[ad_1]

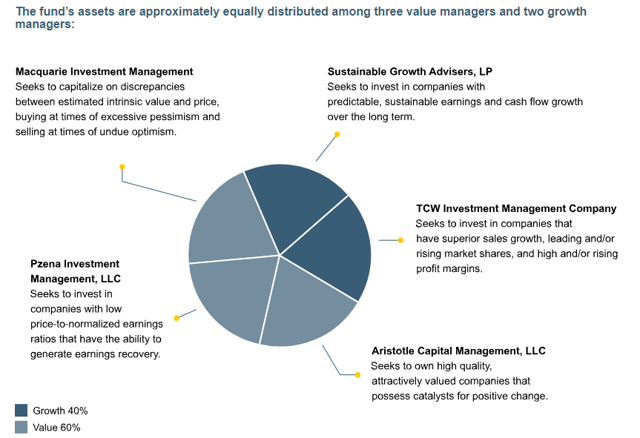

Although the Liberty All-Star Equity Fund (NYSE:USA) has done well since inception, we still have some reservations about it. (Note we will be referring to it as the All-Star Fund from now on in the interest of brevity). The All-Star Fund is true to its name and is a collection of five (hopefully) all-star fund managers. The breakdown for the fund is below:

(Graphic source: All-Star Fund website)

One of our main concerns about this fund, or any portfolio containing a large amount of diversified mutual funds, is that at some point you end up owning the index. One manager may be overweight one sector, another overweight a different sector, and soon everything cancels each other out and your portfolio just resembles an index fund albeit with higher expenses. Indeed, the fund has 158 holdings or about one third of the entire S&P 500 index.

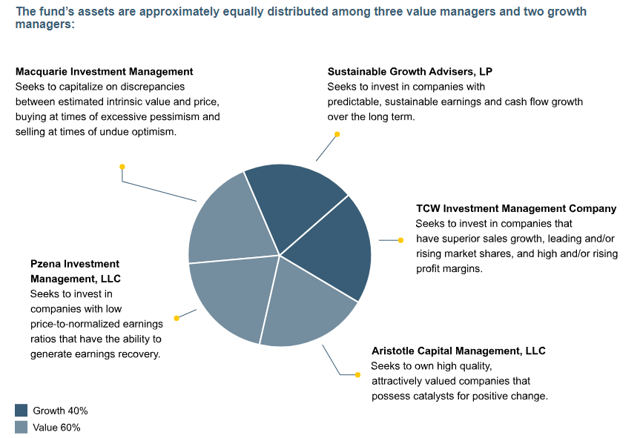

At first glance, the All-Star Fund looks like it might be an exception. Looking at the top holdings shows that the usual S&P 500 suspects are not there, and if they are, they are below their index weight (highlighted in red).

(Graphic source: Morningstar; highlights author)

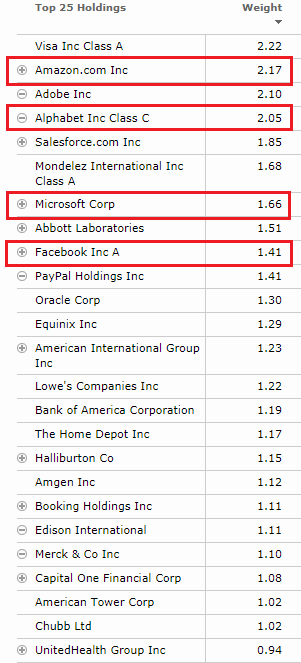

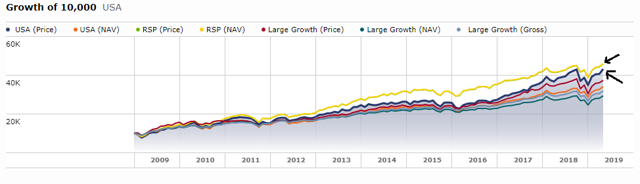

However, one thing stands out. The holdings all have very similar weights and the portfolio looks more like an equal weight index fund rather than a market cap weighted index fund. In fact when we look at past performance versus an equal weight fund, we chose the Invesco S&P 500 Equal Weight Fund (NYSEARCA:RSP), the performance of the All-Star Fund is slightly worse.

(Graphic source: Morningstar; highlights author)

The big question for investors is are you paying 1.01% in expenses for a portfolio that is substantially similar to lower cost index funds? However, for investors with taxable accounts, there is an even larger issue.

The All-Star Fund’s Distribution Policy

The All-Star Fund has a unique policy of paying out 10% of the fund’s net asset value per year. Its website explains the policy as follows:

The current policy is to pay distributions on its common shares totaling approximately 10 percent of its net asset value per year, payable in four quarterly installments of 2.5 percent of the Fund’s net asset value at the close of the New York Stock Exchange on the Friday prior to each quarterly declaration date. The fixed distributions are not related to the amount of the Fund’s net investment income or net realized capital gains or losses and may be taxed as ordinary income up to the amount of the Fund’s current and accumulated earnings and profits. If, for any calendar year, the total distributions made under the distribution policy exceed the Fund’s net investment income and net realized capital gains, the excess will generally be treated as a non-taxable return of capital, reducing the shareholder’s adjusted basis in his or her shares. If the Fund’s net investment income and net realized capital gains for any year exceed the amount distributed under the distribution policy, the Fund may, in its discretion, retain and not distribute net realized capital gains and pay income tax thereon to the extent of such excess.

As you may guess, the fund is generally not going to have dividend income and realized capital gains that amount to 10%. Therefore, a lot of the distribution is essentially the fund selling investments and incurring taxable gains it otherwise wouldn’t need to have incurred. Looking at the distributions made over the past five years, about 70% on the low end to a bit over 90% for a year on the high end were taxable gains (as opposed to non-taxable return of capital). By contrast, distributions from an equal weight index fund like RSP were only about 2% of the fund’s NAV (about equal to the dividend yield).

Summary

We have our doubts that it’s worth paying a 1.01% expense ratio for the All-Star Fund when it shares a lot of similarities with an equal weight index fund such as RSP which only charges .20%. Only you know your own financial circumstances and investment goals, so you have to make the final judgment on what investments will work best for your unique situation. However, we hope this article shows you what you are getting with the All-Star Fund and what some other alternatives might be. One thing we can say for sure is that if you have a taxable account, it’s highly unlikely this fund would make any sense.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News