[ad_1]

The Global X MLP and Energy Infrastructure ETF (MLPX) gives investors exposure to the midstream universe, including master limited partnerships and C-Corporations. That’s in contrast to some of the industry’s leading funds which only concentrate on master limited partnerships. The ETF should do well in the future since its holdings are operating in a favorable business environment and have been building a number of energy infrastructure projects which will fuel their earnings growth. The Global X MLP and Energy Infrastructure ETF offers one of the highest dividend yields and charges one of the lowest fees as compared to similar funds. I think this is a great ETF for those investors who want to gain access to some of the biggest midstream MLPs and companies.

Image courtesy of Pixabay

In my previous article, I’ve talked about those ETFs, such as the ALPS Alerian MLP ETF (AMLP) and its alternative the Global X MLP ETF (MLPA) which invest exclusively in master limited partnerships and give investors exposure to the energy infrastructure industry. These ETFs come with a high dividend yield of more than 8% and give investors an easy way to invest in around 20-24 of the largest energy infrastructure MLPs. However, one drawback of these MLP ETFs is that they focus only on MLPs and ignore the important players of North America’s midstream universe who are registered as c-corporations. However, the Global X MLP and Energy Infrastructure ETF invests in MLPs as well as midstream companies.

The Global X MLP and Energy Infrastructure ETF, or MLPX, is ideal for those investors who are looking to gain broad exposure to the entire midstream energy space of North America, not just MLPs. Remember, some of the biggest operators of pipeline and other infrastructure are registered as midstream companies, not MLPs.

For instance, the Calgary, Canada-based TC Energy Corp. (TRP), formerly known as TransCanada, is one of the biggest midstream entities in North America with a vast asset base that spreads from Calgary to New York. TC Energy, which is valued at $46 billion, is alone responsible for supplying more than a quarter of the natural gas that is consumed across North America by homeowners, industries, and utilities. It is one of the biggest players in North America’s midstream industry yet you wouldn’t find it in any MLP-focused ETF. Similarly, Kinder Morgan (KMI), which is a Houston, Texas-based behemoth that operates the largest network of natural gas pipelines in North America, is also registered as a C-Corporation and therefore can’t get any representation in an MLP ETF. But these midstream companies and others like it are some of MLPX’s top holdings.

Image: Author

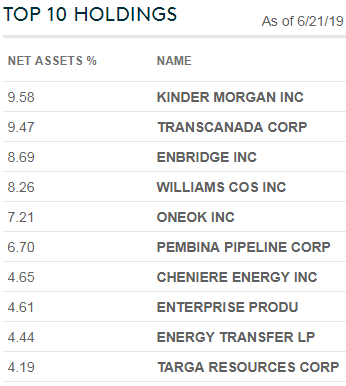

MLPX follows the Solactive MLP & Energy Infrastructure Index. Its top-three holdings are three of the largest midstream companies – TC Energy, Kinder Morgan, and Enbridge (ENB). Enterprise Products (EPD) and Energy Transfer (ET), which are two of the largest MLPs, are MLPX’s eighth and ninth largest holdings. Overall, around 59% of the ETF’s assets are allocated towards C-Corporations, 22% towards MLPs, and the remainder goes to the general partner or other affiliates of MLPs. In total, MLPX follows 34 midstream companies and MLPs which make its portfolio significantly more diversified than most MLP ETFs which track up to 24 firms.

What I also like about MLPX is that it does a smart job of giving investors exposure to a number of MLPs even though, like a traditional ETF and unlike the MLP-focused funds, it is registered under the Investment Company Act of 1940 and can’t put more than 25% of its assets in MLPs. However, it indirectly gains access to the MLPs by investing in their general partners or other related midstream corporations. For instance, instead of investing in the MLP Cheniere Energy Partners (CQP) which owns and operates an LNG export terminal, MLPX invests mainly in its holding company Cheniere Energy Inc. (LNG) which is a C-Corporation and the seventh largest holding of the ETF.

MLPX has $821.89 million of assets under management which means that in terms of size, it is a middle-of-the-pack fund. Although it is substantially smaller than the industry’s benchmark fund AMLP, which has $8.59 billion of assets under management or MLPA which manages $908.4 million, MLPX is considerably bigger than other ETFs like the Alerian Energy Infrastructure ETF (ENFR) and the VanEck Vectors High Income MLP ETF (YMLP) with $65 million and $40 million of assets respectively.

MLPX Top-10 Holdings. Image: Global X Funds.

MLPX is well-positioned to benefit from the healthy business environment marked by growing levels of oil and gas production and declining interest rates. The oil and gas production from the US and Canada continues to climb. The US oil production from the Permian Basin, which is the most prolific shale oil play in the US, will climb to 4.23 million bpd in July, up from 3.45 million bpd in the same period last year, as per data from the US Energy Information Administration. At the same time, the natural gas production from the Appalachia region, which is the largest gas-producing region in the US, will increase to 32.4 billion cf per day in July from 27.98 billion cf per day a year earlier.

MLPX’s holdings who build and operate the energy infrastructure which is needed to transport and process hydrocarbons will profit from the growing energy output. Note that more than 68% of MLPX’s holdings are involved in the storage and transportation of natural gas and liquids. Companies such as TC Energy and Kinder Morgan, which are MLPX’s biggest holdings and have a large footprint in the key shale oil and gas-producing regions, will be some of the biggest beneficiaries. These companies will also further capitalize on growing production by bringing new projects online in the near term. For instance, TC Energy has a large development pipeline of C$30 billion of growth projects which will come online through 2023. These projects which are currently under construction will play a major role in fueling earnings and cash flow growth of these companies.

Meanwhile, the US Federal Reserve has turned dovish this year and now seems prepared to cut interest rates by up to half a percentage point in the near term. The 10-year bond yields have already fallen by 65 basis points this year. That’s increased the appeal of dividend-paying sectors like MLPs and midstream companies.

Since MLPX has midstream corporations as its top holdings which are typically lower-yielding entities than MLPs, the ETF’s dividend yield of 5.33% is much lower than 8% or higher yields offered by MLP-focused funds such as MLPA and AMLP. Therefore, the ETF may not look great from a yield perspective but it will still appeal to those investors who want broad exposure to the midstream universe while still getting an above-average yield.

Note that although MLPX offers a lower yield when compared against MLP-focused funds, it looks much better when put against similar ETFs which also have a diversified portfolio of midstream companies and MLPs. The Alerian Energy Infrastructure ETF, First Trust North American Energy Infrastructure Fund (EMLP), and the Tortoise North American Pipeline (TPYP) hold midstream companies as well as MLPs in their portfolio but they offer lower 12-month yields of 5.22%, 4.04%, and 3.89% respectively. MLPX also offers a higher yield than what investors will get with other dividend-paying sectors, such as REITs and utilities where average yields are 3.59% and 3.27% respectively.

What I also like about MLPX is that it is one of the cheapest funds around with an expense ratio of just 0.45%. This means that the fund charges $45 each year on every $10,000 of investment. That expense ratio is identical to MLPA’s ratio but lower than AMLP’s 0.85%, ENFR’s 0.65%, and EMLP’s 0.95%.

For these reasons, I believe MLPX is a great fund for investors to consider. It has delivered a solid performance this year, with shares rising by 17.4%, easily outperforming its higher-yielding peers MLPA and AMLP who posted gains of 13.7% and 11.6% respectively in the corresponding period. I believe MLPX will likely continue doing well in the future as it benefits from a positive macro backdrop and the strength of its underlying companies.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News