[ad_1]

With any method for computing investment risk and performance, it is important to use data covering as long a time period as possible. In particular, the measurement period must include both bull and bear markets for the investments of interest.

– Peter G. Martin

How Do You Measure Risk in ETFs?

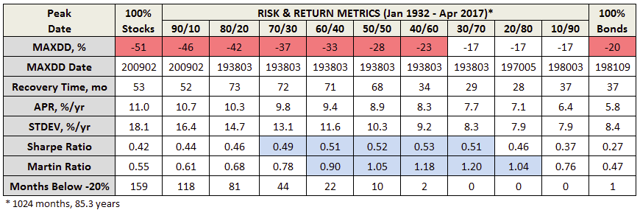

I discuss seven different measures of risk and three measures of risk-adjusted returns. A summary for portfolios from 1932 to 2017 is shown below for Maximum Drawdown, Standard Deviation, Sharpe Ratio and Martin Ratio. The table is from “How Bad Can It Get?” by Charles Boccadoro. It is a comparison of the Sharpe Ratio to the Martin Ratio for the past 85 years by stock-to-bond ratio. For interested readers, I described the Ulcer Index and Martin Ratio in The Great Owl Portfolio last October.

The table shows that the portfolio with the highest Martin Ratio consists of around 30% stocks, compared to 40% stocks for the Sharpe Ratio. I also like that the Martin Ratio shows a wider range of values, as I believe that it captures a better estimate of risk. For example, the Martin Ratio for a 70% stock/30% bond portfolio is 35% lower than a 30% stock/70% bond portfolio, while the Sharpe Ratio is only 4% lower. Also noteworthy is that the 70% stock/30% bond portfolio has twice the drawdown of the 30% stock/70% bond portfolio. Over a very long period of time, portfolios with higher allocations to stock outperform, but my investing time horizon is not 85 years.

(Source: MFO.)

High Risk-Adjusted Return ETFs

I selected 25 funds from 24 Lipper categories based on risk, risk-adjusted returns, and performance compared to peers using Mutual Fund Observer Premium Search. Many of these are appropriate for a late business cycle stage leading into a recession.

| Symbol | Name | Lipper Category |

| GSY | Invesco Ultra Short Duration | Ultra-Short Obligations |

| BSCJ | Invesco BulletShares 2019 Corporate Bond | Short Invest Grade Debt |

| XMLV | Invesco S&P MidCap Low Volatility | Mid-Cap Core |

| USMV | BlackRock iShares Edge MSCI Min Vol USA | Multi-Cap Core |

| SPHD | Invesco S&P 500 High Dividend Low Vol | Equity Income |

| FVD | First Trust Value Line Dividend Index | Multi-Cap Value |

| SDY | State Street SPDR S&P Dividend ETF | Equity Income |

| MGV | Vanguard Mega Cap Value Index ETF | Large-Cap Value |

| XSLV | Invesco S&P SmallCap Low Volatility ETF | Small-Cap Core |

| DON | WisdomTree US MidCap Dividend | Mid-Cap Value |

| PZA | Invesco National AMT-Free Municipal Bond | Muni Gen & Insured Debt |

| BAB | Invesco Taxable Municipal Bond ETF | General Bond |

| FXU | First Trust Utilities AlphaDEX | Utility |

| FCOM | Fidelity MSCI Communication Services | Telecommunication |

| AOK | BlackRock iShares Core Conserv Alloc | Mixed-Asset Target Alloc Consv |

| GQRE | FlexShares Global Qual Real Estate Index | Global Real Estate |

| PSR | Invesco Active US Real Estate | Real Estate |

| AOM | BlackRock iShares Core Moderate Alloc | Mixed-Asset Target Alloc Moderate |

| AOR | BlackRock iShares Core Growth Alloc | Mixed-Asset Target Alloc Growth |

| TOK | BlackRock iShares MSCI Kokusai ETF | Global Large-Cap Core |

| IYLD | BlackRock iShares Morningstar Mult-Asst Inc | Alternative Global Macro |

| ACIM | State Street SPDR MSCI ACWI IMI | Global Multi-Cap Core |

| CGW | Invesco S&P Global Water Index | Global Natural Resources |

| DGT | State Street SPDR Global Dow | Global Large-Cap Value |

| DBEU | Deutsche Xtrackers MSCI Europe Hdgd Eq | European Region |

The Measures of Risk and Risk-Adjusted Returns

One of the most common measure of risk-adjusted return is the Sharpe Ratio, which is the return above a risk-free treasury divided by the Standard Deviation (STDEV) that measures whether the price of a fund is rising, falling, or both. It is not a good measure of risk. The Sortino Ratio is the return above a risk-free investment divided by the downside deviation (DSDEV). The Martin Ratio is the return above a risk-free investment divided by the Ulcer Index, which measures the magnitude and duration of drawdowns.

