[ad_1]

Whenever volatility ETPs are being discussed, the vast majority of the time it’s the VXX, UVXY, SVXY, even TVIX. And of course in the past a lot of the focus was on our fallen hero the XIV, before its unfortunate termination in February 2018.

But how often do you hear people talk about ZIV?

Not often, right? In fact, I think I personally do a fair bit of the heavy lifting when it comes to spreading the word about ZIV. Very few volatility strategists out there have ZIV-specific strategies, and most of them don’t even mention it in any of their articles. As someone who’s been trading volatility ETPs since they launched nearly 10 years ago, would it surprise you to hear that the ZIV is my favourite product? I have nothing against VXX and UVXY, I trade those very often as well, but in my humble opinion ZIV is in a class by itself.

What makes ZIV different?

All the other popular volatility ETPs that I mentioned above (VXX, SVXY, UVXY, TVIX, and the old XIV) are products that derive their price based on a composition of 1st and 2nd month VIX futures contracts, also known as M1 & M2 VIX futures (or VX1 & VX2). If you’re not familiar with those, I suggest you start with my full explanation article here.

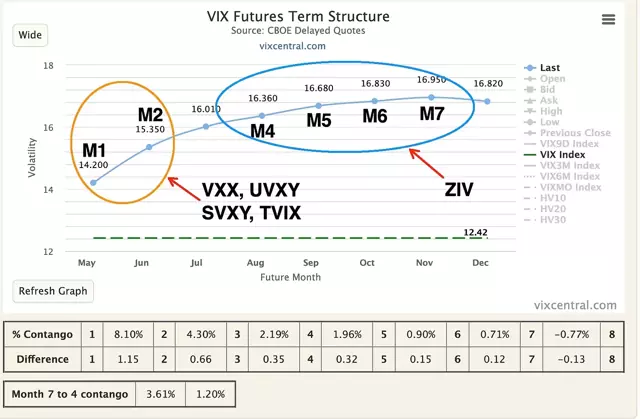

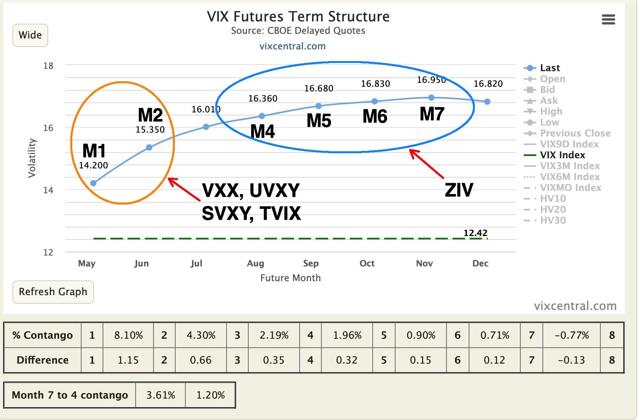

Now the ZIV also derives its price based on a composition of VIX futures, but what makes it unique (and potentially superior) is that the VIX futures used are actually the 4th-7th month futures, or M4-M7. Let’s check out an example taken from vixcentral.com

An example of the VIX futures term structure from April 22, 2019:

So you can see the ZIV is the loner of the group, focusing on the 4th-7th month of the VIX futures for its calculation. The reason this matters is because the slope of the VIX futures curve is typically flatter further out in time at M4-M7 compared to the front end of the curve at M1:M2.

Based on the method the product derives its price, this means in the long-run the daily fluctuations of ZIV are normally smaller than the other products.

It tends to go up less on good days, and go down less on bad days. If you follow my work, you already know why this is a game changer. Remember the profound quote from that very famous volatility strategist:

Losses are more costly to a fund than gains are beneficial” – Brent Osachoff

Joking of course, I’m not famous, but my point is that by far the most important aspect of successful long-term investing is limiting losses and reducing drawdowns. The ZIV has that built into its methodology. It’s a safer product by very design, and that my friends is why it is in my opinion the best product on the market.

