[ad_1]

peterschreiber.media/iStock via Getty Images

According to SmartGrid.gov, the electric grid started being built in the 1890s and over the years was improved upon as technology evolved. Today, more than 9,200 electric generating units with more than 1 million MW of generating capacity are connected to 300,000+ miles of transmission lines. Much of that expansion was done on a regional and patchwork basis. Today, the electric grid is being stretched to capacity not only by its historical patchwork nature, but by the transition to intermittent renewable power generation as well as increased electricity demand from EVs as well as demand growth driven by increases in population, industry demand, and increased use of electronics as a result of the digital transformation. Going forward, a new kind of electric grid (i.e., a “smart-grid”) is needed: one that is built to support renewable power generation, increased demand as a result of EVs, and that can automate & manage the increasing complexity of generating and delivering electricity in the 21st Century. That’s where the First Trust Clean-Edge Smart Grid ETF (NASDAQ:GRID) comes in.

Investment Thesis

A 21st Century “smart-grid” needs to enable:

- Efficient transmission of electricity

- Quick restoration of electricity after power disturbances

- Reduce costs for utility companies & lower power costs for consumers

- Integration of large-scale renewable energy systems

- Integration of bi-directional consumer-owner renewable power generation systems

- Higher capacity to support increased use of EVs and electronics

- Improved security

All of these requirements will lead to increased demand for all the electrical components that will actually make the smart-grid a reality. These include common but oft-overlooked widgets such as transformers, relays, fuses, circuit-breakers, switches, and power quality monitoring and metering devices – just to name a few. These are exactly the components supplied by the companies owned in the GRID ETF.

And remember, this is not a U.S. infrastructure issue. On a per-capita basis, the US still significantly lags both China & the EU in terms of EV adoption. That being the case, significant domestic spending will be required if the EV market share grows to anywhere near the 50% of new vehicle sales expected by 2030. Also, note most of the companies held in the GRID ETF portfolio have strong ESG policies because they fully align with the solutions they deliver as well as that fact that global adoption of strong ESG policies to help mitigate the worst impacts of global warming would lead to strong growth for most of these companies.

So, let’s take a closer look at the fund and see if it might make sense for you to allocate some capital to it.

Top-10 Holdings

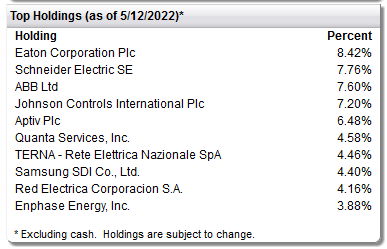

The top-10 holdings in the GRID ETF are shown below and equate to what I consider to be a relatively concentrated ~59% of the entire portfolio:

First Trust

I have no problem with such a high-concentration because investors still get excellent diversity across the sector, but let’s face it: the electrical utility component supplier sector is dominated by a handful of companies, and this funds owns all the big ones.

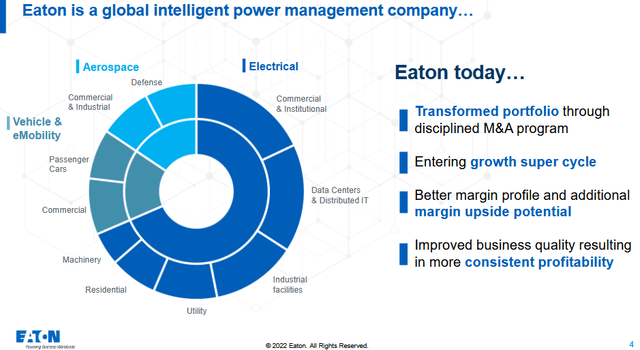

Take #1 holding Eaton (ETN) in which the fund has an 8.4% allocation. Eaton is headquartered in Dublin, Ireland and is a global leader in power management. The company’s Electrical Americas & Electrical Global segment makes electrical & utility-scale power distribution components, residential products, wiring devices, circuit protection products, power reliability equipment, emergency lighting, fire detection, explosion-proof instrumentation, and structural support systems. ETN also operates an Aerospace segment as well as an eMobility segment (see graphic below). The eMobility segment manufactures a plethora of components for the auto & EV sector: voltage inverters and converters, fuses, chargers, circuit protectors, vehicle controls, power distribution systems, fuel tank isolation valves, and commercial vehicle hybrid systems.

