[ad_1]

(Source: Pexels)

Earlier this week, I created a relatively simple model for industry valuations that used equity risk metrics like volatility and systemic exposure to estimate a fair P/E valuation for the given industry. Out of the 200 industries in my database, airlines came in at second best value-for-risk just behind residential construction (ITB). One of my favorite ways to invest in airlines is through the U.S. Global Jets ETF (JETS).

The harmonic average P/E valuation for the airline stocks I looked at was 9X, while the fair value estimate was 14.1X. This implies that airlines, as a whole, are trading over 50% below fair value.

Indeed, global economic risk exposure is high for airlines stocks – but not high enough to make it one of the cheapest industries. Even better, a hedged trade like long airlines-short aerospace may make for a profitable pairs trade that is hedged against the global economy.

Labor issues and Max 8 fears are likely to subside in months to come. While global economic fears are high, consumer confidence and spending remain strong. Solvency was a major concern for airlines following the last crisis, but many of these airlines have been deleveraging. Simply put, valuations are far below reasonable for airlines, and strong industry outperformance can be expected.

The U.S. Global JETS ETF

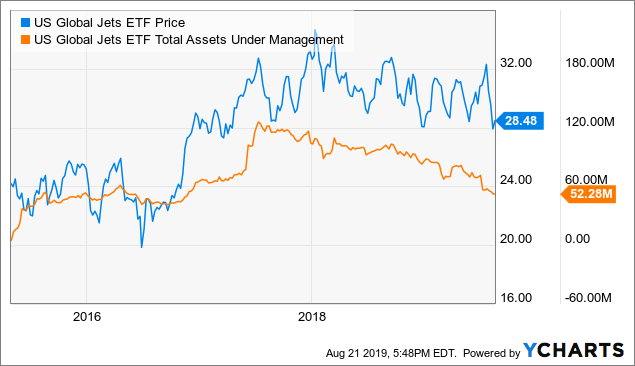

Before I dig into my directional view on a given ETF, I like to go over what exactly it holds and its liquidity situation. The U.S. Global Jets ETF has been trading since 2015 and has net assets under management of $52 million. This is a sign that the fund is liquid enough for most people, but not enough for large volumes of money.

Let’s take a closer look at JET’s AUM to see what fellow investors are doing:

Data by YCharts

Data by YChartsHere we can see that JETS has been trading in a tight range since making a high in 2018. Since then, the fund has bounced between $28.5 and $32 and is currently at the $28.5 support level. This indicates that now may make for a good possible buy point.

We can also see that AUM has been steadily falling, while performance has been flat. This a signal that our fellow investors have been relatively bearish on the fund. As a contrarian-minded investor, this is what I love to see.

Due to this market-cap stagnation, the ETF is currently trading at a very low weighted average P/E ratio of 10X. We will dig in more closely to these financials, but it seems clear that JETS has been the target of increasingly negative expectations.

Foreign Airlines Big Winners

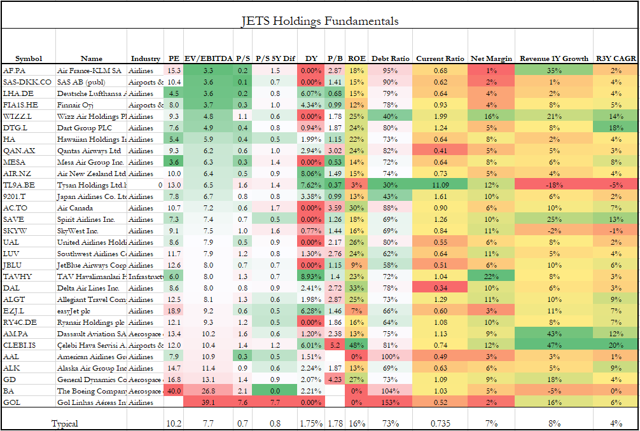

Let’s dig deeper into the fundamentals of these companies to see if there are any major financial risks that help explain their low valuations. To do this, I simply created a list of the companies held by the fund and found their fundamentals.