- It gives the potential for explosive growth if traded correctly

- It has risk management built right into it.

Why drawdown reduction is important:

There are many reasons why investors would be wise to focus on drawdown reduction, but perhaps one of the easiest to understand is just the mathematical truth of large drawdowns being far more costly in the long run. Below is a chart showing the rate of return required to recover from a drawdown:

Notice how the subsequent rate of return required to break even is exponentially larger with larger drawdowns.

- A 20% drawdown, for example, only requires a 25% gain to break even, fairly manageable in a bull market.

- A 50% drawdown, however, is more problematic, requiring a subsequent 100% gain just to break even. This is why it took many investors several years to recover from the financial crisis in 2008/09.

- A 90% drawdown may be catastrophic, requiring a 900% rate of return afterwards just to break even.

Now that may sound absurd, a 90% drawdown, but let’s not forget we are talking about inverse volatility ETPs which can (and as it turns out do) suffer extreme drawdowns from time to time.

February 5th, 2018

Remember Volmageddon? Volpocalypse? Volnado? I’m talking about that fateful day on February 5th, 2018, that saw the largest VIX index spike since October 1987, up 115.6% in a single day. No surprise a volatility event like that had terrible consequences for inverse volatility ETPs. However, not all short volatility ETPs are created equal. Here’s the performance of three of the main ones from Feb. 2, 2018 – Feb. 6, 2018:

XIV: -93.64%

SVXY: -88.41%

ZIV: -19.80%

Now while a -19.80% decline in 2 days isn’t exactly a picnic, ZIV clearly weathered the storm far better than the front month M1:M2 products XIV and SVXY did. So well in fact, it may give ZIV a leg up in the performance department for many years to come.

XIV vs. ZIV from Nov. 30, 2010 – Feb. 15, 2018:

You can see in the chart, every time there was a major drawdown in the XIV, the ZIV overtook it in performance. In 2011, the ZIV overtook the XIV during the European debt crisis. In 2014, it caught up and passed XIV. In 2015 as well it was above during that extended S&P 500 crash. And again after the February 2018 crash, the ZIV just keeps plugging along.

A little warning about risk: All volatility ETPs carry risk and should only be traded by experienced investors, and that does include ZIV. Also, buy and hold is not advisable on any of these volatility ETPs. Having said that, the ZIV has clearly performed much better during all the major drawdowns in the last 10 years and overall may be a safer product.

Why is the ZIV more consistent?

The pricing mechanism with these volatility ETPs is beyond the scope of this introductory article, but in general the more time the VIX futures spend in stable periods, that may lead to better performance in the vol ETPs.

M4 – M7 VIX futures spend more time in contango than M1:M2, and the price fluctuations when there is a short term scare in the broad markets are more subdued on the far end of the VIX futures curve.

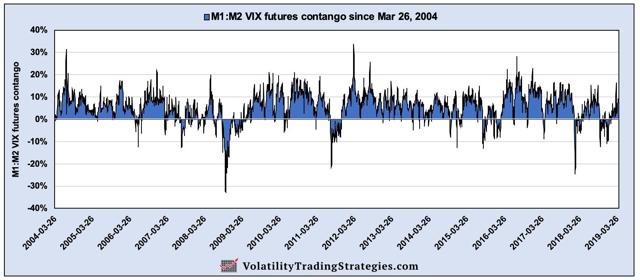

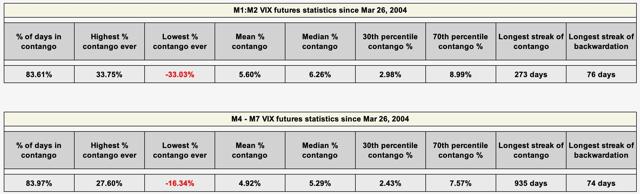

M1:M2 VIX futures since inception:

