[ad_1]

Editor’s note: Seeking Alpha is proud to welcome Blue Sky Management as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Petmal/iStock via Getty Images

Introduction

The KraneShares California Carbon Allowance ETF (NYSEARCA:KCCA) is a compelling investment opportunity with high upside potential, significant structural downside protection, a cost-basis that is inflation-protected by design, supportive of ESG efforts, and uncorrelated to current equity markets. Normally, at this point, we wake up from our dream. However, we will demonstrate in this research report that this trade really does exist in the niche California Carbon Credit Market by purchasing KCCA to gain exposure to California issued CCAs (Carbon Credit Allowances).

This investment makes a lot of sense in contemporary markets where both equity and bond markets look bleak, considering imminent stagflation concerns and short-term interest rate hikes.

KraneShares California Carbon Allowance ETF

The KCCA ETF is relatively new and under-followed, yet represents the only way that retail investors can currently gain pure-play exposure to rising carbon credit prices in California. The ETF parent company is KraneShares, which has developed a variety of ETFs focused on Impact / ESG, Carbon, China, and global thematic trends. KraneShares unrolled KRBN, a majority European carbon market focused ETF in July 2020, which is up 136% since inception. To satisfy strong investor demand for a pure play ETF specifically for the California Carbon Market, which benefits from certain structural advantages that the European Carbon Market does not, KraneShares unrolled KCCA in October of 2021.

Since inception KCCA is up 3% and has traded mostly sideways with a short spike upwards in November 2021 after strong auction results. The ETF has historically traded consistently at NAV with no meaningful premiums or discounts, and holds current-year December dated futures contracts for CCAs. Investors can find more information about the specifics of the ETF on the KraneShares website here.

KCCA is benchmarked to the IHS Markit Carbon CCA Index, which tracks the most traded CCA futures contracts. The ETF specifically holds the CCA Vintage 2022 Future contract, and the associated identifier is CTIZ22 (Comdty). One can track the daily price fluctuations and market buy and sell orders of this futures contract here.

Given the strong fundamentals of the California carbon market that we will discuss in this report, this ETF offers retail investors the unique chance to gain exposure via an ETF that other funds and institutional investors cannot access, and that most retail investors do not understand the market for. KCCA has ~ $30mm in AUM, with a daily volume of ~ $1mm, making it too small and illiquid for even smaller investment funds out there.

What are California Issued CCAs

Essentially, California CCAs are tradable carbon emissions permits that were instituted by the government of California under a Cap-and-Trade system designed to reduce greenhouse gas (“GHG”) emissions by 40% (1990 levels used for reference) by 2030 in 2013. A single allowance legally allows a corporation to emit 1 ton of GHG into the atmosphere. Only “covered emitters”, such as utilities, refiners, industrial companies, etc., are required to purchase and return CCAs after emission. The government of California holds quarterly auctions for these allowances, at which emitters and financial sponsors can buy and sell allowances.

This is a significant system that covers ~80% of carbon emissions in the state of California. In order to achieve the CARB (California Air Resources Board) goal, emissions must drop 4.1% a year; thus, the cap of allowances issued per year will decline at this rate by program mandate. By implementing a rising minimum auction reserve price, as well as by decreasing the credits in circulation each year, the government aims to squeeze prices higher to incentivize businesses to find ways to decrease their emissions due to the growing expense of emission. Through these auctions California raises billions of dollars that they use to fund other climate initiatives.

All of this information is readily available on the California government website, and the government clearly describes their objective here:

The Program applies to emissions that cover approximately 80 percent of the State’s GHG emissions. Each year, fewer allowances are created and the annual cap declines. An increasing annual auction reserve (or floor) price for allowances and the reduction in annual allowances creates a steady and sustained carbon price signal to prompt action to reduce GHG emissions.

The Auction Reserve Price (ARP) is the minimum floor price that allowances can sell for at auction, and this increases annually by 5% + CPI: from 2021 to 2022, this ARP increased from $17.71 to $19.70 (6.22% CPI).

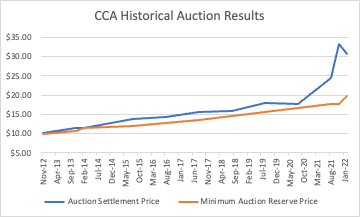

So far, through implementing a steadily rising minimum auction price and by steadily decreasing supply, the California government has been successful in their goal of creating a market structure that pushes the price of carbon credits up over time. We can see the effect of this practically by observing the trend of carbon prices over time at auction.

