[ad_1]

ktsimage/iStock via Getty Images

Investment Thesis

The biotech sector has suffered its largest bear market in its history. There are strong indications that this sector is reversing its trend and that now is a good time for initiating a long position in it.

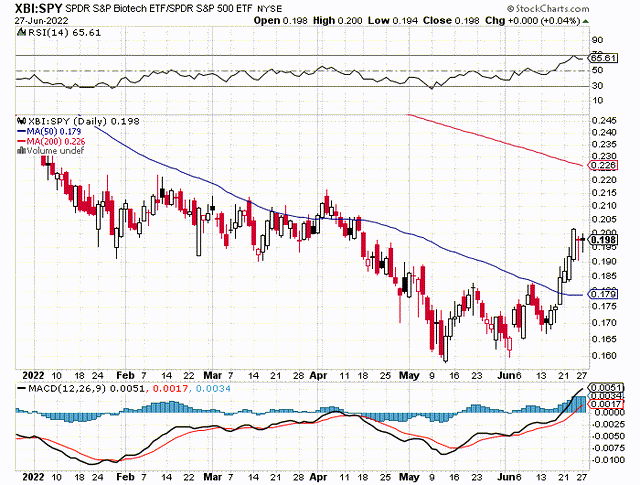

Biotech is one of the few industries currently outperforming the broad market. Its outperformance started in the middle of May, and it is now well established.

www.stockcharts.com

Biotech Sector – Long Term Trends

The biotech sector has very strong long term trends, displaying large changes in investors’ sentiment about this sector. See, as an illustration, the total return of XBI – the SPDR S&P Biotech ETF. From 3/2/2009 to 2/8/2021, XBI had an amazing return of 1,125%. During this 12-year long bull market, XBI had only four deep corrections in 2011, 2014, 2015 and 2018. Since its top on 2/8/2021, XBI has lost 64%, the largest drop in its history.

stockcharts.com

LABU And LABD Are 3X Leveraged Biotech ETFs

LABU and LABD were created on 5/28/2015. The daily returns of LABU are approximately 3X the returns of XBI. LABD is an inverse 3X leveraged ETF, and its daily returns are about -3X the returns of XBI.

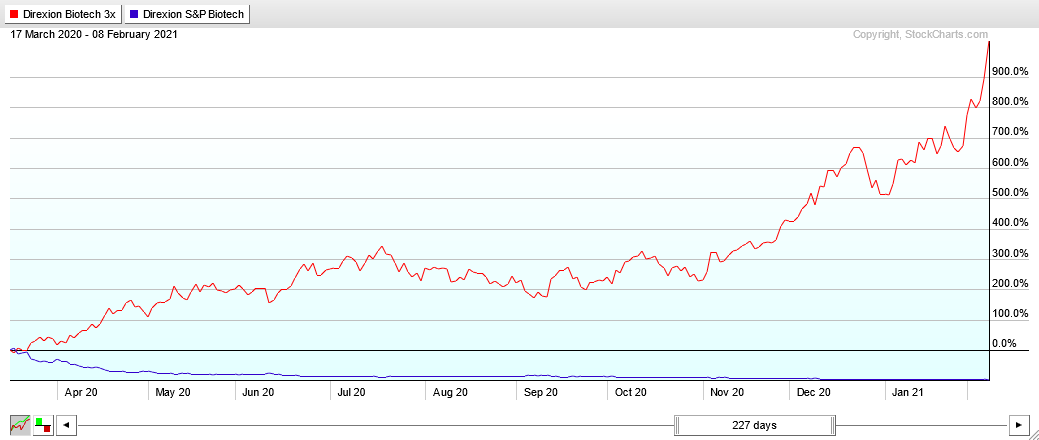

In the figure below, we see the total return of LABU (red) and XBI (BLUE).

stockcharts.com

If one invested in XBI and in its 3X leveraged LABU at LABU’s inception on 5/28/2015, today on 6/24/2022, that investor would have realized a return of -0.81% in XBI and a devastating loss of 95.12 in LABU. This is a classic example of why it is not recommended to invest for long term in leveraged products. As a funny addition, the same investment in LABD would have produced a loss of 99.44%, dropping a $1,000 initial investment to $5.60.

Although the 3X leverage factor is not reliable over long periods of time, it is still possible to realize big returns by investing in LABU and LABD during long term trends. We will show some hypothetical examples.

