[ad_1]

Olemedia/E+ via Getty Images

Lithium is a chemical element with the symbol Li and atomic number 3. It is a soft and silvery-white alkali metal. Lithium is less common in the solar system than 25 of the first 32 chemical elements because of its relative nuclear instability. Lithium’s nuclei are very light, and the metal is an exception, as heavier nuclei tend to be less common.

With the lowest density of all metals, lithium is a critical component in heat-resistant glass and ceramics, lithium grease lubricants, flux additives for iron, steel, and aluminum products, lithium batteries, and lithium-ion batteries. Lithium demand has increased over the past years because of rising requirements for rechargeable batteries for mobile phones, laptops, and digital cameras. Lithium cobalt oxide is the most common lithium battery type found in electric devices.

The growth of the EV market has caused lithium-ion battery demand to explode. EVs require lithium cobalt oxide or lithium nickel cobalt oxide chemistries. In late 2021, Tesla (TSLA), the world’s leading EV maker, changed its battery cell chemistry for standard range vehicles from a nickel-cobalt-aluminum to lithium-iron-phosphate chemistry.

Lithium is essential for EVs and the transition away from fossil fuels. Lithium’s role has caused an explosive rally in the illiquid and rare metal. The Global X Lithium & Battery Tech ETF (NYSEARCA:LIT) product tends to move higher and lower with the metal’s price as it holds shares in the leading producing companies.

Lithium Prices Have Soared

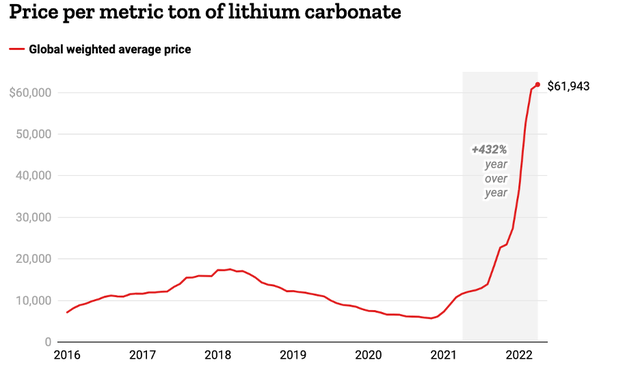

The lithium carbonate price fell to a low of $5,700 per ton in November 2020 as the global pandemic gripped markets across all asset classes.

Lithium Carbonate Price Appreciation (Time.com)

The chart highlights the move to a high of $61,943 per metric ton in April 2022. As the demand for EVs exploded, manufacturers’ lithium requirements skyrocketed.

The Leading Lithium Producers And Consumers – Stockpiles Are Low

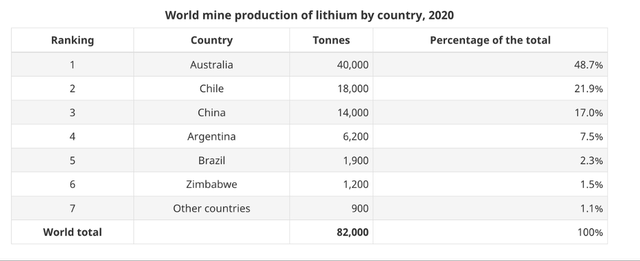

In 2020, three countries mined around 86% of the world’s annual lithium supplies.

Top Lithium Producing Countries 2020 (Canadian Government-https://www.nrcan.gc.ca/our-natural-resources/minerals-mining/minerals-metals-facts/lithium-facts/24009)

The chart shows that Australia is the world’s top lithium producer, with almost double the output of Chile, the top copper producing country and second-leading lithium producer. China, the commodity powerhouse, rounds out the top three.

China controls 80% of the world’s lithium refining and 77% of the global cell capacity. Despite being the third-leading lithium producer, China is also the leading consumer and second top importer behind South Korea and ahead of Japan, the US, and Belgium.

The top six countries with lithium reserves are Bolivia, Argentina, Chile, the US, Australia, and China. Production has struggled to keep up with the rising demand. According to Benchmark Mineral Intelligence, “Lithium carbonate producer stocks have been depleted on continued higher demand on remain at low to non-existent levels.”

Goldman Sachs Is Not Bullish On Battery Metals

On May 31, Goldman Sachs, the company that forecasts copper will rise to $15,000 per ton by 2025 because of the EV revolution, said the bull market in battery metals is over until at least 2024.

Goldman analysts wrote, “Investors are fully aware that battery metals will play a crucial role in the 21st-century global economy. Yet, despite this exponential demand profile, we see the battery metals bull market as over for now.” They went on to write, “That fundamental mispricing has, in turn, generated an outsized supply response well ahead of the demand trend.” Goldman analysts expect cobalt, lithium, and nickel prices to fall over the next two years. After averaging around $54,000 per metric ton in 2022, they see the price falling back to the $16,000 level in 2023. Meanwhile, Goldman expects a demand surge causing a deficit in 2024-2025 that will take prices back to the highs.

LIT Is The Leading Lithium And Battery Tech ETF Product

Goldman’s forecast does not fully consider the potential for accelerating the greener path for energy production and consumption that could cause EV sales to continue their exponential growth. US and European energy policies favor alternative and renewable energy and inhibit fossil fuel production and consumption. The geopolitical tensions with Russia could cause a higher than forecast transition rate from gasoline to battery-powered cars.

