[ad_1]

Fritz Jorgensen/iStock via Getty Images

Introduction

Global X Lithium & Battery Tech ETF’s (LIT) underlying companies are involved in the complete value chain across the lithium cycle, including mining, refinement and battery production. This ETF markets three key selling points on its website:

- High growth, riding on the interest in Electric Vehicles (EVs) and its new technologies.

- Advancing clean technologies, riding on the present Environmental, Social and Governance (ESG) global movement in investing.

- Unconstrained approach, which is considered as attractive by investors given its potential for diversification and capitalize on high-performing stock picks.

The ETF uses the Solactive Global Lithium index as a benchmark. It has around $5 billion under management and has a reasonably average expense ratio of 0.75%.

This article will critically evaluate the above selling points of this fund, its risks and discuss the fund’s prospects in light of present events.

Skyrocketing Lithium prices on tight supply, strong demand

Characterizing the growth of LIT can be complicated, since the component companies of LIT are involved in different parts of the value chain; upstream, midstream or downstream. Generally speaking, much of the growth in revenues from Lithium will arise from a tight supply dynamic in 2022, leading to higher prices. This is likely to benefit upstream players such as Albemarle (ALB), but may lead to higher costs for the EV producers unless these costs are fully passed through. However, during a weak global economy, it is risky to assume that input costs can be easily passed through to the consumer. On that note, the LIT ETF held a large 9.9% of ALB as at 2-Mar-2022, down from 11.2% of ALB as of 31-Jan-2022. In hindsight, the decline in weight to ALB might be inopportune.

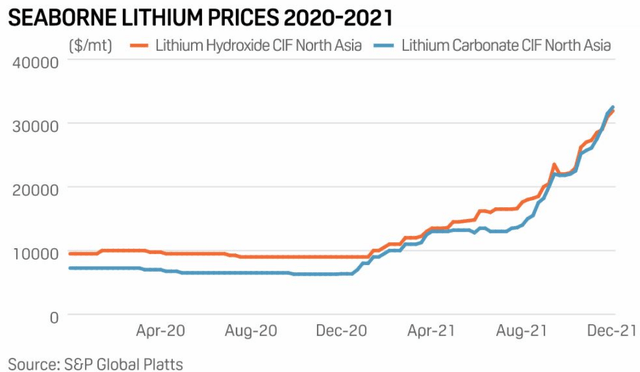

Thus far, the Russia-Ukraine war has had a buoyant impact on commodity prices. Wheat and Oil are the obvious beneficiaries. Lithium would have benefitted from some spillover effects being part of the commodities complex, although it was already skyrocketing prior to the war, with gains of as much as 30% over the last month and a mind-boggling 600% over the last year.

There are reports mentioning Russia’s intentions to produce Lithium and eventually capture 10% of the global market, but given the present situation, Russia’s production plan will likely be scuttled. This will then hamper the growth of supply, especially to Lithium consumers in Europe.

Looking forward, there are expectations of new supply, possibly by 2H2022, with a number of projects in Argentina, Chile and Brazil. Nonetheless, these nations are notorious for high country risk, heightened by income inequalities and social dissent given accusations of COVID mismanagement by the government. The movement towards anti-incumbent sentiment, the shift towards leftist political parties, and willingness to accept China’s funding for infrastructure will exacerbate an already complicated geopolitical situation as elections loom in Latin America, hence clouding the outlook for new supply.

However, if incoming supply does materialize as planned, S&P Global Market Intelligence expects lithium chemical supply to rise to 636,000 mt lithium carbonate equivalent in 2022, up 28% from 497,000 mt in 2021. Between 2021 and 2020, the increase was up 22% from 408,000 mt in 2020 to 497,000 mt in 2021. While there is scope for Lithium prices to correct, I would expect this to be limited since prior supply increases did nothing to curb the massive price increase.