Eaton

ETN currently trades with a forward P/E of 18.8x and yields 2.3%.

Schneider Electric (OTCPK:SBGSF) is the #2 holding with a 7.8% weight. Schneider yields 2.6% and has a TTM PE of 20.8x. Seeking Alpha contributor Stephen Simpson thinks the recent pullback in Schneider’s stock is an opportunity for investors (see Schneider Electric Stock Skids As Investors Dim Light On Electrification, Automation).

Schneider operates two segments: Energy Management & Industrial Automation. The company is a leading global provider of circuit breakers and switches, protection relays, electrical protection and control products, energy management software solutions, transfer switches, surge protection and power conditioning products. The company also provides power monitoring and control products, power quality and power factor correction products, push-button switches, switchboards and rack-mounted electrical panel enclosures.

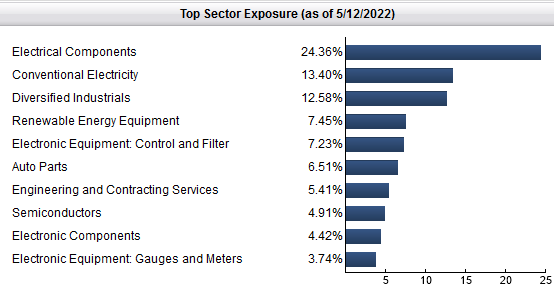

The #3 and #4 holdings – ABB (ABB) and Johnson Controls (JCI) – are similar to the first holdings in that they are leading global providers of electrical components and systems. From my perspective, the top-4 holdings in the GRID fund are the dominant global companies operating in the utility-scale electrical component sector. Not surprisingly given GRID’s top-4 holdings, the entire portfolio composition is skewed to the electrical component manufacturers:

First Trust

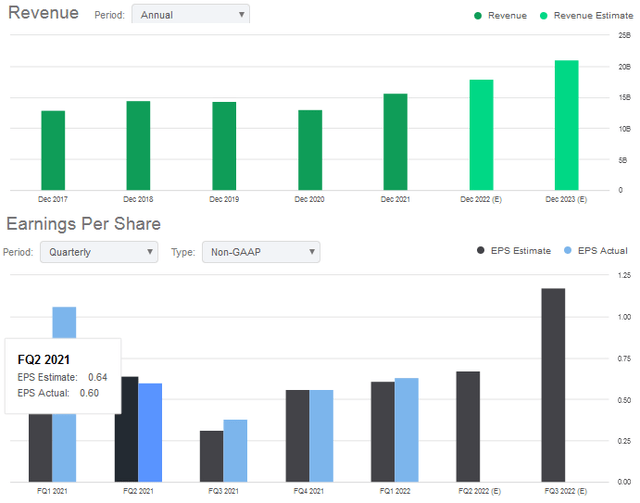

The #5 holding, Aptiv (APTV) has a 6.5% allocation and is a bit different as compared to the top-4 holdings. Aptiv focuses on components and safety technology solutions for the automotive and commercial vehicle markets. It operates in two segments: Signal & Power Solutions, and the Advanced Safety & User Experience segment. Aptiv is expected to show a significant improvement in earnings this year:

Seeking Alpha

The #10 holding with a 3.9% weight is Enphase Energy (ENPH). Enphase designs home energy solutions for the global solar photovoltaic market. The company’s claim-to-fame is its semiconductor-based microinverter. The microinverter converts energy at the individual solar module level to useful electricity at the home and utility level. ENPH’s also provides proprietary networking & software technologies for energy cloud-based monitoring and control services. Enphase also offers battery storage systems.