(Source: California Air Resources Board, found in “Summary of Auction Settlement Prices and Results” PDF)

Auction Pricing and Why CCA Prices Will Keep Rising

Since the program’s creation, CCAs returns in secondary markets have mostly mirrored the annual ARP return. This is because in the past, the program was in its early years where CCA supply was abundant relative to emissions and the ARP was relatively low. We believe that going forward, CCA returns and therefore KCCA returns will decouple from the ARP and actually be significantly higher, because in anticipation of government mandated rising prices and declining supply, market participants have begun to accumulate allowances at auction, causing an imminent future supply shortage. This has already started to happen, as can be seen from the sharp increases in California carbon allowance prices after August 2021.

We note that since 2012, every single current and advance auction has completely sold out except for two auctions: the May 2020 auction during the onset of the pandemic, and the recent February 2022 auction that occurred at the onset of the Russia-Ukraine war. We can see this practically in the graph above: the recent sharp increase in the price of CCAs seems to support the notion that, with the declining supply and annually rising price, the market is beginning to grow tighter, sharply pushing the price of credits higher. Corporations and financial institutions experience these price increases first-hand at auctions and are well aware of these facts; they have thus began hoarding credits in anticipation of these future supply crunches and higher prices. This excerpt is from a recent Bloomberg article published May 11th, 2022:

California’s system has faced oversupply. Companies have bought and held on to so many allowances—“banking” them for future use—that the state is in danger of missing its 2030 target of cutting emissions 40% below 1990’s level.

How are allowance prices and demand high, but emissions haven’t decreased?

Almost 10 years after “cap and trade” began, there is little evidence the system has had much of an impact on curbing GHG emissions. California has seen a decrease in greenhouse gas emissions, however these decreases have had little to do with the cap-and-trade system and actually have been due to other climate programs that are funded through the revenue the California government collects from selling allowances at auction.

What has happened over the last ten or so years is that the supply of outstanding allowances has not yet begun to contract, meaning that corporations have still not been sufficiently incentivized by higher prices caused by supply shortages to lower their emissions. This is why almost every auction has sold out and prices are sharply higher, and yet emissions are still not much lower.

To put into perspective how overaggressive the current system goal is, we can compare the program’s stated emissions goals with actual historical emissions decreases over the last several years. The cap-and-trade program aims for a 4.1% reduction in emissions per year, based on previous decarbonization trends. For reference, according to the California Greenhouse Gas 2000-2019 Emissions Trends and Indicators Report, in 2015 California statewide annual GHG emissions were 440 million tons of CO2e and 418 million in 2019, representing an annualized decrease of ~ 1.02% in emissions – well under the 4.1% necessary to meet CARB’s goal.

Going forward we think that this trend will continue. We believe there to be significant roadblocks to an over aggressive decarbonization goal and think that this has not been priced into current CCA prices. It seems that we are starting to reach a turning point where the demand for CCAs is likely to dominate supply because the bank of circulating, cheap, and readily available CCAs has peaked and is beginning to decline.

This has caused CCAs have begun to trade less in line with the ARP floor and more with regards to the “ceiling” price of CCAs. One can look at the historical graph of CCA prices above to verify this; from June 2020 to Oct 2021 CCA prices almost doubled. The CARB established two reserve tiers at which the price of CCAs is deemed high enough that additional supply can be injected into the market and a price ceiling at which unlimited supply can be issued. The current Tier 1 Price is $46.05, Tier 2 price is $59.17, and price ceiling is $72.29 and all of these also increase at a rate of 5% + CPI per year. Forward looking, assuming 3% inflation which is very conservative by the current CPI of 8.5%, the 2025 Tier 1 Price would be $58.01, representing a ~ 100% increase from the current auction settlement price of $29.15 (based on the most recent auction in February 2022), or a ~ 26% annualized upside assuming our thesis is only right to the Tier 1 price. Considering the downside as the ARP; currently at $19.70, assuming 3% inflation plus the 5% annual built-in increase we previously described, the 2025 ARP should be conservatively $24.82. This means that this trade has a maximum ~ 18% absolute downside over a three year holding period if CCAs were to somehow decrease all the way to the ARP, the absolute minimum.

Thus, we believe an investment in CCAs represents an extremely asymmetric bet that has significant structural downside protections with the ARP, and is well protected against inflation with the ARP’s adjustment for CPI.