Exhibit 1a: Lithium prices enter a multi-year bull run

S&P Market Intelligence

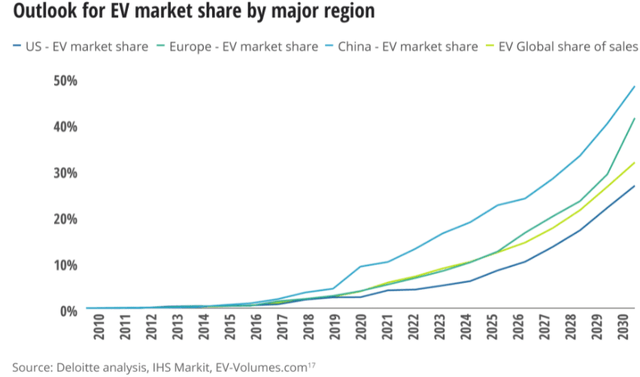

Exhibit 1b: Electric vehicles to be dominant in global share of vehicle sales, with China in the lead, supporting demand for Lithium batteries

Deloitte

Upstream holdings in LIT to benefit, but countered by downstream holdings

Therefore, while higher Lithium prices and tight supply is positive for Lithium producers such as ALB, supply tightness does not bode well for downstream users of Lithium, since it can mean either reduced margins or late deliveries which means being unable to materialize revenues, such as for Electric Vehicle (EV) companies. Apart from its top holding of ALB which was indeed a good buy back then, LIT is exposed to the risks of its midstream and downstream business segments based on its top 5 holdings as at 2-Mar-2022:

- LIT holds 5.6% of Tesla (TSLA), its third largest holding. Tesla both relies on Lithium batteries produced by manufacturers as well as produces its own batteries for its range of EVs.

- LIT holds 6.3% of TDK Corp, its second largest holding. TDK is a Japan-based company that holds Amperex technology with Lithium battery manufacturing facilities in Dongguan, China. It is also quite diversified in terms of its electronic components business. Given its operations base, TDK has major commercial interests in China.

- LIT holds 4.9% of lithium battery manufacturer Contemporary Amperex Technology Co Ltd, its fourth largest holding. The company is one of the largest lithium battery producers in the world and has many trade partnerships with non-Chinese EV manufacturers such as Tesla, BMW, Toyota and Honda.

- LIT holds 4.9% of Ganfeng Lithium Co Ltd, its fifth largest holding. The company supplies to car manufacturers such as BMW, Tesla and Volkswagen. The company extracts and produces Lithium through its global resources, its primary revenue driver, with battery production its secondary driver.

Therefore, LIT should benefit from the higher prices of Lithium through its holdings in upstream parts of the Lithium value chain. Nonetheless, the presence of large holdings in EV manufacturers and battery producers would also mean the ETF holds companies that face the prospect of margin erosion from high input costs.

Geopolitical and trade risks can escalate given US-Europe versus Russia-China relations

In the prior section, it was explained that a number of China-related companies are in the top holdings of the LIT ETF. Thus, the situation can become dicey if geopolitical tensions lead to trade restrictions, especially if China does not impose trade sanctions on Russia. Should this occur, I would imagine the propaganda labelling China as being in cahoots with Russia, given their ideological histories. Also, it would not be surprising for an escalation of geopolitical tensions between China and the West if the Russian invasion of Ukraine was seen as a potential blueprint for relations between China and Taiwan.

The result of these would be potentially unfriendly trade restrictions on countries that do not follow in the footsteps of NATO-related countries. As it stands, China is not aligned with Europe and the US on the war, has not participated in sanctions against Russia, and declared a “no limits” friendship with Russia. Therefore, there is a material risk that China-owned Lithium mines and derivative products such as Lithium batteries could face trade barriers.

Dented by risk aversion

Being a growth and tech-focused ETF, LIT’s valuation has been dented by macro headwinds, primarily from higher interest rates and risk aversion caused by geopolitical tensions. Long term industry growth prospects remain intact given the infrastructure investments to pave the way for EVs. However, high P/E tends to perform poorly during periods of risk aversion – based on a simple average from the table below, P/E for LIT’s top holdings is very high, at 44 times. Investors are in the phase of seeking investments with safe prospects such as consumer non-cyclicals and value, rather than growth. As we can see from the table below, LIT’s top sectors are in cyclicals and technology.

