[ad_1]

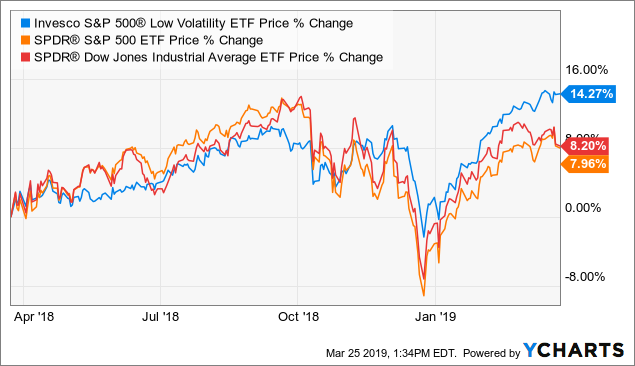

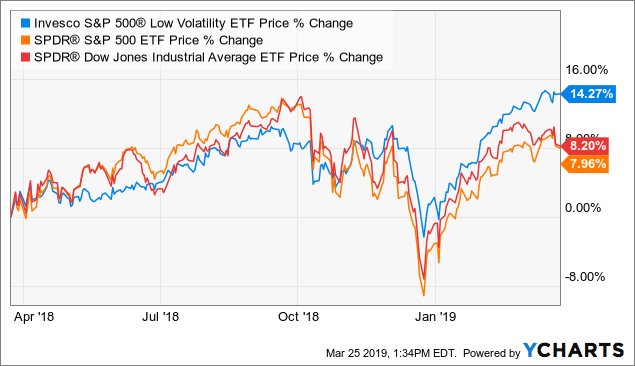

Last Friday, the Dow Jones Industrial Average dropped a whopping 460 points at the close. While looking at my watch list, I noticed my favorite and most widely recommended ETF at my firm, the Invesco S&P 500 Low Volatility Fund (SPLV) was flat on the day. As we investors hear more news on yield inversions and markets hitting new highs, we need funds that can outperform market indices, while providing simple risk management. The SPLV is doing that this year, even as the overall markets are up double digits year-to-date. Let’s take a look at some charts that show the outperformance of the SPLV as of this past quarter.

Data by YCharts

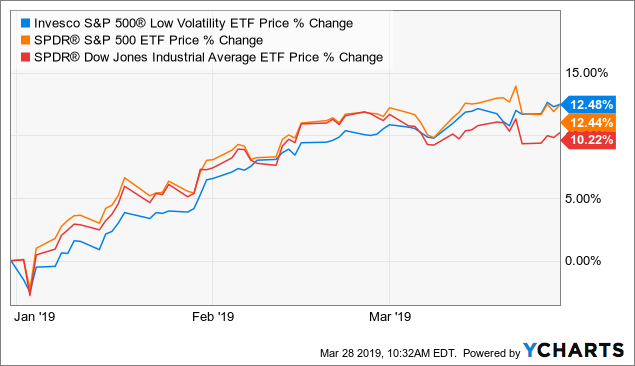

Data by YChartsWhen you look at the past few months, you can see the SPLV again comes out the winner with the most recent volatility we had. Some critics of the fund believe that the SPLV will not keep up with the standard market indices in good times. This year-to-date chart does a pretty good job of showing that is just not true. The SPLV is also outperforming the Diamonds Dow Jones ETF (DIA). Low volatility does not mean that lower returns are expected. I want to showcase one more period of time, the one-year chart.

Data by YCharts

Data by YChartsThis chart shows the biggest outperformance of the SPLV compared to the rest of the markets. The SPLV almost doubled the performance of the SPY this past year.

SPLV Current Portfolio Holdings

When you look at how the SPLV works, the fund takes the lowest volatile 100 companies every quarter in the S&P 500. It makes sense to take a look quarterly to see what these companies are since the fund’s holdings are turning over every quarter.

| RSG | Republic Services Inc. | 1.21 |

| EXC | Exelon Corp. | 1.20 |

| AEP | American Electric Power Co Inc. | 1.16 |

| NEE | NextEra Energy Inc. | 1.16 |

| WEC | WEC Energy Group Inc. | 1.15 |

| AWK | American Water Works Co Inc. | 1.14 |

| CMS | CMS Energy Corp. | 1.14 |

| KO | Coca-Cola Co/The | 1.13 |

| DTE | DTE Energy Co. | 1.13 |

| XEL | Xcel Energy Inc. | 1.13 |

Source: Invesco.com

As you can see from the above table, the current top ten holdings are utilities, REITs, and financials. All these stocks are made up of sectors that are sensitive to the 10-year treasury yield. As the long-end of the curve is dropping, these companies are outperforming other sectors. Some critics will say that having a portfolio of yield sensitive stocks isn’t a good idea. However, as we are learning right now, it’s not prudent to assume that long-term rates will head higher. I can’t overstate the importance of not trying to pick and choose sectors that will outperform for any reason.

Going Forward With SPLV

As this bull market continues to become extended and investors wonder how to protect gains, the SPLV could be an answer for your portfolio. Most investors I meet with on a daily basis do not have that simple risk management in place. Let’s say in your overall portfolio, you own the basic SPDR S&P 500 ETF (SPY). You could easily replace half of that position with SPLV and still own equities, but with an understanding you are receiving at least some risk management. You are selectively owning one-hundred of the lowest volatile companies in the S&P 500 vs. just owning the overall market index.

Another bonus to the SPLV is the 30-day SEC yield right now going forward. The 30-day SEC yield is based on the most recent 30-day period covered by the fund’s filings with the SEC. The yield figure reflects the dividends and interest earned during the period after the deduction of the fund’s expenses. This yield calculation is also referred to as the “standardized yield.” As we speak, the Invesco S&P 500 Low Volatility ETF is paying a 2.4% distribution yield, about 33 basis points higher than it was last year at this time. While looking at the SPY, the 30-day SEC yield is 1.85%. For yield-hungry or dividend-focused investors, the SPLV is a better option for you as well.

SPLV Summary

At the end of the day, nobody really knows what sectors or stocks that will outperform the standard indices. This is a major reason why I am so impressed with the SPLV simple methodology which is still working. Owning the lowest volatile companies in the index is one more step to becoming a prudent investor. Keeping your exposure to equities, while actively reducing the higher beta names, gives you a leg up on any broad market ETF owner. Many investors try to pick the next best asset class or the next best performing stock and fail miserably while trying to do so. This year is proving the case for SPLV as an outperformer and a fund that actively monitors holdings.

Disclosure: I am/we are long SPLV. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Ortner Capital recommends SPLV to clients where the firm believes it a fit for the clients portfolio. These opinions are that of Mr. Josh Ortner, CTFA. Please consult your own financial professional to see if SPLV could be in your best interest.

[ad_2]

Source link Google News