Explaining the Recent Volatility

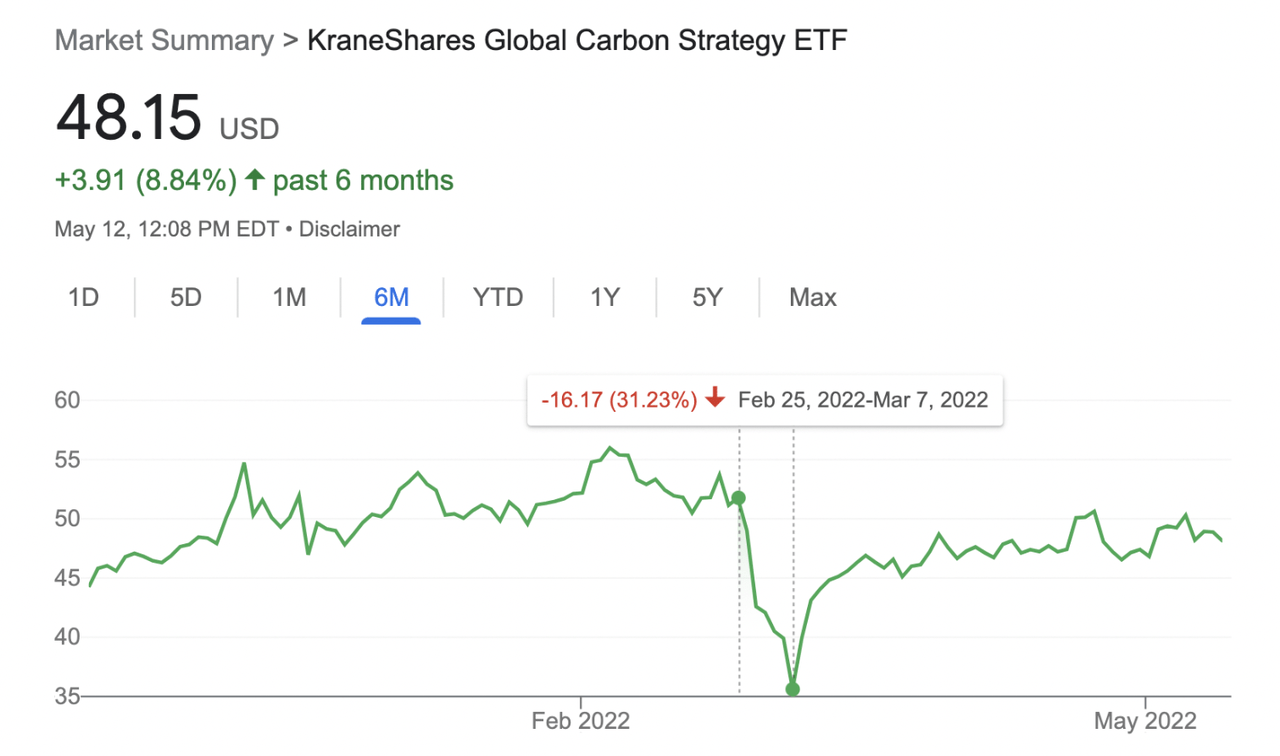

Investors may be concerned at the recent sharp, single week selloff that occurred in the price of the ETF starting Feb 25th, 2022. This corresponds to the invasion of Ukraine by Russia on Feb 24th. At one point the KCCA ETF was down 9% just that morning and almost 20% since the invasion, however it quickly rebounded to roughly pre-invasion levels.

One might ask why because what does California’s carbon market have to do with Europe’s? We recently had the opportunity to spend an hour talking with the managing director of KraneShares, Luke Oliver, who spent 20 years at Deutsche Bank heading up their ETF business. Based on our conversation and our own analysis, our summary explanation of the recent selloff is as follows.

After the Ukraine invasion, Russia was hit with many sanctions. Because of the banking and financial sanctions and general uncertainty over accessibility to foreign funds, Russians sold several of their offshore holdings and unwinded hedges. European carbon allowances are used by corporations and financial sponsors alike to hedge the rising cost of pollution in the case of a regression to fossil fuels in the event of high energy and oil prices. For this reason, there was a sharp selloff in the European carbon market, corresponding to a 31% decrease in the price of KRBN, the European carbon allowance ETF. Other countries in the EU dumped European carbon allowances over concerns about lower production output due to the war (lower production output corresponds to lower carbon emissions by businesses, leading to lower demand for allowances to offset said emissions) as well as general uncertainty regarding future prices. EU futures for carbon allowances tanked, which subsequently tanked the larger KRBN ETF which is roughly ~65% composed of European allowances with a smaller, ~25% exposure to California carbon allowances.

According to the parent company KraneShares, many larger, institutional funds and family offices own KRBN, but they like the structural protection and rising minimum price of the California market so they overweight it by also buying KCCA so that their California market exposure goes from say 25% to 50%. So, to keep their portfolios and exposure balanced in the proportion they desired, these funds had to also start dumping California credits when the EU market tanked to retain their optimal exposure ratio. Given that information, one would expect that the top institutional investor holders of KRBN should also be top institutional investor holders of KCCA: According to a FactSet crosscheck of top ownership for both KCCA and KRBN, 4 firms are top 15 holders of both ETFs: Summit Trail Advisors, The Robert Wood Johnson Foundation, Pekin Hardy Strauss Inc., and Jane Street Capital.

Additionally, the Feb 24th quarterly CCA auction happened on the day of the Russian invasion. This is why the advance credits did not fully sell and the advance auction price dropped from $34 in the November ‘21 auction to $18 now. We assume there was general consensus in the auction that a lot of uncertainty and potential price drops in the future with Russia meant no point buying advance credits at that point.

