[ad_1]

Dilok Klaisataporn/iStock via Getty Images

Author’s note: This article was released to CEF/ETF Income Laboratory members on March 3th, 2022.

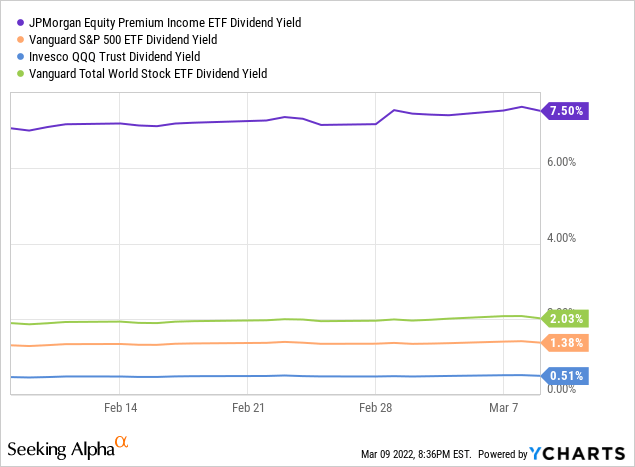

The JPMorgan Equity Premium Income ETF (JEPI) is an actively-managed equity income ETF. The fund invests in both equities and equity-linked notes (ELNs), which are financial derivatives. JEPI’s equities provide the fund with strong, double-digit potential capital gains. JEPI’s ELNs provide the fund with significant income, and a strong 7.6% dividend yield.

JEPI provides investors with strong income and potential capital gains, a rare, solid combination. The fund is a buy, and particularly appropriate for income investors and retirees.

JEPI – Equities and Capital Gains Analysis

JEPI invests in both equities and ELNs. These two asset classes have markedly different characteristics, with JEPI being an amalgamation of both. To understand JEPI as a whole we first need to understand each of the fund’s asset classes separately, so let’s do just that.

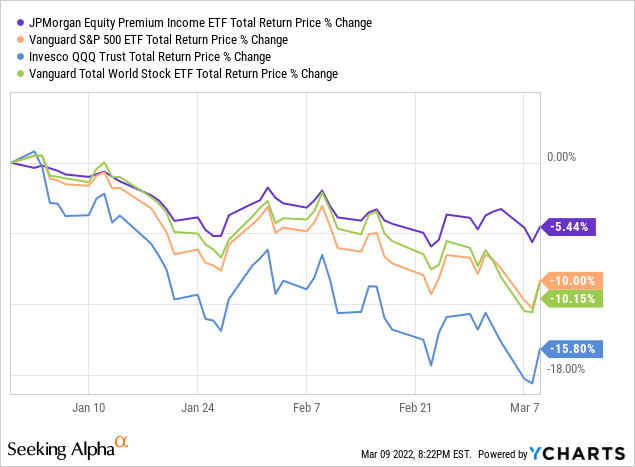

JEPI focuses on large-cap U.S. equities, with these accounting for between 80% and 90% of the value of the fund. Stocks are selected based on their fundamentals, volatility, and (expected) risk-adjusted returns. Lower volatility relative to the S&P 500 is a key consideration and goal, which should reduce portfolio risk, volatility, and losses during downturns and corrections. This has been the case during the ongoing correction, with the fund outperforming most relevant broad-based equity indexes YTD, as expected.

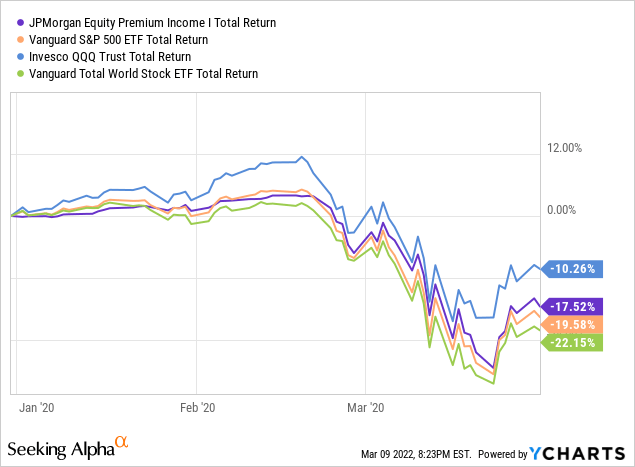

Although JEPI did not exist during 1Q2020, the onset of the coronavirus pandemic, the JPMorgan Equity Premium Income Fund (JEPIX), the mutual fund version of JEPI, did. Both JEPIX and JEPI follow effectively identical strategies, and so we can use JEPIX as a replacement for JEPI for said quarter. JEPIX slightly outperformed most relevant broad-based equity indexes during the quarter, as expected. JEPIX did underperform relative to the Nasdaq-100, due to the latter’s significant exposure to the best-performing tech mega-cap sector.

JEPI’s lower volatility equity portfolio should reduce losses during future downturns, corrections, and recessions, a benefit for the fund and its shareholders. The fund’s ELNs are not lower volatility securities, so the fund as a whole is only marginally less volatile than the S&P 500, under normal conditions at least.