Exhibit 2: Top holdings of LIT as at 3-Mar-2022

|

Holdings |

% Portfolio Weight |

First Bought |

Market Value USD as of Mar 02, 2022 |

1-Year Return |

P/E |

Sector |

|

Albemarle Corp. |

9.91 |

12-Jan-15 |

474,793,682 |

27.64 |

29.76 |

Basic Materials |

|

TDK Corp. |

6.34 |

27-Oct-21 |

303,562,543 |

-11.97 |

12.3 |

Technology |

|

Tesla Inc. |

5.6 |

31-Oct-14 |

268,100,723 |

34.89 |

84.75 |

Consumer Cyclical |

|

Contemporary Amperex Technology Co. Ltd. Class A |

4.92 |

16-Jun-20 |

235,797,298 |

51.12 |

71.43 |

Industrials |

|

Ganfeng Lithium Co. Ltd. Class A |

4.91 |

14-Dec-21 |

235,456,113 |

45.55 |

25.25 |

Basic Materials |

|

Yunnan Energy New Material Co. Ltd. Class A |

4.72 |

16-Jun-20 |

226,050,687 |

109.29 |

— |

Consumer Cyclical |

|

BYD Co. Ltd. Class H |

4.69 |

01-Nov-13 |

224,521,320 |

7.9 |

73.53 |

Consumer Cyclical |

|

Wuxi Lead Intelligent Equipment Co. Ltd. Class A |

4.3 |

16-Jun-20 |

206,200,587 |

29.54 |

— |

Industrials |

|

Panasonic Corp. |

4.3 |

01-Nov-13 |

206,040,168 |

-18.26 |

9.98 |

Technology |

|

EVE Energy Co. Ltd. Class A |

4.24 |

16-Jun-20 |

203,271,850 |

-2.99 |

— |

Source: Morningstar

A critical look at LIT’s diversification and a note on greenwashing

LIT has quite a number of companies based in China (6 out of its top 10 holdings), and as earlier mentioned, the geopolitical cross-currents and how it dents risk aversion are major considerations given LIT’s emerging markets risk exposure. During volatile periods, emerging markets tend to underperform the developed markets, and LIT is significantly exposed to country risk skewed towards China.

It is also discomforting to note that the major Australian Lithium miners are not part of its top holdings, especially when Australia is a major Lithium exporter. Further country diversification would be helpful to reduce the overall riskiness of the ETF so LIT can truly live up to its “Global” name. The “unconstrained approach” of the fund could have been more effectively used to even out country risk especially for an industry rife with geopolitical tensions.

Finally, while LIT is marketed as advancing clean technologies, I suppose it is superficially riding on the ESG movement since I cannot quite see how Lithium mining and excess consumerism for new vehicles is representative of sustainable investing. Well, I suppose there was no fib since LIT is supposed to “advance” clean technologies, rather than have a high sustainability rating.

Conclusion

The present holdings of LIT suggest it has some exposure to higher Lithium prices and some exposure to the consumer cyclical sector of Electric Vehicles (EVs). Upstream Lithium extraction is likely to benefit, but margins may be squeezed for midstream and downstream companies. The EV and Lithium industry remains highly relevant over the long term, although global market jitters hamper optimism to this sector, hence the entry point is difficult to judge. A high P/E ratio and perception of LIT being in the tech sector are further perceptual hurdles to overcome. Finally, LIT has significant exposure to China’s country risk and the odd lack of exposure to Australia’s Lithium miners leaves much to be desired on diversification.

In short, while the Lithium industry benefits from long-term demand, LIT’s underlying holdings have high valuations and the ETF has a significant risk exposure to China that results in accompanying geopolitical and trade risks. This limits the diversification effectiveness of LIT, raising its risk profile, making LIT tactically less attractive given the present volatility in the market.

[ad_2]

Source links Google News