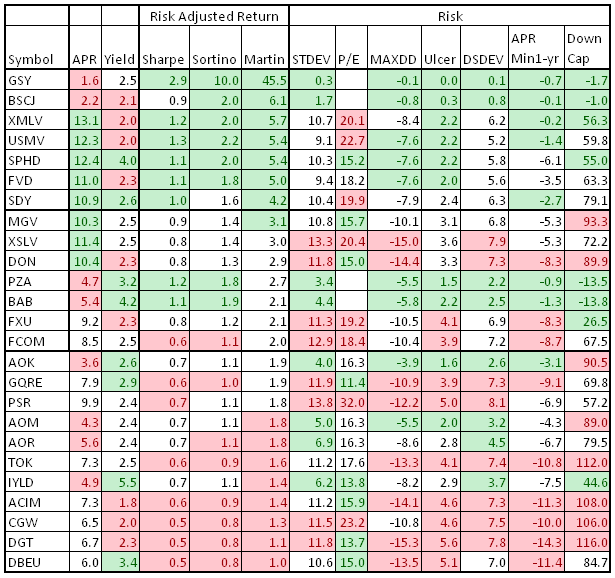

The top section in the table below shows where the Sharpe, Sortino, and Martin ratios are in agreement. Over the past five years, these have been top funds on a risk-adjusted basis. GSY and BSCJ are both bond funds. The returns (APR) have been low, but the risk is even lower. XMLV and USMV are both low volatility funds. SPHD, FVD, and SDY are dividend funds.

Seven measures of risk and volatility are shown, including the minimum 1-year rolling return, Downside Capture and Price-to-Earnings Ratio. I use these more heavily in a late business cycle stage to reduce risk. I include P/E as a risk because investors have been purchasing low volatility funds, and as a result, valuations have risen. For more information, I refer readers to the article “Low Volatility Factor: High Valuation”.

(Source: Created by the Author with Data from Mutual Fund Observer)

The bottom section consists mostly of global and mixed asset funds, where the Sharpe, Sortino, and Martin ratios are in agreement that these funds have not had as high of a risk-adjusted return. I like the low P/E of global funds, and they may be suitable in a portfolio for diversification.

The middle section consists of value funds, small- and mid-cap ETFs, municipal bonds, and Utility and Sector ETFs, where the risk-adjusted return has not been as high.

Portfolio Visualizer

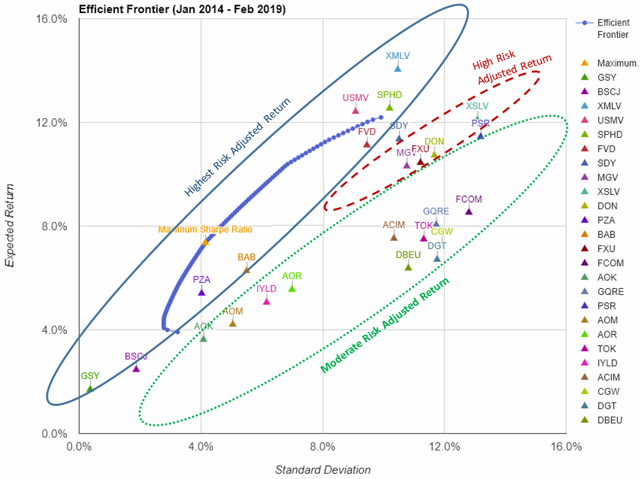

The Efficient Frontier from Portfolio Visualizer is shown below. I have roughly grouped them as they are in the table above.

