[ad_1]

peterschreiber.media/iStock via Getty Images

(This article was co-produced with Hoya Capital Real Estate)

Introduction

brainyquote.com

If investing could be so simple! This year is more like the Chinese proverb: “May you live in interesting times!”. The JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI) is a well-covered ETF; twice by me. The SPDR S&P 500 Trust ETF (NYSEARCA:SPY) is well known to seasoned investors, even those who would never consider owning an Exchange-Trade-Fund (ETF), especially one that is based on an index.

Most previous articles concentrated their analysis either on JEPI’s structure and use of Equity-Linked-Notes (article link), or its appeal to yield investors, with a comparison to other competing funds (article link). I will leave it to interested readers to check out one or both of those articles. Growth investors buy SPY for its superior Total Return; yet 2022 is bringing that “fact” into question.

While I will review both ETFs, I will focus on factors beyond return and yield so readers can decide if JEPI has a place in their allocation as a substitute for some (not all) of their allocation to Large-Cap US stocks.

Reviewing the SPDR S&P 500 Trust ETF

Seeking Alpha describes this ETF as:

SPDR S&P 500 ETF Trust is managed by State Street Global Advisors, Inc. The fund invests in public equity markets of the United States. It invests in stocks of companies operating across diversified sectors. The fund invests in growth and value stocks of large-cap companies. It seeks to track the performance of the S&P 500 Index, by using full replication technique. SPY was formed on January 22, 1993.

Source: seekingalpha.com SPY

SPY has $385b in assets, the largest ETF by AUM. The current yield is 1.4%. The managers charge 9bps in fees, which is becoming a high level for index-based funds: Vanguard’s equivalent ETF is at 3bps; Fidelity’s is even less.

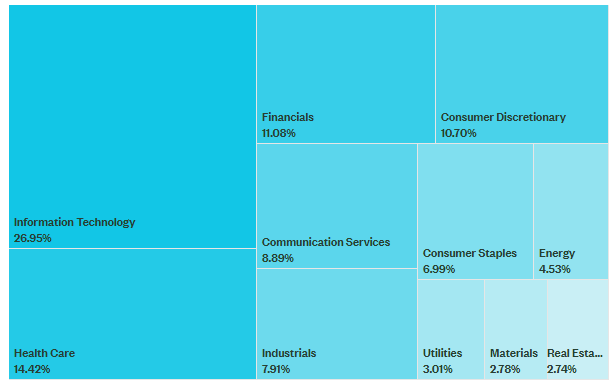

SPY Holdings review

saga.com

Even with the Tech meltdown of 2022, currently at 25%, Information Technology stocks are still the largest allocation, almost twice the weight of the next largest allocation, Health Care stocks. One of the best sectors in 2022, up 36%, is Energy but its weight is only 4.53% even with that performance.

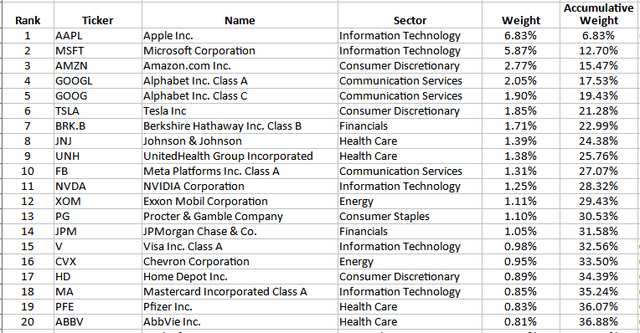

Top 20 Holdings

ssga.com; compiled by Author

SPY holds 505 stocks but the above stocks will drive its performance as they account for almost 37% of the portfolio. On the positive side, seven sectors are represented.

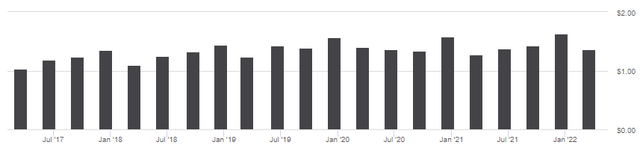

SPY Distribution review

seekingalpha.com SPY DVDs

Seeking Alpha gives SPY an overall grade of “A-“, though most of the sub-category grades are in the “C” range. Payouts are 100% qualified dividends.

Reviewing the JPMorgan Equity Premium Income ETF

Seeking Alpha describes this ETF as:

The JPMorgan Equity Premium Income ETF is managed by J.P. Morgan Asset Management, Inc. The fund invests in public equity markets. The fund invests directly and through other funds in stocks of companies operating across diversified sectors. It invests in volatile stocks of companies across diversified market capitalization. It invests in stocks of companies that are deemed socially conscious in their business dealings and directly promote environmental responsibility. JEPI was formed on May 20, 2020.