Returns Over 3/17/2020 – 2/8/2021 Uptrend

LABU: 1020.55%

LABD: -97.31%

50% LABU + 50 LABD: 923.24%

stockcharts.com

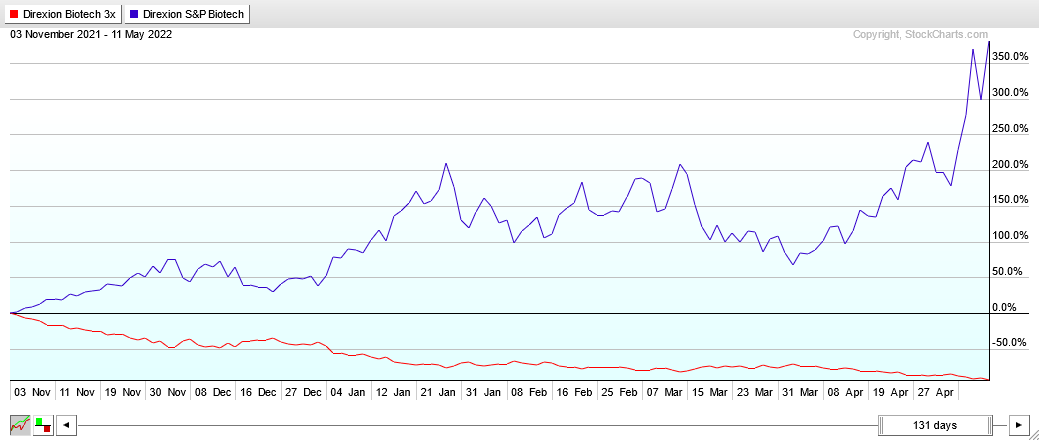

Returns Over 11/3/2021 – 5/11/2022 Downtrend

LABU: -93.02%

LABD: 381.36%

50% LABU + 50 LABD: 288.34%

stockcharts.com

LABU – Double Bottom

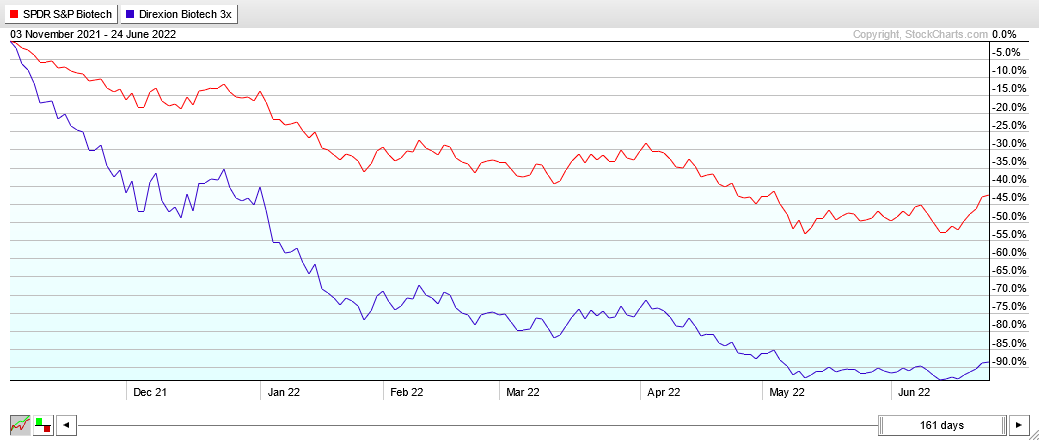

XBI and LABU made a double bottom on 5/11 and 6/13.

stockcharts.com

Over the last two months, the biotech sector exhibited a double bottom, and it is likely undergoing a major trend reversal. Over the last five trading days, from June 16 to June 24, the biotech ETFs made the following returns:

XBI: 20.46%

LABD: -46.14%

LABU: 69.73%

Risks

In addition to the risk of investing in equities during a broad market bear market, investing in inverse and leveraged funds presents considerable challenges.

Both LABU and LABD are 3X leveraged and have high expense ratios: 0.96% for LABU and 1% for LABD. Leveraged ETFs are also suffering higher losses during periods of high volatility in the markets.

Because of the high risks associated with inverse and leveraged ETFs, investing in LABU and LABD are not suitable for long term investing. They require close monitoring and quick corrective measures to avoid big losses of capital.

Conclusion

There are many ways of how one can play the Biotech sector’s long term trends. The easiest is to hold LABU when Biotech is in uptrend and hold LABD when Biotech is in downtrend. In this article, I presented examples when a correct/lucky selection of LABU or LABD would have produced outsized profits.

I showed that an alternative strategy of investing equally in LABU and LABD at the beginning of a new trend would have also produced excellent results.

LABU presents a profitable investing opportunity. LABU is a BUY.

Its inverse, LABD is a sell.

[ad_2]

Source links Google News