See below:

(Note: “Typical” denotes median values for each column)

(Data source: Unclestock)

Overall, we can see that most of these airline stocks have very low valuations with a median of 10X (which equal to that of the fund). We can also see that EV/EBITDA multiples are at a very low 7.7X for the typical firm and the holdings are trading 20% below their five-year average price-to-sales ratio. Clearly, investors expect very poor future earnings, particularly for foreign airlines like Lufthansa (OTCQX:DLAKY), which trades at a P/E of 4.5X.

Now, these companies do have some financial red flag risks. We can see that quite a few of these companies are burdened by high debt and that most do not carry an adequate cash balance, as seen by the low current account measurements. That said, in this low interest rate world, companies can safely carry higher debt burdens than they could in 2008. Further, solvency has been improving for most, and median ROE is quite high at 16%, which indicates that the market value of assets is likely above book value.

Airlines as a whole almost went bankrupt in 2008. As with most of the industries that almost went bankrupt then, investors have been too nervous since. As recession fears are on the rise again, investors seem to have a knee-jerk selling reaction to industries that underperformed in 2008, even when the fundamental risks of those industries have been largely fixed. This is seen to an extreme in airlines, home construction, and banks (KBE).

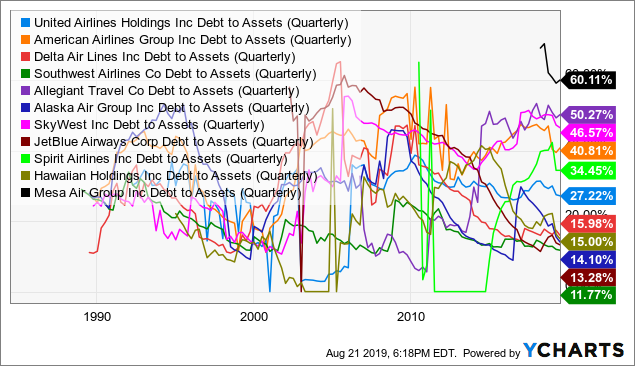

Take a look at debt-to-assets for the U.S. airlines since 1990:

Data by YCharts

Data by YChartsAdmittedly, this is not as clean a chart as I’d like, but it shows the cycles of U.S. airline leverage well. We can see that airlines levered up in the early ’90s and then fell until the 2000 recession. After that, they rose until 2008 and have fallen dramatically since for most of the airlines.

Most likely, as the next recession occurs, investors will be shocked by JETS, as it outperforms the S&P 500 due to its healthier balance sheet. Accordingly, they will see JETS as a safe investment and may even allow for renewed leverage expansion over the next bull cycle. This will most likely be to the benefit of equity investors.

U.S. Consumer Demand Still Strong

For this section, I’ll focus on the macroclimate facing the U.S. airlines, though the arguments hold true for the European airlines as well. Airlines need low oil prices and strong consumer demand to perform well. They already have low oil prices, and consumer strength may continue to surprise the markets.

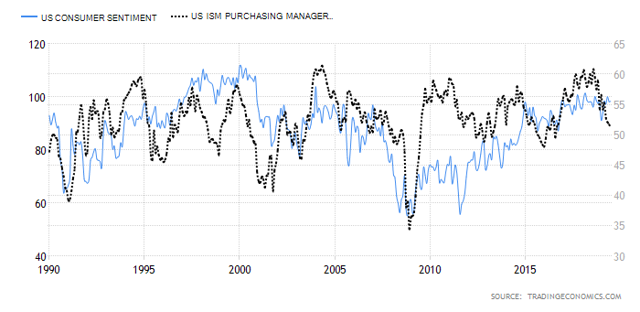

When I review my leading economic indicators, I have been noticing an interesting divergence between labor and business. Business confidence and manufacturing is far more negative than consumer confidence and retail spending. Many analysts take this to simply mean consumer confidence is too high and will fall toward business confidence. On the other hand, consumers may truly have the economic upper hand.

Take a look at U.S. consumer confidence vs. business confidence (right axis) since 1990:

(Source: Trading Economics)

We can see here that consumer sentiment has remained near all-time highs, while business confidence is fading. This should be supportive for airlines because it is a sign than ticket demand will stay strong, while input prices, like oil, may fall due to a manufacturing downturn.