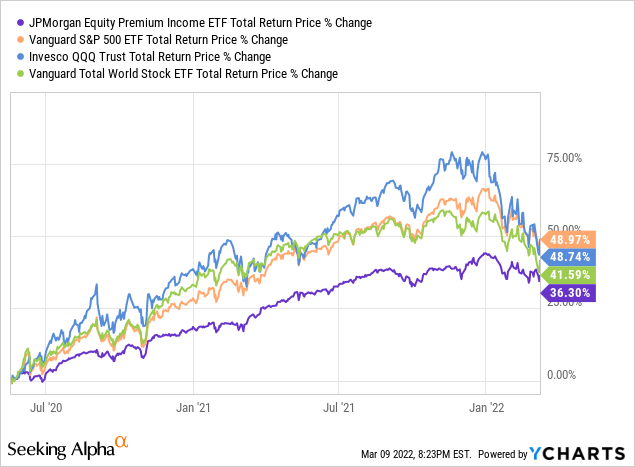

On the flipside, lower volatility stocks tend to experience fewer capital gains during bull markets, and in the very long term. Safety generally comes at a price, and that price is lower returns. JEPI itself has underperformed most broad-based equity indexes during bull markets, and since inception, as expected.

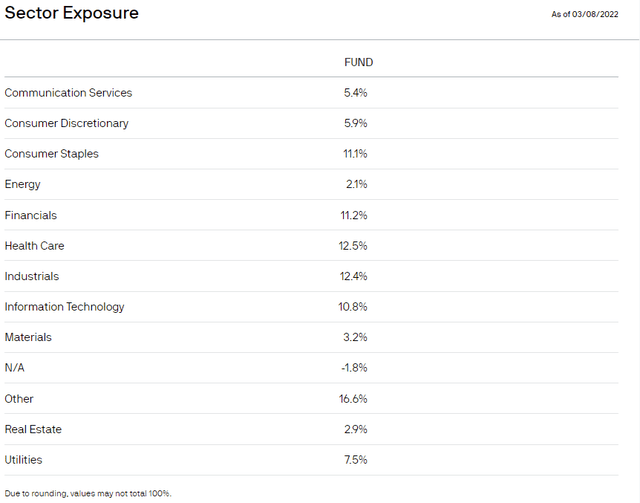

As a final note, JEPI’s equity holdings are reasonably well-diversified, with investments in 100 different companies, and exposure to all relevant industry segments. The fund is currently moderately underweight tech, while being overweight industrials, consumer staples, and utilities. Industry exposures seem roughly constant through time, and reflect a bias towards cheap, undervalued, old-economy industries. These industries have performed particularly well these past few months, which helps explain the fund’s comparatively strong performance YTD.

JEPI Corporate Website

JEPI – ELNs and Dividend Analysis

JEPI’s other important holdings are a set of leveraged equity ELNs. These account for between 10% and 20% of the value of the fund. Exposure is higher, as these are leveraged investments. Meaning, these ELNs are a small portion of the fund’s value, but a significant portion of the fund’s performance, income, characteristics, etc. JEPI’s ELNs are derivatives which provide exposure to S&P 500 returns plus written call options on the same. These derivatives are functionally equivalent to a massively leveraged position in the Global X S&P 500 Covered Call ETF (XYLD), previously covered here.

JEPI’s ELNs generate a significant amount of income, boosting the fund’s dividend yield to 7.6%. This is a strong yield on an absolute basis, and significantly higher than that of all relevant broad-based equity indexes.

JEPI’s strong 7.6% dividend yield is the fund’s most significant benefit, and its core investment thesis. JEPI is mostly an income fund, which investors buy for the income. The fund’s other benefits, including its diversification, potential capital gains, and lower losses during downturns, matter too, but the yield is key, in my opinion at least.

As an aside, JEPI’s ELNs have little upside potential, but average downside potential. Lower upside potential means lower capital gains and returns during bull markets and in the very long-term, as previously shown. Although the ELNs have average downside potential, the fund’s equity holdings are comparatively safe, lower volatility securities, and so the fund generally experiences lower losses during downturns.

JEPI – Risks and Other Considerations

JEPI is a strong fund and investment opportunity, but one with several important risks. The situation is somewhat complicated, not easy to summarize, but important.

JEPI’s equity investments are sometimes held for short periods of time. Turnover is quite high, reaching 195% during 2021. This is consistent with an average holding period of just six months, and consistent with a fund which changes their entire holdings twice a year. As a comparison, the S&P 500 has a turnover rate of 2.0%, and the average equity fund has a turnover rate of 31.0%, as per Fidelity. JEPI’s high turnover rate is clear evidence of an aggressively actively-managed fund. As such, JEPI’s returns are strongly dependent on the fund’s investment management team, and its specific investment decisions.