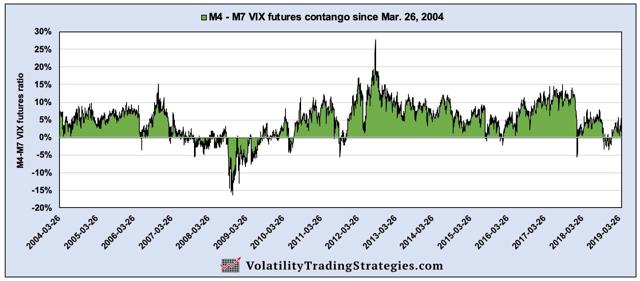

M4 – M7 VIX futures since inception:

You can see most of the M4-M7 backwardation periods were contained to the financial crisis in 2008/09. The rest of the time it was actually very stable and this is one of the reasons the ZIV has performed so well over time.

Since January 2010, M4 – M7 VIX futures have spent 93.6% of trading days in contango, with the longest duration of backwardation being only 34 days. Compare that to M1:M2 VIX futures at 86.3% of trading days in contango, and several longer periods of backwardation.

Keep an eye on the M4-M7 VIX futures:

Volatility traders are accustomed to viewing contango and backwardation in terms of the front two-month VIX futures M1 & M2. That’s correct with respect to the majority of volatility ETPs (VXX, SVXY, UVXY, TVIX) and I would suggest they continue to do that. However, hopefully after reading this article the potential benefit to increasing focus to include ZIV is clear. For that, we also have to expand our view of contango and backwardation to include M4-M7 VIX futures. I show both of those values in my daily blog in my 20 metric Volatility Dashboard, but you can also get the information at vixcentral.com.

There are many volatility metrics that one should take into account, but speaking specifically to M4-M7 contango:

– If M4-M7 VIX futures are upward sloping and in contango, all other things being equal, this may be a tailwind for a long ZIV (short volatility) position

– If M4-M7 VIX futures are downward sloping and in backwardation, all other things being equal, this may be a tailwind for a long VXZ (long volatility) position

Now the absolute value of contango or backwardation is meaningful, but it’s really the percentile rank that’s the most useful, so I suggest you add that metric to your watchlist as well. That’s how you can tell whether it’s actually high or low, to compare it against itself of the past. Percentile ranking shows where today’s value is in relation to all previous values since inception.

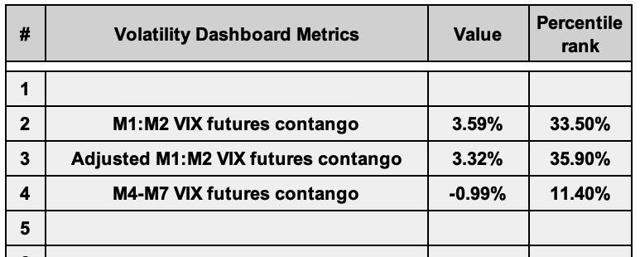

My 20 metric Volatility Dashboard as of Friday May 24, 2019:

Can you see the percentile ranking of M4-M7 VIX futures contango? Only 11.4%, meaning that about 89% of trading days going back to inception had higher levels of M4-M7 contango than we currently see. And the absolute value itself of -0.99% is well below its long-term mean of 4.92%.

Now there are other factors involved, but the low contango may harm its short-term performance compared to the stronger M1:M2 VIX futures contango that is currently around its 35th percentile.

Matching up the correct VIX futures to the corresponding underlying volatility ETP being traded may yield better long-term performance.

Conclusion

For knowledgeable traders there are several viable volatility ETPs out there to trade, and if the trader puts risk management at the forefront of their strategy they can all be managed effectively and profitably. But as I’ve shown, structurally the ZIV is unique and definitely worth a spot on people’s radar going forward.

The 4th-7th month VIX futures (and ZIV) may be a more accurate barometer of the overall health of the economy than the short term M1:M2. More consistent, with a more long-term view of what may be coming.

I’ve been trading it for over 7 years now, so I invite you to give it a serious look as well. If your investing philosophy is similar to mine and you do value safety and consistency above all else, then ZIV may be tailor-made for you.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News