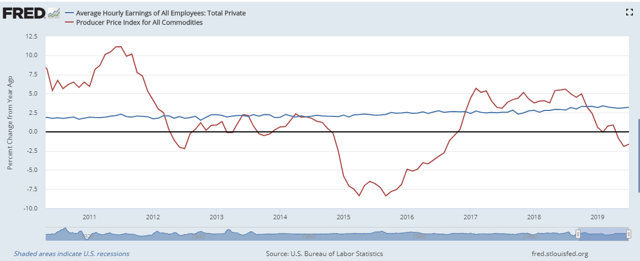

To see this from another angle, take a look at wage inflation in blue vs. commodity producer prices in red. The further the blue line is above the red line, the higher the likely future profit margins for airlines:

(Source: Federal Reserve Economic Database)

Since the recession, wage inflation has steadily climbed from 1.7% in 2010 to 3.2% today, while producer prices are once again falling.

The macroeconomic conditions are supportive of JETS in both the long and short run. In my opinion, the next downturn will look nothing like the last and a large downturn in consumer demand (i.e., large rise in unemployment) is less likely.

Of course, if the global economy continues to weaken, JETS will almost definitely decline, though less than many expect. As I’ll explain in the next section, even that global economic exposure can be hedged away.

Actionable Trade Idea

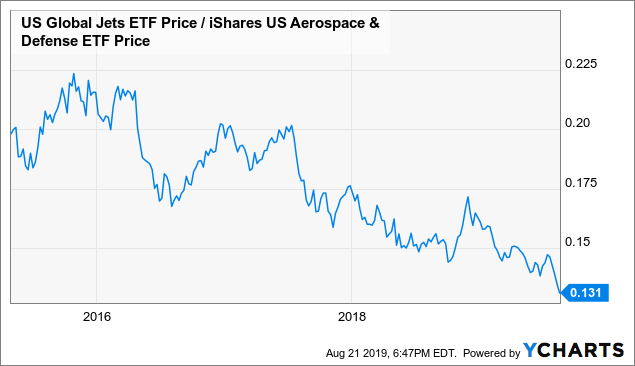

I always like to leave my readers and subscribers with actionable trade ideas. Specifically, those that are designed to deliver maximum alpha through risk hedging. In my opinion, the best way to bet on JETS is by going long JETS-short the iShares U.S. Aerospace & Defense ETF (ITA). Why? Because both funds are subject to similar economic exposure, but valuations and financial risks are much higher for aerospace firms.

For example, if you look back to the “fundamentals by holding” table, you’ll find that the most expensive U.S. companies in JETS are Boeing (BA) and General Dynamics (GD), which are aerospace firms that snuck their way into an airline ETF.

Take a look at the pair trade’s performance over the past few years:

Data by YCharts

Data by YChartsNow, I know most investors prefer not to catch falling knives, but I expect this downtrend to end soon. In my opinion, this is a great buy point for the ratio because it is currently at the bottom of its channel. This is a sign that short-term performance is likely to be positive. Time will be the ultimate judge, but I would not be surprised if the long-run trend ends or reverses over the coming year.

Overall, I’m bullish on JETS, but because I am bearish on the equity market as a whole, I will refrain from giving a price target now. That said, I expect the JETS/ITA pairs trade to rise to 0.15 by year-end, or a 15% return. This is a bit high, but it appears that JETS is at least 40% undervalued and ITA is 20% overvalued. As a result, the pairs trade has a 60% project rise to 0.20 before the funds are at fair value.

Interested In Closely Following Global Events?

“The Country Club” is a dedicated service that focuses on single-country and regional ETFs with the goal of helping our subscribers diversify globally and get a better grasp on how world events will affect their portfolio. We will certainly be providing subscribers further updates on this idea.

Subscribers receive exclusive ideas, model portfolios, and a wide range of tools including our exclusive “Country Club Dashboard” which allows them to visualize global financial and economic data. If you haven’t already, please consider our 2-week free trial and get your passport to global markets today!

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in JETS over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News