(Source: Portfolio Visualizer)

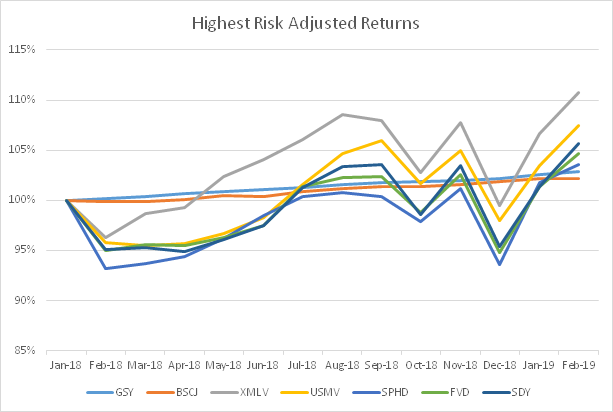

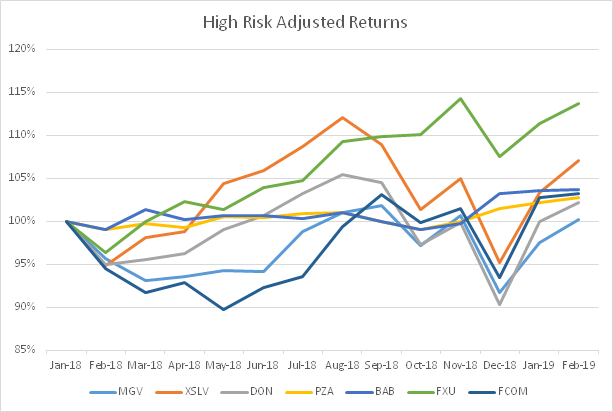

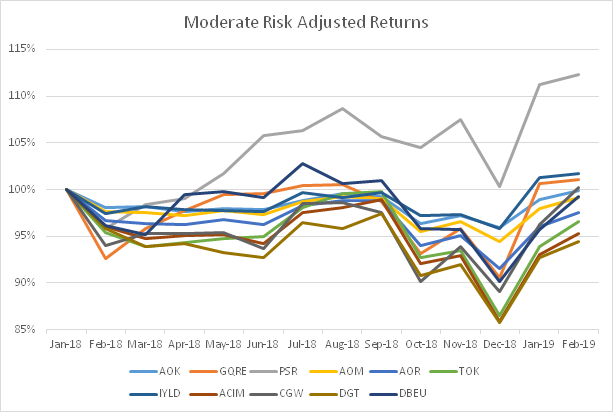

The next three charts show the returns for the past 12 months for the same groupings as above. It can be clearly seen that the Highest Risk-Adjusted Returns are less volatile than the other two categories.

(Source: Created by the Author with Data from Portfolio Visualizer)

Of the High Risk-Adjusted Returns, the First Trust Utilities AlphaDEX ETF (FXU) and the Invesco National AMT-Free Municipal Bond Portfolio ETF (PZA) have clearly been more stable investments.

(Source: Created by the Author with Data from Portfolio Visualizer)

The Moderate Risk-Adjusted Funds have not fared well during the past 12 months.

(Source: Created by the Author with Data from Portfolio Visualizer)

Morningstar

The Morningstar ratings are shown below. The risk ratings are low-to-average.

| Symbol | Fund Category | Rating | Risk | Return |

Return 3 Mon |

| GSY | Ultrashort Bond | 4 | Below Average | Above Average | 0.9 |

| BSCJ | Short-Term Bond | 5 | Above Average | High | 0.6 |

| XMLV | Mid-Cap Value | 5 | Low | High | 2.8 |

| USMV | Large Blend | 4 | Low | Above Average | 2.4 |

| SPHD | Large Value | 5 | Below Average | Above Average | 2.4 |

| FVD | Large Value | 5 | Low | Above Average | 2.1 |

| SDY | Large Value | 5 | Below Average | High | 2.2 |

| MGV | Large Value | 4 | Average | Above Average | -0.4 |

| XSLV | Small Value | 5 | Low | High | 2.0 |

| DON | Mid-Cap Value | 5 | Average | High | 2.3 |

| PZA | Muni Nation Long | 4 | Above Average | Above Average | 2.8 |

| BAB | Long-Term Bond | 4 | Below Average | Average | 3.9 |

| FXU | Utilities | 3 | Average | Average | -0.5 |

| FCOM | Communications | 4 | Average | Above Average | 1.7 |

| AOK | Alloc – 30% to 50% Eq | 2 | Low | Below Average | 2.8 |

| GQRE | Global Real Estate | 4 | Average | Above Average | 5.5 |

| PSR | Real Estate | 4 | Below Average | Above Average | 4.5 |

| AOM | Alloc – 30% to 50% Eq | 3 | Below Average | Average | 2.6 |

| AOR | Alloc – 50% to 70% Eq | 3 | Below Average | Average | 2.6 |

| TOK | World Large Stock | 4 | Average | Above Average | 3.3 |

| IYLD | Alloc – 30% to 50% Eq | 4 | Above Average | Above Average | 4.5 |

| ACIM | World Large Stock | 4 | Average | Above Average | 2.5 |

| CGW | Misc. Sector | Below Average | 6.7 | ||

| DGT | World Large Stock | 3 | Average | Average | 2.7 |

| DBEU | Europe Stock | 5 | Low | High | 3.7 |

(Source: Morningstar)

