[ad_1]

NicoElNino/iStock via Getty Images

Just when we thought the conflict between Russia and Ukraine was starting to deescalate, President Joe Biden warned on Thursday that the possibility of a Russian invasion was “very high.”

Moscow continues to deny any aggressive action, but they are still asking for assurances that NATO will retreat from eastern Europe and that Ukraine will never join the military alliance. Ukraine has reiterated that it will not give in to those demands.

The geopolitical landscape only continues to feed the risk-off sentiment taking hold of the market. On Thursday, U.S. broad-based equity indices traded down—Nasdaq (-2.88%), S&P 500 (-2.12%), and the Dow (-1.78%). The VIX spiked 15.73% and the 10-year Treasury yield fell below 2.0% (-3.66%).

Equity markets are not the only asset class hurting, and with high inflation and strong consumer spending, the Federal Reserve is expected to increase interest rates multiple times this year.

One of the most direct impacts of potential future rate hikes is on the housing market. According to the Mortgage Bankers Association (MBA), the average 30-year fixed-rate conforming mortgage rate increased to 4.05% – marking the first time it’s been above 4.0% since October 2019.

Both Goldman Sachs and Bank of America have now projected seven interest rate increases this year, so odds are mortgage rates will continue to rise. Mortgage applications for new homes saw a weekly decline of 5.4%, and refinancing applications dropped to the lowest level since Q2 2019.

In the current macroeconomic environment, which Lipper classifications realized the largest inflows and outflows this past week?

Author

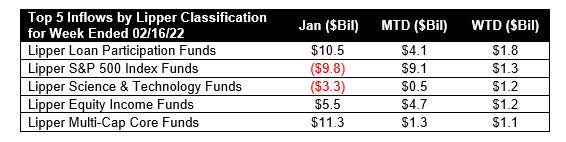

The top five inflows into Lipper classifications for the week ended February 16, 2022, were Loan Participation Funds (+$1.8 billion), S&P 500 Index Funds (+$1.3 billion), Science & Technology Funds (+$1.2 billion), Equity Income Funds (+$1.1 billion), and Multi-Cap Core Funds (+$1.1 billion).

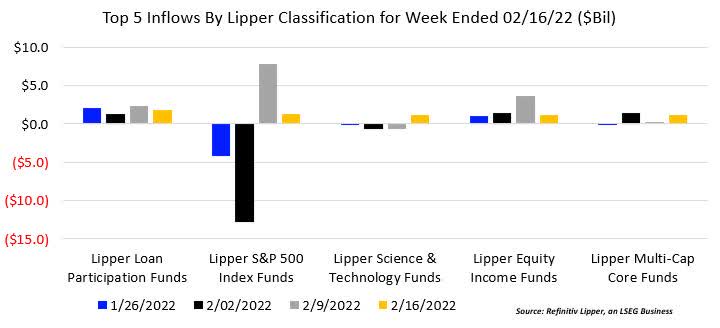

While Loan Participation Funds, Equity Income Funds, and Multi-Cap Core Funds have seen persistent inflows to start the year, Lipper S&P 500 Index Funds and Lipper Science & Technology Funds have been more volatile. The below chart shows the net flows for the five Lipper classifications over the past four weeks.

Author

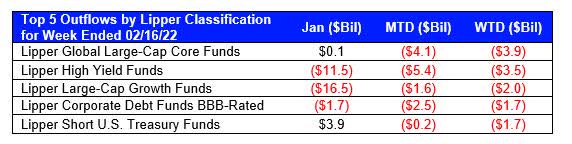

On the other hand, the top five outflows out of Lipper classifications for the week ended February 16 were Global Large-Cap Core Funds (-$3.9 billion), High Yield Funds (-$3.5 billion), Large-Cap Growth Funds (-$2.0 billion), Corporate Debt Funds BBB-Rated (-$1.7 billion), and Short U.S. Treasury Funds (-$1.7 billion).

Author

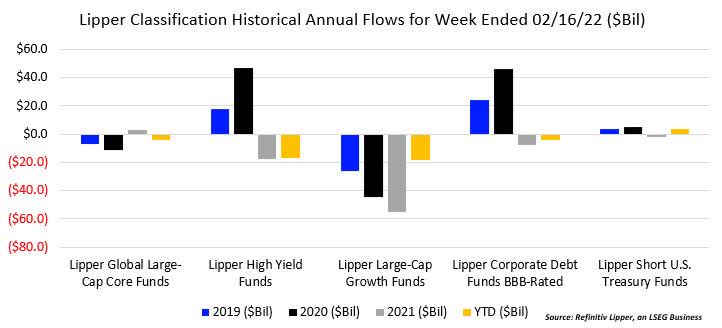

Both High Yield Funds and Corporate Debt Funds BBB-Rated have suffered consecutive significant weekly outflows which continues their trend from last year.

As another victim of a rising rates environment, your plain vanilla fixed income security becomes less attractive as rates increase and higher yields are found elsewhere. The below chart shows these five Lipper classification net flows over the past three years as well as their preliminary year-to-date totals.

Author

The last item to highlight is the movement from large-cap growth issues to a more multi-cap and value approach. Lipper Large-Cap Growth Funds have seen $16.5 billion flow out the door so far this year after posting three straight years of annual outflows. The beneficiaries up to this point have been Lipper Multi-Cap Core Funds (+$12.6 billion) and Lipper Large-Cap Value Funds (+$5.2 billion).

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

[ad_2]

Source links Google News