[ad_1]

pichet_w/iStock via Getty Images

By Matt Wagner

2021 was a disappointing year for emerging markets (“EM”) as an asset class. The MSCI Emerging Markets Index was down 2.5%, lagging MSCI ACWI by 21%.

For global asset allocators, there are a few key themes to consider for this year as it relates to EM:

- A high-inflation environment.

- Rising interest rates.

- The overhang of China regulatory risks/China slowdown under its “zero COVID-19” policy.

The WisdomTree Emerging Markets High Dividend Fund (NYSEARCA:DEM) – which outperformed the MSCI EM Index by 1,425 basis points (bps) in 2021 – may be well positioned for contending with these themes.

Theme 1: High Inflation

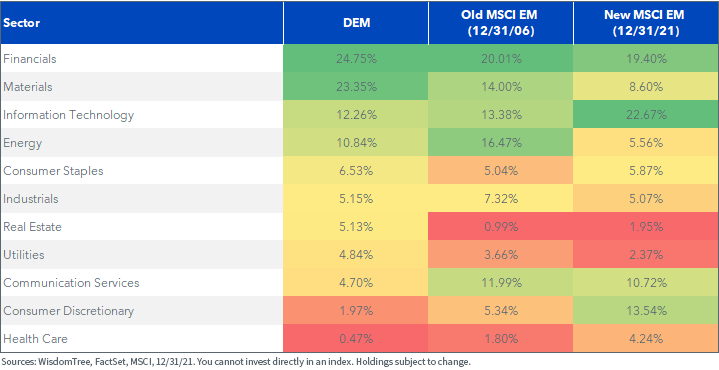

DEM is over-weight in the most inflation-sensitive sectors – Financials, Real Estate, Materials, and Energy – making it a prime candidate, we believe, for investors in search of inflation hedges.

Unlike the 2000s, the current sector weights of the broad MSCI EM Index skew more toward technology and tech-enabled companies, making it less of a beneficiary of a potential commodity supercycle.

Theme 2: Rising Interest Rates

As we’ve seen in recent weeks when high-growth names have come under pressure, growth stocks that derive more of their value from far-out cash flows are more negatively impacted by higher rates.

Conversely, value stocks that have higher current cash flows and pay out higher dividends are more positively impacted.

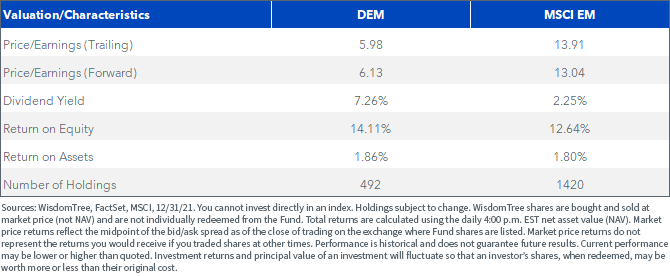

Out of all of WisdomTree’s ETFs, no product screens higher on value and income than DEM with its dividend yield more than 7% and a 6x price-to-earnings multiple.

Theme 3: China Risks

China’s regulatory crackdown on its large tech-enabled companies came as a surprise to markets in 2021. It’s possible that this risk is fully priced-in/appreciated by investors.

Nonetheless, concerns about the investability of Chinese companies – accentuated by U.S. government blacklists of Chinese companies – or merely concerns about the disproportionate weight of China in the MSCI EM Index (34%) have led some investors to search for “ex-China” solutions.

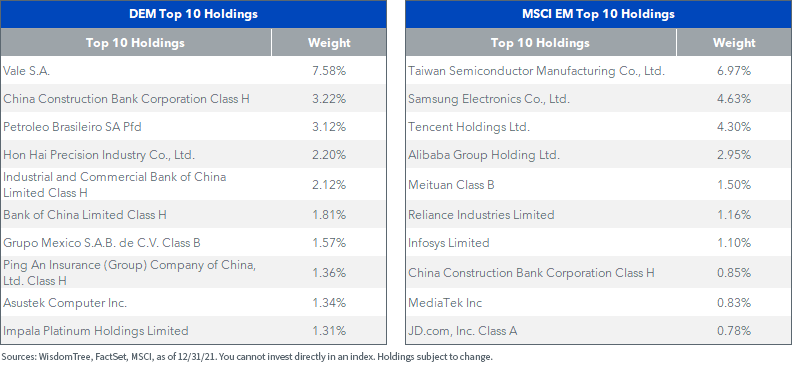

By screening on the high-yielding companies in the emerging market universe, DEM is naturally under-weight in the high-growth Chinese companies that have accumulated significant weights in the MSCI EM Index. On an aggregate country basis, DEM is under-weight in China by 9%, with a more modest 25% weight as of December 31, 2021.

With just a 15% holdings overlap to MSCI EM, DEM can be a useful complementary EM allocation to dial back exposure to China-tech headline risk or used in isolation to navigate the themes we’ve highlighted for this year.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing on a single sector generally experience greater price volatility. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation, intervention, and political developments. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Matt Wagner, CFA, Associate, Research

Matt Wagner joined WisdomTree in May 2017 as an Analyst on the Research team. In his current role as an Associate, he supports the creation, maintenance, and reconstitution of our indexes and actively managed ETFs. Matt started his career at Morgan Stanley, working as an analyst in Treasury Capital Markets from 2015 to 2017 where he focused on unsecured funding planning, execution and risk management. Matt graduated from Boston College in 2015 with a B.A. in International Studies with a concentration in Economics. In 2020, he earned a Certificate in Advanced Valuation from NYU Stern. Matt is a holder of the Chartered Financial Analyst designation.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

[ad_2]

Source link Google News