[ad_1]

Introduction

In this regular note, we provide a discussion on the degree of fundamental tightness/looseness across the industrial metals, with a special focus on copper, zinc, and aluminium, in order to formulate a clear view on the Invesco DB Base Metals Fund (DBB).

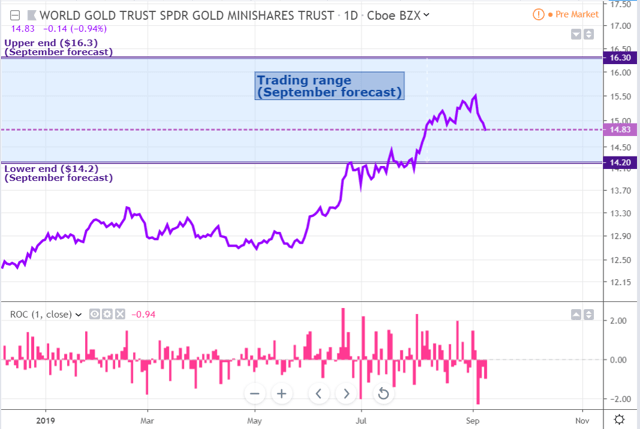

DBB, which includes principally copper, aluminium, and zinc, has rebounded well since we published our previous Metals Update (August 19).

While DBB is still below our near-term target of $16.00 per share, we believe that the recent rebound will continue by year-end, as positioning shifts gradually from extremely bearish due to a change in focus from the macro to the micro.

As September tends to be a busier season for metals consumption after the slow summer months, positivity in the physical market could intensify the re-positioning across the base metals space.

Looking ahead, we see a further 5% appreciation in DBB over the next month or so.

Source: Trading View, Orchid Research

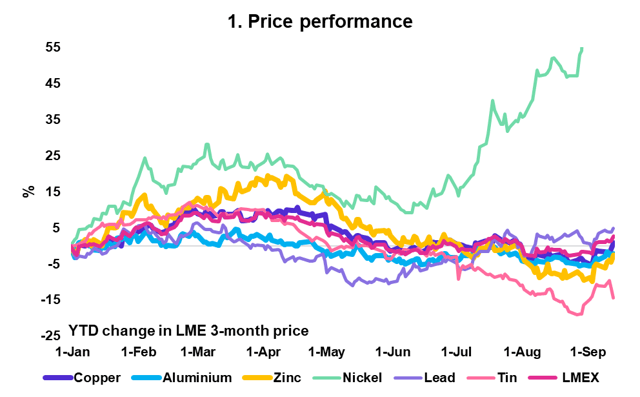

Price performance

Source: Bloomberg, Orchid Research

DBB’s metals have enjoyed a sharp rebound on the LME, with zinc, copper, and aluminium up 8%, 6%, and 3%, respectively. This comes after intense weakness in August.

On the macro front, the rebound has been driven by 1) more optimism over US-China trade relations after a friendlier rhetoric from both sides and 2) more policy easing from China. This has therefore prompted investors to reassert upside exposure to the base metals, after an extremely weak performance in H1 2019.

Macro dynamics have turned slightly bullish for DBB.

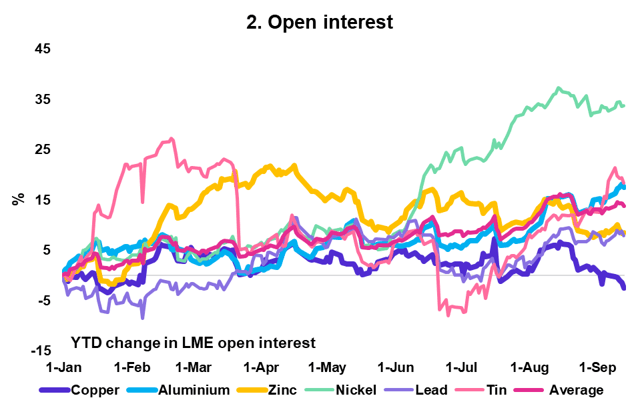

Open interest

Source: Bloomberg, Orchid Research

The open interest has decreased in copper so far in September, suggesting that the strength is driven by short-covering. The lack of fresh buying points to a fragile sentiment.

But the open interest has increased in LME aluminium and LME zinc, suggesting that the rebound in both aluminium and zinc has been primarily supported by fresh buying. The implementation of outright long positions reflects a bullish sentiment.

On net, the fluctuations in open interest in DBB’s metals has been moderately bullish for DBB.

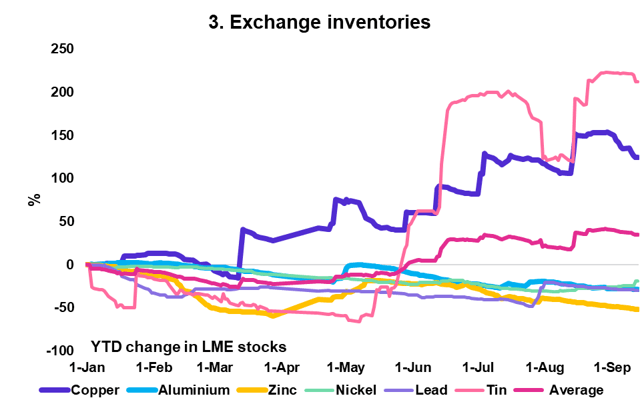

Exchange inventories

Source: Bloomberg, Orchid Research

DBB’s metals have seen their respective LME inventory decline so far this month, especially for copper (-12% MTD) and zinc (-7% MTD), while LME aluminium stocks have only declined on the margin (-1% MTD).