Source: seekingalpha.com JEPI

JEPI has $4.2b in assets and provides investors with an 8.4% yield. The managers charge 35bps in fees; in line with other actively-managed ETFs. What make JEPI different from most other high-yield equity funds is their use of Equity-Linked-Notes, or ELNs.

What Is an Equity-Linked Note?

An equity-linked note (ELN) is an investment product that combines a fixed-income investment with additional potential returns that are tied to the performance of equities. Equity-linked notes are usually structured to return the initial investment with a variable interest portion that depends on the performance of the linked equity. ELNs can be structured in many different ways, but the vanilla version works like a strip bond combined with a call option on a specific security, a basket of securities or an index like the S&P 500 or DJIA. In the case of a note linked to an equity index, the security would typically be called an equity index-linked note.

In the simplest form, a $1,000 5-year equity-linked note could be structured to use $800 of the fund to buy a 5-year strip bond with a 4.5% yield-to-maturity and then invest and reinvest the other $200 in call options for the S&P 500 over the 5-year life of the note. There is a chance that the options will expire worthless, in which case the investor gets back the $1,000 initially put in. If, however, the options appreciate in value with the S&P 500, those returns are added to the $1,000 that will eventually be returned to the investor.

Source: investopedia.com ELNs

Along with earning option premiums embedded in the ELNs, JEPI expects the ETF to achieve lower volatility than SPY generates for its investors. We will look to see if that has occurred when the funds are compared later in this article.

JEPI Holdings review

While JEPI benchmarks against the S&P 500 Index, it only holds about 100 of the 500 stocks. Their Summary Prospectus outlines the process used to pick the best stocks to own outside of what the ELNs might invest in. These were the major points:

- The adviser ranks companies according to what it believes to be their relative value. The adviser’s valuation rankings are produced with the help of a variety of models that quantify the research team’s findings.

- The adviser often considers a number of other criteria, such as improving company fundamentals; impact on the overall risk of the portfolio; high perceived potential reward compared to perceived potential risk; and possible temporary mispricing caused by market over-reactions.

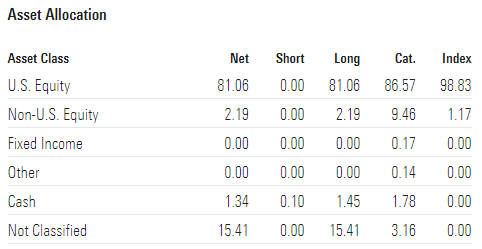

morningstar.com JEPI Holdings

The “Not Classified” includes the ELNs.

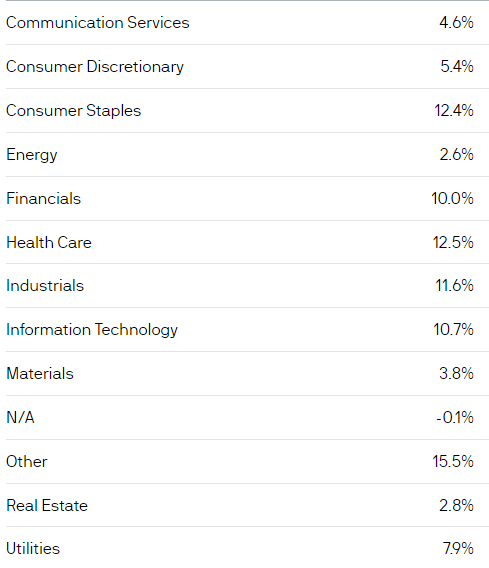

The sector allocation is this:

am.jpmorgan.com

I will compare these to SPY’s allocations later but it’s obvious no sector dominates JEPI like SPY has. If the ELNs were a “sector”, it would be the largest one.

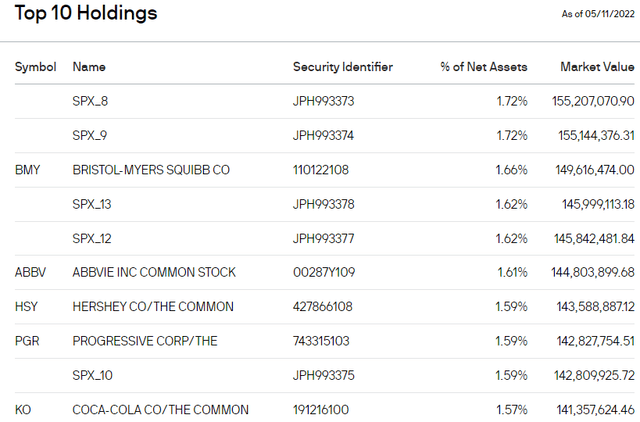

am.jpmorgan.com

Currently they hold 12 Equity Linked Notes (the SPX names), which account for about 15.5% of the portfolio. The semi-annual report (12/21) listed the ELNs were spread across seven different banks, all well-known large institutions. In total, JEPI holds 117 positions.

