[ad_1]

Oleksandr Siedov/iStock via Getty Images

By Alex Rosen

Summary

We rate KraneShares CSI China Internet ETF (NYSEARCA:KWEB) a hold, given the broader global equity market outlook. However, we consider it a long-term buy, with the understanding that the path to prosperity in this sector is likely to be full of interim volatility.

No one can say for sure what the future holds. In February 2022, everyone was saying Russia was just bluffing and would never actually invade Ukraine – but it wasn’t. In the spring of 2020, Donald Trump said that COVID-19 would just disappear as summer approaches – but it didn’t. We can say that China would never dare invade Taiwan, and maybe we’re right. But if it does, the long-term implications – especially in the internet software and service sector – would be potentially catastrophic.

Strategy

The ETF offers investors access to a narrow but prominent segment of the Asian economy: Chinese technology stocks. As can be expected for an ETF that tracks Chinese internet activity, the largest holding is Alibaba (BABA) – the Chinese answer to Amazon (AMZN).

Proprietary ETF Grades

-

Offense/Defense: Offense

-

Segment: Non-U.S. Equity

-

Sub-Segment: China

-

Correlation (vs. S&P 500): Moderate

-

Expected Volatility (vs. S&P 500): Very High

Holding Analysis

KWEB’s equity portfolio has turned over much more rapidly than most equity ETFs we follow. Its historical turnover rate is 60%, which means that more than half the portfolio’s holdings change from year to year. However, the fund’s largest holdings have been more stable members of KWEB’s portfolio. In fact, just seven stocks make up about 50% of the portfolio. Two of those, Alibaba and Tencent (OTCPK:TCEHY), make up almost 20% of the total ETF’s assets, likely because the ETF has a 10% cap on any one holding. Otherwise, it would probably be larger.

Strengths

Over the last three decades, China has evolved from a base manufacturing country to developing one of the most sophisticated technology sectors in the world. Despite the recent macroeconomic shocks to China’s economy, it remains one of the world’s two economic superpowers. It will continue to be as it’s still a rising hegemon that has yet to reach the pinnacle of its supremacy. This confidence in China’s ascension is based in no small part by the tremendous growth in the internet software and service providers sector.

Weaknesses

KWEB essentially puts all its eggs in one basket. It might not benefit from economic strength in other sectors, and its tech sector is not particularly correlated to the U.S. tech sector, as one might think. As a result, KWEB’s correlation to the broad equity market is toward the low end of the universe of equity ETFs we follow.

Opportunities

As we see it, the broader Chinese economy’s loss is likely to be KWEB’s gain. Alternatively, this might all be saber-rattling in order to ensure full support from the “old guard” in China. It is said that out of chaos comes order. As such, regardless of which direction China goes, its digital sector is likely to continue to be a leader. And, with globally dominant firms such as Alibaba and Tencent – among other major Chinese internet companies – anchoring the holdings, KWEB has an opportunity to produce significant returns for patient investors.

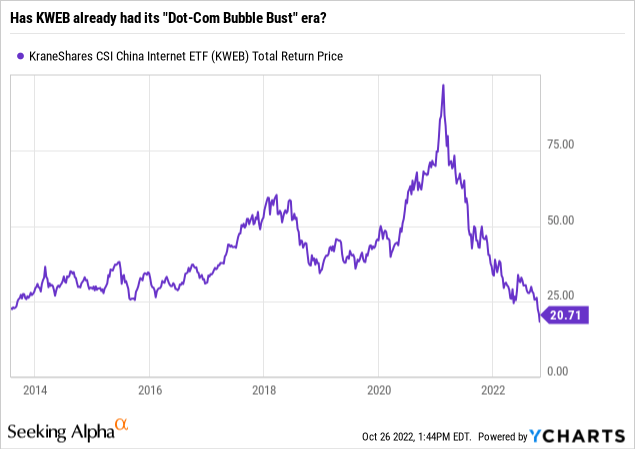

The chart below shows that KWEB now sells at its lowest price since the ETF debuted back in 2013. It has fallen about 80% since its early 2021 peak. While a price decline of that magnitude doesn’t happen by accident (there are fundamental and obvious geopolitical factors involved), as investors we do take notice when an ETF stacked with successful business is sitting on the long-term “discount rack.” This is the case with KWEB.

Threats

The Chinese economy appears to be trending downward, especially with the installment of Xi Jinping for a third term, who seems to be cracking down on dissension and thus stifling economic growth. Due to the strong dollar and global supply chain issues, the Chinese manufacturing sector is set to face a serious decline. As a result, sectors producing less tangible goods, such as the internet software and service providers sector, seem poised to take over as the dominant future industries for the Asian giant.

Currently, the Chinese markets are in deep turmoil as investors try to assess how the Chinese Communist Party’s five-year congress will play out. Xi has clearly consolidated his power and has yet to clarify in which direction he will take China, whether it be continued crackdowns on dissension that inhibit the flow of capital from Hong Kong or a full-scale invasion of Taiwan.

Long term, it is very difficult to see exogenous threats, as China has worked very hard to ensure its internet software and service providers sector is at the top of the “food chain.” In the short term, the greatest threats to KWEB are purely endogenous.

For example, the Russian energy sector was also seen as bulletproof, until the Russians started firing bullets. The greatest short-term threats would be if China decided to invade Taiwan. This could greatly upset the balance of power, and then all bets are off. KWEB would be a casualty of renewed or continued disdain for investment in China.

Proprietary Technical Ratings

- Short-Term Rating (next 3 months): Hold

- Long-Term Rating (next 12 months): Buy

Conclusions

ETF Quality Opinion

KWEB is made up of some of China’s strongest tech companies. In an investment landscape pitted with landmines, the simplicity of KWEB’s model makes it a very reliable option that should be able to hold its position regardless of external factors.

ETF Investment Opinion

For all the reasons laid out above, we value KWEB as a good addition to a broader portfolio. While the market might not have bottomed out yet, in the long run an ETF based on the Chinese software sector is likely to show sustained growth. Given what this ETF has shown the ability to do in past bull markets, it could again provide the kind of returns that can anchor an aggressive equity portfolio.

[ad_2]

Source links Google News