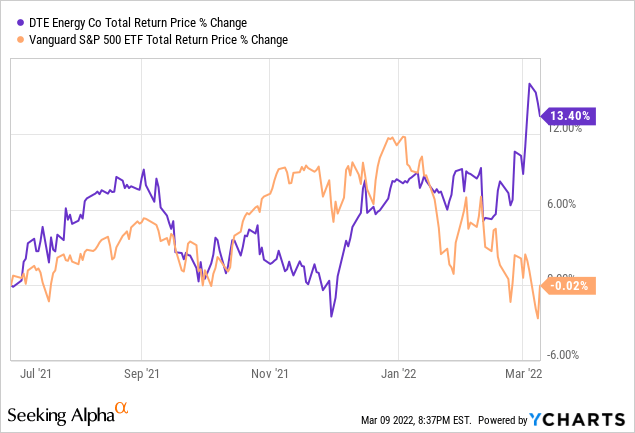

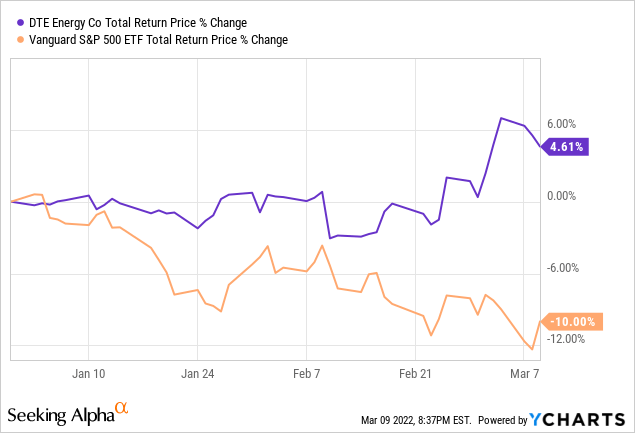

As an example of the above, let’s have a quick look at JEPI’s largest equity holding, the DTE Energy Company (DTE). DTE is a regulated energy utility, with comparatively safe, low-volatility revenues, earnings, dividends and returns, but lower prospective growth and returns. DTE’s characteristics are typical of JEPI’s holdings. DTE is a recent addition to the fund, being included sometime during the second half of 2021. As DTE is the fund’s largest holding, it has a comparatively large influence on the fund’s performance. DTE has outperformed the S&P 500 since it was included in the fund, so it seems that its inclusion was the right choice.

DTE has performed particularly well YTD, a period of moderate stock market losses. JEPI’s investment in DTE led to higher returns and lower losses during the current correction, a solid combination.

JEPI’s performance is dependent on management correctly identifying and investing in best-performing stocks like DTE. Although this is the case for most funds, it is particularly important for an aggressive actively-managed fund like JEPI. Remember, DTE is the fund’s largest holding, but it was only recently included in the fund, and will likely be sold in the coming months (remember that high portfolio turnover rate). These constant movements create the opportunity for massive gains or losses, with results being ultimately dependent on the specific investment decisions made by the fund’s management team. I’ve looked through several of the bigger investment decisions recently made by the fund. All decisions seemed reasonable, none of seemed questionable or unwise, but things can always change, and sometimes for the worse.

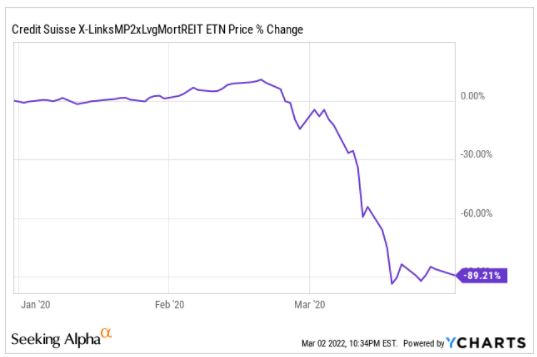

On another note, leveraged ELNs, including those held by JEPI, are excessively risky securities.

Leveraged ELNs significantly underperform during downturns, as was the case for several leveraged ELNs focusing on mREITs during 1Q2020. Losses were massive, and will almost certainly be massive during future downturn.

Y Charts

As such, I would not invest in a fund focusing on said securities. JEPI’s ELNs position is relatively small, accounting for only 10% to 20% of its value, which significantly reduces the overall risk of said securities, and prevented the fund from experiencing excessive losses during 1Q2020, unlike some other leveraged ELNs.. In my opinion, JEPI’s ELN allocation is small enough that risks are not excessive. More risk-averse investors, especially those who wish to limit their exposure to complicated leveraged products, might disagree, and should choose to invest in other funds.

The combination of aggressive active-management and investments in leveraged ELNs could potentially lead to significant losses during downturns. JEPI’s ELNs significantly underperform during downturns. JEPI’s equities generally do not, but only because the fund’s managers have successfully selected reasonably safe stocks during prior downturns. There is no guarantee that the fund’s managers will successfully pick appropriate stocks during future downturns. If they do not, the fund could experience above-average losses and underperformance. Although this has not happened in the past, it is a risk moving forward.

These are odd, complicated issues, but terribly important. JEPI’s 7.6% dividend yield comes from massively leveraged ELNs. These are incredibly risky investments. Although these risks have not materially affected the fund’s performance in the past, this might not be the case moving forward.

Conclusion

JEPI’s strong 7.6% dividend yield and potential capital gains make the fund a buy.

[ad_2]

Source links Google News