Performance

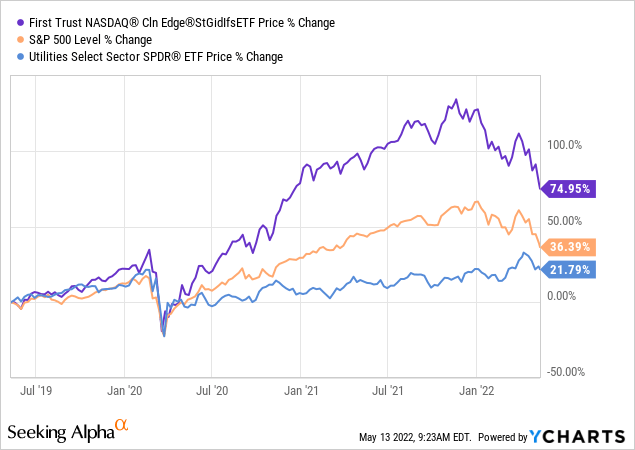

As mentioned in the bullets, GRID has under-performed the S&P500 over the past 12-months, but has significantly outperformed the S&P500 over the past 3-years:

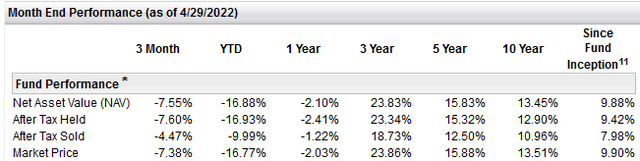

As can be seen in the graphic above, the GRID ETF has also significantly outperformed the Utilities Select Sector SPDR ETF (XLU). On a longer-term basis, the GRID ETF has a solid 10-year average annual return of 13.45%:

First Trust

Risks

The GRID ETF could be affected by all the normal macro-environment risks of the day including high inflation, prospects for higher interest rates, COVID-19 lock-downs in China leading to lower global economic growth and supply-chain disruption, Putin’s horrific war-of-choice in Ukraine and the resulting sanctions placed on Russia by the U.S. and its Democratic free allies. Any of these risks by themselves could lead to lower economic growth, while together could lead to a global recession (or worse).

The GRID ETF has a high expense ratio of 0.63%. That’s fine when the fund was an out-performer, but such a large expense ratio could take a big bite out of investor returns in a slower global growth scenario.

Meantime, and despite the relatively attractive yields of some of the top holdings, the overall fund delivered income of only 0.88% over the past year (ending 4/29/2022). The takeaway here is that the primary investment opportunity of GRID is not income – it’s capital appreciation.

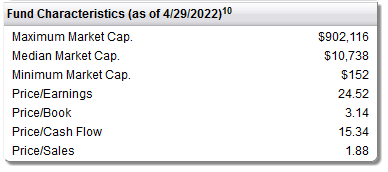

On the other hand, GRID could be considered a relative value compared to the broad market:

First Trust

GRID’s price-to-book ratio of 3.1x compares very favorably to the S&P 500’s 4.0x.

Summary & Conclusion

While I like the investment thesis behind the GRID ETF’s fundamental outlook, the relatively high expense ratio concerns me given the risks of the current investment macro-environment. That being the case, I will rate GRID a HOLD. However, as I mentioned in my recent article on portfolio management in volatile times (See “The Four Horseman”), I would try to take advantage of market volatility to, perhaps, pick up the GRID ETF “on sale”. Regardless, given the day-to-day gyrations of the current market, I wouldn’t go “all in” at once, but rather scale in over time in order to make sure you don’t miss a better opportunity if the market were to go lower still.

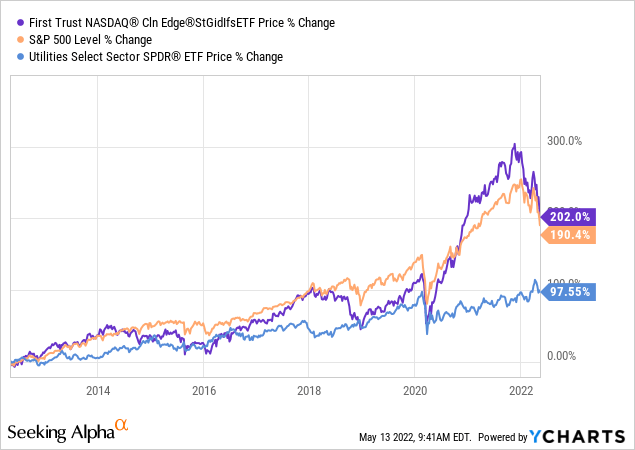

I’ll end with a 10-year chart of the GRID ETF versus the S&P 500 and the XLU utility ETF:

[ad_2]

Source links Google News