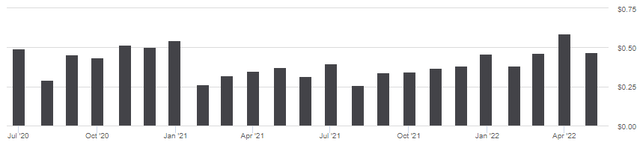

JEPI Distribution review

seekingalpha.com JEPI DVDs

JEPI’s overall dividend grade is “A+” but its short history prevents grading most of the sub-categories. Despite option activity inside the ELNs, which can generate ROC distributions, all data indicates 100% of the payouts are from Net Investment Income, like SPY.

Comparing ETFs

The two ETFs are commonly compared by return and yield, and I will do those too, but I include other factors that might influence which fund to overweight within a portfolio as there is a place for both ETFs in most investor portfolios.

Return

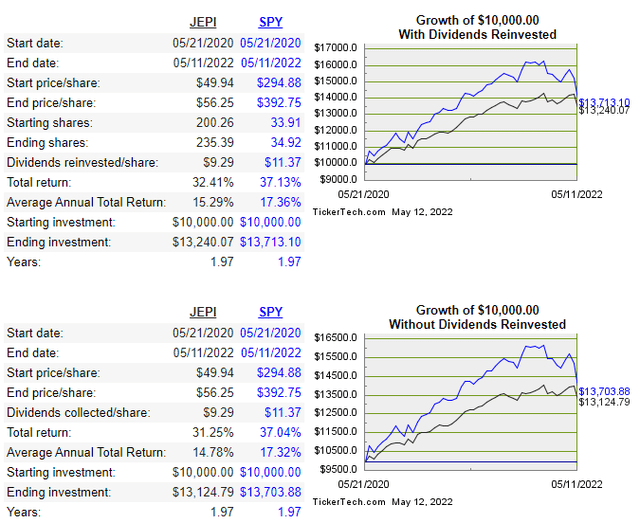

I will do this in two ways. The first set of data assumes dividend reinvestment; the second does not.

Drip Returns Calculator (Dividend Channel)

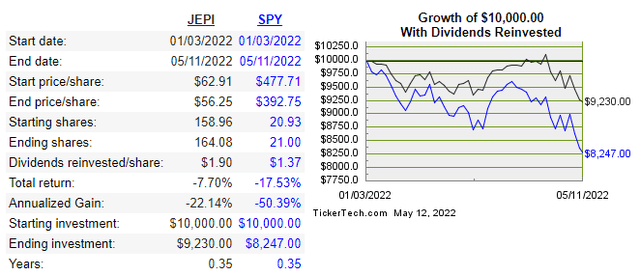

Over JEPI’s two-year life, SPY provided a better return in either case, though the gap is wider for those JEPI investors who took their payouts. To show how the market matters even for these two ETFs, the next chart shows only 2022 data. Here, JEPI is the clear winner.

Drip Returns Calculator (Dividend Channel)

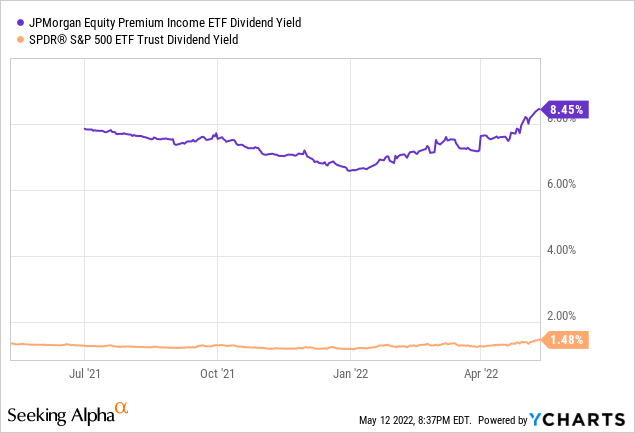

Yield

The data is limited as YCharts uses annualized data. The above is no surprise as JEPI uses the ELNs to generate income for its investors.

