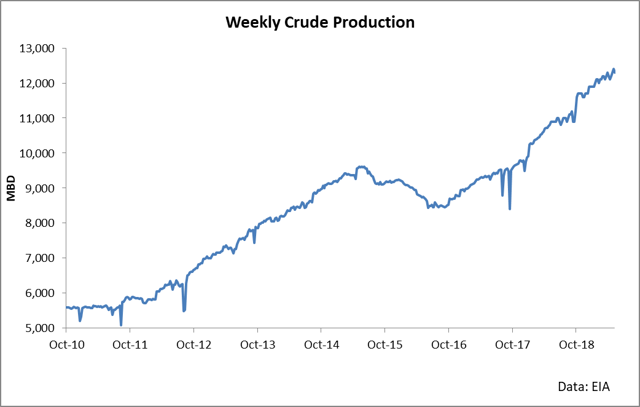

On the supply side, a simple chart of production almost tells the entire story:

Production has basically doubled in 8 years, and the EIA is expecting production to continue in an unabated climb for at least the next several years, according to the Annual Energy Outlook. This is bearish for crude oil when you factor in the high possibility of continued weak refining demand, as this will push crude into inventory and result in a lower price of crude.

It’s a bad trade

Holding NDP is a bad trade at this point, due to the simple fact that the fundamentals of both crude and natural gas are bearish. NDP earns most of its revenues through companies which have earnings directly tied to the price of crude and natural gas, and each of these commodities is fundamentally bearish. Until the supply and demand equation reverses, NDP is likely to continue to fall.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News