[ad_1]

kmatija

Yesterday near the close of the session, the White House announced pardons that will impact roughly 6,500 people who have been incarcerated for marijuana possession:

Biden pardoned all those convicted of all prior federal offenses of simple possession of marijuana and ordered U.S. regulators to review how the drug is classified.

The response in the stock market was intense with US-based cannabis companies seeing massive volume spikes, trading halts, and gains of 30% or more spread out across the sector. The AdvisorShares Pure US Cannabis ETF (NYSEARCA:MSOS) was a huge winner on the day with 30.2% move higher to close out the Thursday session.

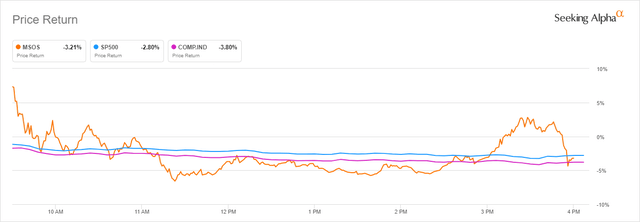

MSOS vs Indexes (Seeking Alpha)

Despite an initial selloff Friday morning in response to the jobs report, MSOS was able to regain traction in the afternoon before aggressively selling off in the final 15 minutes – likely as a result of profit taking from shorter term traders. Friday’s MSOS close was roughly in line with the Nasdaq and the S&P 500 which closed off 3.8% and 2.8% to end the session. Despite the end of day decline in the final quarter hour, I think there is a compelling technical setup for MSOS going forward now that we’ve had a fundamental catalyst.

Pot stocks have contributed to the burning of more than just leaves

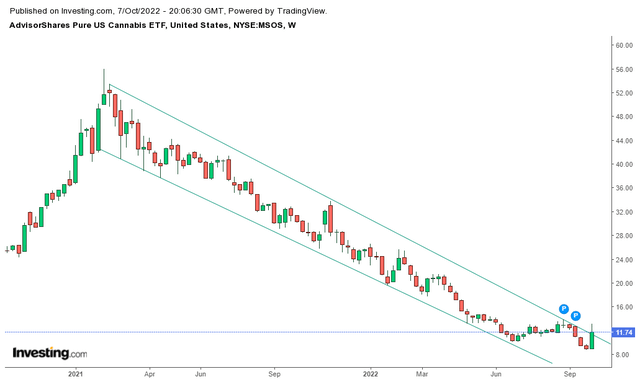

Betting on pot over the last year and half as been a good way to set your capital on fire. I know this from experience as I started buying MSOS in the $20s. Domestic cannabis companies enjoyed a really strong 2020 when just about every risk asset was going gangbusters. However, unlike most of the broad stock market which topped out in Q4 of last year, pot stocks peaked in February of 2021. Since the $55 top in MSOS, the ETF and just about all of the top names in the fund have traded down in a painfully organized channel:

investing.com

Depending on where you want to draw the lines, you could argue the pop in share price this week actually created a breakout close on the long term declining channel. While I think this chart is potentially foreshadowing a move higher if the broad market cooperates, I think the daily chart gives some insight into where resistance levels may be:

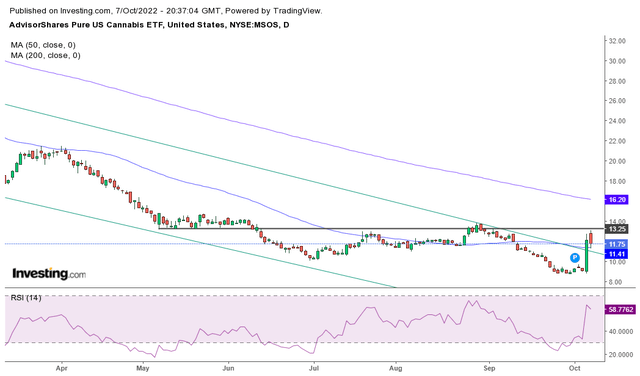

investing.com

Utilizing that same trend line as our diagonal resistance, we can see that MSOS did break-out and pull back without closing back below it. The ETF was also able to maintain a close above its 50 day moving average of $11.41. If the shares can take out key resistance at $13.25 next week, I think bulls have a shot at the 200 day moving average. That figure currently stands at $16.50. This is purely the trading view. From a fundamental perspective, MSOS is equally interesting to me.

Fund Details & Top Holdings

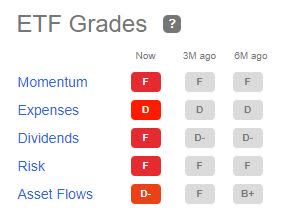

MSOS has a 0.72% expense ratio and a 0.58% dividend yield. For an actively managed fund I wouldn’t say it’s a terribly expensive ETF from where I sit but it does have poor grades from Seeking Alpha with an expense ratio grade of “D” and a dividend grade of “F.” The objective of the fund is to give the investor exposure to US-based multi-state operating marijuana producers. Seeking Alpha’s grades of the ETF are pretty awful:

Seeking Alpha

As mentioned above, expense and dividend grades are poor. We can also see both risk and momentum get “F” grades. Given the Schedule 1 classification of cannabis, this is a risky area to invest and that is obviously well reflected in the graphic above and from the fund’s summary prospectus:

Although the medical use of marijuana is legal in more than half of the states, as well as the District of Columbia, and non-medical use of marijuana is legal in an increasing number of states and the District of Columbia, the possession and use of marijuana remains illegal under U.S. federal law

The bold above is my emphasis. We’ve also seen the problem with momentum play out over the last year and half and that F grade there is well deserved. The fund does have a fairly high concentration to its top 10 holdings at 90%.

Source: AdvisorShares

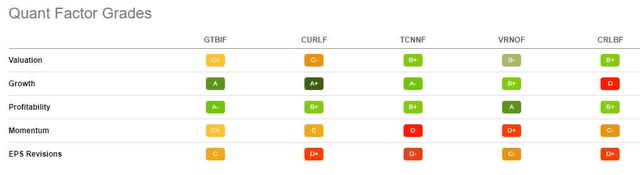

Furthermore, the top 5 holdings account for 73% of the fund’s total allocation. If we look at the Quant Factor grades for those companies, we can actually see a much better picture than if we just look at the ETF grades:

Seeking Alpha

Every single one of these companies has a profitability grade of “B+” or better and 3 of the 5 have a least an “A-” in growth. The momentum grades in the actual fund holdings aren’t as negative as the fund itself and 3 of the 5 companies have positive valuation grades. Given these scores, I think the fundamental setup in the fund is actually fairly attractive.

Risks

Obviously there are several risks. Cannabis is still illegal federally in the United States and this is an ETF made up of United States companies that produce cannabis. Read that line again if you need to. This ETF will probably have a ceiling until there is more drastic change to the way the federal government treats marijuana. That said, we saw a really good sign this week. Additionally, because of the nature of these businesses, the stocks are all traded over the counter. That creates potential liquidity concerns in the underlying assets. As far as risk potential in the market goes, this one is right up there.

Summary

But there are signs of life on the chart. For the second consecutive day, Friday’s share volume was better than 10 times the previous daily volume average. If we see a move by congress to pass SAFE banking, I think this ETF is going to run hard. MSOS is down about 85% from its all-time high. These pot stocks have been largely left for dead by retail investors and the institutional money can’t come in until there are changes to the laws. Those law changes seem to have started. You could argue for buying the individual names over the ETF with this level of concentration, but I’m not an expert in pot producers. I just know I want exposure to the idea. I bought more MSOS today.

[ad_2]

Source links Google News