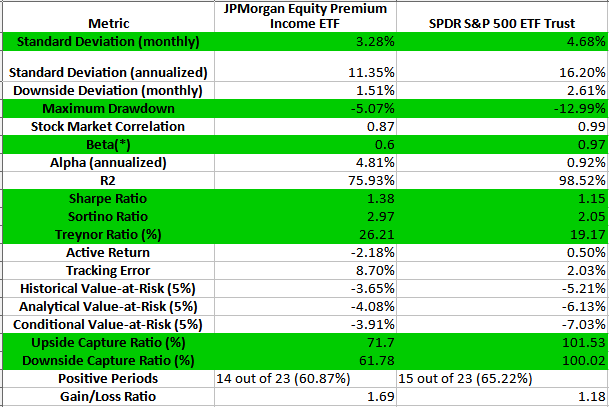

Risks

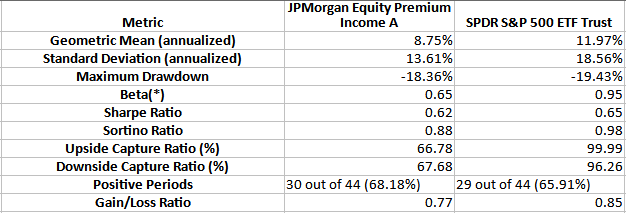

PortfolioVisualizer.com; compiled by Author

The ones highlighted in Green are the data points I am most familiar with and every one of them shows JEPI is the less risky investment. Of course, the 71.5% versus 101.53% Upside Capture, while it dampens volatility, means JEPI is missing out on 30+% of the bull market movements!

Economic Exposure

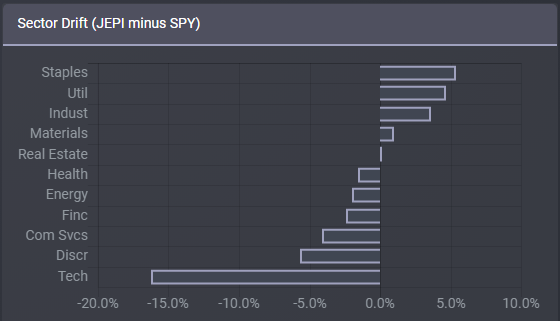

By this, I am mainly referring to the differences in sector weights as SPY owns every stock in JEPI’s portfolio, but the allocations vary widely.

ETFRC.com

JEPI’s large underweight in Technology stocks compared to SPY has been a key reason for its outperformance so far in 2022, and a reason behind SPY being better over the past two years as the market took off from the COVID-19 bottom, which occurred before JEPI launched.

A longer look changes some evaluations

JPM has a mutual fund which dates back to 8/31/2018: JPMorgan Equity Premium Income Fund Class AA (JEPAX). This mutual fund and the ETF own the same assets and show the same results since JEPI started, which allows for a second SPY to “JEPI” evaluation.

PortfolioVisualizer.com; compiled by Author

The two ratios that switched to favoring SPY using the longer life of JEPAX were the Sharpe and Sortino ones. The Gain/Loss ratio also reversed. While it still does not favor SPY, the Maximum Drawdown is much closer due to the COVID-19 market meltdown now being included.

Portfolio Strategy

With many managers looking to capture investors interested in investing in lower cost ETFs, there is a growing number, like JEPI, that have a much older mutual fund equivalent which can be used for better comparisons, as more data is always good to have. Something to keep in mind when doing your due diligence.

Here I presented two ETFs that are usually considered for different reasons but as I showed, those assumptions do not always play out, though the current results make sense when viewed from their portfolio construction. SPY’s unrestricted strategy should work best when the market is in a long-term uptrend. JEPI should and has done better in choppy and down-trending markets investors are currently experiencing.

This helps remind us to keep our investing goals in mind when buying and later reevaluating our holdings and asset allocation. Asking ourselves the following questions needs to be done on some time frame of your choosing:

- Why did I buy this asset and is it performing as expected?

- If yes, is it still the best asset to meet those expectations?

- If no, will it going forward or is it time to get out?

Final Thoughts

My view of the JEPI ETF has improved as more history occurred and my understanding of how well its strategy worked in different market conditions became available. This can be seen in my other JEPI-focused articles:

- JEPI: Good But There Are Better ETFs Available

- JPMorgan Equity Premium Income ETF: Income Without Taking On Interest-Rate Risk

One reason investors look at funds like JEPI is to find that proverbial “better mousetrap”. While there are plenty of challengers, these articles compared some SPY challengers:

- Exploring ETF Alternatives To Owning SPY

- Exploring CEF Alternatives To Owning SPY

So even if an investor likes the JPMorgan Equity Premium Income ETF, proper due diligence should be including other potential options in their research. The above articles provide some to consider for both SPY and JEPI.

Both JEPI and SPY are excellent choices for their main goal for investors but now is a questionable time to be entering the market.

[ad_2]

Source links Google News