The overall drawdown of exchange inventories points to tighter fundamental dynamics, which are in our view supported by stronger seasonal demand since the start of the month.

LME metal outflows, if sustained, should continue to support DBB.

The recent fluctuations in exchange inventories for DBB’s metals are bullish for DBB.

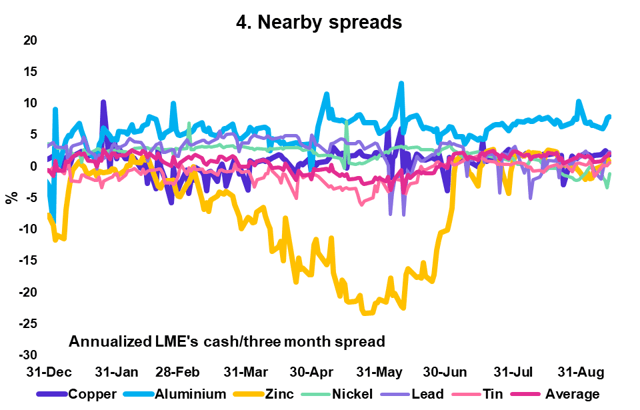

Nearby spreads

Source: Bloomberg, Orchid Research

Nearby spreads in LME copper, LME aluminium, and LME zinc have been quite noisy since the start of the month, with some tightening at the front end of the LME aluminium curve.

On net, the recent changes in nearby spreads so far this month are neutral for DBB.

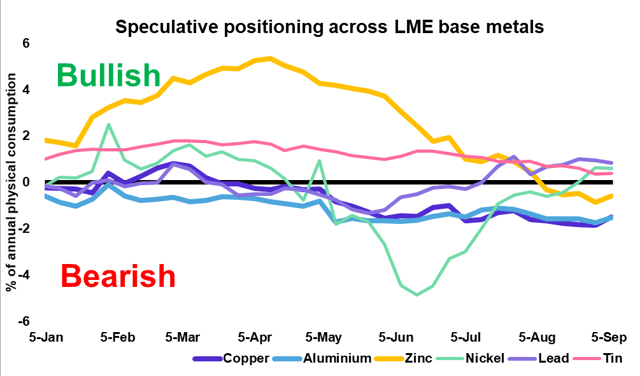

Spec positioning

Source: Bloomberg, Orchid Research

We have seen some short-covering since the start of the month across the board, including for DBB’s metals.

Still, there is plenty of room for additional speculative buying in the coming months considering the overall net short positioning across the LME base metals space.

The recent bout of short-covering across DBB’s metals is bullish for DBB.

Conclusion

In line with our expectations, DBB has rebounded well since our previous update. Our fundamental indicators are overall bullish, pointing to further strength in the immediate term.

While a continuation of macro positivity could intensify the recent wave of short-covering, it is important to note that fundamental dynamics are also getting stronger and act as a meaningfully positive tailwind for base metals prices.

Against this, we expect a further 5% appreciation in DBB over the next month or so, retaining our near-term target of $16.00 per share.

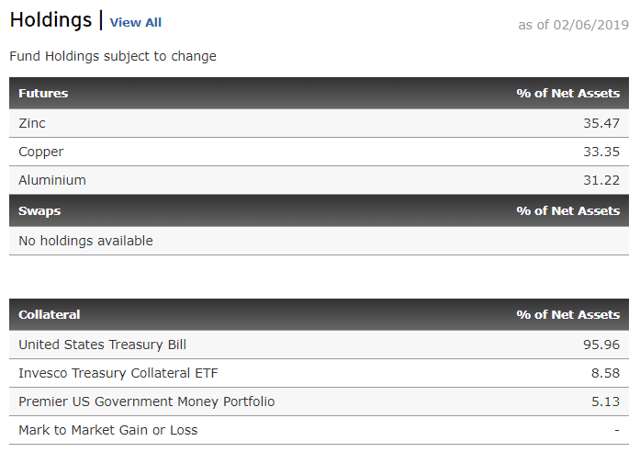

About Invesco DB Base Metals Fund (DBB)

Invesco DB Base Metals Fund allows investors to assert exposure to some of the LME base metals.

The composition of the Fund is as follows:

DBB’s assets under management total $150 million, with an average daily volume of $1.18 million and average spread (over the past 60 days) of 0.10%.

Its expense ratio is 0.80%, which makes it a relatively cheap ETF to get an exposure to the industrial metals complex.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Our research has not been prepared in accordance with the legal requirements designed to promote the independence of investment research. Therefore, this material cannot be considered as investment research, a research recommendation, nor a personal recommendation or advice, for regulatory purposes.

[ad_2]

Source link Google News