Lithium is not a liquid metal like copper, aluminum, or even the less-than liquid nickel market. It is virtually impossible for investors and traders to buy physical lithium. The only investment route is via a limited number of publicly traded producing companies. Chinese lithium producer Tianqi Lithium, a subsidiary of Chengdu Tianqi Industry Group, leads the world in hard-rock lithium output. The company has production assets in Australia, Chile, and China. Albemarle Corp. (ALB), a US producer, is the second-leading lithium miner.

Sociedad Quimica y Minera de Chile (SQM) is the leading Chilean lithium carbonate producer. ALB and SQM are established producing companies that should move higher or lower with the lithium price.

The fund summary for the Global X Lithium & Battery Tech ETF states:

Fund Summary of the LIT ETF Product (Barchart)

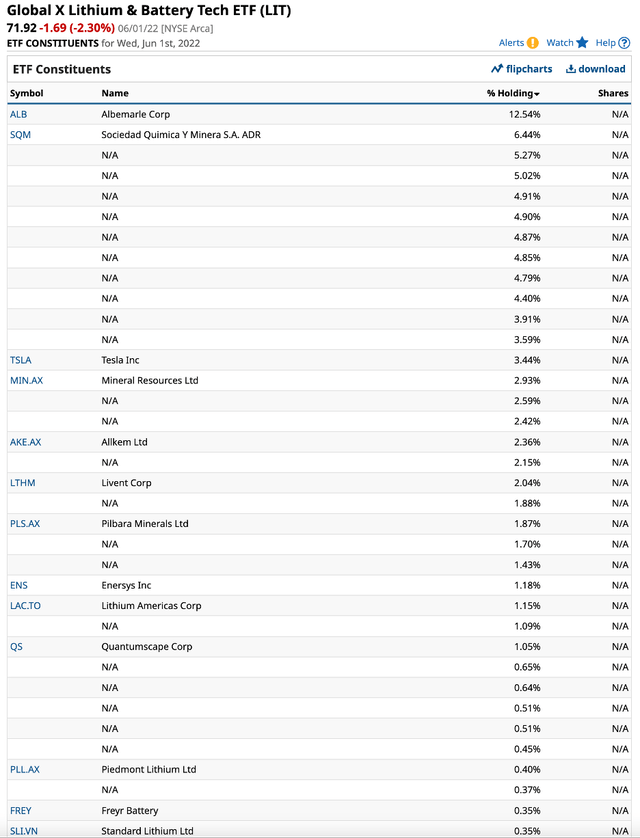

LIT’s top holdings include:

Top Holdings of the LIT ETF Product (Barchart)

The holdings include ALB, SQM, and Pilbara Minerals Ltd, a Western Australian elite lithium producer. The diversified ETF holds other smaller lithium producing and exploration companies, and even has a small position in Tesla, the top EV manufacturer.

At $71.92 per share, LIT has over $4.755 billion in assets under management. The ETF trades an average of 845,245 shares each day and charges a 0.75% management fee.

A Bearish Trend In 2022 – Buy LIT On A Blow-Off To The Downside

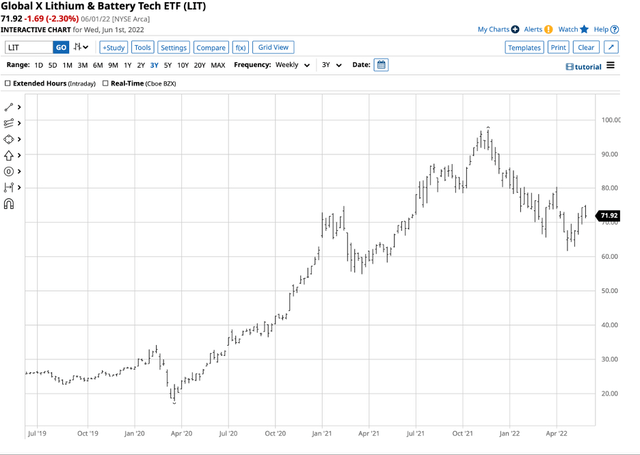

The LIT ETF reached rock bottom at $17.83 per share in March 2020 when the global pandemic gripped markets across all asset classes. Many metal and mineral prices fell to lows in March 2020. The ETF took off on the upside, making higher lows and higher highs until late 2021.

Chart of the LIT ETF Product (Barchart)

The chart shows the rally that took LIT to a high of $97.13 per share on November 22, 2021. The over 440% rally ran out of upside steam, with LIT making lower highs and lower lows since the late 2021 high.

At the $71.92 level on June 2, LIT recovered from the most recent April 26 $61.67 low. The trend in 2022 remains bearish, and if Goldman Sachs is correct, LIT could fall further. However, this lithium ETF is a candidate for accumulation over the coming months as the demand for the metal will continue to rise. A scale-down buying approach, leaving plenty of room to add as LIT falls could be a road to significant profits when the illiquid lithium market turns higher over the coming years. Put the LIT ETF on your investment radar.

[ad_2]

Source links Google News