My Favorite ETFs

I created three portfolios of the funds that I liked most, to maximize returns over the past 13 months for 4%, 6%, and 8% target standard deviations. While the returns are close for the three portfolios, my preference is towards less risk.

| Portfolio Allocations | |||||

| Name | Ticker | 4% Vol | 6% Vol | 8% Vol | SPY |

| Invesco Ultra Short Duration | GSY | 30% | 25% | 30% | |

| Invesco BulletShares 2019 Corp Bd | BSCJ | 25% | 20% | 5% | |

| Invesco S&P 500 Hi Div Lo Vol | SPHD | 5% | 10% | 20% | |

| First Trust Value Line Div | FVD | 17% | 25% | 25% | |

| Invesco Nat. AMT-Free Muni Bd | PZA | 13% | 10% | 5% | |

| iShares Core Cons Alloc | AOK | 5% | 5% | 5% | |

| iShares MSCI Kokusai | TOK | 5% | 5% | 10% | |

| Portfolio Metrics | |||||

| Return | 2.8% | 3.1% | 3.4% | 5.5% | |

| Max. Drawdown | -2.1% | -3.1% | -4.6% | -13.5% | |

| Sharpe Ratio | 0.22 | 0.24 | 0.23 | 0.29 | |

| Sortino Ratio | 0.32 | 0.33 | 0.32 | 0.41 | |

| Portfolio Exposure | |||||

| US Stocks | 24% | 36% | 49% | ||

| Intl. Stocks | 5% | 6% | 7% | ||

| US Bonds | 41% | 34% | 24% | ||

| Intl. Bonds | 9% | 8% | 6% | ||

| Cash | 21% | 17% | 13% | ||

(Source: Created by the Author with Data from Portfolio Visualizer)

Here is how the portfolios and funds have performed over the past 13 months. Each of the three portfolios performed in a low volatile manner, with close returns in spite of the large difference in stock allocation.

(Source: Portfolio Visualizer)

Below is the fund performance over the past 12 months.

| Name | Ticker | Avg Rtn | Stdev | Max. Drawdown | Sharpe | Sortino |

| Invesco Ultra Short Duration | GSY | 2.6% | 0.3% | 0.0% | 2.2 | 6.1 |

| Invesco BulletShares 2019 Corp Bd | BSCJ | 1.8% | 0.7% | -0.2% | -0.2 | -0.2 |

| Invesco S&P 500 Hi Div Lo Vol | SPHD | 3.3% | 13.9% | -7.5% | 0.2 | 0.2 |

| First Trust Value Line Div | FVD | 5.6% | 13.1% | -7.6% | 0.3 | 0.5 |

| Invesco Nat AMT-Free Muni Bd | PZA | 1.0% | 3.3% | -2.5% | -0.3 | -0.4 |

| iShares Core Cons Alloc | AOK | 0.8% | 5.1% | -4.1% | -0.2 | -0.3 |

| iShares MSCI Kokusai | TOK | 2.5% | 15.7% | -13.5% | 0.1 | 0.2 |

(Source: Created by the Author with Data from Portfolio Visualizer)

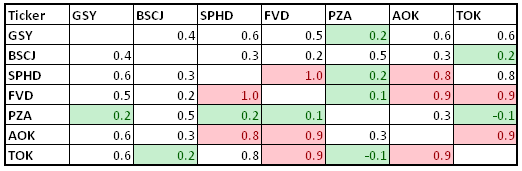

The following table shows the correlations between the funds. The equity funds are most correlated to each other. PZA is the least correlated to other funds.

(Source: Created by the Author with Data from Portfolio Visualizer)

Summary

Each month, I evaluate whether I should make a small change to my portfolio in order to reduce risk and increase risk-adjusted returns. This month, I traded a volatile health care fund for a less volatile dividend and income fund following the concepts in this article.

Disclosure: I am/we are long FXU. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am an engineer with an MBA nearing retirement and not an economist nor an investment professional. The information provided is for educational purposes and should not be considered as advice. Investors should do their due diligence research and/or use an investment professional.

[ad_2]

Source link Google News