[ad_1]

Muenz/iStock via Getty Images

Just because there’s tarnish on the copper, doesn’t mean there’s not a shine beneath – Laurence Yep

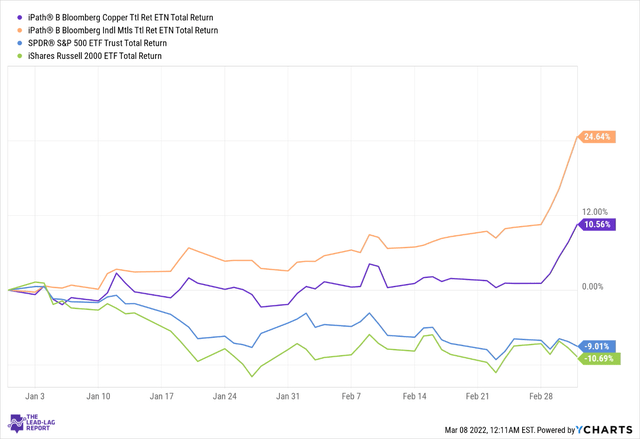

Supporters of The Lead-Lag Report would note that I’ve previously researched and written about some of the attractive dynamics in the industrial metals segment. Incidentally, at a time when US equities have been taken to the cleaners (for instance, the S&P500 is down by 9% and the Russell 2000 is down by double-digits this year), an ETN tracking industrial metals (JJM) is up by ~11% during the same period. If you thought that was good enough, what is one to make of the iPath Bloomberg Copper Subindex Total Return ETN (JJC) which has provided returns that are 2.5x better than even JJM?

YCharts

Evidently, there’s a lot to like about Doctor Copper. What’s driving this and what’s in store?

Before I touch upon conditions in the copper market, I also just want to reiterate that JJC is a product that does not offer direct exposure to physical copper, but rather, its movements are linked to an index that tracks copper futures contracts.

Copper landscape

Twitter

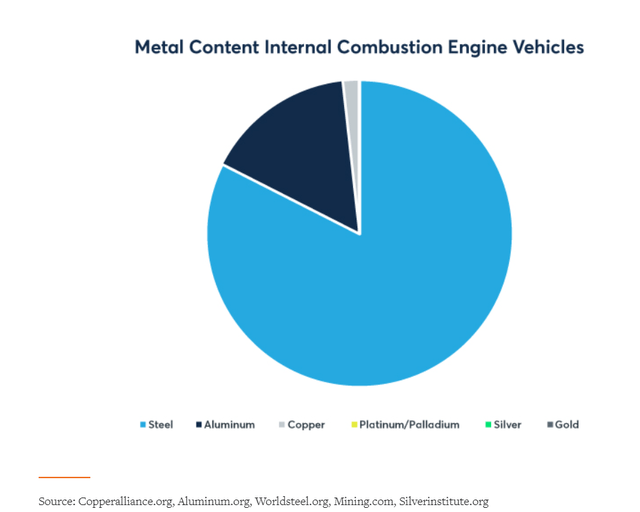

As highlighted last year in The Lead-Lag Report, copper’s long-term allure is being driven by a deeper thrust into renewable energy (integral component of wind turbines, solar panels) and the ongoing pivot from ICEs to EVs. There are a lot of naysayers out there questioning if we could achieve net-zero greenhouse gas emissions by 2050 but if you’re a glass-half-full person, you’d know that whilst this is likely to be challenging, it isn’t an outlandish target. If we are to transition to a low-carbon landscape, expect copper to be a fundamental cog in this broad transition.

Reuters

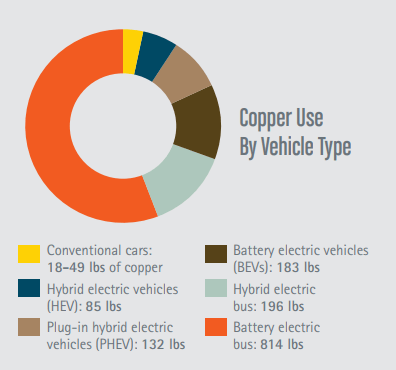

Just take EVs for example. Your traditional ICE uses a very limited amount of copper, estimated to be anything between 18-49lbs; with EVs, copper is used across the board, be it the wiring, the motor, the battery, the inverter, the associated charging station, etc., due to its strong conductivity and efficiency qualities. In effect, the amount of copper used across the EV spectrum can range from 85lbs- over 800lbs (in the case of battery-electric buses).

Copper Development Association

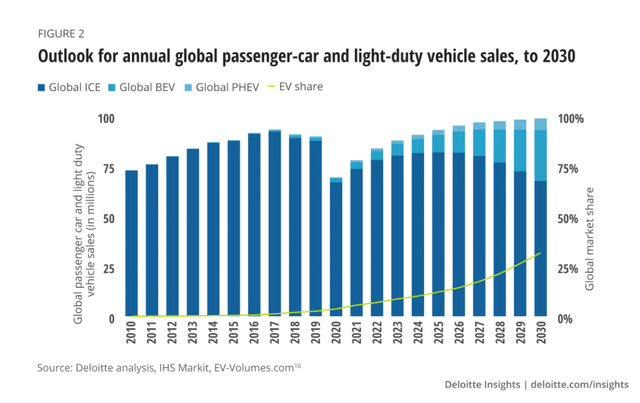

During the current decade, EVs are poised to grow at an impressive CAGR of nearly 30% even as the EV share gradually inches up to 32% by the end of the decade.