To summarize, the drop was caused by very technical short term selling when in actuality, fundamentally the price of carbon should be going up. LNG and Nuclear energy prices are going through the roof, so institutions will have to use coal more and carbon emissions will be greater. The current California auction price of $29 was actually higher in the latest auction than in Nov ‘21 at $28. KRBN, the Europe ETF, actually spiked once the invasion happened as traders understood that war meant higher energy prices, a backslide into coal, and higher emissions, but once Russia started dumping the market fell heavily.

Catalyst

In the short term, the catalyst is simple. There is not much variation in where CCAs trade on a day-to-day basis assuming no major geopolitical events like Russia-Ukraine happen. However, the price of the CCAs does often fluctuate significantly on auction days, as covered emitters look to reload and the state issues nearly 70% of supply. Thus, we believe over time that the catalyst are the auction days. Because of the relatively weird February auction, we believe that it is smart to buy before Wednesday, May 18th: the date of the next auction.

Going forward, given the rising minimum reserve price, increasing banking of credits and a government mandated annually decreasing cap of credits, we don’t see how California Carbon Credits and thus $KCCA cannot increase in price.

Possible Risks

We believe there are three main risks that could negatively impact the thesis, however we will explain why we feel that each is unlikely to materially affect returns over a long-term holding period.

Businesses leave California

Covered emitters tend to be capital intensive businesses: dairy farms, industrials, refiners, utilities etc. Rising CCAs might incur heavy short-term costs, usually moving operations across state lines requires significant capital investment. Furthermore, California is already a high tax state so these businesses likely have significant incentive to be in/stay in California.

CARB negatively modifies the program

In 2018, CA passed a 2045 carbon neutrality order showing that CA has only gotten more progressive on climate change. Considering the increasingly young demographic in California and that the original Cap-and-Trade law passed with recent bipartisan support. The revenue that the California government generates through this program has become essential to their budget for other preservation efforts such as protecting against deforestation, etc. which makes it unlikely they will adversely amend.

Companies and Funds Bank Allowances

Another short term risk to the CCA thesis is that recently covered emitters have been “banking” CCAs: meaning that they have been storing them as assets on their balance sheet. Essentially, because companies realize CCAs will drastically increase in price over the next 3-5 years, they are jumping the gun and stocking up on allowances now. Thus, as companies have recently begun to fill their respective “banks”, we could see a short term decrease in demand. This risk is mitigated by the auction data: at every auction except for extreme circumstances such as the onset of the Covid-19 pandemic and the onset of the Russia-Ukraine conflict, over the last several years every single auction has seen both current and advance allowances sell out. We think this means that while some corporations are early and are beginning to bank credits, there is still significant demand at auctions from corporations who haven’t done the same. Over the long term, we think this just further suggests that our CCA thesis is correct and corporations have realized that. On May 10th, 2022, the California government announced that “It is likely that the existing bank of 310 allowances will be needed over the early part of this decade and will be exhausted by the end of the decade. During the same period, prices for allowances will continue to increase at least 5 percent plus inflation year-over-year, sending a steadily increasing price signal to spur investment in onsite reductions for covered entities”

Conclusion

To conclude, we have attempted in this report to break down the Californian Cap-and-Trade program into an easy to understand system and explain why we think Californian carbon prices are extremely likely to rise in the future. Based on our analysis we are very confident that California carbon allowance prices will continue to rise over the next 3-5 years. We think this for two main reasons: the first is that we do not see Californian companies reducing their emissions enough in the near term to reduce the demand for these credits. This is demonstrated through a comparison of the publicly available state-wide CO2e yearly emission data with the CARB’s published CO2e emission reduction goals, and also by observing that auctioned credits completely sell out each quarter. The second main reason we think that allowance prices will continue to rise is that the structure of the auction makes it almost impossible for them not to. The Californian government has made it extremely clear that they have designed the auctions in a way that forces prices to increase over time, and we believe the best way to take advantage of this is by purchasing KCCA, an ETF that gives owners exposure to this market by holding futures contracts on carbon credits.

By owning KCCA over a three year period, an investor receives all the benefits of a seemingly imminent rally in carbon prices while also losing very little of their investment in the event of a collapse or prolonged recession in the carbon market. They also own a security with zero correlation to any major indices and one that also acts as a buffer against inflation because of the way the minimum auction reserve prices account for CPI in their yearly increase calculation.

We recommend purchasing at current prices. In light of our analysis of the perpetually rising auction reserve price, we also recommend adding to the position on any short term price decreases, such as the Russia-Ukraine conflict, as we see them as good opportunities to accumulate with the safety of having a rising minimum auction price as a tailwind.

[ad_2]

Source links Google News