Deloitte

Then you have China, which is of course the largest consumer of the metal. Given some of the challenges since 2021, people are questioning if the Chinese economy will have the necessary appetite for commodities, but recent evidence suggests that copper still has ample clout. Whilst recent Chinese import numbers for this year showed a dwindling appetite for the likes of coal, iron ore, crude oil, and natural gas, that wasn’t the case for copper. Unwrought copper imports for the first two months of the year rose by 9.7% whilst those of ores and concentrates rose by 10.2%. Besides this, recent reports emerging from China imply that the country will be coming out with renewed stimulus programs that should help address any demand-side pressures.

Bloomberg

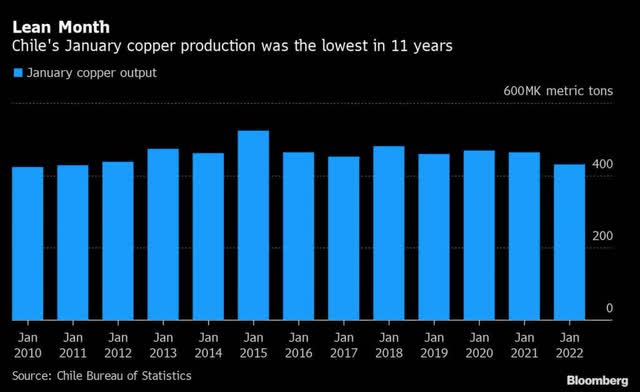

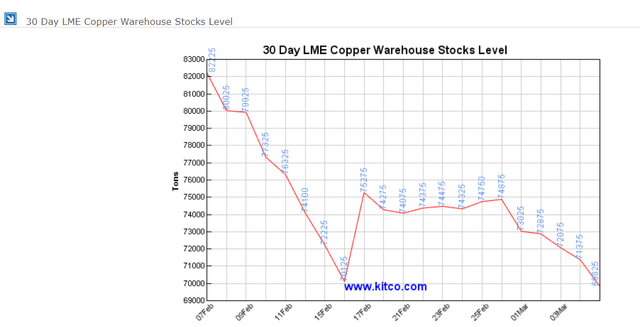

On the supply side, it does not also help that the world’s largest copper mining nation- Chile was hampered by issues such as water scarcity and weak ore quality. This consequently saw Chile’s latest monthly production decline by 7.5%, a remarkably weak number when you consider the historical track record. Besides, Chile’s production woes, you also have a situation where LME registered copper inventory is currently only at 69800 tons, the lowest since 2005.

Kitco

Conclusion

Things are no doubt heating up in the copper market but it would be unrealistic to expect this immediate price surge to sustain well into H2; I would expect to see some pullback in the prices of the commodity as we progress through the year.

Firstly, note that after only having grown by 2.1% in 2021, copper mine production will likely ramp up over the next two years growing by 3.9% and 4.6% respectively. Besides after having seen a deficit of 42000 tons last year, we will likely see a sizeable surplus of 328000 tons this year followed by an even larger surplus of 496000 tons.

Then those of you who follow The Lead-Lag Report would note that last year I had highlighted the X factor of China’s strategic mineral reserves (Citigroup believes China holds around 2m tons of copper). This is something that could come into play this year as well if the country chooses to cash in on elevated prices. The added supply could weigh on copper prices.

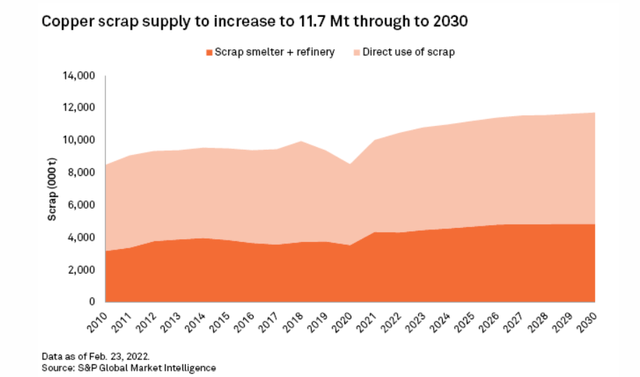

Twitter S&P Global

Finally, I’d also like to highlight the underappreciated aspect of copper recycling from end-of-life products and process-generated scrap. Whilst it may not necessarily be a game-changer (S&P Global expects copper scrap supply to increase to 11.7MT by the end of this decade from current levels of 10MT), it could potentially help reduce the global dependence on primary ore and help keep a lid on the long term trajectory of copper prices.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

[ad_2]

Source links Google News